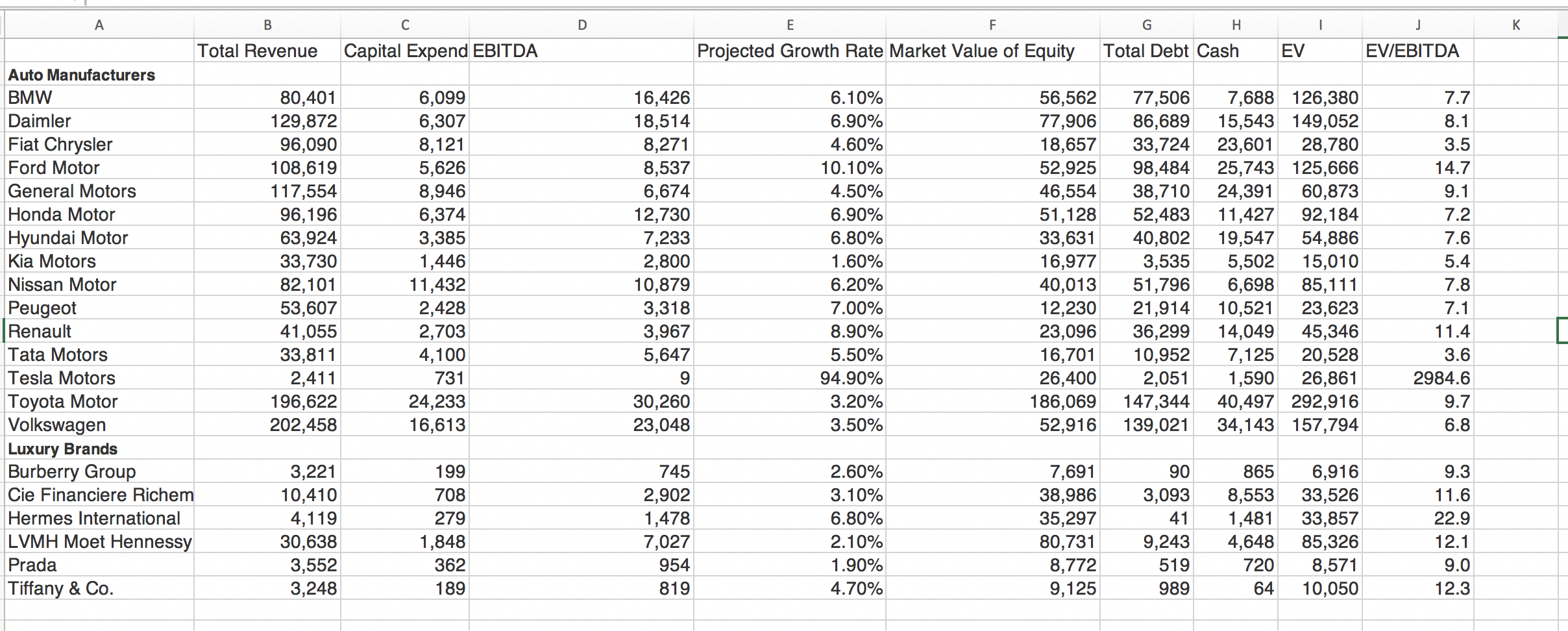

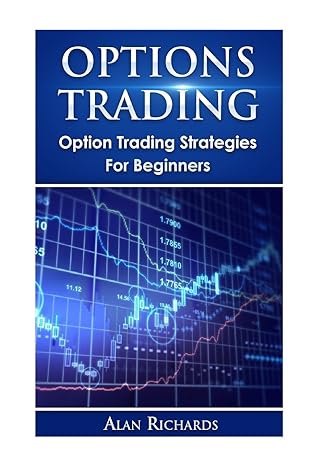

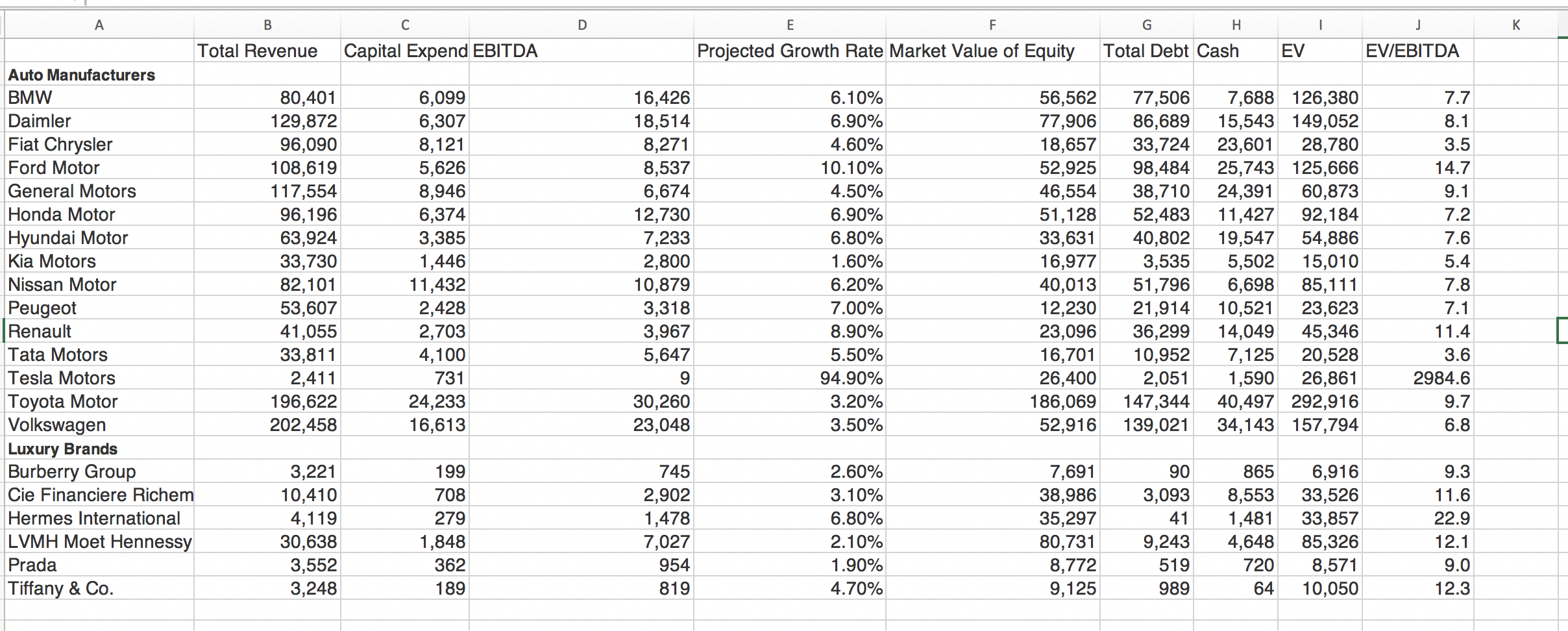

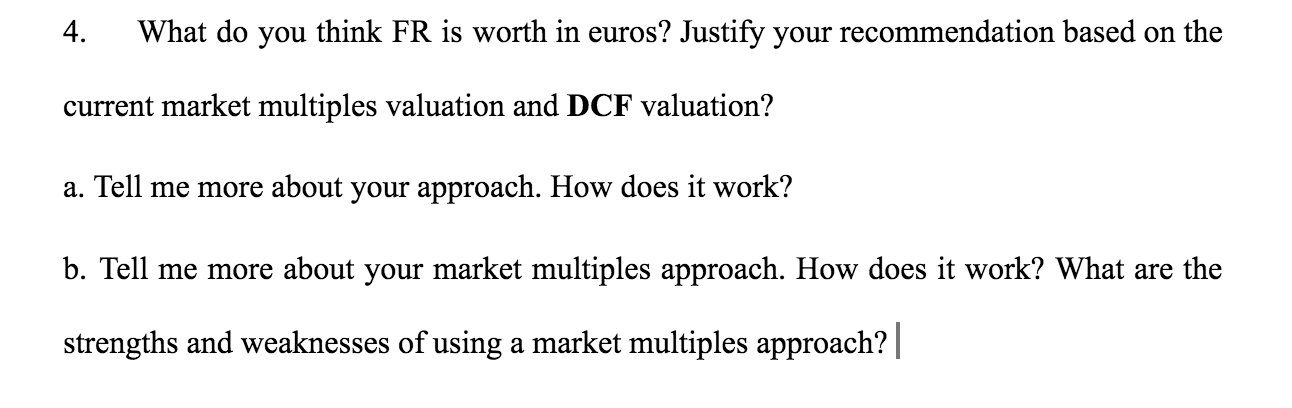

B D E F G H 1 J K Projected Growth Rate Market Value of Equity Total Debt Cash EV EV/EBITDA A C Total Revenue Capital Expend EBITDA Auto Manufacturers BMW 80,401 6,099 Daimler 129,872 6,307 Fiat Chrysler 96,090 8,121 Ford Motor 108,619 5,626 General Motors 117,554 8,946 Honda Motor 96,196 6,374 Hyundai Motor 63,924 3,385 Kia Motors 33,730 1,446 Nissan Motor 82,101 11,432 Peugeot 53,607 2,428 Renault 41,055 2,703 Tata Motors 33,811 4,100 Tesla Motors 2,411 731 Toyota Motor 196,622 24,233 Volkswagen 202,458 16,613 Luxury Brands Burberry Group 3,221 199 Cie Financiere Richem 10,410 708 Hermes International 4,119 279 LVMH Moet Hennessy 30,638 1,848 Prada 3,552 362 Tiffany & Co. 3,248 189 16,426 18,514 8,271 8,537 6,674 12,730 7,233 2,800 10,879 3,318 3,967 5,647 6.10% 6.90% 4.60% 10.10% 4.50% 6.90% 6.80% 1.60% 6.20% 7.00% 8.90% 5.50% 94.90% 3.20% 3.50% 56,562 77,906 18,657 52,925 46,554 51,128 33,631 16,977 40,013 12,230 23,096 16,701 26,400 186,069 52,916 77,506 86,689 33,724 98,484 38,710 52,483 40,802 3,535 51,796 21,914 36,299 10,952 2,051 147,344 139,021 7,688 126,380 15,543 149,052 23,601 28,780 25,743 125,666 24,391 60,873 11,427 92,184 19,547 54,886 5,502 15,010 6,698 85,111 10,521 23,623 14,049 45,346 7,125 20,528 1,590 26,861 40,497 292,916 34,143 157,794 7.7 8.1 3.5 14.7 9.1 7.2 7.6 5.4 7.8 7.1 11.4 3.6 2984.6 9.7 6.8 30,260 23,048 745 2,902 1,478 7,027 954 819 2.60% 3.10% 6.80% 2.10% 1.90% 4.70% 7,691 38,986 35,297 80,731 8,772 9,125 90 3,093 41 9,243 519 989 865 8,553 1,481 4,648 720 64 6,916 33,526 33,857 85,326 8,571 10,050 9.3 11.6 22.9 12.1 9.0 12.3 4. What do you think FR is worth in euros? Justify your recommendation based on the current market multiples valuation and DCF valuation? a. Tell me more about your approach. How does it work? b. Tell me more about your market multiples approach. How does it work? What are the strengths and weaknesses of using a market multiples approach? | B D E F G H 1 J K Projected Growth Rate Market Value of Equity Total Debt Cash EV EV/EBITDA A C Total Revenue Capital Expend EBITDA Auto Manufacturers BMW 80,401 6,099 Daimler 129,872 6,307 Fiat Chrysler 96,090 8,121 Ford Motor 108,619 5,626 General Motors 117,554 8,946 Honda Motor 96,196 6,374 Hyundai Motor 63,924 3,385 Kia Motors 33,730 1,446 Nissan Motor 82,101 11,432 Peugeot 53,607 2,428 Renault 41,055 2,703 Tata Motors 33,811 4,100 Tesla Motors 2,411 731 Toyota Motor 196,622 24,233 Volkswagen 202,458 16,613 Luxury Brands Burberry Group 3,221 199 Cie Financiere Richem 10,410 708 Hermes International 4,119 279 LVMH Moet Hennessy 30,638 1,848 Prada 3,552 362 Tiffany & Co. 3,248 189 16,426 18,514 8,271 8,537 6,674 12,730 7,233 2,800 10,879 3,318 3,967 5,647 6.10% 6.90% 4.60% 10.10% 4.50% 6.90% 6.80% 1.60% 6.20% 7.00% 8.90% 5.50% 94.90% 3.20% 3.50% 56,562 77,906 18,657 52,925 46,554 51,128 33,631 16,977 40,013 12,230 23,096 16,701 26,400 186,069 52,916 77,506 86,689 33,724 98,484 38,710 52,483 40,802 3,535 51,796 21,914 36,299 10,952 2,051 147,344 139,021 7,688 126,380 15,543 149,052 23,601 28,780 25,743 125,666 24,391 60,873 11,427 92,184 19,547 54,886 5,502 15,010 6,698 85,111 10,521 23,623 14,049 45,346 7,125 20,528 1,590 26,861 40,497 292,916 34,143 157,794 7.7 8.1 3.5 14.7 9.1 7.2 7.6 5.4 7.8 7.1 11.4 3.6 2984.6 9.7 6.8 30,260 23,048 745 2,902 1,478 7,027 954 819 2.60% 3.10% 6.80% 2.10% 1.90% 4.70% 7,691 38,986 35,297 80,731 8,772 9,125 90 3,093 41 9,243 519 989 865 8,553 1,481 4,648 720 64 6,916 33,526 33,857 85,326 8,571 10,050 9.3 11.6 22.9 12.1 9.0 12.3 4. What do you think FR is worth in euros? Justify your recommendation based on the current market multiples valuation and DCF valuation? a. Tell me more about your approach. How does it work? b. Tell me more about your market multiples approach. How does it work? What are the strengths and weaknesses of using a market multiples approach? |