Answered step by step

Verified Expert Solution

Question

1 Approved Answer

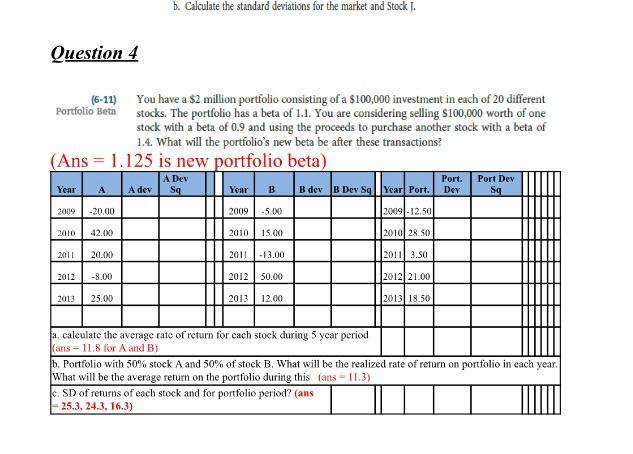

b. Calculate the standard deviations for the market and Stock J. Question 4 (6-11) Portfolio Beta You have a $2 million portfolio consisting of

b. Calculate the standard deviations for the market and Stock J. Question 4 (6-11) Portfolio Beta You have a $2 million portfolio consisting of a $100,000 investment in each of 20 different stocks. The portfolio has a beta of 1.1. You are considering selling $100,000 worth of one stock with a beta of 0.9 and using the proceeds to purchase another stock with a beta of 1.4. What will the portfolio's new beta be after these transactions? (Ans 1.125 is new portfolio beta) A Dev Year A A dev Sq Year B B dev B Dev Sq Year Port. Port. Dev Port Dev Sq 2009 -20.00 2009 -5.00 2009-12.50 2010 42.00 2010 15.00 2010 28.50 2011 20.00 2011 -13.00 2011 3.50 2012 -8.00 2012 50.00 2012 21.00 2013 25.00 2013 12.00 2013 18.50 a. calculate the average rate of return for each stock during 5 year period (ans-11.8 for A and B) b. Portfolio with 50% stock A and 50% of stock B. What will be the realized rate of return on portfolio in each year. What will be the average return on the portfolio during this (ans 11.3) c. SD of returns of each stock and for portfolio period? (ans 25.3, 24.3, 16.3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started