Answered step by step

Verified Expert Solution

Question

1 Approved Answer

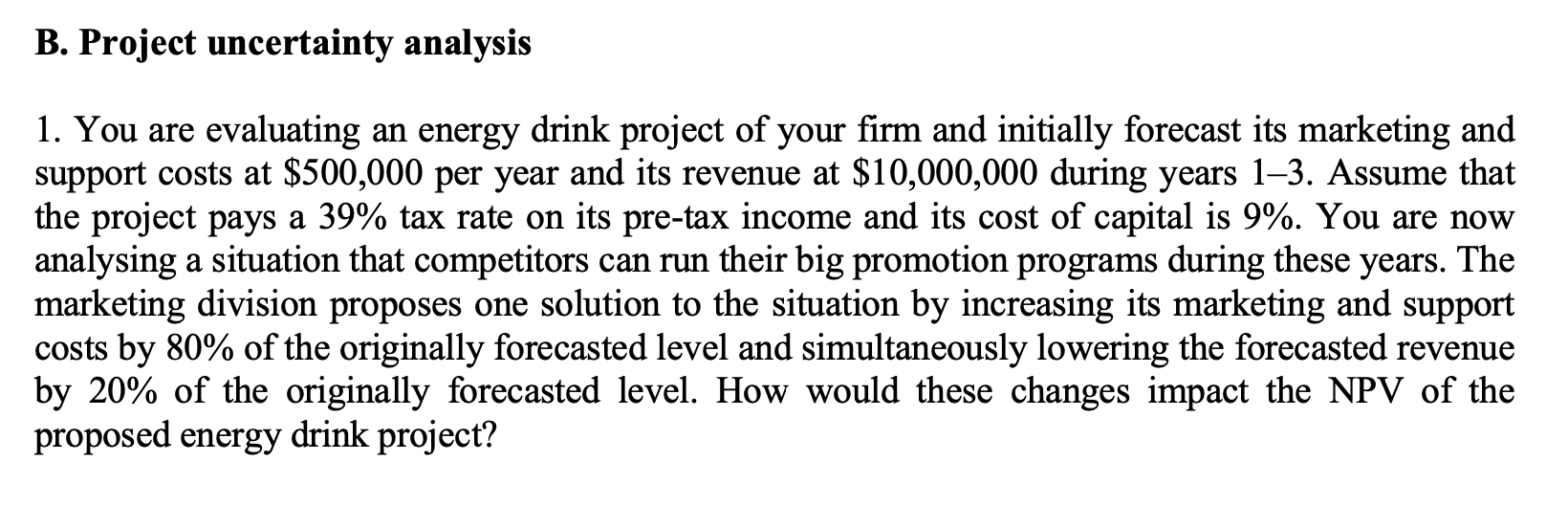

B. Project uncertainty analysis 1. You are evaluating an energy drink project of your firm and initially forecast its marketing and support costs at (

B. Project uncertainty analysis 1. You are evaluating an energy drink project of your firm and initially forecast its marketing and support costs at \\( \\$ 500,000 \\) per year and its revenue at \\( \\$ 10,000,000 \\) during years \\( 1-3 \\). Assume that the project pays a 39\\% tax rate on its pre-tax income and its cost of capital is \9. You are now analysing a situation that competitors can run their big promotion programs during these years. The marketing division proposes one solution to the situation by increasing its marketing and support costs by \80 of the originally forecasted level and simultaneously lowering the forecasted revenue by \20 of the originally forecasted level. How would these changes impact the NPV of the proposed energy drink project

B. Project uncertainty analysis 1. You are evaluating an energy drink project of your firm and initially forecast its marketing and support costs at \\( \\$ 500,000 \\) per year and its revenue at \\( \\$ 10,000,000 \\) during years \\( 1-3 \\). Assume that the project pays a 39\\% tax rate on its pre-tax income and its cost of capital is \9. You are now analysing a situation that competitors can run their big promotion programs during these years. The marketing division proposes one solution to the situation by increasing its marketing and support costs by \80 of the originally forecasted level and simultaneously lowering the forecasted revenue by \20 of the originally forecasted level. How would these changes impact the NPV of the proposed energy drink project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started