Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B) The customer and the bank buy a house for 10 million, the bank contributing 80% of the price, by paying 8 million, and

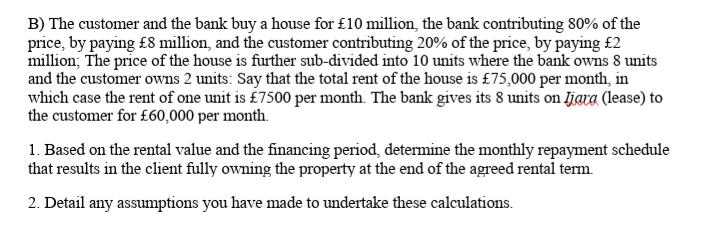

B) The customer and the bank buy a house for 10 million, the bank contributing 80% of the price, by paying 8 million, and the customer contributing 20% of the price, by paying 2 million; The price of the house is further sub-divided into 10 units where the bank owns 8 units and the customer owns 2 units: Say that the total rent of the house is 75,000 per month, in which case the rent of one unit is 7500 per month. The bank gives its 8 units on ljara (lease) to the customer for 60,000 per month. 1. Based on the rental value and the financing period, determine the monthly repayment schedule that results in the client fully owning the property at the end of the agreed rental term. 2. Detail any assumptions you have made to undertake these calculations.

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Ans Step 1 The rental value of a property is the fair market value of the property when it is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6367a4c89ca4e_241453.pdf

180 KBs PDF File

6367a4c89ca4e_241453.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started