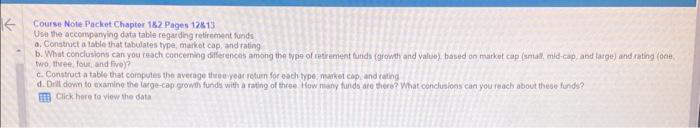

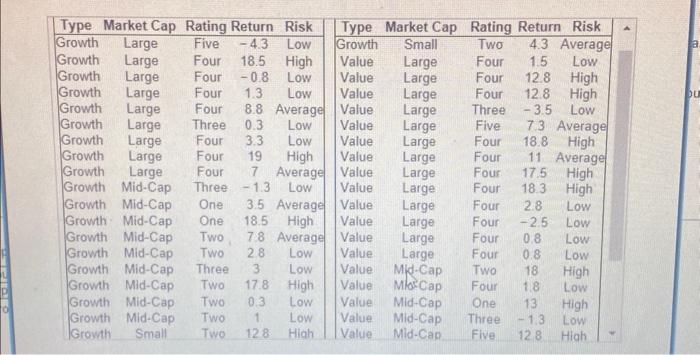

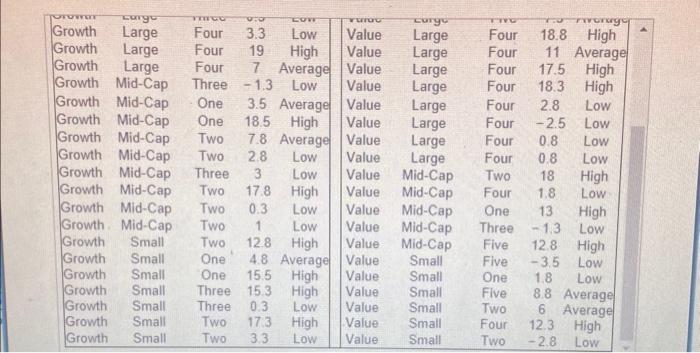

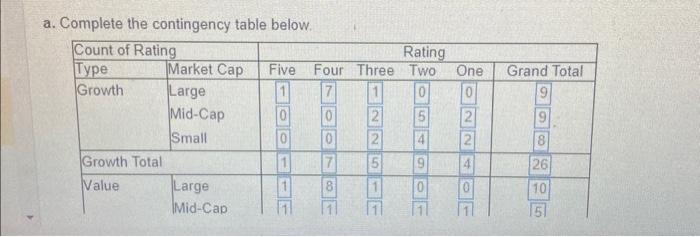

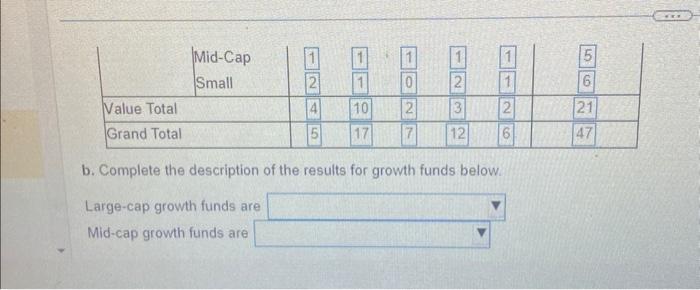

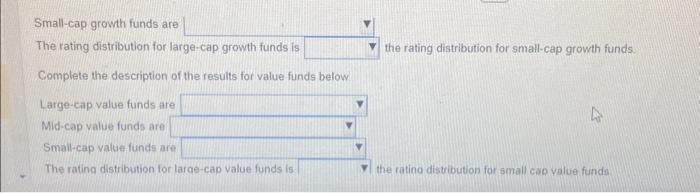

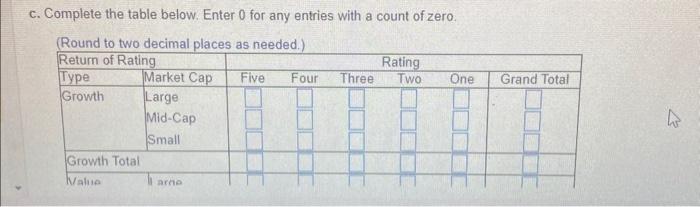

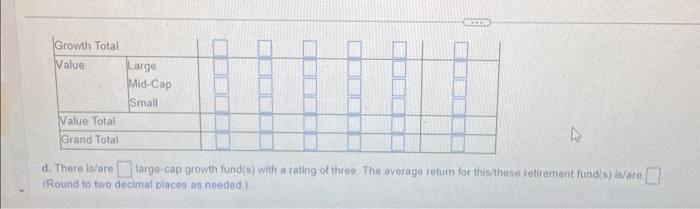

b. Complete the description of the results for growth funds below. Large-cap growth funds are Mid-cap growth funds are a. Complete the contingency table below. d. There is/are large-cap growth fund(s) with a rating of three. The average return for this/these retirement fund(s) is/are (Round to two decimal places as needed) Small-cap growh funds are The rating distribution for large-cap growth funds is the rating distribution for small-cap growth funds. Complete the description of the results for value funds below Large-cap value funds are Mid-cap value funds are Small-cap value funds are The rating distribution for larae-cap value funds is: the ratina distribution for small cap value funda Course Note Packet Chapter 182 Pages 12813 Use the accompanying data table regarding retirement funds a. Construct a table that tabulates type, maket cap, and rating b. What conclusions can you reach concerning differences among the type of retirement furids (growath and value) based on markot cap (smas, mid-cap, and targe) and rating (one two, thees, louk, and Fro)? c. Construct a table that computes the aveeage thee year retuin for esch trpe maiket cap and rating d. Dilli down to examine the large-cep grombi funds with a rating of three. Hew nany funds are stere? What canclusions can you reach about these funds? Clickhere to view the data c. Complete the table below. Enter 0 for any entries with a count of zero. b. Complete the description of the results for growth funds below. Large-cap growth funds are Mid-cap growth funds are a. Complete the contingency table below. d. There is/are large-cap growth fund(s) with a rating of three. The average return for this/these retirement fund(s) is/are (Round to two decimal places as needed) Small-cap growh funds are The rating distribution for large-cap growth funds is the rating distribution for small-cap growth funds. Complete the description of the results for value funds below Large-cap value funds are Mid-cap value funds are Small-cap value funds are The rating distribution for larae-cap value funds is: the ratina distribution for small cap value funda Course Note Packet Chapter 182 Pages 12813 Use the accompanying data table regarding retirement funds a. Construct a table that tabulates type, maket cap, and rating b. What conclusions can you reach concerning differences among the type of retirement furids (growath and value) based on markot cap (smas, mid-cap, and targe) and rating (one two, thees, louk, and Fro)? c. Construct a table that computes the aveeage thee year retuin for esch trpe maiket cap and rating d. Dilli down to examine the large-cep grombi funds with a rating of three. Hew nany funds are stere? What canclusions can you reach about these funds? Clickhere to view the data c. Complete the table below. Enter 0 for any entries with a count of zero