Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You win the Mightyball lottery, which promises a $1 million payout - yippee! But, there's a catch - your winnings will be paid as

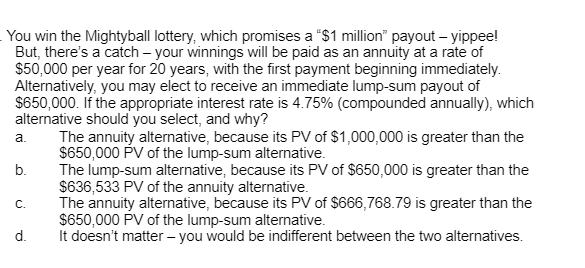

You win the Mightyball lottery, which promises a "$1 million" payout - yippee! But, there's a catch - your winnings will be paid as an annuity at a rate of $50,000 per year for 20 years, with the first payment beginning immediately. Alternatively, you may elect to receive an immediate lump-sum payout of $650,000. If the appropriate interest rate is 4.75% (compounded annually), which alternative should you select, and why? The annuity alternative, because its PV of $1,000,000 is greater than the $650,000 PV of the lump-sum alternative. The lump-sum alternative, because its PV of $650,000 is greater than the $636,533 PV of the annuity alternative. The annuity alternative, because its PV of $666,768.79 is greater than the $650,000 PV of the lump-sum alternative. It doesn't matter - you would be indifferent between the two alternatives. a. b. C. d.

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

CORRECT ANSWER c The annuity alternative because its PV of 666 76879 is grea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started