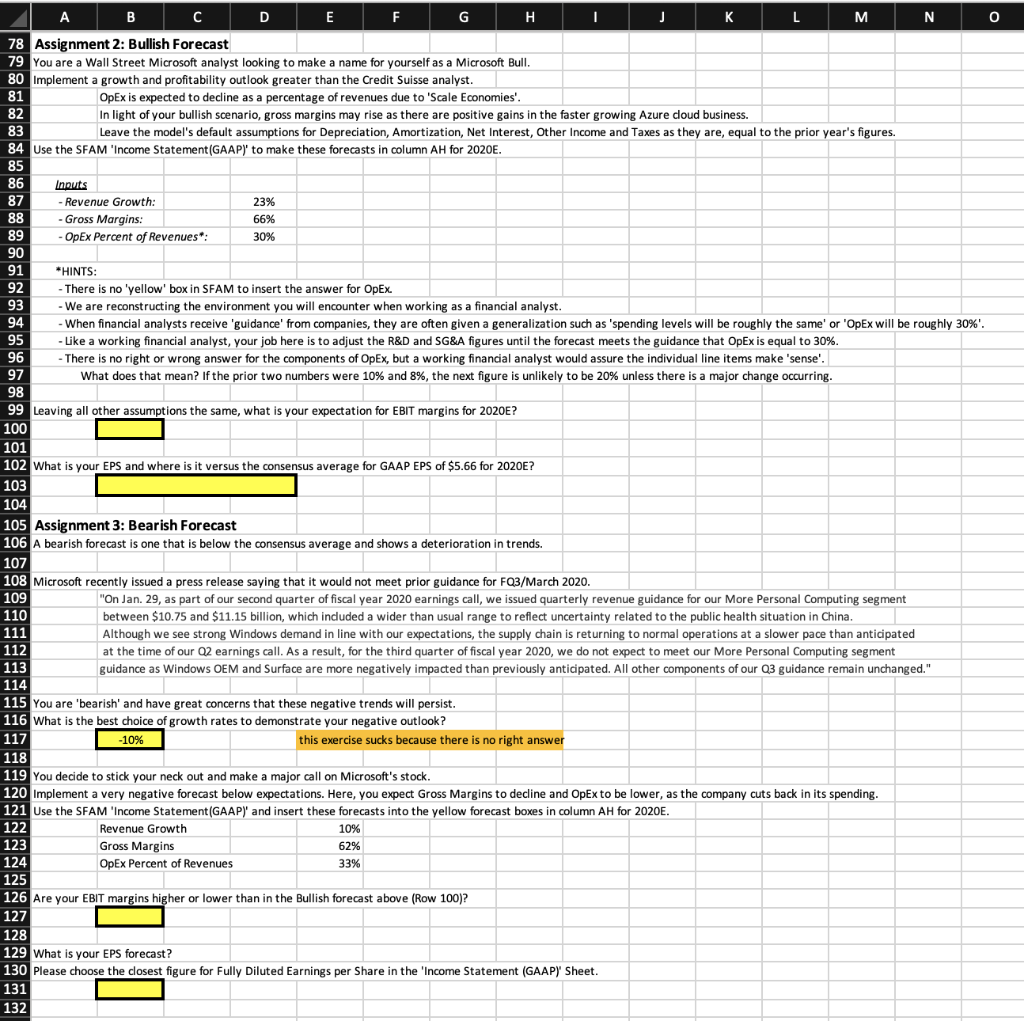

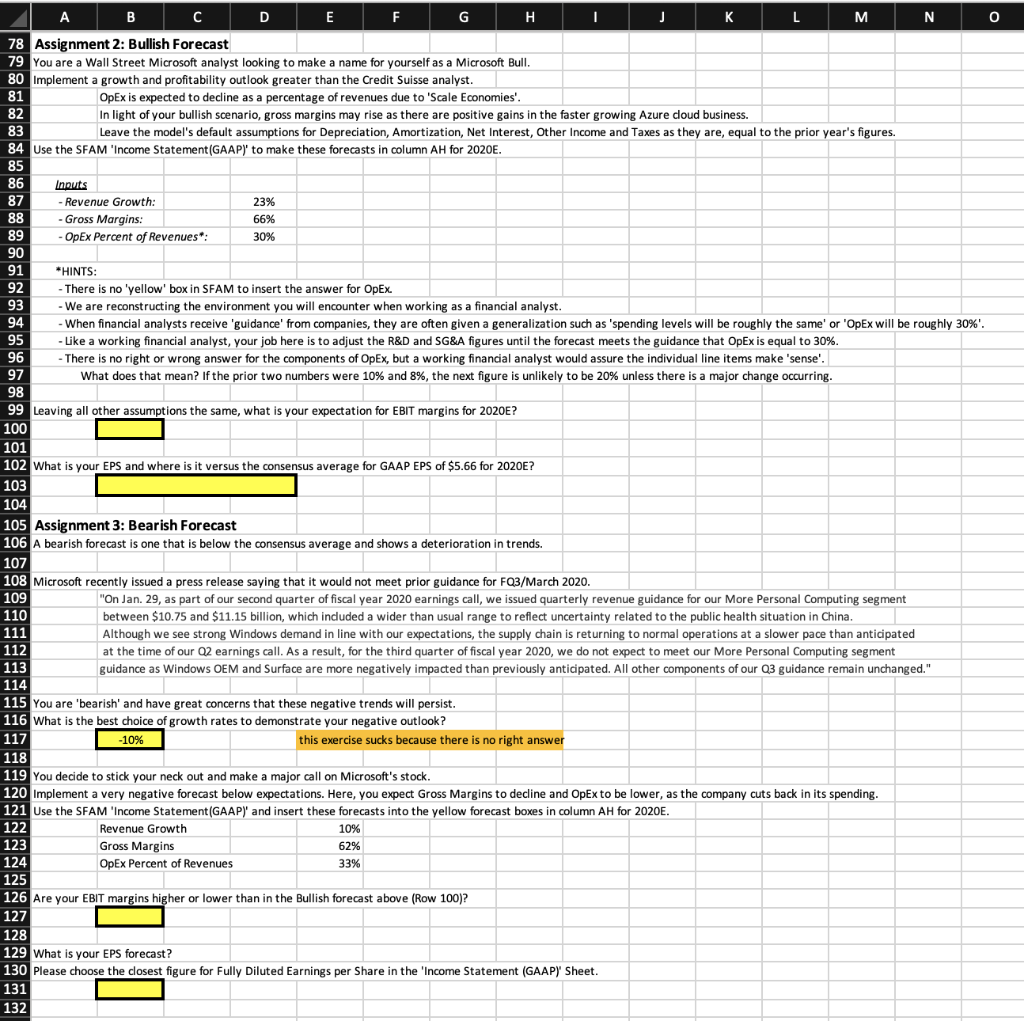

B C D E F G H I J L M N O 78 Assignment 2: Bullish Forecast 79 You are a Wall Street Microsoft analyst looking to make a name for yourself as a Microsoft Bull. 80 Implement a growth and profitability outlook greater than the Credit Suisse analyst. 81 OpEx is expected to decline as a percentage of revenues due to 'Scale Economies'. 82 In light of your bullish scenario, gross margins may rise as there are positive gains in the faster growing Azure doud business. 83 Leave the model's default assumptions for Depreciation, Amortization, Net Interest, Other Income and Taxes as they are, equal to the prior year's figures. 84 Use the SFAM 'Income Statement(GAAP)' to make these forecasts in column AH for 2020E. 85 86 Inputs 87 Revenue Growth: 23% 88 - Gross Margins: 66% 89 OpEx Percent of Revenues 30% 90 91 *HINTS: 92 - There is no 'yellow' box in SFAM to insert the answer for Opex 93 - We are reconstructing the environment you will encounter when working as a financial analyst. 94 -When financial analysts receive 'guidance from companies, they are often given a generalization such as 'spending levels will be roughly the same' or 'OpEx will be roughly 30%. 95 - Like a working financial analyst, your job here is to adjust the R&D and SG&A figures until the forecast meets the guidance that OpEx is equal to 30%. 96 - There is no right or wrong answer for the components of OpEx, but a working financial analyst would assure the individual line items make sense'. 97 What does that mean? If the prior two numbers were 10% and 8%, the next figure is unlikely to be 20% unless there is a major change occurring. 98 99 Leaving all other assumptions the same, what is your expectation for EBIT margins for 2020E? 100 101 102 What is your EPS and where is it versus the consensus average for GAAP EPS of $5.66 for 2020E? 103 104 105 Assignment 3: Bearish Forecast 106 A bearish forecast is one that below the consensus average and shows a deterioration in trends. 107 108 Microsoft recently issued a press release saying that would not meet prior guidance for FQ3/March 2020. 109 "On Jan. 29, as part of our second quarter of fiscal year 2020 earnings call, we issued quarterly revenue guidance for our More Personal Computing segment 110 between $10.75 and $11.15 billion, which included a wider than usual range to reflect uncertainty related to the public health situation in China. 111 Although we see strong Windows demand in line with our expectations, the supply chain is returning to normal operations at a slower pace than anticipated 112 at the time of our 02 earnings call. As a result, for the third quarter of fiscal year 2020, we do not expect to meet our More Personal Computing segment 113 guidance as Windows OEM and Surface are more negatively impacted than previously anticipated. All other components of our 03 guidance remain unchanged." 114 115 You are 'bearish' and have great concerns that these negative trends will persist. 116 What is the best choice of growth rates to demonstrate your negative outlook? 117 -10% this exercise sucks because there is no right answer 118 119 You decide to stick your neck out and make a major call on Microsoft's stock. 120 Implement a very negative forecast below expectations. Here, you expect Gross Margins to decline and OpEx to be lower, as the company cuts back in its spending. 121 Use the SFAM 'Income Statement(GAAP)' and insert these forecasts into the yellow forecast boxes in column AH for 2020E. 122 Revenue Growth 10% Gross Margins 62% 124 OpEx Percent of Revenues 33% 125 126 Are your EBIT margins higher or lower than in the Bullish forecast above (Row 100)? 127 128 129 What is your EPS forecast? 130 Please choose the closest figure for Fully Diluted Earnings per Share in the 'Income Statement (GAAP) Sheet. 131 132 123 B C D E F G H I J L M N O 78 Assignment 2: Bullish Forecast 79 You are a Wall Street Microsoft analyst looking to make a name for yourself as a Microsoft Bull. 80 Implement a growth and profitability outlook greater than the Credit Suisse analyst. 81 OpEx is expected to decline as a percentage of revenues due to 'Scale Economies'. 82 In light of your bullish scenario, gross margins may rise as there are positive gains in the faster growing Azure doud business. 83 Leave the model's default assumptions for Depreciation, Amortization, Net Interest, Other Income and Taxes as they are, equal to the prior year's figures. 84 Use the SFAM 'Income Statement(GAAP)' to make these forecasts in column AH for 2020E. 85 86 Inputs 87 Revenue Growth: 23% 88 - Gross Margins: 66% 89 OpEx Percent of Revenues 30% 90 91 *HINTS: 92 - There is no 'yellow' box in SFAM to insert the answer for Opex 93 - We are reconstructing the environment you will encounter when working as a financial analyst. 94 -When financial analysts receive 'guidance from companies, they are often given a generalization such as 'spending levels will be roughly the same' or 'OpEx will be roughly 30%. 95 - Like a working financial analyst, your job here is to adjust the R&D and SG&A figures until the forecast meets the guidance that OpEx is equal to 30%. 96 - There is no right or wrong answer for the components of OpEx, but a working financial analyst would assure the individual line items make sense'. 97 What does that mean? If the prior two numbers were 10% and 8%, the next figure is unlikely to be 20% unless there is a major change occurring. 98 99 Leaving all other assumptions the same, what is your expectation for EBIT margins for 2020E? 100 101 102 What is your EPS and where is it versus the consensus average for GAAP EPS of $5.66 for 2020E? 103 104 105 Assignment 3: Bearish Forecast 106 A bearish forecast is one that below the consensus average and shows a deterioration in trends. 107 108 Microsoft recently issued a press release saying that would not meet prior guidance for FQ3/March 2020. 109 "On Jan. 29, as part of our second quarter of fiscal year 2020 earnings call, we issued quarterly revenue guidance for our More Personal Computing segment 110 between $10.75 and $11.15 billion, which included a wider than usual range to reflect uncertainty related to the public health situation in China. 111 Although we see strong Windows demand in line with our expectations, the supply chain is returning to normal operations at a slower pace than anticipated 112 at the time of our 02 earnings call. As a result, for the third quarter of fiscal year 2020, we do not expect to meet our More Personal Computing segment 113 guidance as Windows OEM and Surface are more negatively impacted than previously anticipated. All other components of our 03 guidance remain unchanged." 114 115 You are 'bearish' and have great concerns that these negative trends will persist. 116 What is the best choice of growth rates to demonstrate your negative outlook? 117 -10% this exercise sucks because there is no right answer 118 119 You decide to stick your neck out and make a major call on Microsoft's stock. 120 Implement a very negative forecast below expectations. Here, you expect Gross Margins to decline and OpEx to be lower, as the company cuts back in its spending. 121 Use the SFAM 'Income Statement(GAAP)' and insert these forecasts into the yellow forecast boxes in column AH for 2020E. 122 Revenue Growth 10% Gross Margins 62% 124 OpEx Percent of Revenues 33% 125 126 Are your EBIT margins higher or lower than in the Bullish forecast above (Row 100)? 127 128 129 What is your EPS forecast? 130 Please choose the closest figure for Fully Diluted Earnings per Share in the 'Income Statement (GAAP) Sheet. 131 132 123