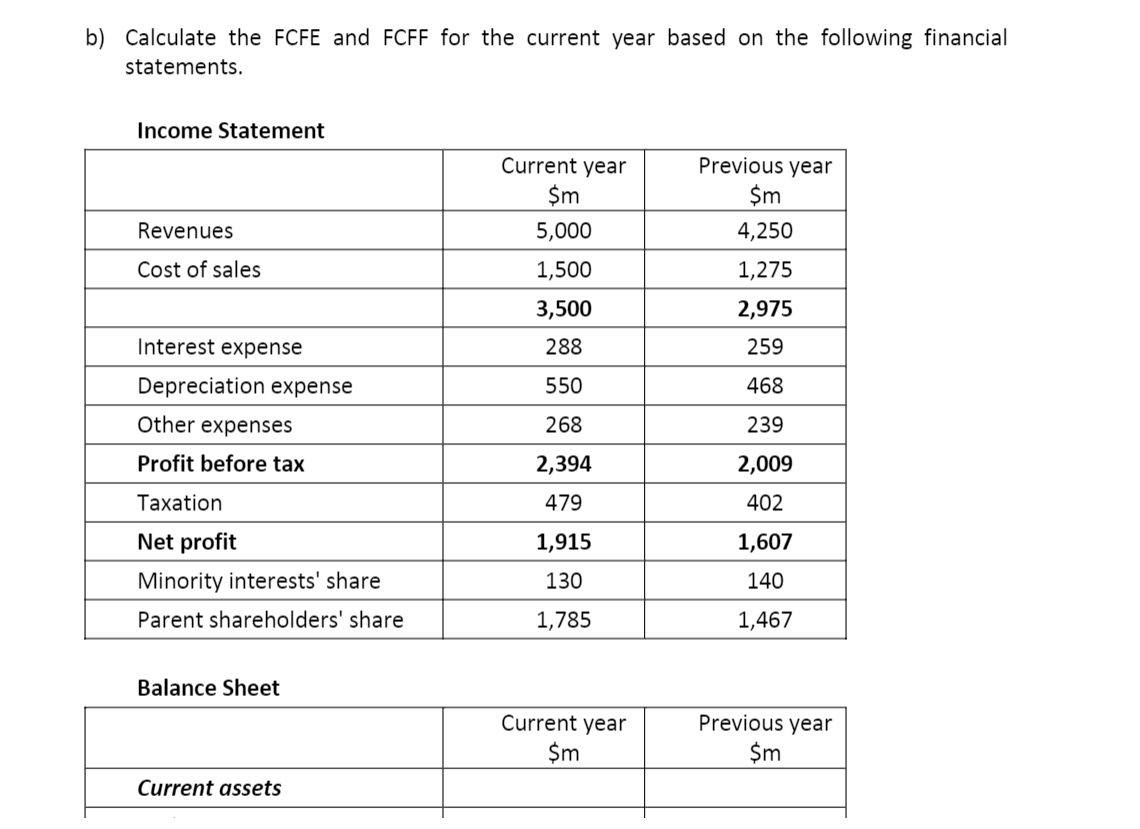

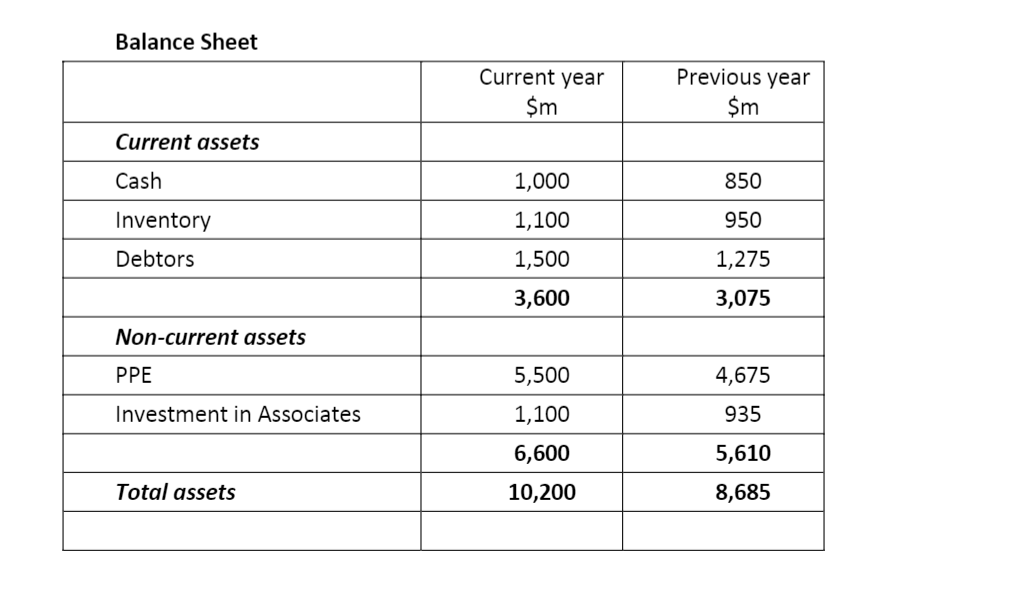

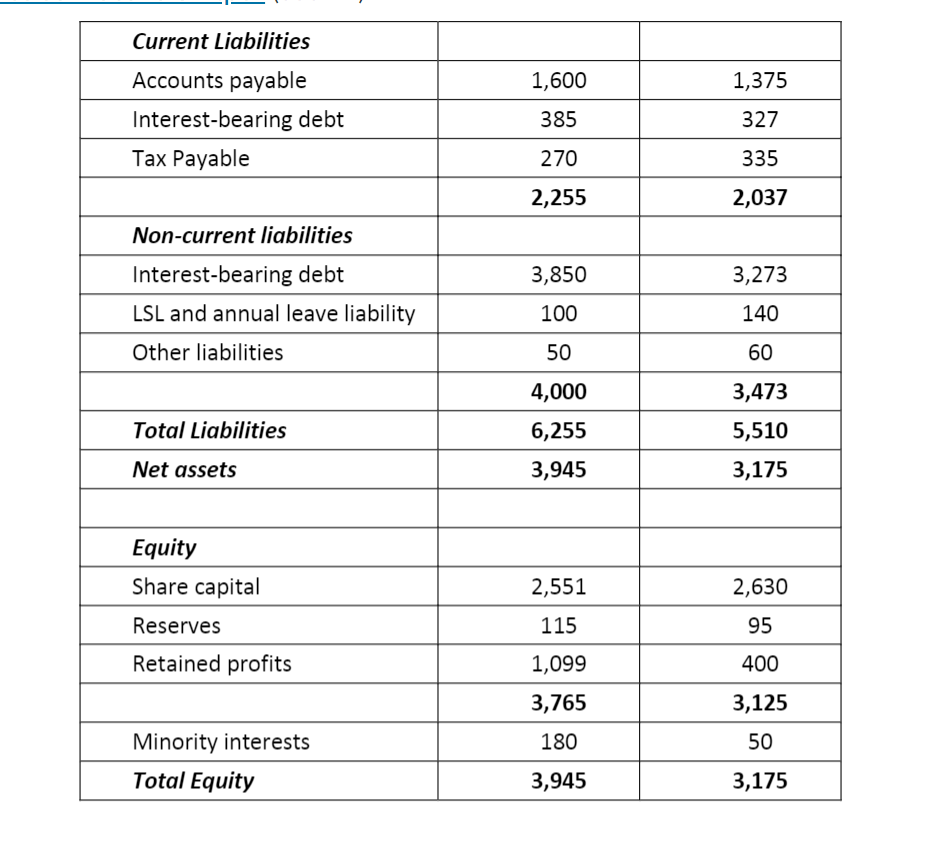

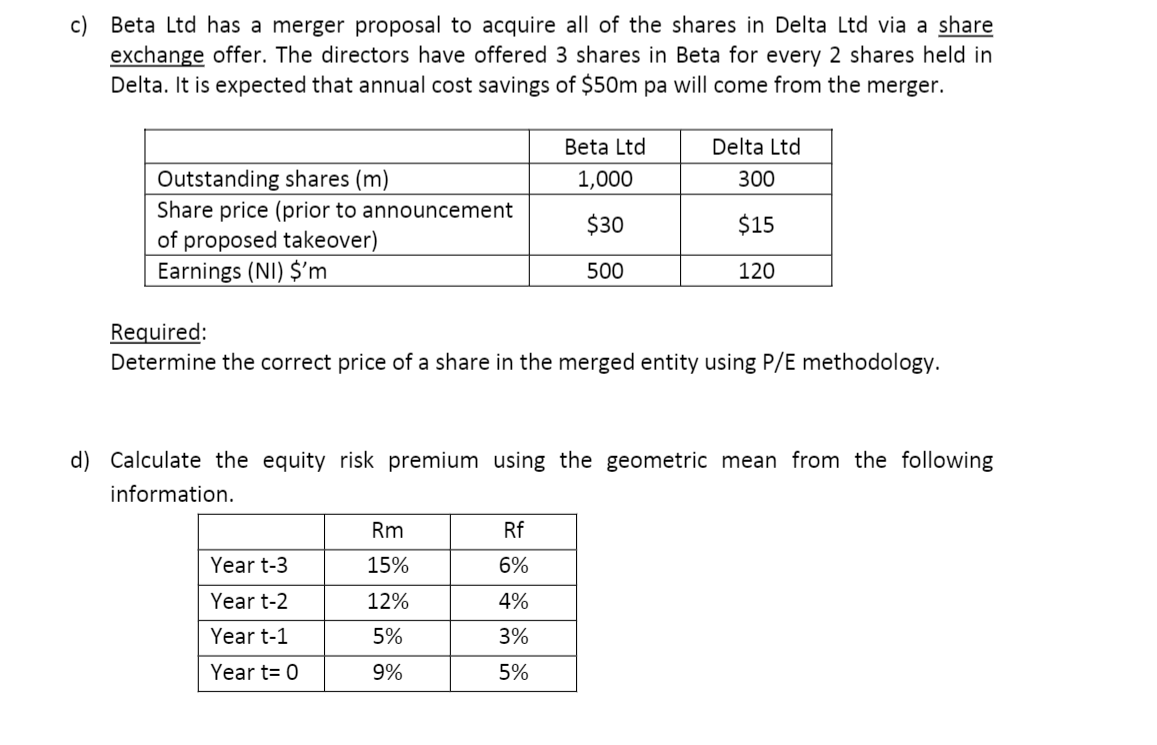

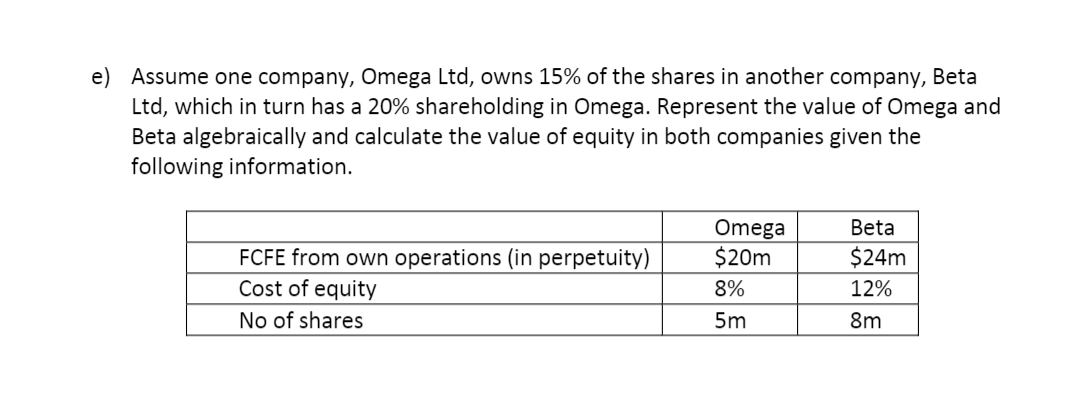

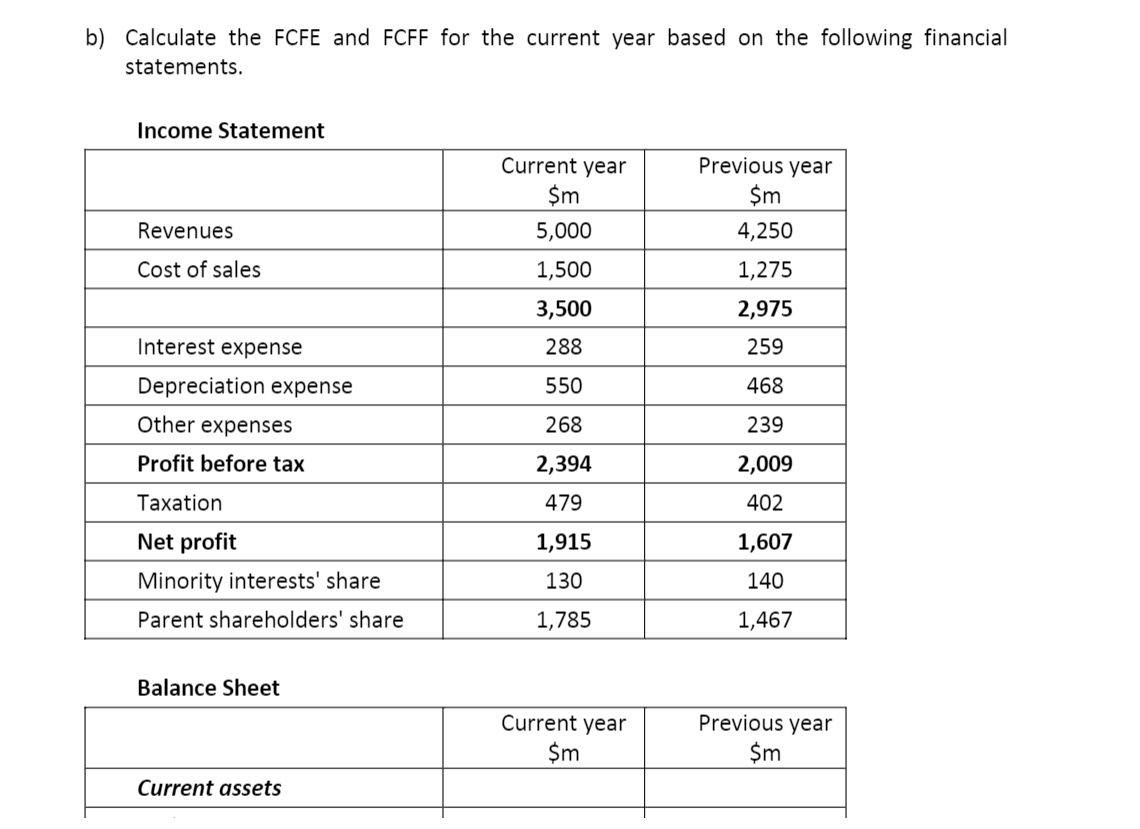

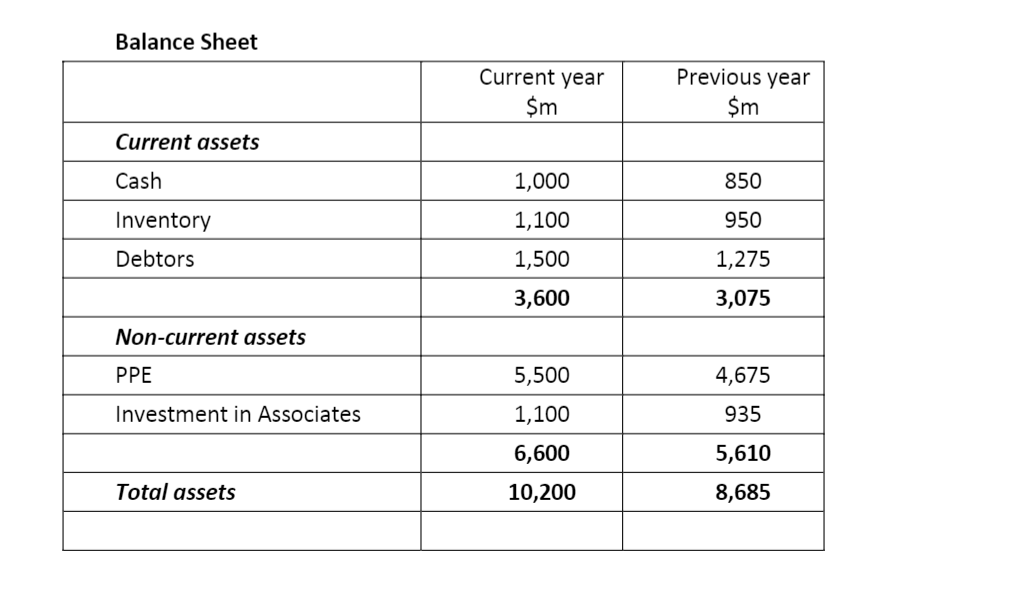

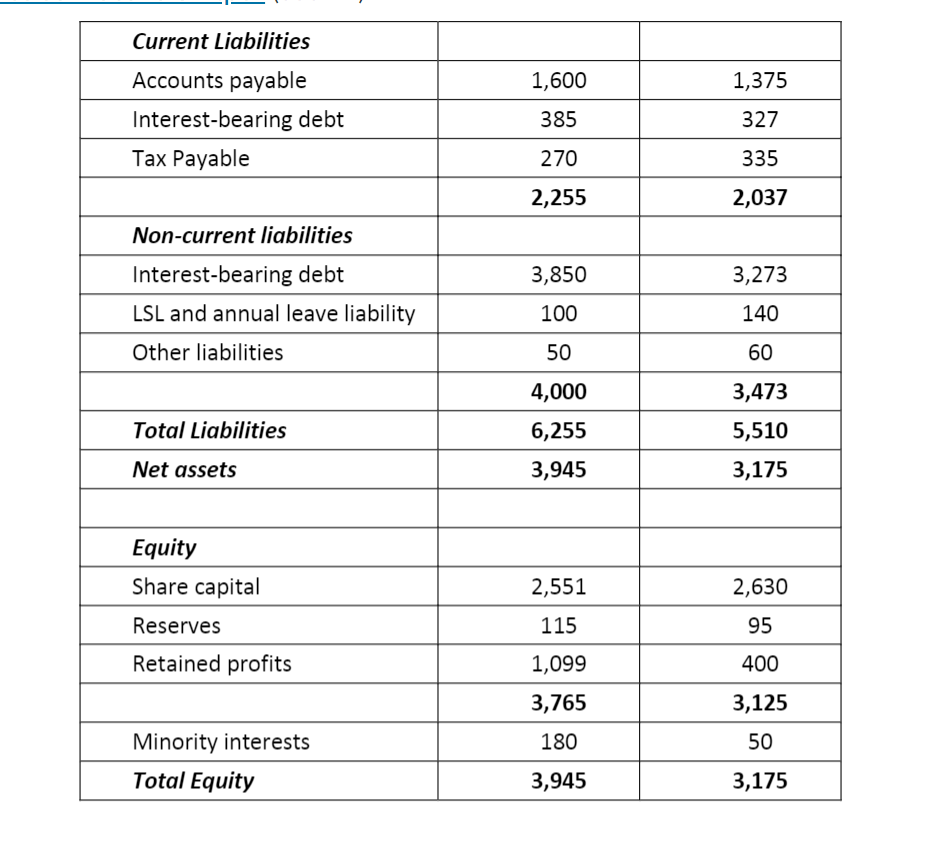

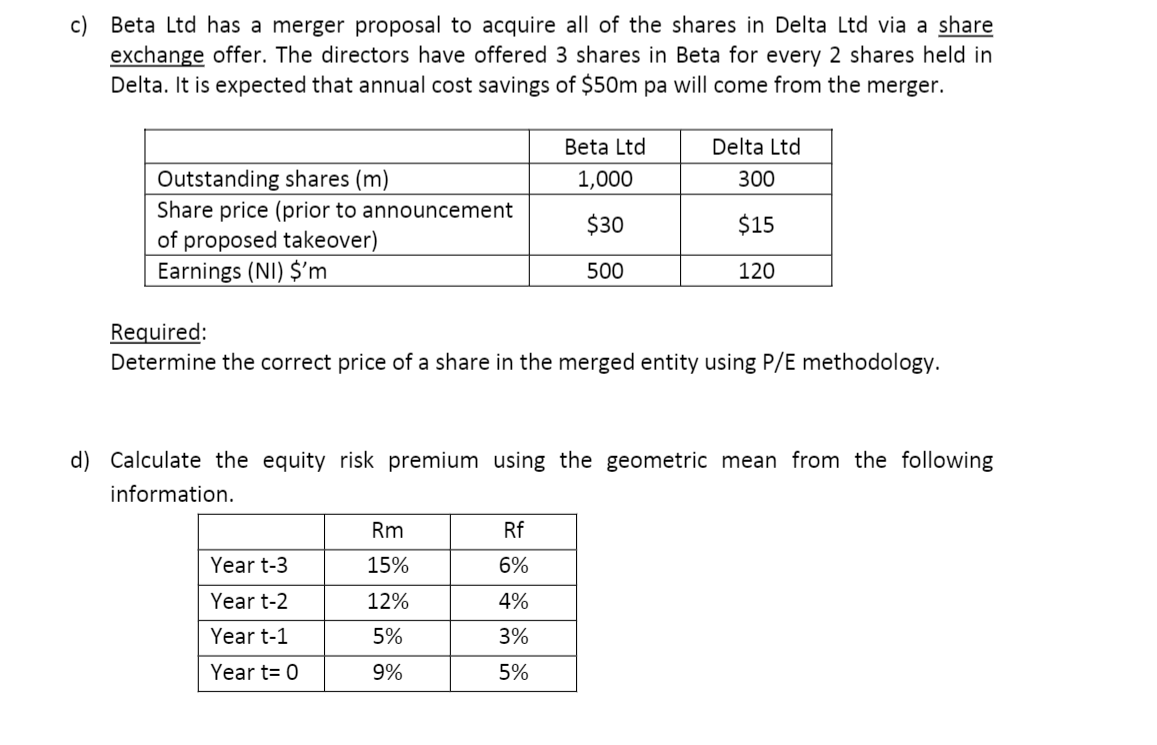

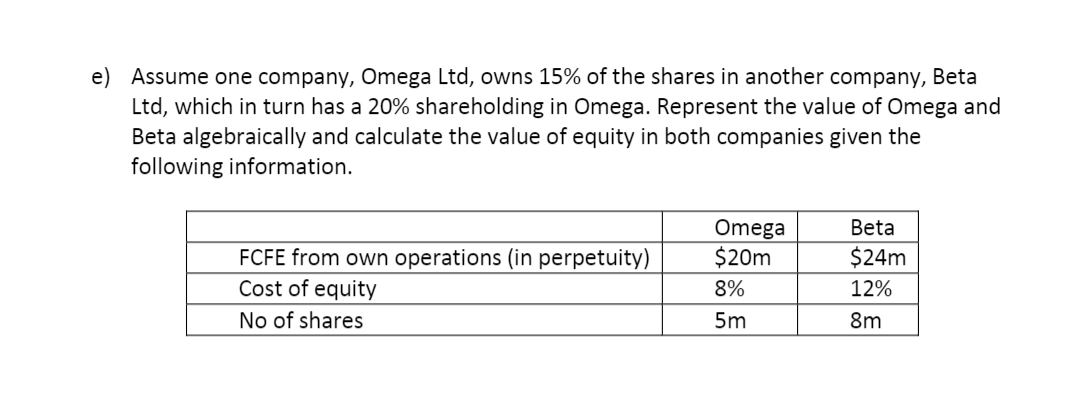

b) Calculate the FCFE and FCFF for the current year based on the following financial statements. Income Statement Current year $m Previous year $m Revenues 5,000 4,250 Cost of sales 1,500 1,275 3,500 2,975 Interest expense 288 259 Depreciation expense 550 468 Other expenses 268 239 Profit before tax 2,394 2,009 Taxation 479 402 Net profit 1,915 1,607 Minority interests' share 130 140 Parent shareholders' share 1,785 1,467 Balance Sheet Current year Previous year $m $m Current assets Balance Sheet Current year Previous year $m $m Current assets Cash 1,000 850 Inventory 1,100 950 Debtors 1,500 1,275 3,600 3,075 Non-current assets PPE 5,500 4,675 Investment in Associates 1,100 935 6,600 5,610 Total assets 10,200 8,685 Current Liabilities Accounts payable 1,600 1,375 Interest-bearing debt 385 327 Tax Payable 270 335 2,255 2,037 Non-current liabilities Interest-bearing debt 3,850 3,273 LSL and annual leave liability 100 140 Other liabilities 50 60 4,000 3,473 Total Liabilities 6,255 5,510 Net assets 3,945 3,175 Equity Share capital 2,551 2,630 Reserves 115 95 Retained profits 1,099 400 3,765 3,125 Minority interests 180 50 Total Equity 3,945 3,175 c) Beta Ltd has a merger proposal to acquire all of the shares in Delta Ltd via a share exchange offer. The directors have offered 3 shares in Beta for every 2 shares held in Delta. It is expected that annual cost savings of $50m pa will come from the merger. Beta Ltd Delta Ltd 1,000 300 Outstanding shares (m) Share price (prior to announcement of proposed takeover) Earnings (NI) $'m $30 $15 500 120 Required: Determine the correct price of a share in the merged entity using P/E methodology. d) Calculate the equity risk premium using the geometric mean from the following information. Rm Rf Year t-3 15% 6% Year t-2 12% 4% Year t-1 5% 3% Year t=0 9% 5% e) Assume one company, Omega Ltd, owns 15% of the shares in another company, Beta Ltd, which in turn has a 20% shareholding in Omega. Represent the value of Omega and Beta algebraically and calculate the value of equity in both companies given the following information. Omega $20m FCFE from own operations (in perpetuity) Cost of equity No of shares Beta $24m 12% 8% 5m 8m