Answered step by step

Verified Expert Solution

Question

1 Approved Answer

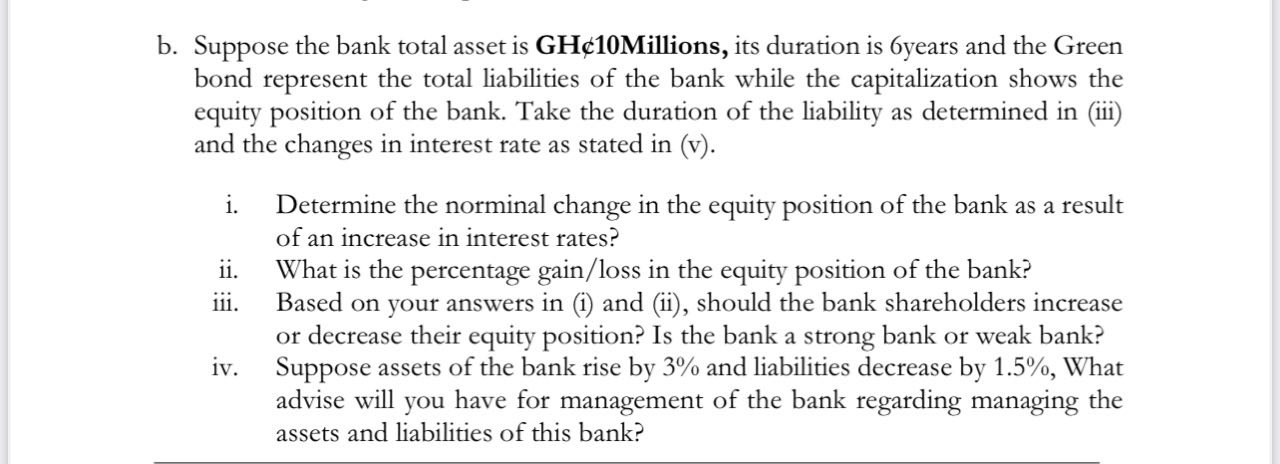

b . Suppose the bank total asset is GH 1 0 Millions, its duration is 6 years and the Green bond represent the total liabilities

b Suppose the bank total asset is GHMillions, its duration is years and the Green

bond represent the total liabilities of the bank while the capitalization shows the

equity position of the bank. Take the duration of the liability as determined in iii

and the changes in interest rate as stated in v

i Determine the norminal change in the equity position of the bank as a result

of an increase in interest rates?

ii What is the percentage gainloss in the equity position of the bank?

iii. Based on your answers in i and ii should the bank shareholders increase

or decrease their equity position? Is the bank a strong bank or weak bank?

iv Suppose assets of the bank rise by and liabilities decrease by What

advise will you have for management of the bank regarding managing the

assets and liabilities of this bank?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started