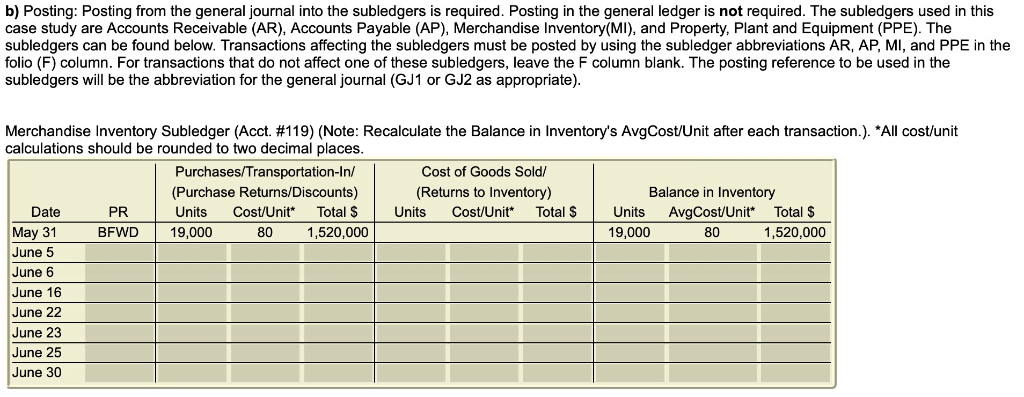

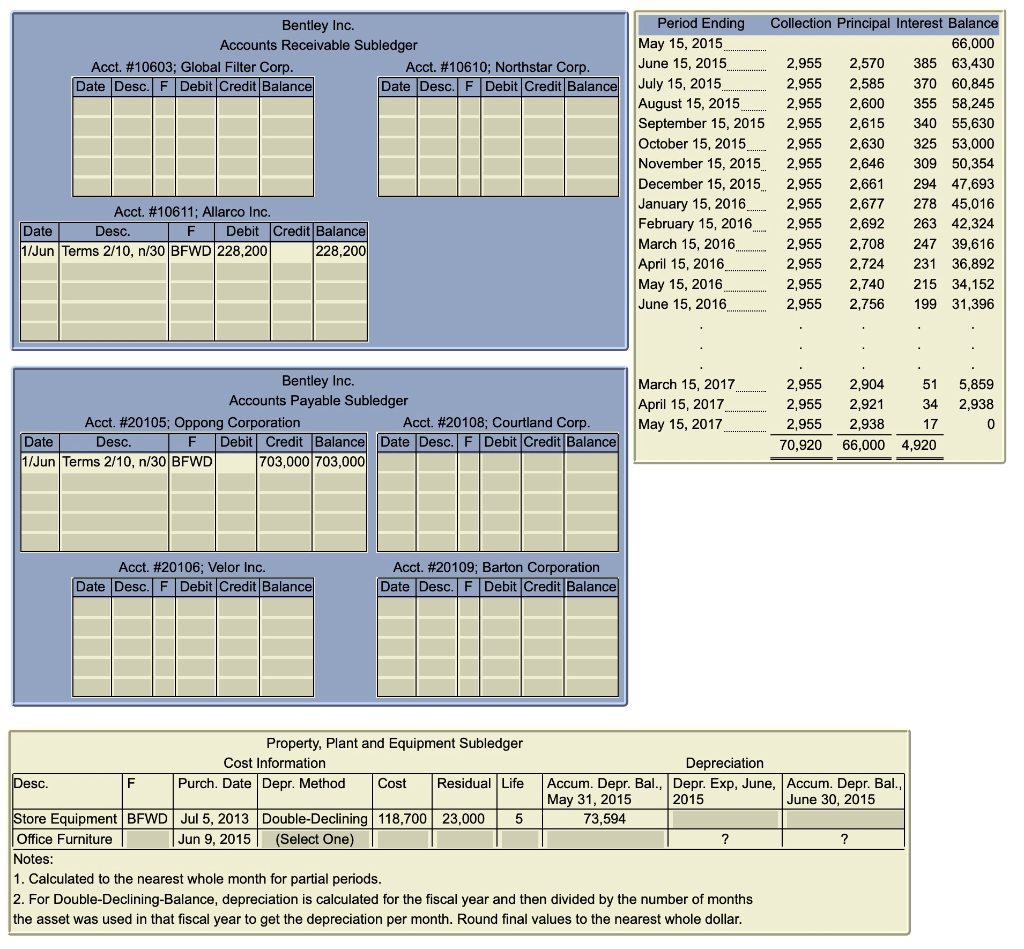

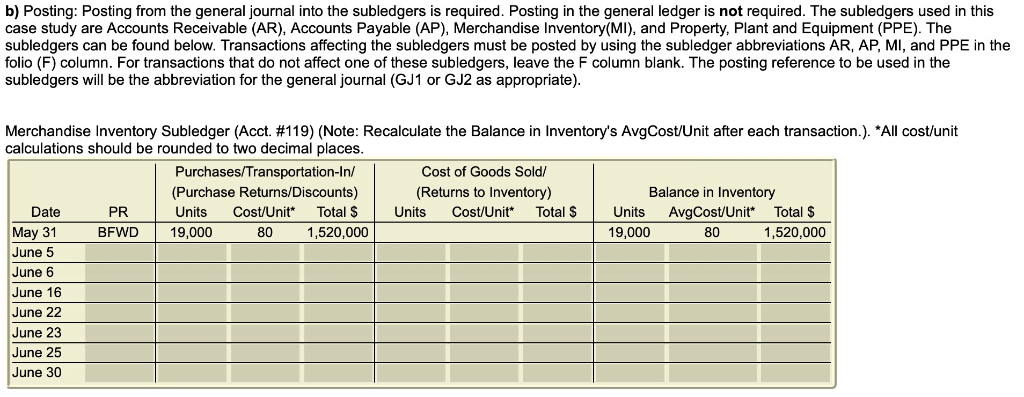

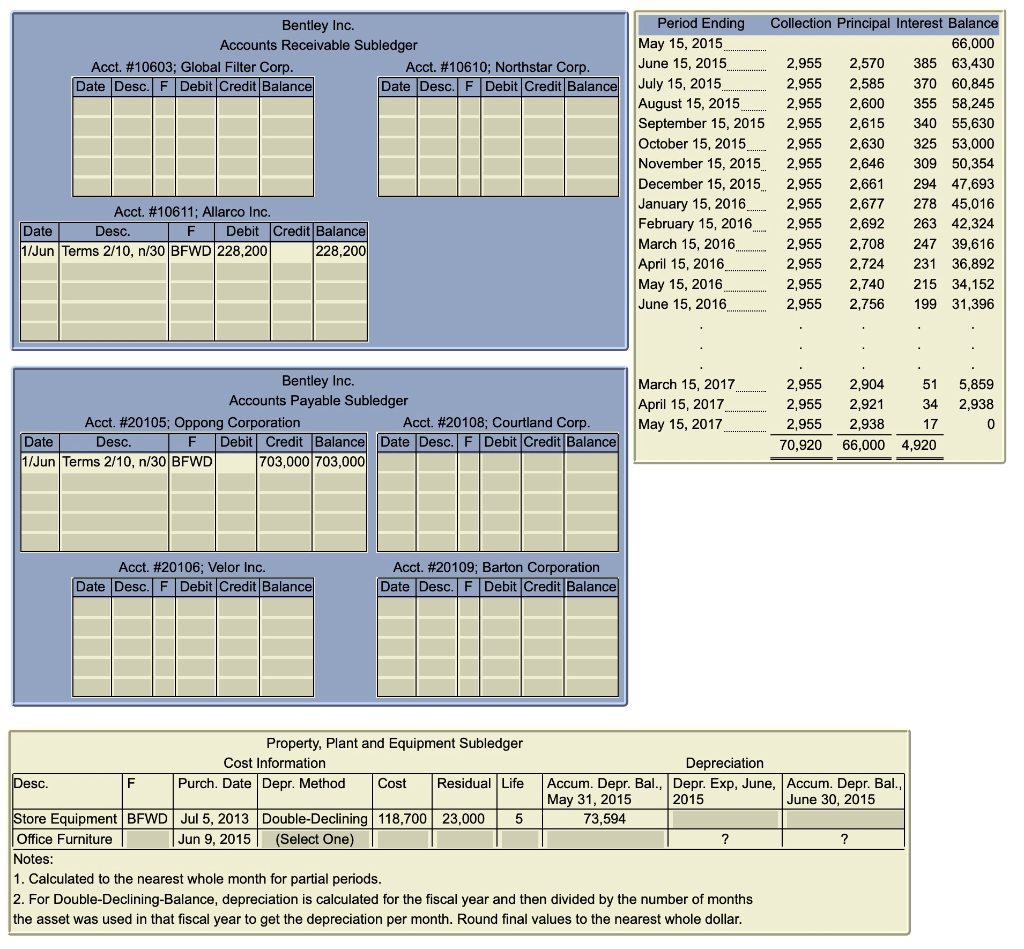

b) Posting: Posting from the general journal into the subledgers is required. Posting in the general ledger is not required. The subledgers used in this case study are Accounts Receivable (AR), Accounts Payable (AP), Merchandise Inventory (MI), and Property, Plant and Equipment (PPE). The subledgers can be found below. Transactions affecting the subledgers must be posted by using the subledger abbreviations AR, AP, MI, and PPE in the folio (F) column. For transactions that do not affect one of these subledgers, leave the F column blank. The posting reference to be used in the subledgers will be the abbreviation for the general journal (GJ1 or GJ2 as appropriate) Merchandise Inventory Subledger (Acct. #119) (Note: Recalculate the Balance in Inventory's AvgCost/Unit after each transaction.). *All cost/unit calculations should be rounded to two decimal places Purchases/Transportation-In/ (Purchase Returns/Discounts) Units Cost/Unit Total SUnis Cost/Unit Total S Units AvgCost/Unit Total S Cost of Goods Sold (Returns to Inventory) Balance in Inventory Date May 31 June 5 June 6 June 16 June 22 June 23 June 25 June 30 PR BFWD 19,000 80 1,520,000 19,000 80 1,520,000 Period Ending 15, 2015 June 15, 2015 July 15, 2015 August 15, 2015 September 15, 2015 2,955 2,615 340 55,630 October 15, 2015 November 15, 2015 2,955 2,646 309 50,354 December 15, 2015 2,9552,661 294 47,693 January 15, 2016 February 15, 2016 March 15, 2016 April 15, 2016 May 15, 2016 June 15, 2016 Collection Principal Interest Balance 66,000 2,9552,570 385 63,430 2,9552,585 370 60,845 2,9552,600 355 58,245 Bentley Inc. Accounts Receivable Subledger Acct. #10603; Global Filter Corp Date |Desc. F |Debit Credit Balance Acct. #10610; Northstar Corp Date Desc. F Debit Credit Balan 2,9552,630 325 53,000 2,9552,677 278 45,016 2,9552,692 263 42,324 2,9552,708 24739,616 2,955 2,724 231 36,892 2,9552,740215 34,152 2,9552,756 199 31,396 Acct. #10611: Allarco Inc. Date Desc. F Debit Credit Balan 1/Jun Terms 2/10, n/30 BFWD 228,200 228,200 Bentley Inc. Accounts Payable Subledger March 15, 2017 April 15, 2017 May 15, 2017 2,955 2,904 2,955 2,921 2,9552,938 51 5,859 34 2,938 Acct. #20105: Oppong Corporation Acct. #20108: Courtland Corp Date 1/Jun Terms 2/10, n/30 BFWD Desc. F Debit Credit Balancel Date Desc. FIDebit Credit Balance 70,92066,000 4,920 703,000 703,000 Acct. #20106: Velor Inc Acct. #20109; Barton Corporation Date Desc. F Debit Credit Balance Property, Plant and Equipment Subledger Cost Information Depreciation SC. Purch. Date Depr. Method Co Residual LifeAccum. Depr. Bal., Depr. Exp, June, Accum. Depr. Bal May 31, 2015 73,594 2015 June 30, 2015 tore Equipment BFWD Jul 5, 2013 Double-Declining 118,700 23,000 5 Office Furniture Notes: 1. Calculated to the nearest whole month for partial periods 2. For Double-Declining-Balance, depreciation is calculated for the fiscal year and then divided by the number of months the asset was used in that fiscal year to get the depreciation per month. Round final values to the nearest whole dollar. Jun 9, 2015 (Select One) b) Posting: Posting from the general journal into the subledgers is required. Posting in the general ledger is not required. The subledgers used in this case study are Accounts Receivable (AR), Accounts Payable (AP), Merchandise Inventory (MI), and Property, Plant and Equipment (PPE). The subledgers can be found below. Transactions affecting the subledgers must be posted by using the subledger abbreviations AR, AP, MI, and PPE in the folio (F) column. For transactions that do not affect one of these subledgers, leave the F column blank. The posting reference to be used in the subledgers will be the abbreviation for the general journal (GJ1 or GJ2 as appropriate) Merchandise Inventory Subledger (Acct. #119) (Note: Recalculate the Balance in Inventory's AvgCost/Unit after each transaction.). *All cost/unit calculations should be rounded to two decimal places Purchases/Transportation-In/ (Purchase Returns/Discounts) Units Cost/Unit Total SUnis Cost/Unit Total S Units AvgCost/Unit Total S Cost of Goods Sold (Returns to Inventory) Balance in Inventory Date May 31 June 5 June 6 June 16 June 22 June 23 June 25 June 30 PR BFWD 19,000 80 1,520,000 19,000 80 1,520,000 Period Ending 15, 2015 June 15, 2015 July 15, 2015 August 15, 2015 September 15, 2015 2,955 2,615 340 55,630 October 15, 2015 November 15, 2015 2,955 2,646 309 50,354 December 15, 2015 2,9552,661 294 47,693 January 15, 2016 February 15, 2016 March 15, 2016 April 15, 2016 May 15, 2016 June 15, 2016 Collection Principal Interest Balance 66,000 2,9552,570 385 63,430 2,9552,585 370 60,845 2,9552,600 355 58,245 Bentley Inc. Accounts Receivable Subledger Acct. #10603; Global Filter Corp Date |Desc. F |Debit Credit Balance Acct. #10610; Northstar Corp Date Desc. F Debit Credit Balan 2,9552,630 325 53,000 2,9552,677 278 45,016 2,9552,692 263 42,324 2,9552,708 24739,616 2,955 2,724 231 36,892 2,9552,740215 34,152 2,9552,756 199 31,396 Acct. #10611: Allarco Inc. Date Desc. F Debit Credit Balan 1/Jun Terms 2/10, n/30 BFWD 228,200 228,200 Bentley Inc. Accounts Payable Subledger March 15, 2017 April 15, 2017 May 15, 2017 2,955 2,904 2,955 2,921 2,9552,938 51 5,859 34 2,938 Acct. #20105: Oppong Corporation Acct. #20108: Courtland Corp Date 1/Jun Terms 2/10, n/30 BFWD Desc. F Debit Credit Balancel Date Desc. FIDebit Credit Balance 70,92066,000 4,920 703,000 703,000 Acct. #20106: Velor Inc Acct. #20109; Barton Corporation Date Desc. F Debit Credit Balance Property, Plant and Equipment Subledger Cost Information Depreciation SC. Purch. Date Depr. Method Co Residual LifeAccum. Depr. Bal., Depr. Exp, June, Accum. Depr. Bal May 31, 2015 73,594 2015 June 30, 2015 tore Equipment BFWD Jul 5, 2013 Double-Declining 118,700 23,000 5 Office Furniture Notes: 1. Calculated to the nearest whole month for partial periods 2. For Double-Declining-Balance, depreciation is calculated for the fiscal year and then divided by the number of months the asset was used in that fiscal year to get the depreciation per month. Round final values to the nearest whole dollar. Jun 9, 2015 (Select One)