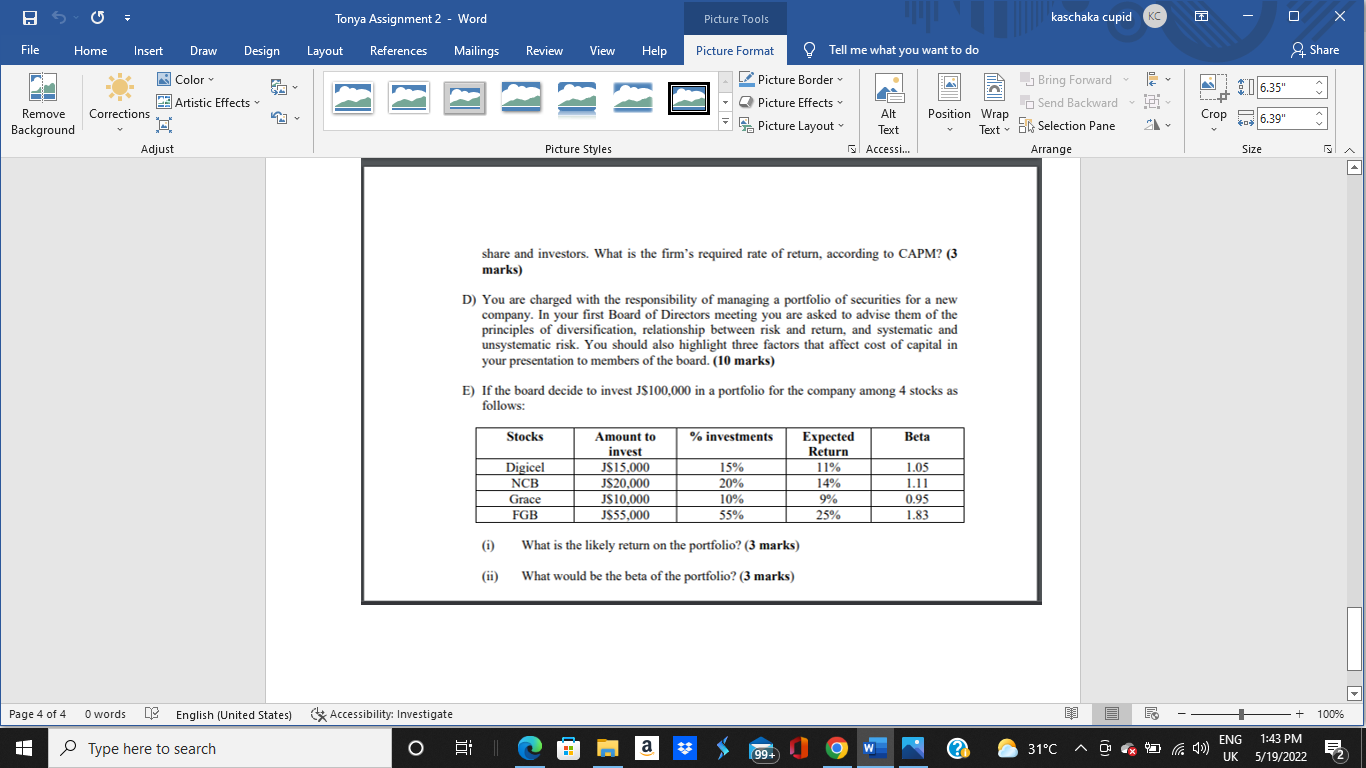

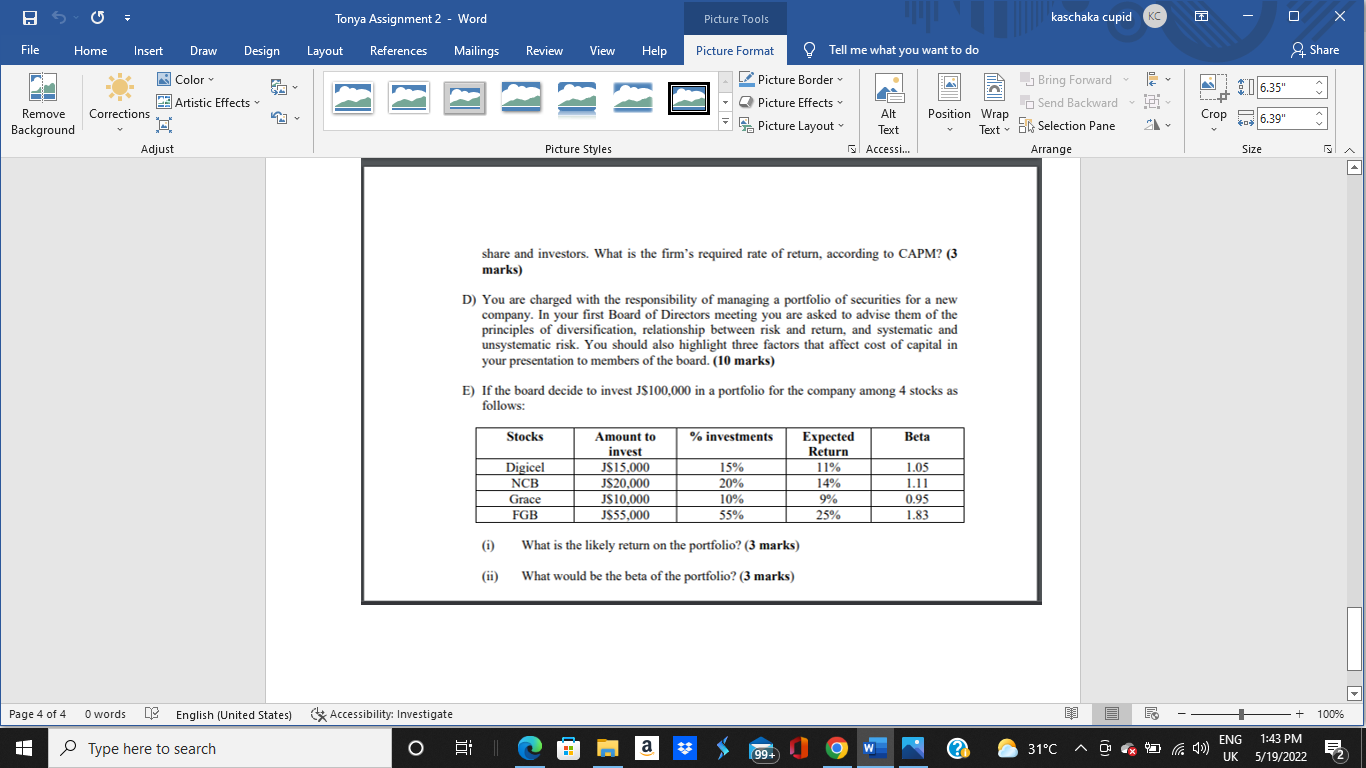

B = File Remove Corrections Background Page 4 of 4 + Home Insert Draw Design Color Artistic Effects Sa T Adjust O words Type here to search English (United States) Tonya Assignment 2 - Word Layout References Mailings 441\ Review View Tell me what you want to do Picture Border Picture Effects Picture Layout Alt Text Picture Styles Accessi... QUESTION 4. (25 MARKS) A) Why is an annual report of great interest to an investor? (3 marks) B) A firm's optimal capital structure was 55% debt at a cost (kp) of 20%, 4% Preference stock at a cost (kp) of 12.3%, and 41% common equity at a cost (ke) of 15.4%. If the tax rate is 40%: find the weighted cost of capital. (3 marks) C) Prentice Hall Enterprises has a beta of 1.45. The risk-free rate is 6% and the expected rate of return on the market is 10%. The company currently pays a dividend of $2.00 per 2 share and investors. What is the firm's required rate of return, according to CAPM? (3 marks) D) You are charged with the responsibility of managing a portfolio of securities for a new company. In your first Board of Directors meeting you are asked to advise them of the principles of diversification, relationship between risk and return, and systematic and unsystematic risk. You should also highlight three factors that affect cost of capital in your presentation to members of the board. (10 marks) E) If the board decide to invest J$100,000 in a portfolio for the company among 4 stocks as follows: || a 99+ Accessibility: Investigate O Help Picture Tools Picture Format Position Wrap Text kaschaka cupid KC 28 Bring Forward Send Backward Selection Pane Arrange 31C 6.35" ***** Crop 6.39" Size ) ENG 1:43 PM UK 5/19/2022 Share S 100% B = File Remove Corrections Background Page 4 of 4 + Home Insert Draw Design Color G Artistic Effects T Adjust O words Type here to search English (United States) Tonya Assignment 2 - Word References Mailings Layout Accessibility: Investigate 441\ Review View Tell me what you want to do Picture Border Picture Effects Picture Layout Position Wrap Alt Text Accessi... Text V Picture Styles share and investors. What is the firm's required rate of return, according to CAPM? (3 marks) D) You are charged with the responsibility of managing a portfolio of securities for a new company. In your first Board of Directors meeting you are asked to advise them of the principles of diversification, relationship between risk and return, and systematic and unsystematic risk. You should also highlight three factors that affect cost of capital in your presentation to members of the board. (10 marks) E) If the board decide to invest J$100,000 in a portfolio for the company among 4 stocks as follows: Stocks % investments Beta Amount to invest Expected Return J$15,000 15% 11% 1.05 JS20,000 20% 14% 1.11 Digicel NCB Grace FGB 10% 9% 0.95 J$10,000 J$55,000 55% 25% 1.83 What is the likely return on the portfolio? (3 marks) What would be the beta of the portfolio? (3 marks) a 99+ O (i) (ii) || Help Picture Tools Picture Format W kaschaka cupid KC 28 Bring Forward Send Backward Selection Pane Arrange 31C D E 6.35" ***** Crop 6.39" Size ) ENG UK 1:43 PM 5/19/2022 Share S 100% B = File Remove Corrections Background Page 4 of 4 + Home Insert Draw Design Color Artistic Effects Sa T Adjust O words Type here to search English (United States) Tonya Assignment 2 - Word Layout References Mailings 441\ Review View Tell me what you want to do Picture Border Picture Effects Picture Layout Alt Text Picture Styles Accessi... QUESTION 4. (25 MARKS) A) Why is an annual report of great interest to an investor? (3 marks) B) A firm's optimal capital structure was 55% debt at a cost (kp) of 20%, 4% Preference stock at a cost (kp) of 12.3%, and 41% common equity at a cost (ke) of 15.4%. If the tax rate is 40%: find the weighted cost of capital. (3 marks) C) Prentice Hall Enterprises has a beta of 1.45. The risk-free rate is 6% and the expected rate of return on the market is 10%. The company currently pays a dividend of $2.00 per 2 share and investors. What is the firm's required rate of return, according to CAPM? (3 marks) D) You are charged with the responsibility of managing a portfolio of securities for a new company. In your first Board of Directors meeting you are asked to advise them of the principles of diversification, relationship between risk and return, and systematic and unsystematic risk. You should also highlight three factors that affect cost of capital in your presentation to members of the board. (10 marks) E) If the board decide to invest J$100,000 in a portfolio for the company among 4 stocks as follows: || a 99+ Accessibility: Investigate O Help Picture Tools Picture Format Position Wrap Text kaschaka cupid KC 28 Bring Forward Send Backward Selection Pane Arrange 31C 6.35" ***** Crop 6.39" Size ) ENG 1:43 PM UK 5/19/2022 Share S 100% B = File Remove Corrections Background Page 4 of 4 + Home Insert Draw Design Color G Artistic Effects T Adjust O words Type here to search English (United States) Tonya Assignment 2 - Word References Mailings Layout Accessibility: Investigate 441\ Review View Tell me what you want to do Picture Border Picture Effects Picture Layout Position Wrap Alt Text Accessi... Text V Picture Styles share and investors. What is the firm's required rate of return, according to CAPM? (3 marks) D) You are charged with the responsibility of managing a portfolio of securities for a new company. In your first Board of Directors meeting you are asked to advise them of the principles of diversification, relationship between risk and return, and systematic and unsystematic risk. You should also highlight three factors that affect cost of capital in your presentation to members of the board. (10 marks) E) If the board decide to invest J$100,000 in a portfolio for the company among 4 stocks as follows: Stocks % investments Beta Amount to invest Expected Return J$15,000 15% 11% 1.05 JS20,000 20% 14% 1.11 Digicel NCB Grace FGB 10% 9% 0.95 J$10,000 J$55,000 55% 25% 1.83 What is the likely return on the portfolio? (3 marks) What would be the beta of the portfolio? (3 marks) a 99+ O (i) (ii) || Help Picture Tools Picture Format W kaschaka cupid KC 28 Bring Forward Send Backward Selection Pane Arrange 31C D E 6.35" ***** Crop 6.39" Size ) ENG UK 1:43 PM 5/19/2022 Share S 100%