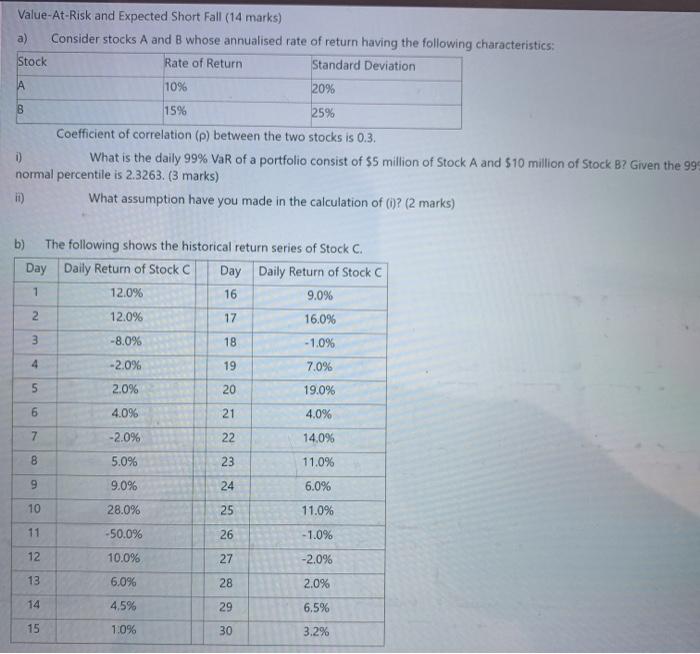

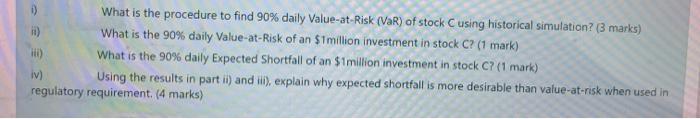

B Value-At-Risk and Expected Short Fall (14 marks) a) Consider stocks A and B whose annualised rate of return having the following characteristics: Stock Rate of Return Standard Deviation A 10% 20% 25% Coefficient of correlation (p) between the two stocks is 0.3. 0 What is the daily 99% VaR of a portfolio consist of $5 million of Stock A and $10 million of Stock B? Given the 999 normal percentile is 2.3263. (3 marks) D) What assumption have you made in the calculation of ()? (2 marks) 15% b) The following shows the historical return series of Stock C. Day Daily Return of Stock C Day Daily Return of Stock C 1 12.0% 16 9.0% 2 12.0% 17 16.0% 3 -8.0% 18 - 1.0% 4 -2.0% 19 7.0% 5 2.0% 20 19.0% 6 4.096 21 4.0% 7 -2.0% 22 14.0% 5.0% 23 11.0% 9 9.0% 24 6.0% 5 10 28.0% 25 11.0% 11 -50.0% 26 -1.0% 12 10.0% 27 -2.0% 13 6.0% 28 2.0% 14 4.5% 29 6.5% 15 1.0% 30 3.2% 0 What is the procedure to find 90% daily Value-at-Risk (VaR) of stock Cusing historical simulation? (3 marks) ii) What is the 90% daily Value-at-Risk of an $1million investment in stock C? (1 mark) H) What is the 90% daily Expected Shortfall of an $1 million investment in stock C? (1 mark) iv) Using the results in partii) and ill), explain why expected shortfall is more desirable than value-at-risk when used in regulatory requirement. (4 marks) B Value-At-Risk and Expected Short Fall (14 marks) a) Consider stocks A and B whose annualised rate of return having the following characteristics: Stock Rate of Return Standard Deviation A 10% 20% 25% Coefficient of correlation (p) between the two stocks is 0.3. 0 What is the daily 99% VaR of a portfolio consist of $5 million of Stock A and $10 million of Stock B? Given the 999 normal percentile is 2.3263. (3 marks) D) What assumption have you made in the calculation of ()? (2 marks) 15% b) The following shows the historical return series of Stock C. Day Daily Return of Stock C Day Daily Return of Stock C 1 12.0% 16 9.0% 2 12.0% 17 16.0% 3 -8.0% 18 - 1.0% 4 -2.0% 19 7.0% 5 2.0% 20 19.0% 6 4.096 21 4.0% 7 -2.0% 22 14.0% 5.0% 23 11.0% 9 9.0% 24 6.0% 5 10 28.0% 25 11.0% 11 -50.0% 26 -1.0% 12 10.0% 27 -2.0% 13 6.0% 28 2.0% 14 4.5% 29 6.5% 15 1.0% 30 3.2% 0 What is the procedure to find 90% daily Value-at-Risk (VaR) of stock Cusing historical simulation? (3 marks) ii) What is the 90% daily Value-at-Risk of an $1million investment in stock C? (1 mark) H) What is the 90% daily Expected Shortfall of an $1 million investment in stock C? (1 mark) iv) Using the results in partii) and ill), explain why expected shortfall is more desirable than value-at-risk when used in regulatory requirement. (4 marks)