Please help

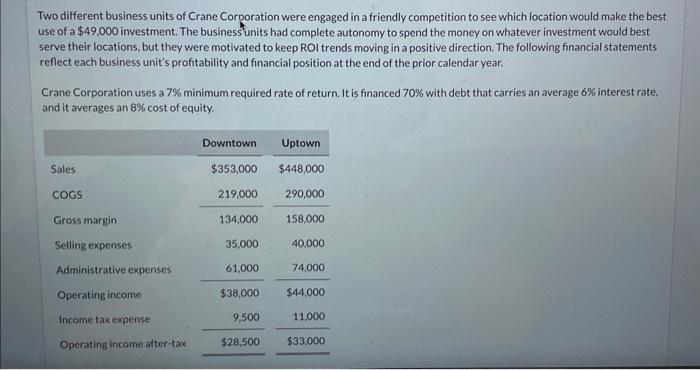

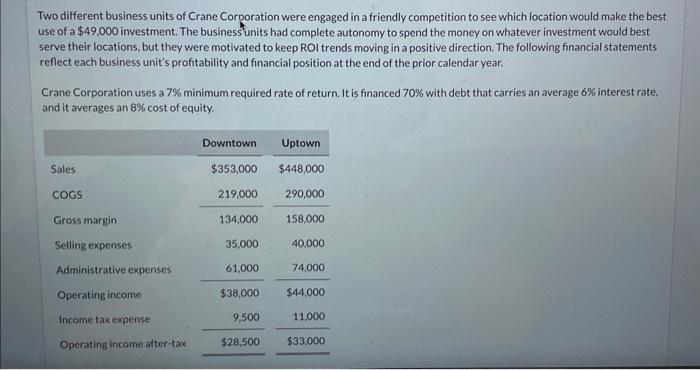

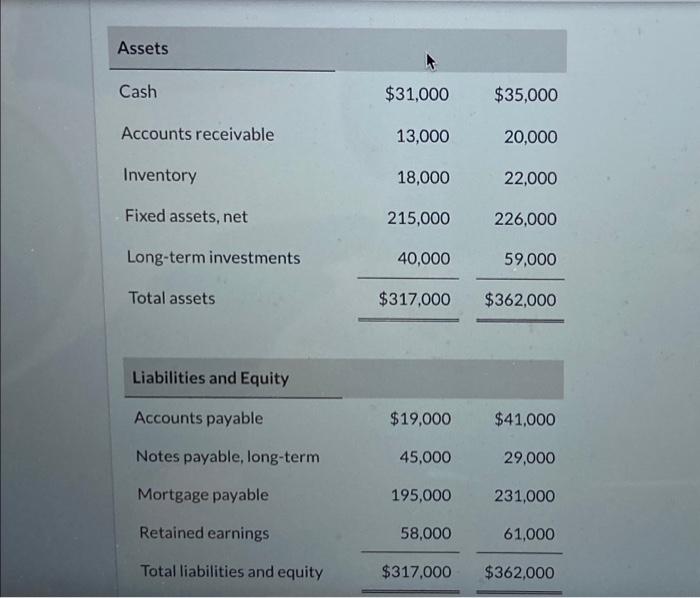

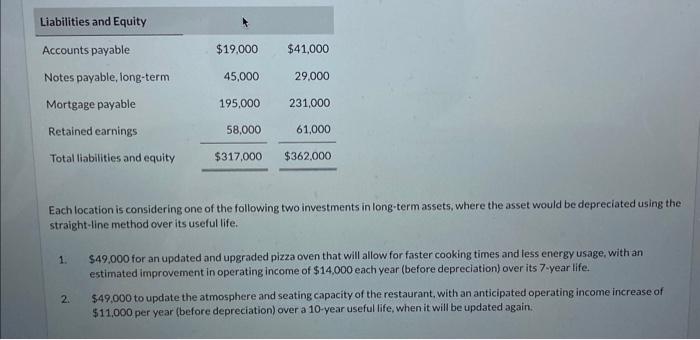

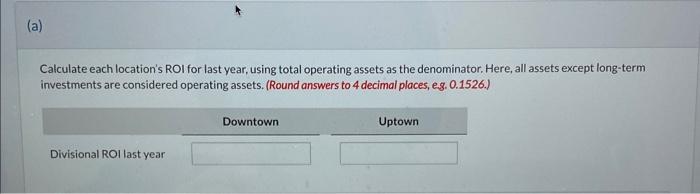

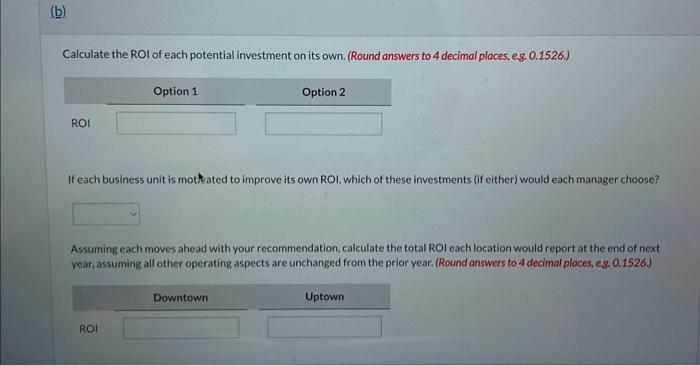

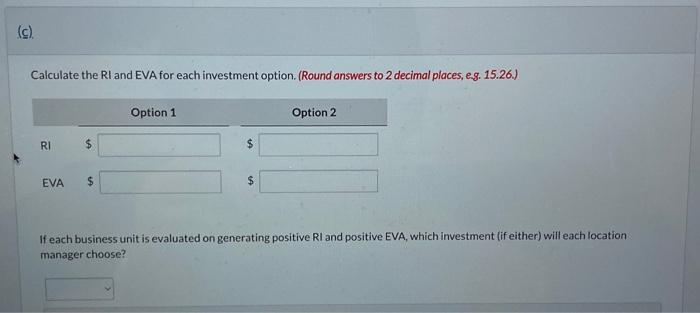

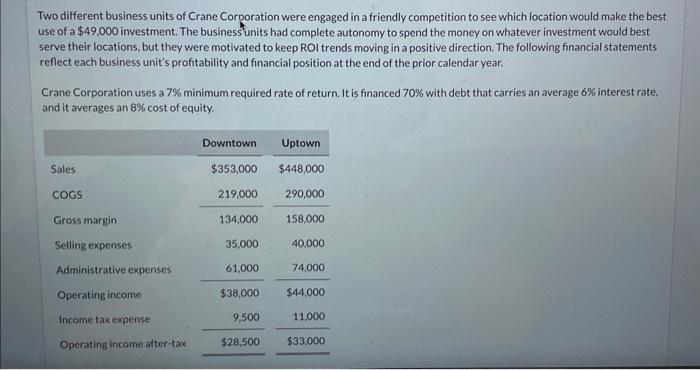

Two different business units of Crane Corporation were engaged in a friendly competition to see which location would make the best use of a $49,000 investment. The business units had complete autonomy to spend the money on whatever investment would best serve their locations, but they were motivated to keep ROI trends moving in a positive direction. The following financial statements reflect each business unit's profitability and financial position at the end of the prior calendar year. Crane Corporation uses a 7% minimum required rate of return. It is financed 70% with debt that carries an average 6% interest rate. and it averages an 8% cost of equity. \begin{tabular}{lrrr} Assets & & \\ \hline Cash & $31,000 & $35,000 \\ & 13,000 & 20,000 \\ Accounts receivable & 18,000 & 22,000 \\ Inventory & 215,000 & 226,000 \\ Fixed assets, net & 40,000 & & 59,000 \\ Long-term investments & $317,000 & $362,000 \\ Total assets & & \end{tabular} \begin{tabular}{lrrr} Liabilities and Equity & & \\ \hline Accounts payable & $19,000 & $41,000 \\ Notes payable, long-term & 45,000 & 29,000 \\ Mortgage payable & 195,000 & 231,000 \\ Retained earnings & 58,000 & 61,000 \\ Total liabilities and equity & $317,000 & $362,000 \\ \hline \hline \end{tabular} Each location is considering one of the following two investments in long-term assets, where the asset would be depreciated using the straight-line method over its useful life. 1. $49,000 for an updated and upgraded pizza oven that will allow for faster cooking times and less energy usage, with an estimated improvement in operating income of $14,000 each year (before depreciation) over its 7-year life. 2. $49,000 to update the atmosphere and seating capacity of the restaurant, with an anticipated operating income increase of $11,000 per year (before depreciation) over a 10-year useful life, when it will be updated again. Calculate each location's ROI for last year, using total operating assets as the denominator. Here, all assets except long-term investments are considered operating assets. (Round answers to 4 decimal places, e.3. 0.1526.) Calculate the ROI of each potential investment on its own. (Round answers to 4 decimal places, eg. 0.1526.) If each business unit is mothated to improve its own ROI, which of these investments (if either) would each manager choose? Assuming each moves ahead with your recommendation, calculate the total ROl each location would report at the end of next year, assuming all other operating aspects are unchanged from the prior year. (Round answers to 4 decimal ploces, e.g. 0.1526 .) Calculate the RI and EVA for each investment option. (Round answers to 2 decimal places, e.g. 15.26.) If each business unit is evaluated on generating positive RI and positive EVA, which investment (if either) will each location manager choose? Two different business units of Crane Corporation were engaged in a friendly competition to see which location would make the best use of a $49,000 investment. The business units had complete autonomy to spend the money on whatever investment would best serve their locations, but they were motivated to keep ROI trends moving in a positive direction. The following financial statements reflect each business unit's profitability and financial position at the end of the prior calendar year. Crane Corporation uses a 7% minimum required rate of return. It is financed 70% with debt that carries an average 6% interest rate. and it averages an 8% cost of equity. \begin{tabular}{lrrr} Assets & & \\ \hline Cash & $31,000 & $35,000 \\ & 13,000 & 20,000 \\ Accounts receivable & 18,000 & 22,000 \\ Inventory & 215,000 & 226,000 \\ Fixed assets, net & 40,000 & & 59,000 \\ Long-term investments & $317,000 & $362,000 \\ Total assets & & \end{tabular} \begin{tabular}{lrrr} Liabilities and Equity & & \\ \hline Accounts payable & $19,000 & $41,000 \\ Notes payable, long-term & 45,000 & 29,000 \\ Mortgage payable & 195,000 & 231,000 \\ Retained earnings & 58,000 & 61,000 \\ Total liabilities and equity & $317,000 & $362,000 \\ \hline \hline \end{tabular} Each location is considering one of the following two investments in long-term assets, where the asset would be depreciated using the straight-line method over its useful life. 1. $49,000 for an updated and upgraded pizza oven that will allow for faster cooking times and less energy usage, with an estimated improvement in operating income of $14,000 each year (before depreciation) over its 7-year life. 2. $49,000 to update the atmosphere and seating capacity of the restaurant, with an anticipated operating income increase of $11,000 per year (before depreciation) over a 10-year useful life, when it will be updated again. Calculate each location's ROI for last year, using total operating assets as the denominator. Here, all assets except long-term investments are considered operating assets. (Round answers to 4 decimal places, e.3. 0.1526.) Calculate the ROI of each potential investment on its own. (Round answers to 4 decimal places, eg. 0.1526.) If each business unit is mothated to improve its own ROI, which of these investments (if either) would each manager choose? Assuming each moves ahead with your recommendation, calculate the total ROl each location would report at the end of next year, assuming all other operating aspects are unchanged from the prior year. (Round answers to 4 decimal ploces, e.g. 0.1526 .) Calculate the RI and EVA for each investment option. (Round answers to 2 decimal places, e.g. 15.26.) If each business unit is evaluated on generating positive RI and positive EVA, which investment (if either) will each location manager choose