Answered step by step

Verified Expert Solution

Question

1 Approved Answer

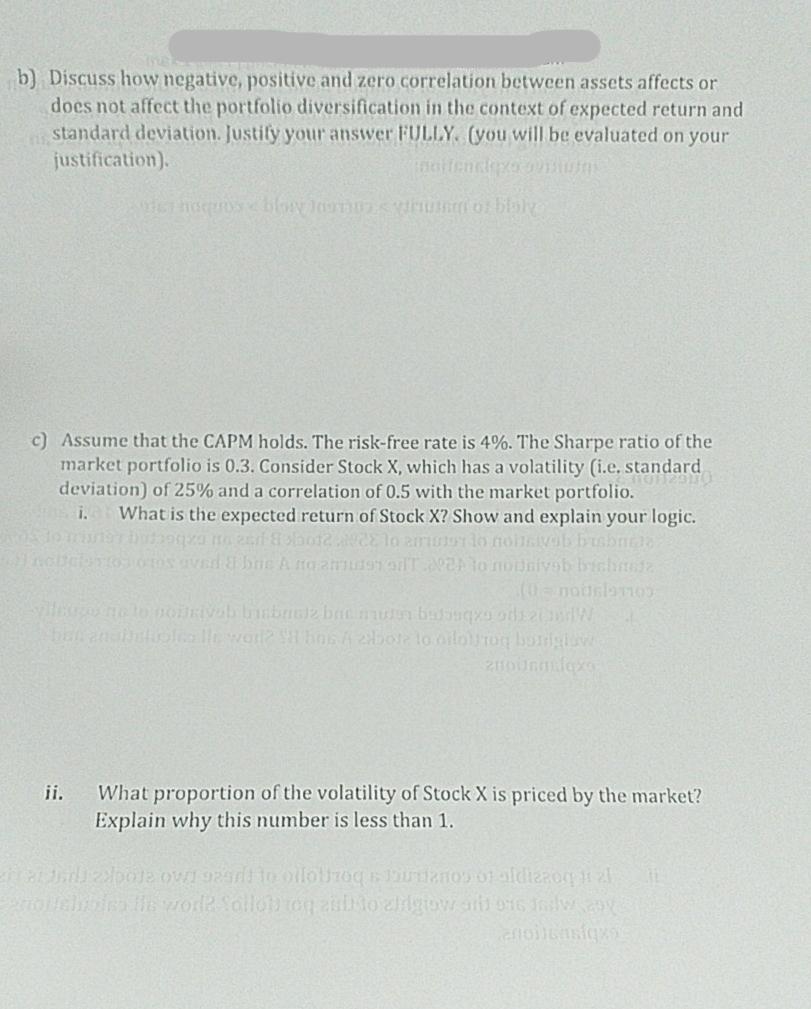

b) Discuss how negative, positive and zero correlation between assets affects or does not affect the portfolio diversification in the context of expected return

b) Discuss how negative, positive and zero correlation between assets affects or does not affect the portfolio diversification in the context of expected return and standard deviation. Justify your answer FULLY. (you will be evaluated on your justification). indifenalexan of naquos blowy loans wiring of blaly c) Assume that the CAPM holds. The risk-free rate is 4%. The Sharpe ratio of the market portfolio is 0.3. Consider Stock X, which has a volatility (i.e. standard deviation) of 25% and a correlation of 0.5 with the market portfolio. i. What is the expected return of Stock X? Show and explain your logic. lo nobyab babes noteprooms aved & bne A no auga 24 to nounivab bichnetz vllego no to porivab bebacle bac muten badu (0-nouslam103 od 20 W ben andelola lle work? SH bins A bote to oiloroq boniglow ii. What proportion of the volatility of Stock X is priced by the market? Explain why this number is less than 1. arjal zapoje ow! 92ard to oilotiroq udanos of aldiazol bisa lies wor? Sollo tog and to aldgrow and one indlway

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started