Answered step by step

Verified Expert Solution

Question

1 Approved Answer

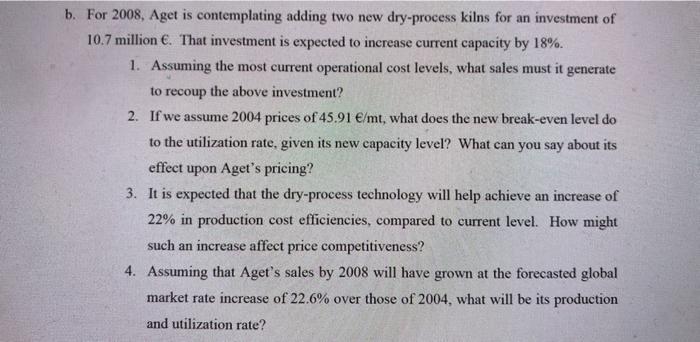

b. For 2008, Aget is contemplating adding two new dry-process kilns for an investment of 10.7 million . That investment is expected to increase

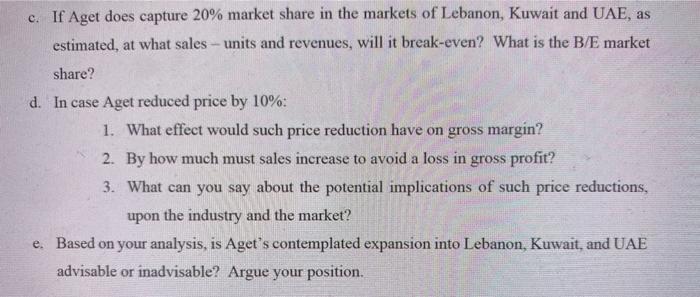

b. For 2008, Aget is contemplating adding two new dry-process kilns for an investment of 10.7 million . That investment is expected to increase current capacity by 18%. 1. Assuming the most current operational cost levels, what sales must it generate to recoup the above investment? 2. If we assume 2004 prices of 45.91 /mt, what does the new break-even level do to the utilization rate, given its new capacity level? What can you say about its effect upon Aget's pricing? 3. It is expected that the dry-process technology will help achieve an increase of 22% in production cost efficiencies, compared to current level. How might such an increase affect price competitiveness? 4. Assuming that Aget's sales by 2008 will have grown at the forecasted global market rate increase of 22.6% over those of 2004, what will be its production and utilization rate? c. If Aget does capture 20% market share in the markets of Lebanon, Kuwait and UAE, as estimated, at what sales - units and revenues, will it break-even? What is the B/E market share? d. In case Aget reduced price by 10%: 1. What effect would such price reduction have on gross margin? 2. By how much must sales increase to avoid a loss in gross profit? 3. What can you say about the potential implications of such price reductions, upon the industry and the market? e. Based on your analysis, is Aget's contemplated expansion into Lebanon, Kuwait, and UAE advisable or inadvisable? Argue your position.

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Partioulars Js QU ParticuDars 2004E 2 003e Romanks O Liquidity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started