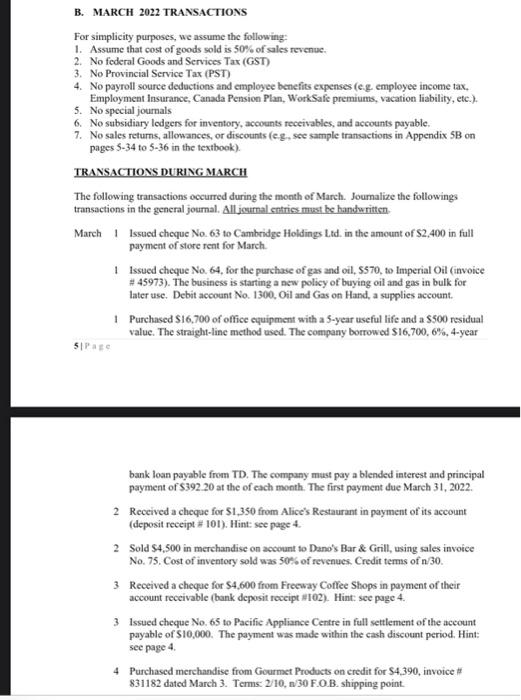

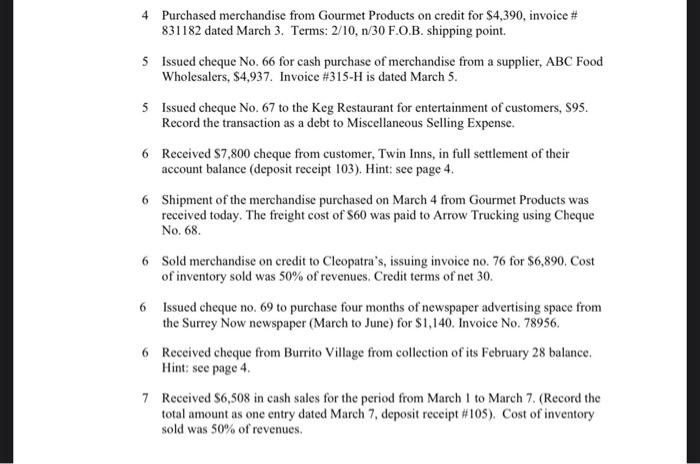

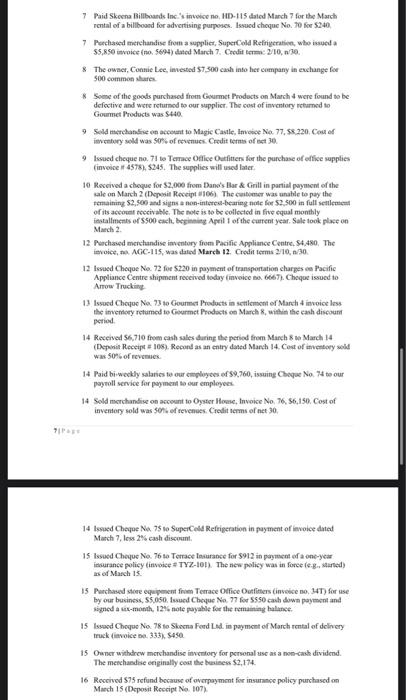

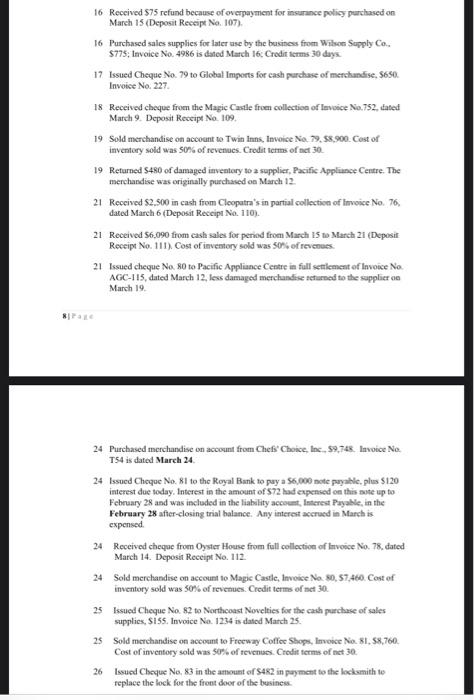

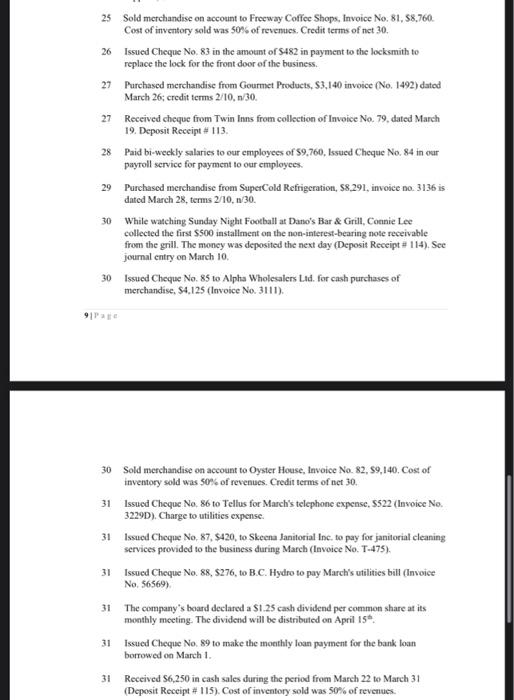

B. MARCH 2022 TRANSACTIONS For simplicity purposes, we assume the following: 1. Assume that cost of goods sold is 50% of sales revenue. 2. No federal Goods and Services Tax (GST) 3. No Provincial Service Tax (PST) 4. No payroll source deductions and employee benefits expenses (e.g. employee income tax, Employment lnsurance, Canada Pension Plan, WorkSafe premiums, vacation liability, etc.). 5. No special journals 6. No subsidiary ledgers for inventory, accounts receivables, and accounts payable. 7. No sales returns, allowances, or discounts (eg, see sample transactions in Appendix SB on pages 5-34 to 5-36 in the texibook). TRANSACTIONS DURING MARCH The following transactions occurred during the month of March. Joumalize the followings transactions in the general journal. All joumal entries must be handwritten. March 1 Issued cheque No. 63 to Cambridge Holdings L.td. in the amount of \$2,400 in full payment of store rent for March. 1 Issued cheque No. 64, for the purchase of gas and oil, \$570, to Imperial Oil (invoice \# 45973). The business is starting a acw policy of buying oil and gas in bulk for later use. Debit account No. 1300, Oil and Gas on Hand, a supplies account. 1 Purchased $16,700 of office equipment with a 5-year useful life and a $500 residual value. The straight-line method used. The company borrowed $16,700,6%,4-year 5|Pase bank loan payable from TD. The company must pay a blended interest and principal payment of $392.20 at the of each month. The first payment due March 31, 2022. 2 Received a cheque for 51,350 from Alice's Restaurant in payment of its account (deposit receipt = H 101). Hint: see page 4 . 2 Sold \$4,500 in merchandisc on acoount to Dano's Bar \& Grill, using sales invoice No. 75. Cost of inventory sold was 50% of revenues. Credit terms of n/30. 3 Received a cheque for $4,600 from Freeway Coffee Shops in payment of their account receivable (bank deposit reccipt Hi 102 ). Hint: see page 4. 3 Issued cheque No. 65 to Pacific Appliance Centre in full settlement of the account payable of $10,000. The payment was made within the cash discount period. Hint: see page 4. 4 Purchased merchandise from Gourmet Products on credit for $4,390, invoice \# 831182 dated March 3. Terms: 2/10, n/30 F.O.B. shipping point. 4 Purchased merchandise from Gourmet Products on credit for $4,390, invoice \# 831182 dated March 3. Terms: 2/10, n/30 F.O.B. shipping point. 5 Issued cheque No. 66 for cash purchase of merchandise from a supplier, ABC Food Wholesalers, \$4,937. Invoice #315H is dated March 5. 5 Issued cheque No. 67 to the Keg Restaurant for entertainment of customers, \$95. Record the transaction as a debt to Miscellaneous Selling Expense. 6 Received $7,800 cheque from customer, Twin Inns, in full settlement of their account balance (deposit receipt 103). Hint: see page 4. 6 Shipment of the merchandise purchased on March 4 from Gourmet Products was received today. The freight cost of $60 was paid to Arrow Trucking using Cheque No. 68. 6 Sold merchandise on credit to Cleopatra's, issuing invoice no. 76 for $6,890. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 6 Issued cheque no. 69 to purchase four months of newspaper advertising space from the Surrey Now newspaper (Mareh to June) for \$1,140. Invoice No. 78956. 6 Received cheque from Burrito Village from collection of its February 28 balance. Hint: see page 4. 7 Received \$6,508 in cash sales for the period from March I to March 7. (Record the total amount as one entry dated March 7, deposit receipt #105 ). Cost of inventory sold was 50% of revenues. 7 Paid Skeena Billboands Inc." 1 invoice no, 115-115 dated Manch 7 for the March rental of a billboosd for advertising purposes. Issued choque No. 70 for 5240 . 7 Pactaseed merchandise from a supplier, SuperCold Refrigerativo, who issued a 55,850 invoice (no, 5694 ) dated Mareh 7. Credit terma: 2/0, n/2. 8 The owact, Contuic Lee, invested $7,500 cash into her company in euchange foe 500 common aluares. 8 Soene of the goods purchased frem Gourmet Prodects on March 4 were found to be. defoctive and wete returnod to our supplicr. The eost of inventory retarned to Goumet Products was $440. 9 Sodd merchancise on accoent to Magic Casale, Imveice Na. 77, \$5, 220, Cou of ievcetery sold was 50 wh of etvenues. Credit terms of eet 30 . 9 Issued cheque no. 71 to Terace Ofice Ourfiten for the purchase of effice supplies (inveive it 4578 ), 5245. The rupplies will used later. 10 Roccived a choque for 32,000 from Dand's Blar k Grilt in partial paynocm of the sale on March 2 (Deposit Reveigt elo6). The caibomer was unable to pay the fermaining 52,500 atul signs a non-inthres-bearing note for 52,500 in full sealentent of tis aceouef toecivable. The note is to be sollected in five equal monthly iestallments of $500 cach. beginaieg Ageil 1 of the curent year, Sale took place on March 2. 12 Perchased mershandise inventory from Pacific Appliance Centre, 54,480. The itroice, ald ACiC-115, was dared March 12. Crodit terms 210,n30. 12 Issued Cheque Na. 72 foe 5220 in payment of transportation charges we Pacific Appliance Centre shipment reccived lodry (invoice sa. 6667). Choqoe issucd to Arrow Trucking. 13. Issusd Cheque Ne. 73 so Gounmet Products in settlemont of Marth 4 invoice less the imvenhery retumed to Geurmet Prodacts on March 8, withit the eash discounf pertiod. 14 Recerved \$6, 710 from cash sales during the period frem March 8 wo March 14 (Dephit Receipt I 108). Recond as an entry dated Mlanch 14. Coot of anveneory wold was 50/6 of revinaes. 14 Paid bi wockly salaries tw our cmployos of 99,760 , issuing Cheque No. 74 to our paynoll service for poyment ta sur employees. 14 Sold merchandive on account to Oyseer Hloame, Invoice No, T6, 36,150 . Cost of inventery sold was 50 ti ef tevenues. Crealit serms of net 30 . 14 tsued Cheque No. 75 so SuperCeld Refrigeration in fayment of invoice dated March 7, loss 2\% eash discount. 15. Issusd Cheyue No. 76 so Terrace laarance for $912 in pryment of a one-year insurance policy (invoice a TYZ-101). The new policy was in foree (e.g., sterted) as of Masch 15 . 15 Purchased sties equipenent fiven Terrace ONfice Ouafitters (invesce no, 4T) for use by our business, 55.050. Isued Cheque No. 77 for 5550 cash down payment and signed a sec-month, 124 , note payable for the remaining balunee. 15 Issasd Choyue Na. 78 to Skecna Fond Lad in payment of March rental of delivery truck (lavoice ba., 335), $490. 15. Oaner withdrew merchandise invertory for personal use as a non-cash fividend. The menchasdise eniginally cosa the berisen $2,174. 16 Reccived 575 refund because of overpayment for insurnoce policy purchased on March 15 (Deposit Reccipt Na. 107 ) 16 Received $75 refund because of overpayment for insurance policy purchased on March 15 (Deposit Receipe No. 107). 16 Purchased sales supplies for later use by the business from Wilson Supply Co., \$775; Invoice No. 4986 is dated March I6: Credir kerms 30 dayx. 17 Issued Cheque No. 79 to Global Imports for cash parchase of merchandise, 9650. Invoise No. 227. 18 Received cheque from the Magic Castle fruen collection of lavoice No.752, dated Marzh 9. Deposit Rescipt No. 109. 19 Sold merchandise on account wo Twin Inns, Invoise Na. 79, 58,900 . Cast of inventory sold was 50% of revenues. Credit nerms of net 30 . 19 Returned $480 of damaged inventory to a supplier, Pacific Appliance Centre. The merchandise was originally purchased on March 12 . 21 Reccived $2.500 in cash from Cleopatra's in partial collection of linvoice No. 76, dated March 6 (Deposit Reccipt No. 110). 21 Received 56,090 from cash sales for period from March 15 to March 21 (Deposir Receipt No. 111). Cost of inventory sold was 50 th of revenues. 21 Issued cheque No. 80 to Pacific Appliance Ceatre in full sentlement of Invoice Na. AGC-115, dated March 12, less damaged merchandise sechurned to the supplier oe March 19. 24 Purchased merchandise on account from Chef' Choice, lnc, 59,748. Invoice Ne. T54 is dated March 24. 24 Issued Cheque No. 81 to the Royal Bark to pay a 56,000 note pryable, plus $120 interest due today. Interest in the amount of 572 had expensed on this aste up to February 28 and was included in the liability account, Interest Pryable, in the Febraary 28 after-closing trial balance. Any interest accrued in March is. expensed. 24. Received cheque from O ster House from full collection of Invoise No. 78, dated March 14. Deposit Reccipt No. 112. 24. Sold merchandise on account to Magic Castle, Invoise Na. 50, 57,460. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 25 Issued Cheque No. 82 to Northcoast Novelties for the cach purchase of sales supplics, \$155. Invoice No. 1234 is datod March 25. 25 Sold merchandise on account to Freeway Coffer Shops, lnvoice Na. 81, 58,760. Cost of inventory sold was 50% of tevenues. Credit terms of nat 30 . 26 Issued Cheque No, 83 in the amount of 9482 in pey ment to the locksmith to replace the lock for the front door of the business. 25 Sold merchandise on account to Frecway Coffec Shops, Invoice No, 81, 58,760. Cost of inventory sold was 50% of revenucs. Credit terms of net 30 . 26 Issued Cheque No. 83 in the amount of $482 in payment to the locksmith to replace the lock for the front door of the business. 27 Purchased merchandise from Gourmet Products, 53,140 invoice (No. 1492) dated March 26; credit terms 2/10, n/30. 27 Received cheque from Twin Inns from collection of Invoice No. 79, dated March 19. Deposit Reccipt \# 113. 28 Paid bi-weckly salaries to our cmployees of 59,760 , lssued Cheque No, 84 in our payroll service for payment to our employees. 29 Purchased merchandise from SuperCold Refrigcration, \$8.291, invoice no. 3136 is dated March 28 , terms 2/10,n/30. 30 While watching Sunday Night Football at Dano's Bar \& Grill, Connie Lee collected the first $500 installment on the non-interest-bearing note receivable from the grill. The money was deposited the next day (Deposit Receipt \# 114). See journal entry on March 10. 30 Issued Cheque No. 85 to Alphs Wholesalers Ltd. for cash purchases of merchandise, $4,125 (Invoice No, 3111). 30 Sold merchandise on account to Oyster House, Invoice No. 82, \$9,140, Cost of inventory sold was 50% of revenues. Credit terms of net 30. 31 Issued Cheque No. 86 to Tellus for March's telephone expense, 5522 (Invoice No. 3229D). Charge to utilities expense. 31 Issued Cheque No, 87, $420, to Skeena Janitorial Ine, to pay for janitorial cleaning services provided to the business during March (Invoice No. T-475). 31 Issued Cheque No. 88, \$276, to B.C. Hydro to pay March's utilities bill (Invoice No, 56569) 31 The company's board declared a $1.25 cash dividend per common share at its monthly meeting. The dividend will be distributed on April 15. 31 Issued Cheque No. 89 to make the moethly loan payment for the bank loan borrowed on March 1. 31 Received S6,250 in cash sales during the period from March 22 to March 31 (Deposit Receipt \# I15). Cost of inventory sold was 50% of revenues