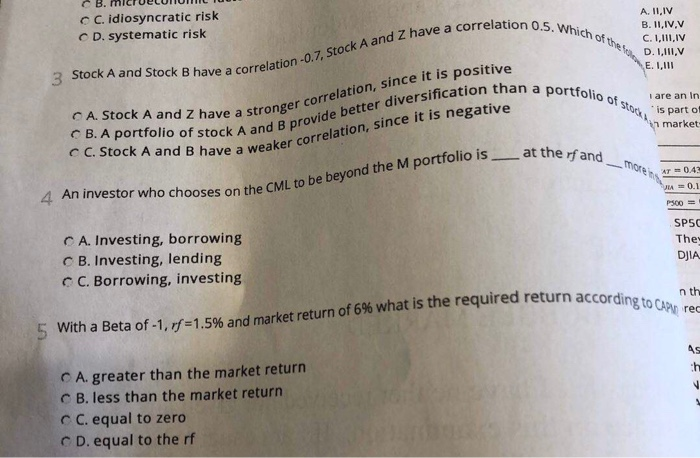

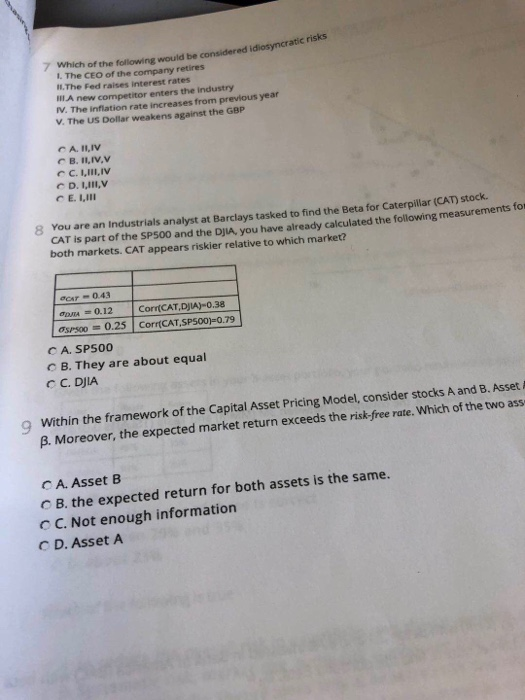

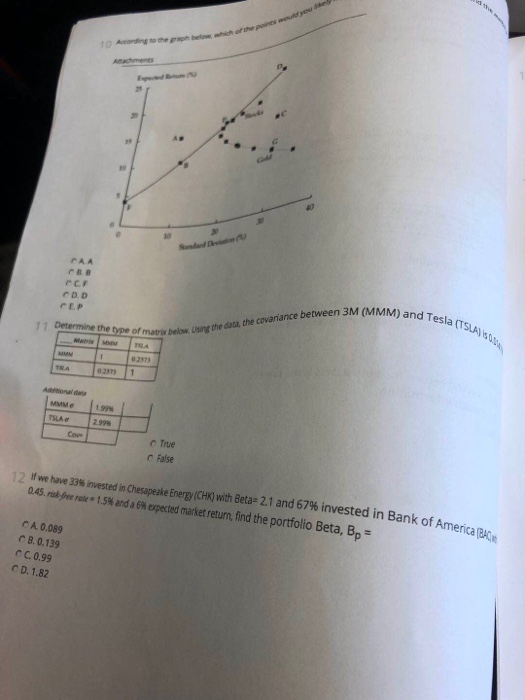

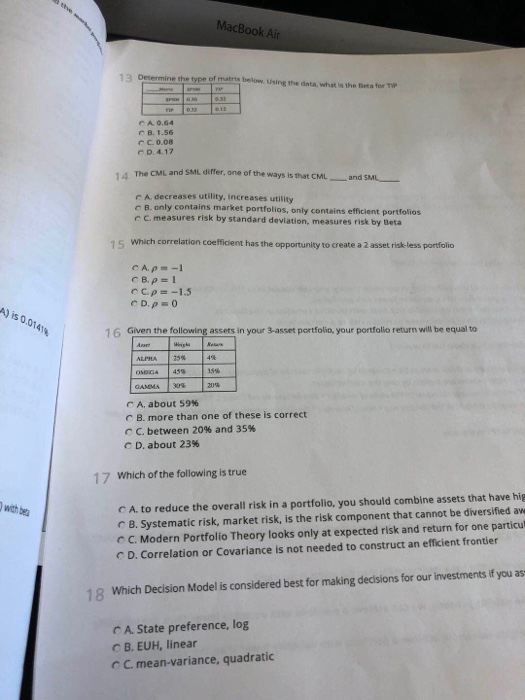

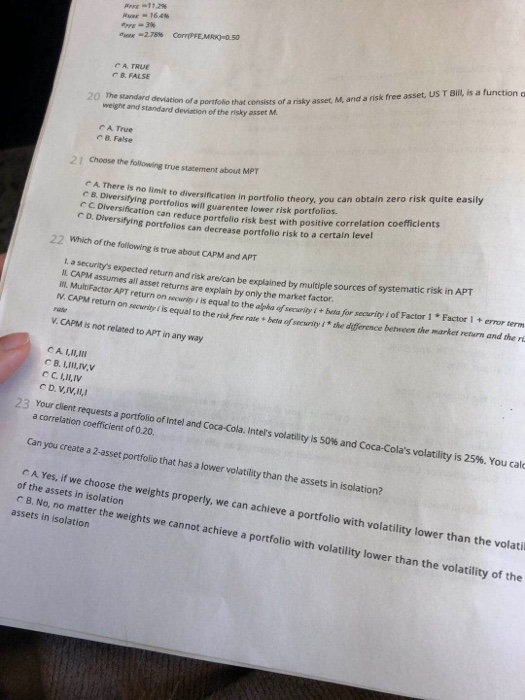

B. MICFUELUNUML U C. idiosyncratic risk CD. systematic risk 0.5. Which of thes A. II,IV B. II,IV.v C. 1,111,1V ck A and Z have a correlation 05 D. 1,111, E. I, 3 Stock A and Stock B have a correlation Correlation-0.7, Stock A and Z have than a portfolio of story are an in is part of market A. Stock A and Z have a stronge CB. A portfolio of stock A and B P C C. Stock A and B have a weaker have a stronger correlation, since it is positive stock A and B provide better diversification th s have a weaker correlation, since it is negative at ther and the M portfolio is at the rf and more 043 JIA = 0.1 4 An investor who chooses on the CML to be P500 = CA. Investing, borrowing B. Investing, lending C C. Borrowing, investing SPSC They DJIA d return according to CAPL rec nth 5 With a Beta of -1. rf =1.5% and market return of 6% what is the required return acco, A greater than the market return CB. less than the market return CC. equal to zero CD. equal to the rf 72 7 Which of the following would be considered idiosyncratic 1. The CEO of the company retires 1. The Fed raises interest rates HII A new competitor enters the industry IV. The inflation rate increases from previous year V. The US Dollar weakens against the GBP CA. II, IV B. II,IV.V C. I,III, IV CD. LIHV CE. 1,111 8 You are an Industrials analyst at Barclays tasked to find the Beta for Caterpillar (CAT) stock. CAT is part of the SP500 and the DIIA vou have already calculated the following measurements to both markets. CAT appears riskier relative to which market? or -0.43 A = 0.12 Corr(CAT,DJIA)-0.38 sroo = 0.25 Corr(CAT,SP500)-0.79 CA. SP500 B. They are about equal CC. DJIA Within the framework of the Capital Asset Pricing Model, consider stocks A and B. Asset B. Moreover, the expected market return exceeds the risk-free rate. Which of the two ass CA. Asset B B. the expected return for both assets is the same. O C. Not enough information CD. Asset A CAA COD CEP and Tesla (TSLA the covariance between 3M (MMM)an Determine the type of s low. Using MA TA 1 MMM ITSLAG Com True false 12 If we have 33 invested in Chesapeake Energy ICHK) with Beta-2.1 and 67% invested in Bank of America 0.45. rofecrate 1.5% and a 6 expected market return, find the portfolio Beta, B Bank of America BA CA. 0.089 B. 0.139 CC. 0.99 CD. 1.82 MacBook Air arx below. Using the data what is the tets for CAO.GA 3.1.56 0.00 CD 4.17 The CML and SML differ, one of the ways is that CML and SML A decreases utility, increases utility CB only contains market portfolios, only contains efficient portfolios measures risk by standard deviation, measures risk by Beta 15 which correlation coefficient has the opportunity to create a 2 asset risk-less portfolio CAP = -1 CBp=1 CP= -1.5 CD.p=0 A) is 0.01414 16 Given the following assets in your 3-asset portfolio, your portfolio return will be equal to ALPHA 35 OCA 455 GAMMA 4% 156 2 A. about 59% CB. more than one of these is correct C. between 20% and 35% CD, about 23% 17 Which of the following is true CA. to reduce the overall risk in a portfolio, you should combine assets that have hig B. Systematic risk, market risk, is the risk component that cannot be diversified aw C. Modern Portfolio Theory looks only at expected risk and return for one particu D. Correlation or Covariance is not needed to construct an efficient frontier 18 Which Decision Model is considered best for making decisions for our investments if you as CA State preference, log CB. EUH, linear OC mean-variance, quadratic Nr 16.41 -2.784 CorFEMR0-50 CA TRUE C FALSE 20 The standard deviation of a portfolio that consists of weight and standard deviation of the risky asset M. a portfolio that consists of a risky asset M, and a risk free asset, US T BIN is a function CA True 8. False 21 Choose the following the statement about MPT Mere is no limit to diversificare a can obtain zero risk quite easily CB Diversifying portfolios will parenter lower risk portfolios. ication can reduce portfelio risk best with positive correlation coefficients - Diversifying portfolios can decrease portfolio risk to a certain leve 22 Which of the following is true about CAPM and APT La security's expected y s expected return and risk are can be explained by multiple sources of systematic risk in APT IL CAPM assumes all asset returns are explain by only the market factor m. MultiFactor APT return on OF APT return on writy is equal to the a writy is equal to the algo r ity big for security of Factor 1 Factor 1 or term I. CAPM return on www return on w rity is equal to the risk free rate het of ruity she difference between the marker return and then V. CAPM is not related to APT in any way CALI, CB. I,II,IV. CC. I,II,IV CD. V.IV,14,1 2. Your client requests a portfolio of Intel and Coca-Cola, Intel's volatility is 50% and Coca-Cola's volatility is 25%. You cale a correlation coefficient of 0.20 Can you create a 2-asset portfolio that has a lower volatility than the assets in isolation? CA Yes, if we choose the weights properly, we can achieve a portfolio with volatility lower than the volati of the assets in isolation B. No, no matter the weights we cannot achieve a portfolio with volatility lower than the volatility of the assets in Isolation