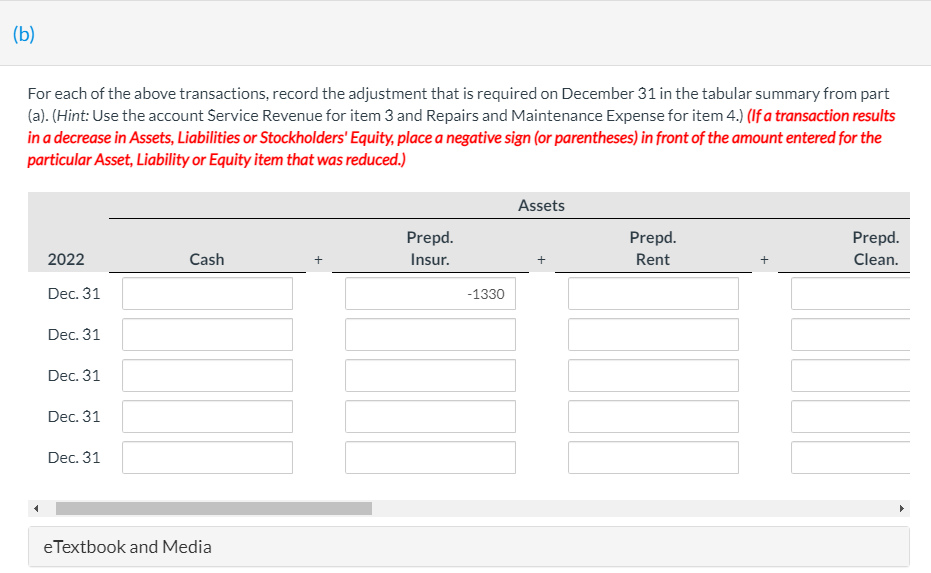

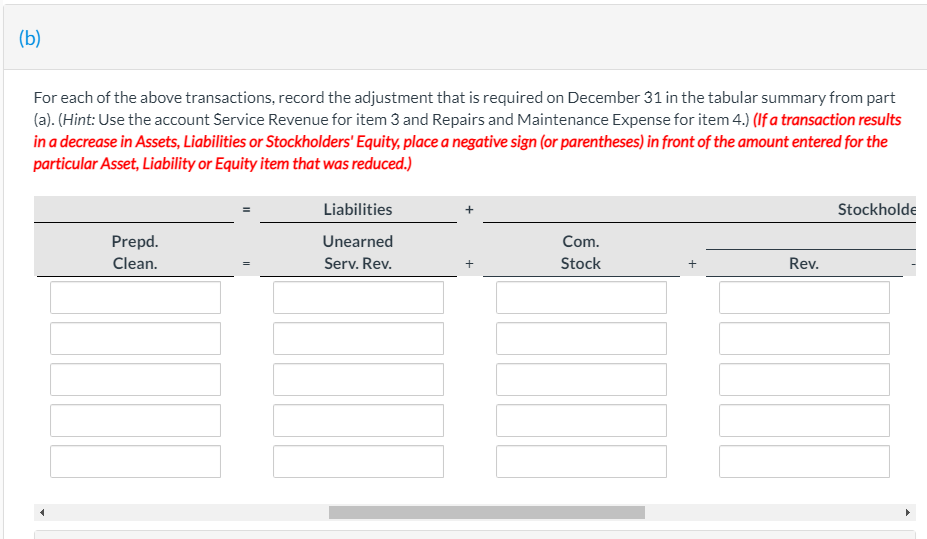

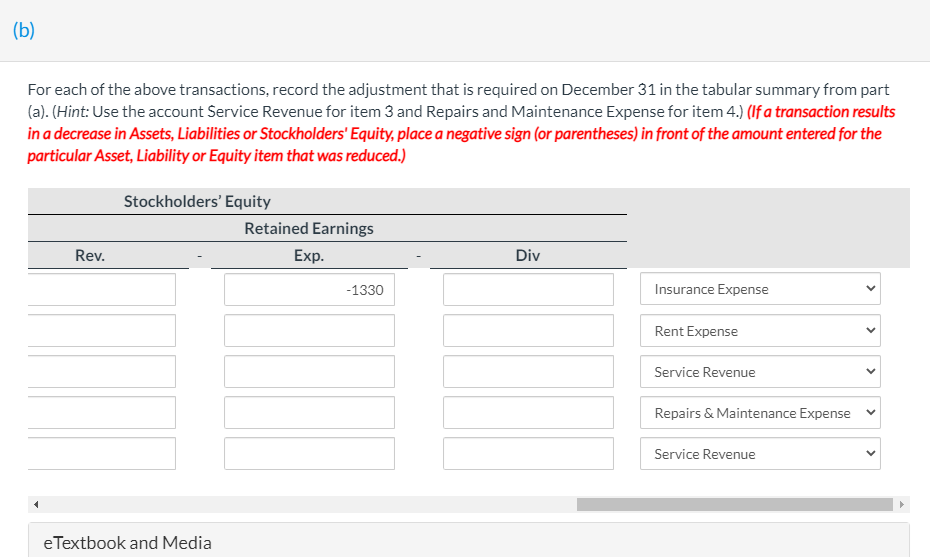

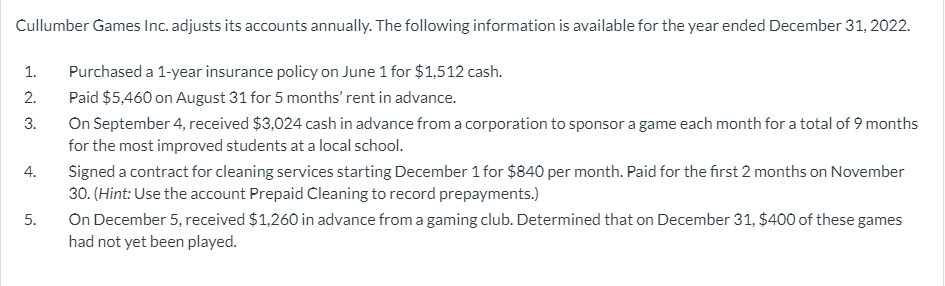

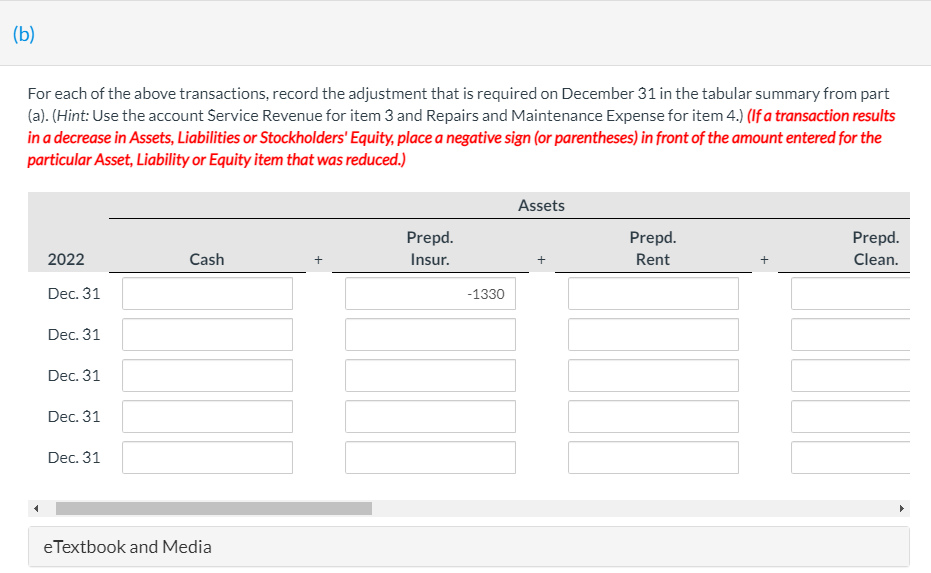

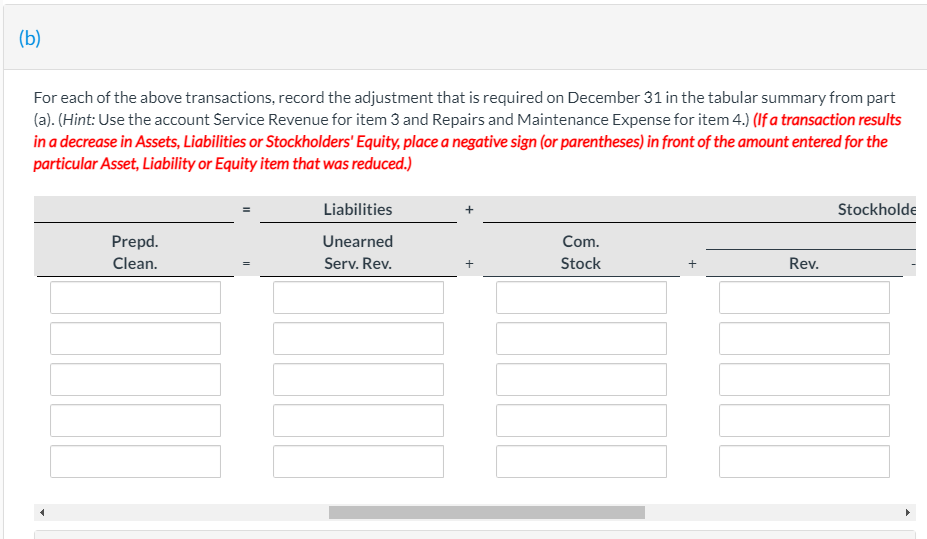

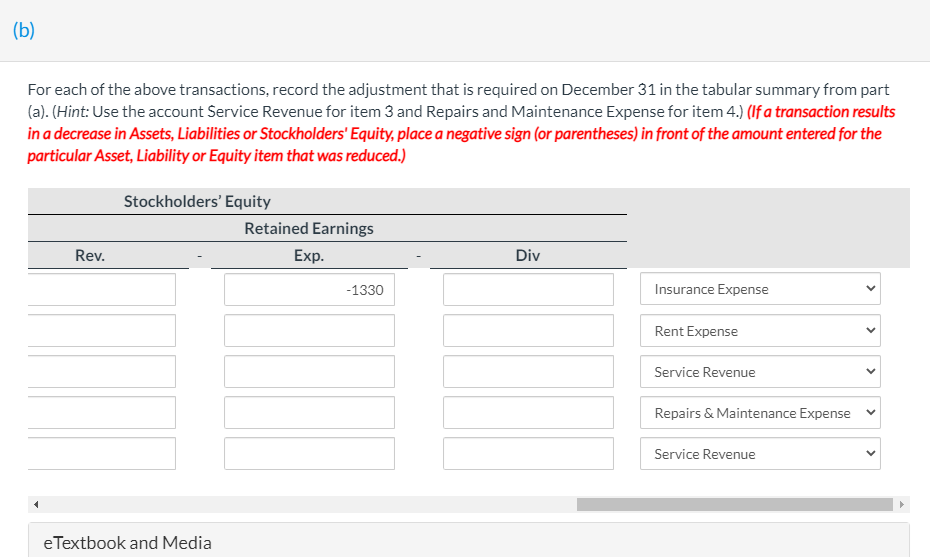

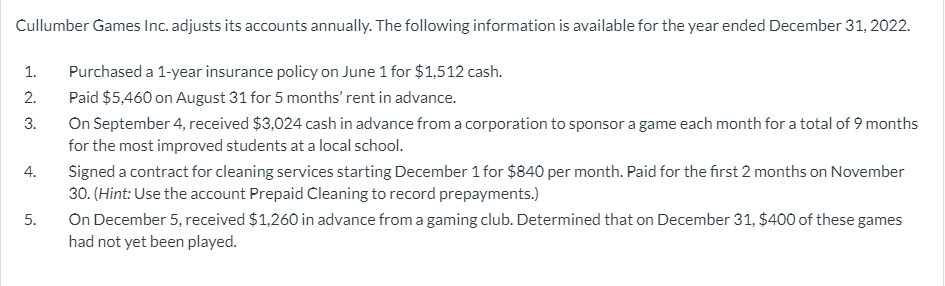

(b) For each of the above transactions, record the adjustment that is required on December 31 in the tabular summary from part (a). (Hint: Use the account Service Revenue for item 3 and Repairs and Maintenance Expense for item 4.) (If a transaction results in a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Prepd. Insur. Prepd. Rent Prepd. Clean. 2022 Cash + + + Dec. 31 -1330 Dec. 31 Dec. 31 Dec. 31 Dec. 31 e Textbook and Media (b) For each of the above transactions, record the adjustment that is required on December 31 in the tabular summary from part (a). (Hint: Use the account Service Revenue for item 3 and Repairs and Maintenance Expense for item 4.) (If a transaction results in a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Liabilities Stockholde Prepd. Clean. Unearned Serv. Rev. Com. Stock + Rev. (b) For each of the above transactions, record the adjustment that is required on December 31 in the tabular summary from part (a). (Hint: Use the account Service Revenue for item 3 and Repairs and Maintenance Expense for item 4.) (If a transaction results in a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Retained Earnings Exp. Rev. Div Repairs & Maintenance Expense Service Revenue e Textbook and Media Cullumber Games Inc. adjusts its accounts annually. The following information is available for the year ended December 31, 2022. 1. 2. 3. Purchased a 1-year insurance policy on June 1 for $1,512 cash. Paid $5,460 on August 31 for 5 months' rent in advance. On September 4, received $3,024 cash in advance from a corporation to sponsor a game each month for a total of 9 months for the most improved students at a local school. Signed a contract for cleaning services starting December 1 for $840 per month. Paid for the first 2 months on November 30. (Hint: Use the account Prepaid Cleaning to record prepayments.) On December 5, received $1,260 in advance from a gaming club. Determined that on December 31, $400 of these games had not yet been played. 4. 5