Answered step by step

Verified Expert Solution

Question

1 Approved Answer

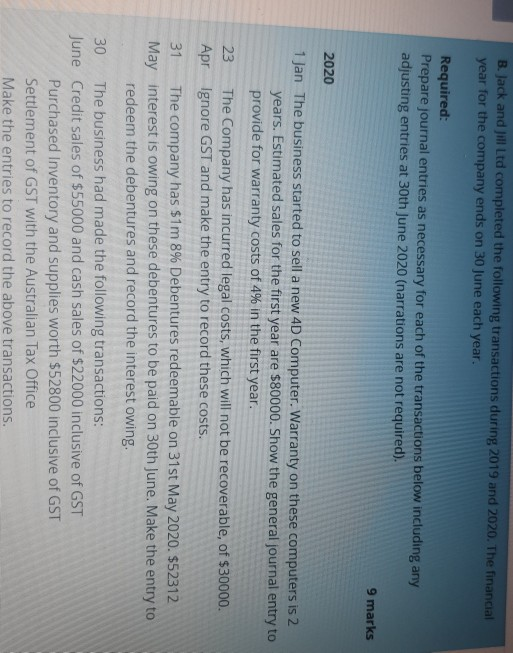

B. Jack and Jill Ltd completed the following transactions during 2019 and 2020. The financial year for the company ends on 30 June each year.

B. Jack and Jill Ltd completed the following transactions during 2019 and 2020. The financial year for the company ends on 30 June each year. Required: Prepare journal entries as necessary for each of the transactions below including any adjusting entries at 30th June 2020 (narrations are not required). 9 marks 2020 1 Jan The business started to sell a new 4D Computer. Warranty on these computers is 2 years. Estimated sales for the first year are $80000. Show the general journal entry to provide for warranty costs of 4% in the first year. 23 The Company has incurred legal costs, which will not be recoverable, of $30000. Apr Ignore GST and make the entry to record these costs. 31 The company has $1m 8% Debentures redeemable on 31st May 2020. $52312 May interest is owing on these debentures to be paid on 30th June. Make the entry to redeem the debentures and record the interest owing. 30 The business had made the following transactions: June Credit sales of $55000 and cash sales of $22000 inclusive of GST Purchased Inventory and supplies worth $52800 inclusive of GST Settlement of GST with the Australian Tax Office Make the entries to record the above transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started