Answered step by step

Verified Expert Solution

Question

1 Approved Answer

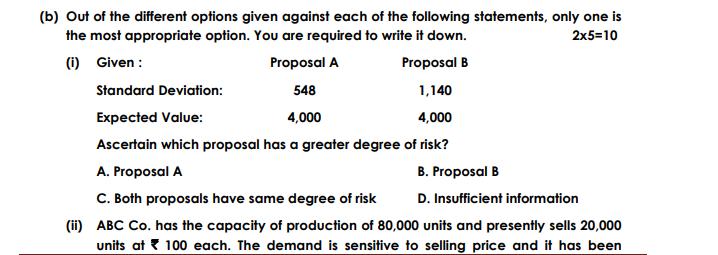

(b) Out of the different options given against each of the following statements, only one is the most appropriate option. You are required to

(b) Out of the different options given against each of the following statements, only one is the most appropriate option. You are required to write it down. 2x5=10 (i) Given: Proposal A Proposal B Standard Deviation: 1,140 Expected Value: 4,000 Ascertain which proposal has a greater degree of risk? A. Proposal A B. Proposal B D. Insufficient information C. Both proposals have same degree of risk (ii) ABC Co. has the capacity of production of 80,000 units and presently sells 20,000 units at 100 each. The demand is sensitive to selling price and it has been 548 4,000 observed that for every reduction of 10 in Selling Price, the demand is doubled. If the Profit Margin on Sale is 25%, the Target Cost at full capacity would be A. 60 B. 80 C. 100 D. None of these (iii) Ramdev Manufacturing Co. produces the following Products, using 5,000 tons of Coal at a cost of 15 per ton into a common process: Coke- 3,500 Tons, Tar -1,200 Tons, Sulphate of Ammonia - 52 Tons and Benzol - 48 Tons. 200 Tons of material is lost in Process as waste and air evaporation. Labour and Overheads for the process are 15,000 and 6,000 respectively. The Joint- Cost apportioned in the above ratio for Coke will be A. 50,000 B. 70,000 C. 80,000 D. 90,000 (iv) Ganesh Ltd., produces a product, which has a Variable Cost of Materials 40, Labour 10 and Overheads 4. The Selling Price is 90 per unit. Under a wage agreement, an increase of 10% is payable to all direct workers from the beginning of the forthcoming year, while the Material Cost is expected to increase by 7.5%, Variable Overheads by 5% and Fixed Overhead by 3%. The total Variable cost per unit in the forthcoming year will be A. 54 B. 58.20 C. 60.20 D. None of these (v) Following information is available for the 1st and 2nd quarter of the year for ABC Ltd.: Quarter Quarter-1 Quarter-2 Production in units 36,000 42,000 The Variable Cost per unit will be A. 3 C. 5 Semi-variable cost *2,80,000 3,10,000 B.6 D. None of these

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started