b) Consider an alternative to the previous scenario: the funds needed to cover the liquidity needs are borrowed from a bank. The bank designs a debt contract that stipulates an amount to be repaid at the end of the year, whenever possible, senior to any other claim. Can the company secure the funds needed by financing the liquidity shock with debt? What strategy will the company follow then? Compare your answer to the solution obtained under equity finance and discuss.

FM422 Corporate Finance: Amil Dasgupta

c) Suppose that in fact Bob Ituary immediately (and in a visible and public manner) rejected the risky strategy and fired the junior manager. True to its business model, RiskAdventure chose the safe strategy and negotiated with its bank a loan on that basis (i.e., the debt is negotiated after the risky strategy has been eliminated), to finance the 750,000. Consider now a situation that arises at some intermediate date, that is after the sums needed to cover the liquidity needs (750,000) have been invested and the operating strategy (the safe one) has been chosen, but before final cash flows are realized. It now appears that, at an extra cost of 50,000, all cash flows described in Table 1 can be increased by 54,000. Their respective chances are unaffected and remain as described in Table 1. Assume that unexpectedly Bob has access to some personal funds just equal to 50,000. If the sum of 750,000 was initially financed by debt, would Bob want to inject his own 50,000 in RiskAdventure? Comment on your result and describe what kind of negotiation could take place between the bank and Bob Ituary in relation to this further investment.

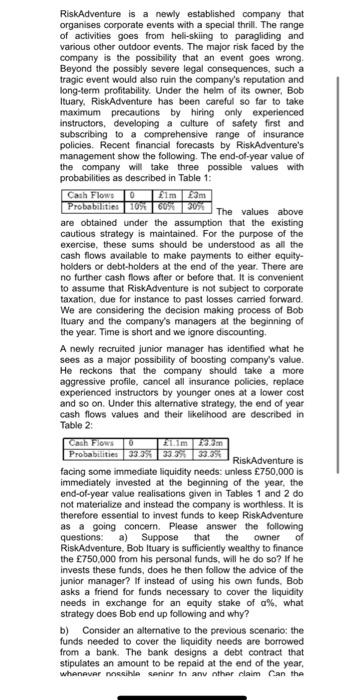

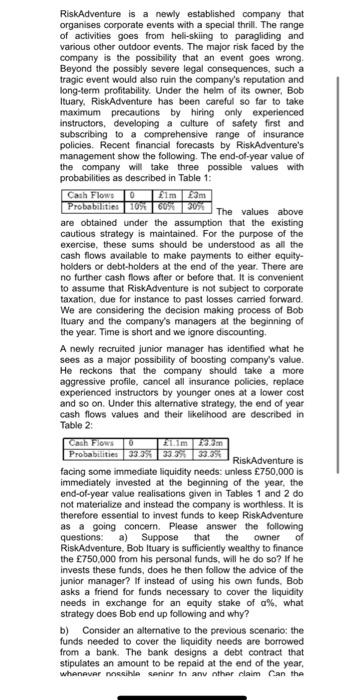

RiskAdventure is a newly established company that organises corporate events with a special thrill. The range of activities goes from heli-skiing to paragliding and various other outdoor events. The major risk faced by the company is the possiblity that an event goes wrong. Beyond the possibly severe legal consequences, such a tragic event would also ruin the company's reputation and long-term profitability. Under the heim of its owner, Bob Ituary. RiskAdventure has been careful so far to take maximum precautions by hiring only experienced instructors, developing a culture of safety first and subscribing to a comprehensive range of insurance policies. Recent financial forecasts by RiskAdventure's management show the following. The end-of-year value of the company will take three possible values with probabilities as described in Table 1: The values above are obtained under the assumption that the existing cautious strategy is maintained. For the purpose of the exercise, these sums should be understood as all the cash flows available to make payments to either equityholders or debt-holders at the end of the year. There are no further cash flows after or before that. It is convenient to assume that RiskAdventure is not subject to corporate taxation, due for instance to past losses carried forward. We are considering the decision making process of Bob Ituary and the company's managers at the beginning of the year. Time is short and we ignore discounting. A newly recruited junior manager has identified what he sees as a major possibility of boosting company's value. He reckons that the company should take a more aggressive profile, cancel all insurance policies, replace experienced instructors by younger ones at a lower cost and so on. Under this allemative strategy, the end of year cash flows values and their likelihood are described in Table 2: RiskAdventure is a newly established company that organises corporate events with a special thrill. The range of activities goes from heli-skiing to paragliding and various other outdoor events. The major risk faced by the company is the possiblity that an event goes wrong. Beyond the possibly severe legal consequences, such a tragic event would also ruin the company's reputation and long-term profitability. Under the heim of its owner, Bob Ituary. RiskAdventure has been careful so far to take maximum precautions by hiring only experienced instructors, developing a culture of safety first and subscribing to a comprehensive range of insurance policies. Recent financial forecasts by RiskAdventure's management show the following. The end-of-year value of the company will take three possible values with probabilities as described in Table 1: The values above are obtained under the assumption that the existing cautious strategy is maintained. For the purpose of the exercise, these sums should be understood as all the cash flows available to make payments to either equityholders or debt-holders at the end of the year. There are no further cash flows after or before that. It is convenient to assume that RiskAdventure is not subject to corporate taxation, due for instance to past losses carried forward. We are considering the decision making process of Bob Ituary and the company's managers at the beginning of the year. Time is short and we ignore discounting. A newly recruited junior manager has identified what he sees as a major possibility of boosting company's value. He reckons that the company should take a more aggressive profile, cancel all insurance policies, replace experienced instructors by younger ones at a lower cost and so on. Under this allemative strategy, the end of year cash flows values and their likelihood are described in Table 2

b) Consider an alternative to the previous scenario: the funds needed to cover the liquidity needs are borrowed from a bank. The bank designs a debt contract that stipulates an amount to be repaid at the end of the year, whenever possible, senior to any other claim. Can the company secure the funds needed by financing the liquidity shock with debt? What strategy will the company follow then? Compare your answer to the solution obtained under equity finance and discuss.

b) Consider an alternative to the previous scenario: the funds needed to cover the liquidity needs are borrowed from a bank. The bank designs a debt contract that stipulates an amount to be repaid at the end of the year, whenever possible, senior to any other claim. Can the company secure the funds needed by financing the liquidity shock with debt? What strategy will the company follow then? Compare your answer to the solution obtained under equity finance and discuss.