Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) Chop Bar Ltd is launching a new, innovative product onto the market and is trying to decide on the right launch price for the

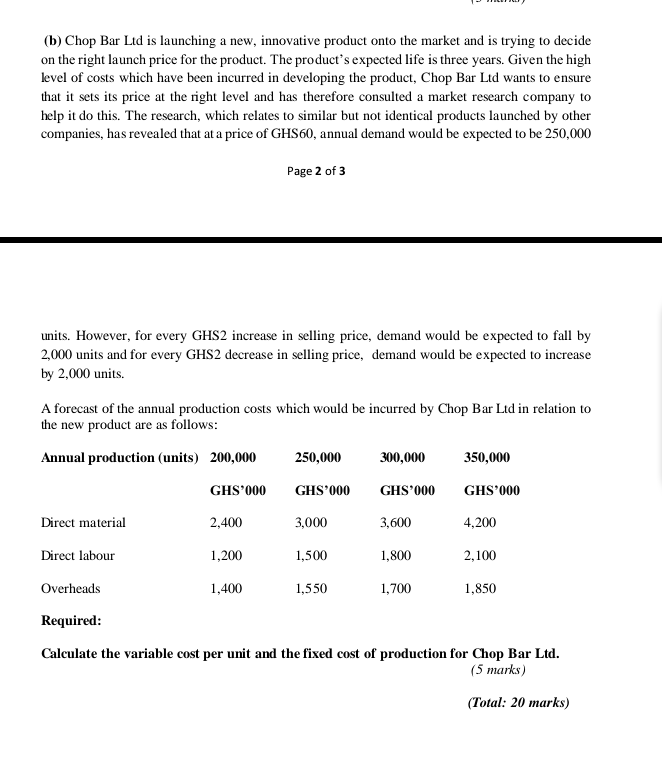

(b) Chop Bar Ltd is launching a new, innovative product onto the market and is trying to decide on the right launch price for the product. The product's expected life is three years. Given the high level of costs which have been incurred in developing the product, Chop Bar Ltd wants to ensure that it sets its price at the right level and has therefore consulted a market research company to help it do this. The research, which relates to similar but not identical products launched by other companies, has revealed that at a price of GHS60, annual demand would be expected to be 250,000 Page 2 of 3 units. However, for every GHS2 increase in selling price, demand would be expected to fall by 2,000 units and for every GHS2 decrease in selling price, demand would be expected to increase by 2,000 units. A forecast of the annual production costs which would be incurred by Chop Bar Ltd in relation to the new product are as follows: Required: Calculate the variable cost per unit and the fixed cost of production for Chop Bar Ltd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started