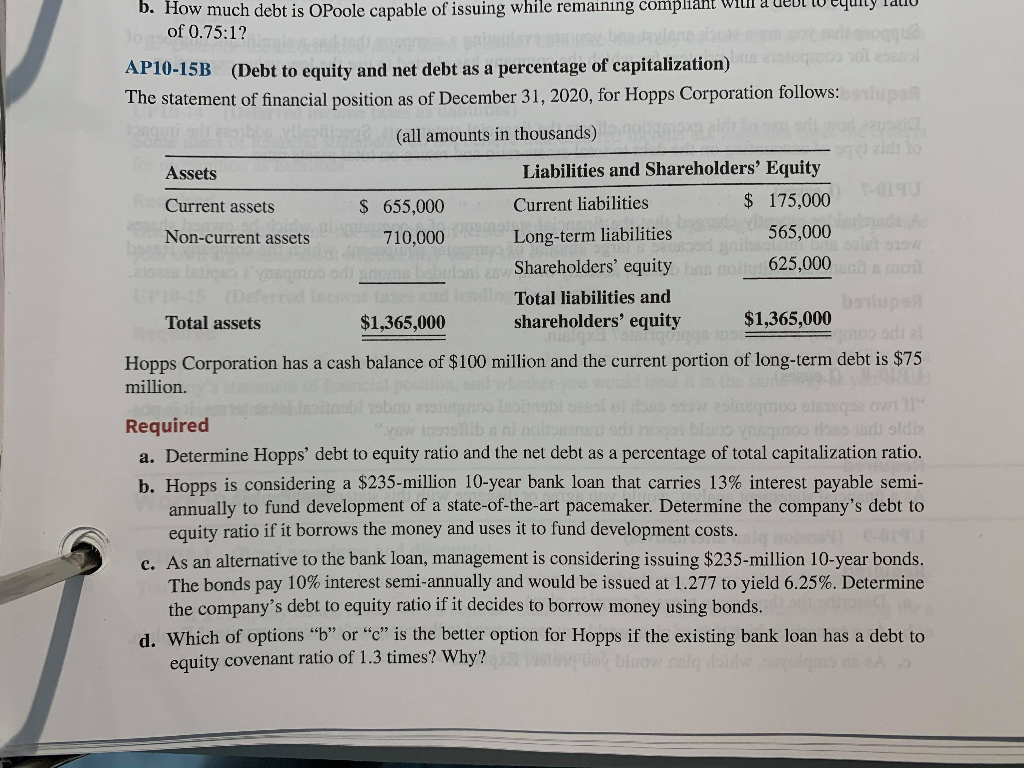

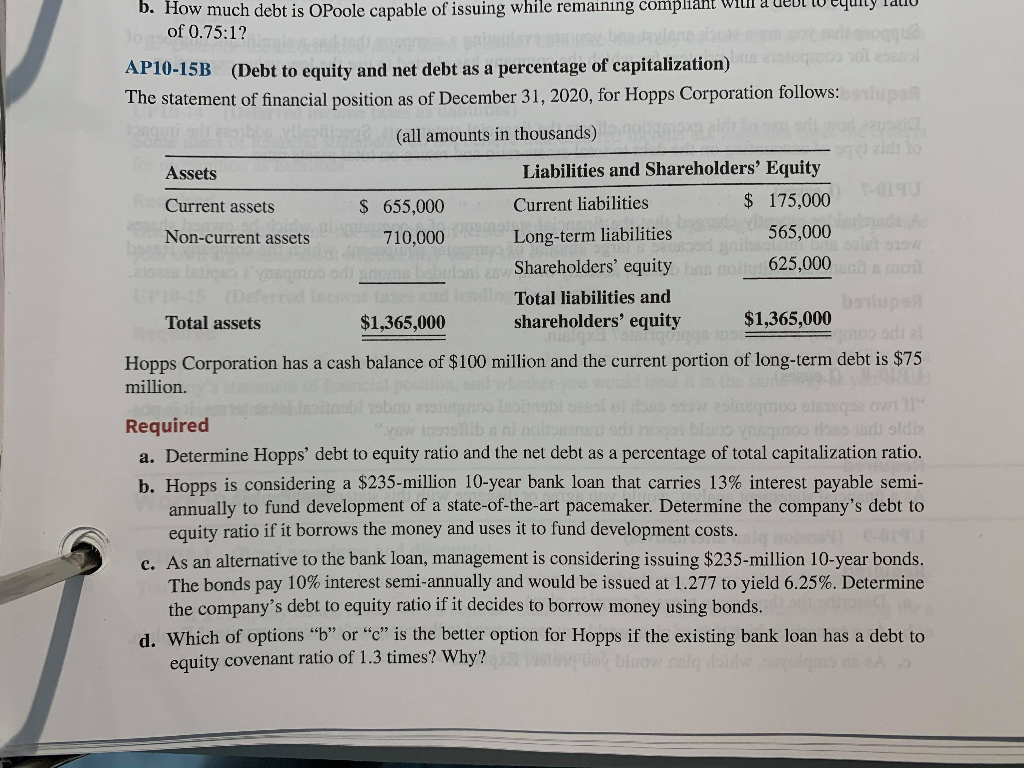

b. How much debt is OPoole capable of issuing while remaining compliant will del i equity Idio of 0.75:1? 10-15B (Debt to equity and net debt as a percentage of capitalization) The statement of financial position as of December 31, 2020, for Hopps Corporation follows: (all amounts in thousands) Assets Current assets Non-current assets $ 655,000 710,000 Liabilities and Shareholders' Equity Current liabilities $ 175,000 Long-term liabilities 565,000 Shareholders' equity 625,000 Total liabilities and shareholders' equity $1,365,000 to Total assets $1,365,000 Hopps Corporation has a cash balance of $100 million and the current portion of long-term debt is $75 million. Required wawishibsn ba si no lo y oo total oldin a. Determine Hopps' debt to equity ratio and the net debt as a percentage of total capitalization ratio. b. Hopps is considering a $235-million 10-year bank loan that carries 13% interest payable semi- annually to fund development of a state-of-the-art pacemaker. Determine the company's debt to equity ratio if it borrows the money and uses it to fund development costs. c. As an alternative to the bank loan, management is considering issuing $235-million 10-year bonds. The bonds pay 10% interest semi-annually and would be issued at 1.277 to yield 6.25%. Determine the company's debt to equity ratio if it decides to borrow money using bonds. d. Which of options "b" or "c" is the better option for Hopps if the existing bank loan has a debt to equity covenant ratio of 1.3 times? Why? b. How much debt is OPoole capable of issuing while remaining compliant will del i equity Idio of 0.75:1? 10-15B (Debt to equity and net debt as a percentage of capitalization) The statement of financial position as of December 31, 2020, for Hopps Corporation follows: (all amounts in thousands) Assets Current assets Non-current assets $ 655,000 710,000 Liabilities and Shareholders' Equity Current liabilities $ 175,000 Long-term liabilities 565,000 Shareholders' equity 625,000 Total liabilities and shareholders' equity $1,365,000 to Total assets $1,365,000 Hopps Corporation has a cash balance of $100 million and the current portion of long-term debt is $75 million. Required wawishibsn ba si no lo y oo total oldin a. Determine Hopps' debt to equity ratio and the net debt as a percentage of total capitalization ratio. b. Hopps is considering a $235-million 10-year bank loan that carries 13% interest payable semi- annually to fund development of a state-of-the-art pacemaker. Determine the company's debt to equity ratio if it borrows the money and uses it to fund development costs. c. As an alternative to the bank loan, management is considering issuing $235-million 10-year bonds. The bonds pay 10% interest semi-annually and would be issued at 1.277 to yield 6.25%. Determine the company's debt to equity ratio if it decides to borrow money using bonds. d. Which of options "b" or "c" is the better option for Hopps if the existing bank loan has a debt to equity covenant ratio of 1.3 times? Why