Answered step by step

Verified Expert Solution

Question

1 Approved Answer

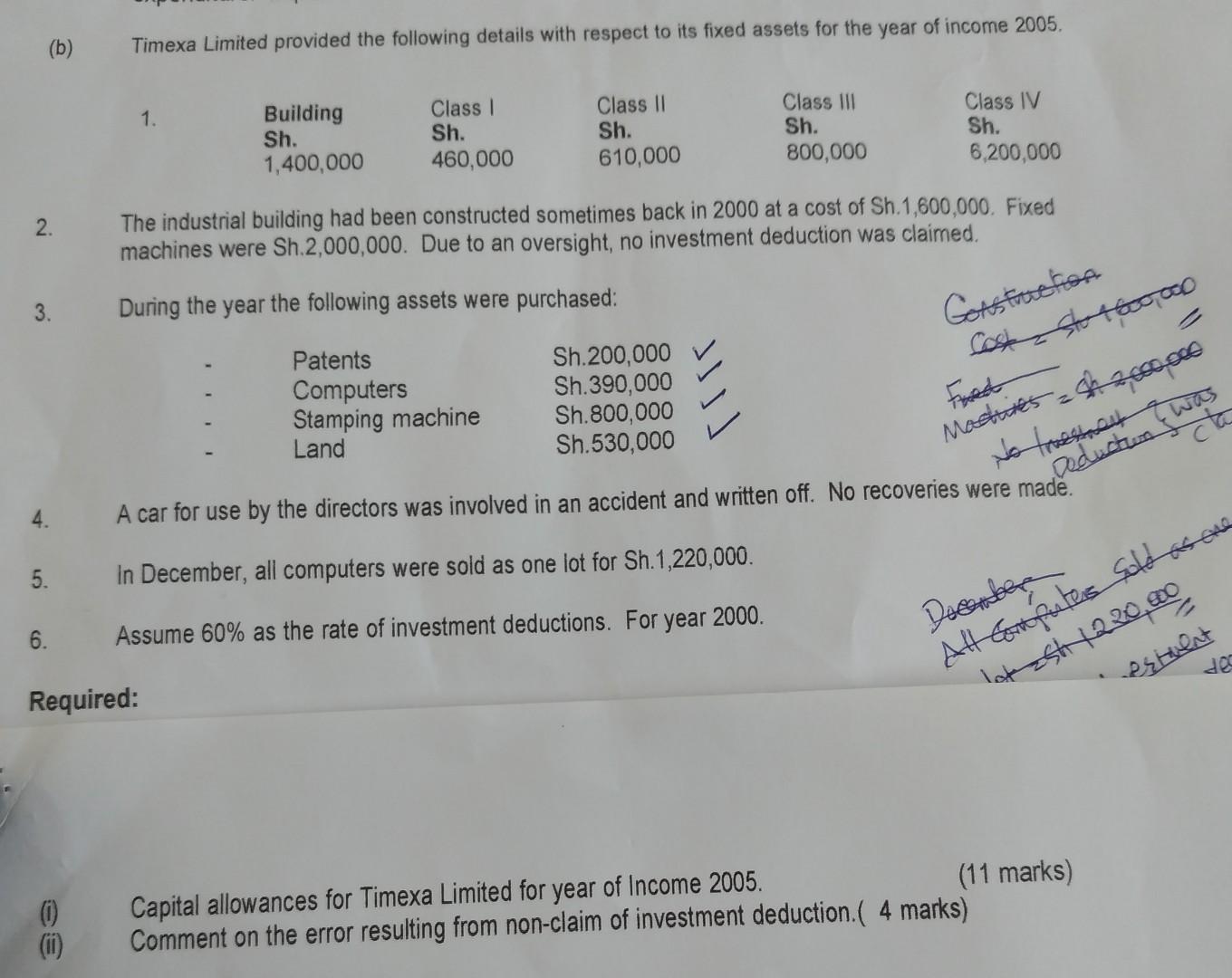

(b) Timexa Limited provided the following details with respect to its fixed assets for the year of income 2005. 1. 2. The industrial building had

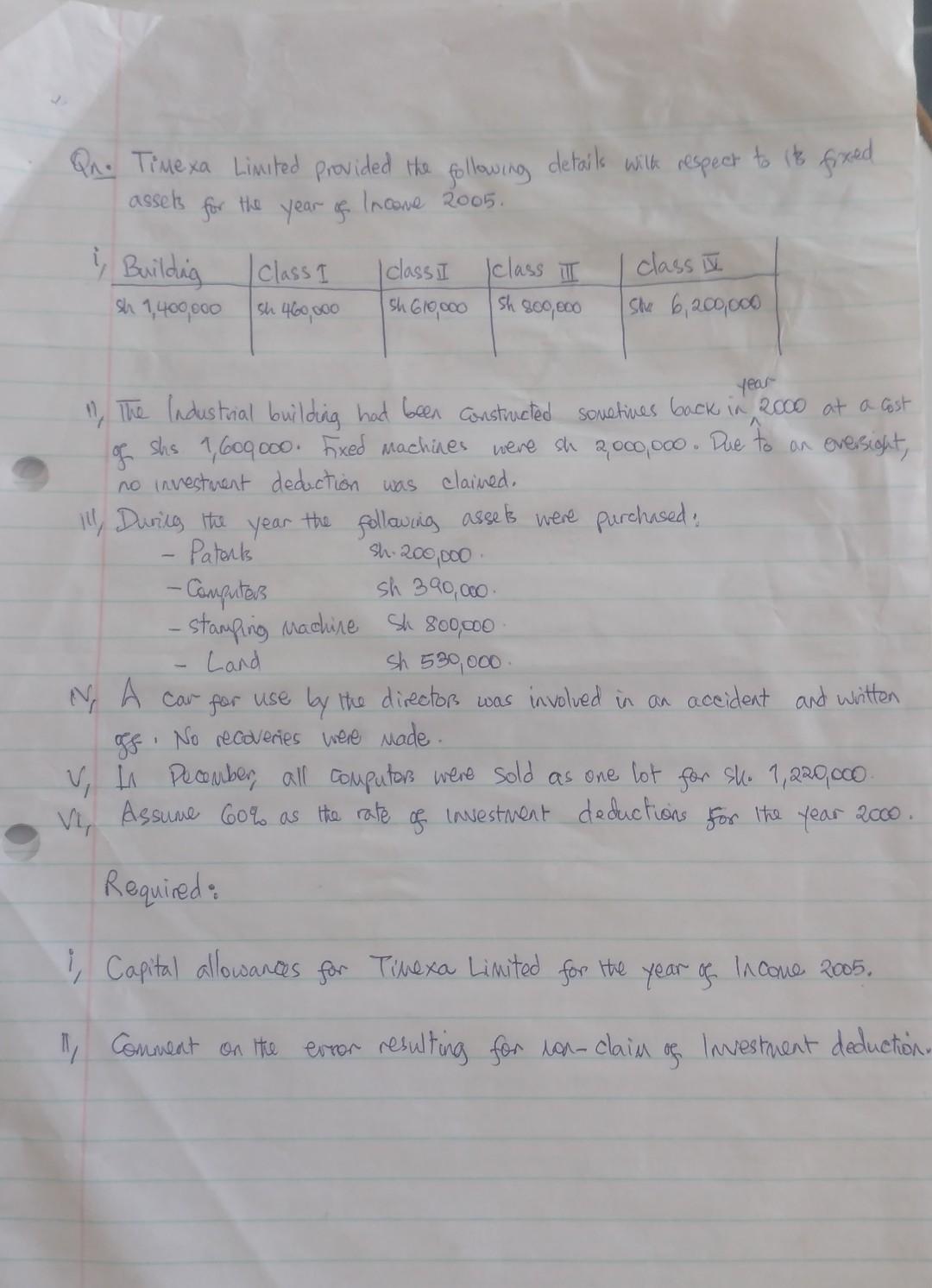

(b) Timexa Limited provided the following details with respect to its fixed assets for the year of income 2005. 1. 2. The industrial building had been constructed sometimes back in 2000 at a cost of Sh. 1,600,000. Fixed machines were Sh.2,000,000. Due to an oversight, no investment deduction was claimed. 3. During the 4. A car for use by the directors was involved in an accident and written off. No recoveries were mad. 5. In December, all computers were sold as one lot for Sh. 1,220,000. 6. Assume 60% as the rate of investment deductions. For year 2000 . Required: (i) Capital allowances for Timexa Limited for year of Income 2005. (11 marks) (ii) Comment on the error resulting from non-claim of investment deduction.( 4 marks) Qn. Timexa Limited provided the following details wilk respect to is fixed assets for the year of lncone 2005 . 11, The Industrial building had been constructed sovetines back in 2000 at a cost of shs 1,609000. Fxed machines vere sh 2,000,000. Dee to an oversight, no investuent deduction was clained. 111, Duries the year the folloving assets were purchased: - Paterts sh. 200,000 . - Computers sh 390,000 . - stamping machire Sh 800,000. - Land Sh 530,000. N. A car for use lay the director was involved in an accident and witten gef. No recoveries were nade. V1 In Pecember, all couputor were sold as one lot for su. 1,220,000. Vi, Assume 60% as the rate of investment deductions for the year 2000 . Required: i. Capital allowances for Tinexa Linited for the year of Incone 2005. 11/ Comment on ite error resulting for ron-clain of Investrient deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started