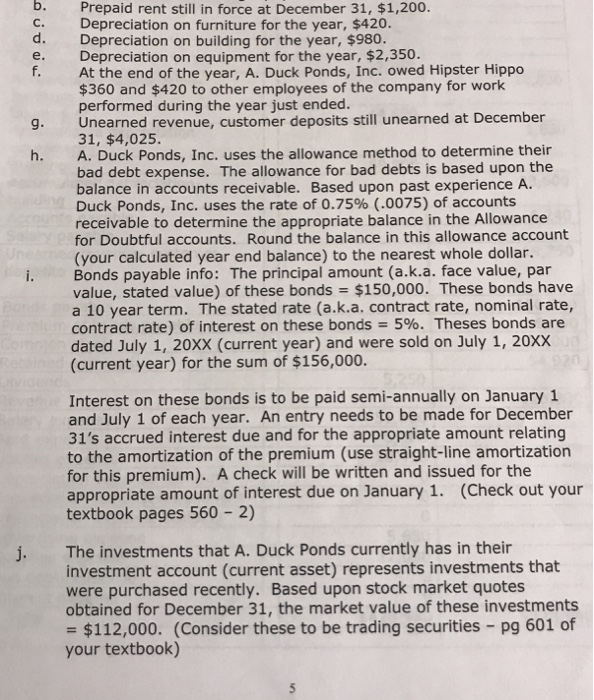

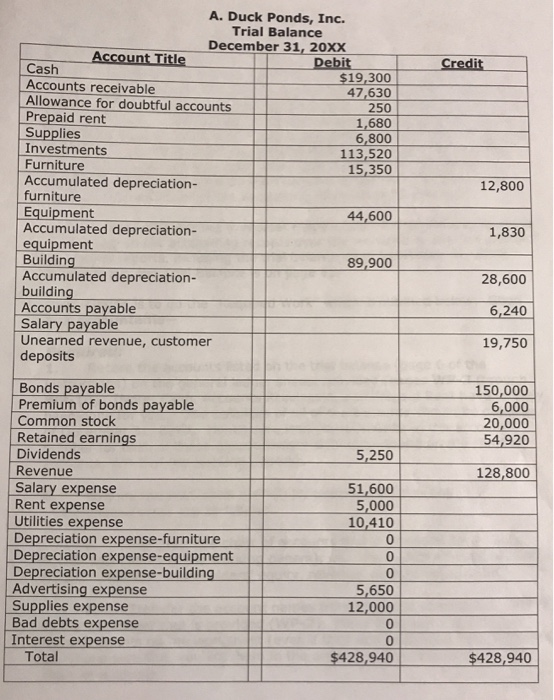

b. Prepaid rent still in force at December 31, $1,200 Depreciation on furniture for the year, $420 Depreciation on building for the year, $980. Depreciation on equipment for the year, $2,350. At the end of the year, A. Duck Ponds, Inc. owed Hipster Hippo $360 and $420 to other employees of the company for work performed during the year just ended. Unearned revenue, customer deposits still unearned at December 31, $4,025. A. Duck Ponds, Inc. uses the allowance method to determine their bad debt expense. The allowance for bad debts is based upon the balance in accounts receivable. Based upon past experience A. Duck Ponds, Inc. uses the rate of 0.75% (.0075) of accounts receivable to determine the appropriate balance in the Allowance for Doubtful accounts. Round the balance in this allowance account (your calculated year end balance) to the nearest whole dollar Bonds payable info: The principal amount (a.k.a. face value, par value, stated value) of these bonds $150,000. These bonds have a 10 year term. The stated rate (a.k.a. contract rate, nominal rate, contract rate) of interest on these bonds 5%. Theses bonds are dated July 1, 20XX (current year) and were sold on July 1, 20XX (current year) for the sum of $156,000. d. e. 9. h. i. Interest on these bonds is to be paid semi-annually on January 1 and July 1 of each year. An entry needs to be made for December 31's accrued interest due and for the appropriate amount relating to the amortization of the premium (use straight-line amortization for this premium). A check will be written and issued for the appropriate amount of interest due on January 1. (Check out your textbook pages 560 2) j. The investments that A. Duck Ponds currently has in their investment account (current asset) represents investments that were purchased recently. Based upon stock market quotes obtained for December 31, the market value of these investments $112,000. (Consider these to be trading securities pg 601 of your textbook) b. Prepaid rent still in force at December 31, $1,200 Depreciation on furniture for the year, $420 Depreciation on building for the year, $980. Depreciation on equipment for the year, $2,350. At the end of the year, A. Duck Ponds, Inc. owed Hipster Hippo $360 and $420 to other employees of the company for work performed during the year just ended. Unearned revenue, customer deposits still unearned at December 31, $4,025. A. Duck Ponds, Inc. uses the allowance method to determine their bad debt expense. The allowance for bad debts is based upon the balance in accounts receivable. Based upon past experience A. Duck Ponds, Inc. uses the rate of 0.75% (.0075) of accounts receivable to determine the appropriate balance in the Allowance for Doubtful accounts. Round the balance in this allowance account (your calculated year end balance) to the nearest whole dollar Bonds payable info: The principal amount (a.k.a. face value, par value, stated value) of these bonds $150,000. These bonds have a 10 year term. The stated rate (a.k.a. contract rate, nominal rate, contract rate) of interest on these bonds 5%. Theses bonds are dated July 1, 20XX (current year) and were sold on July 1, 20XX (current year) for the sum of $156,000. d. e. 9. h. i. Interest on these bonds is to be paid semi-annually on January 1 and July 1 of each year. An entry needs to be made for December 31's accrued interest due and for the appropriate amount relating to the amortization of the premium (use straight-line amortization for this premium). A check will be written and issued for the appropriate amount of interest due on January 1. (Check out your textbook pages 560 2) j. The investments that A. Duck Ponds currently has in their investment account (current asset) represents investments that were purchased recently. Based upon stock market quotes obtained for December 31, the market value of these investments $112,000. (Consider these to be trading securities pg 601 of your textbook)