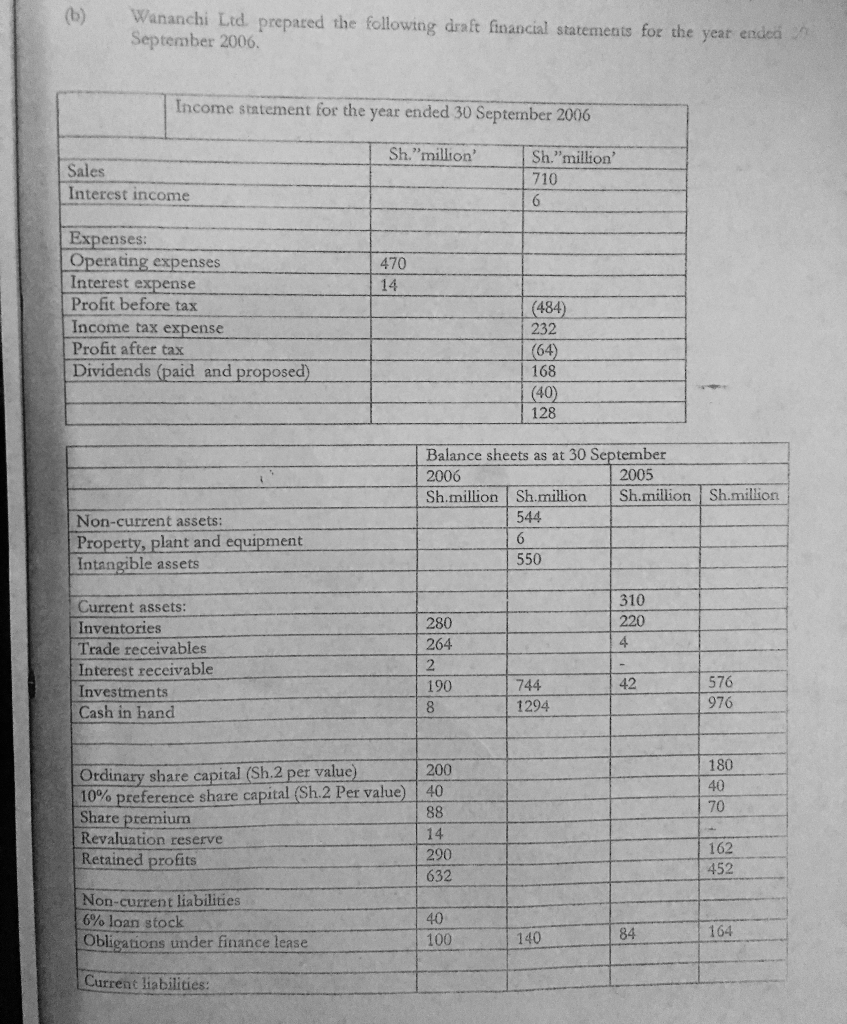

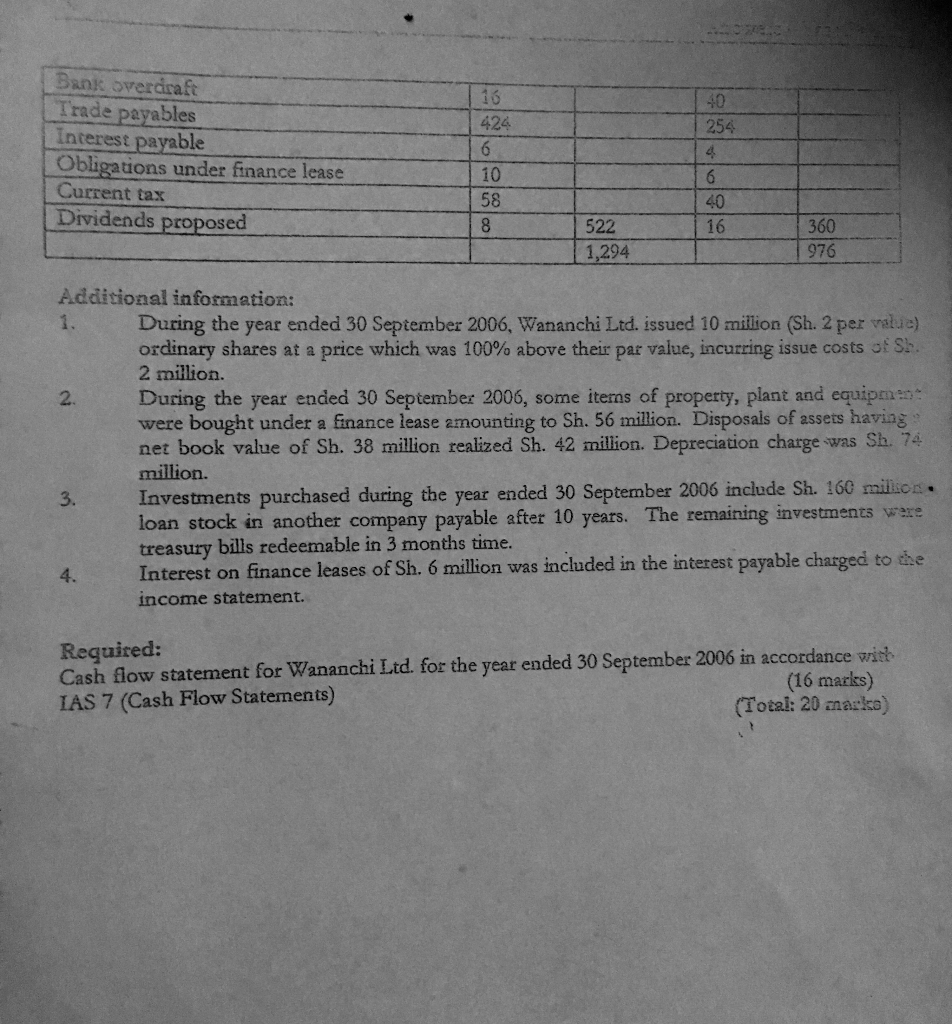

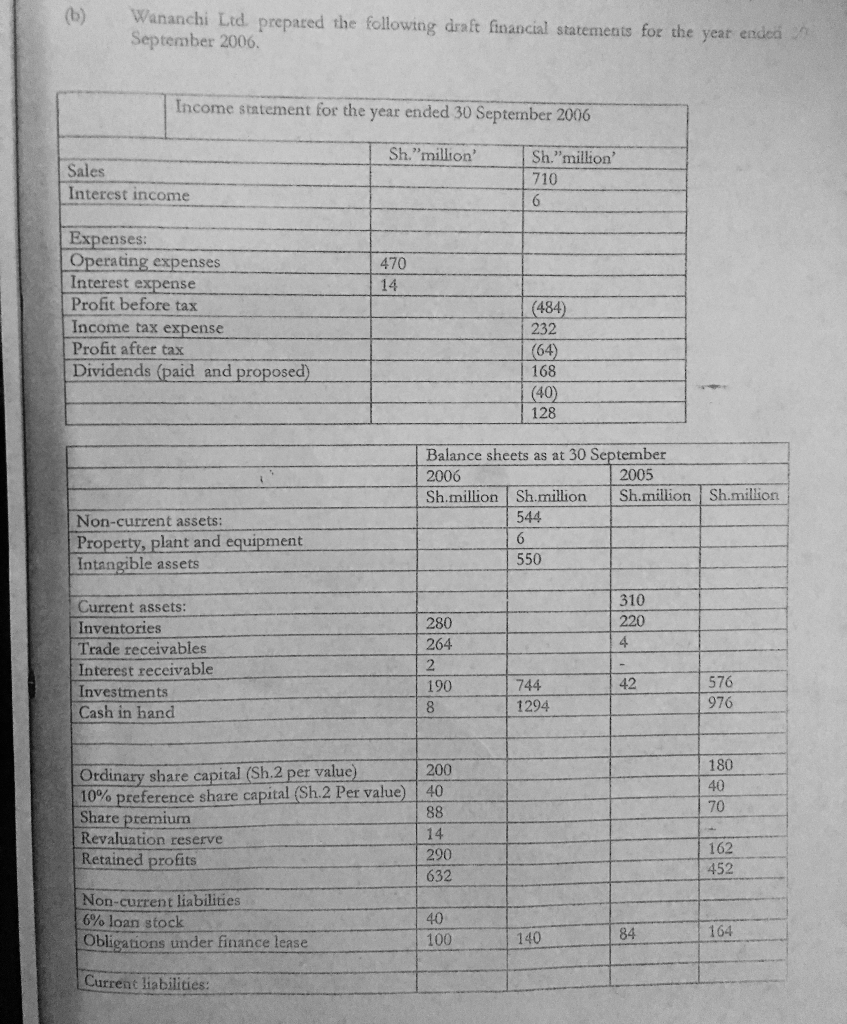

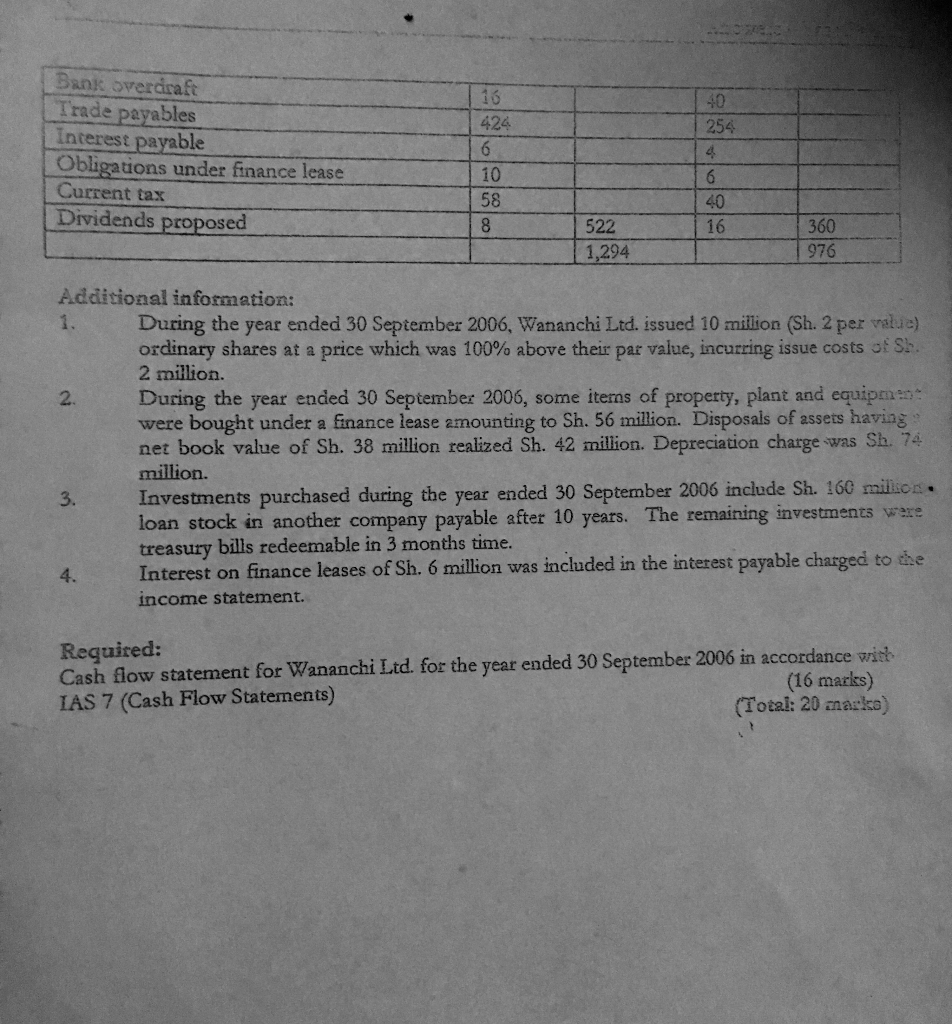

(b) Wananchi Ltd. prepared the following draft financial statements for the year endea 90 September 2006. Income statement for the year ended 30 September 2006 Sh."million Sh."million' Sales Interest income 710 6 Expenses: Operating expenses Interest expense 470 14 Profit before tax (484) 232 Income tax expense Profit after tax Dividends (paid and proposed) (64) 168 (40) 128 Balance sheets as at 30 September 2006 2005 Sh.million Sh.million Sh.million Sh.million 544 Non-current assets: Property, plant and equipment Intangible assets 550 310 Current assets: 220 280 Inventories 4 264 Trade receivables 2 Interest receivable 576 42 744 190 Investments 976 1294 Cash in hand 180 Ordinary share capital (Sh.2 per value) 10% preference share capital (Sh.2 Per value) Share premium Revaluation reserve Retained profits 200 40 40 70 88 14 162 290 452 632 Non-current liabilities 6% loan stock 40 164 84 140 100 Obligations under finance lease Current liabilities: Bank overdraft 16 40 Trade payables Interest payable Obligations under finance lease Current tax 424 254 10 6 58 40 Dividends proposed 522 360 16 1,294 976 Additional information: 1. During the year ended 30 September 2006, Wananchi Ltd. issued 10 million (Sh. 2 per value) ordinary shares at a price which was 100 % above their par value, incurring issue costs sf Sh. 2 million. During the year ended 30 September 2006, some itens of property, plant and equipment were bought under a finance lease amounting to Sh. 56 million. Disposals of assets net book value of Sh. 38 million realized Sh. 42 million. Depreciation charge was Sh. 74 million. Investments purchased during the year ended 30 September 2006 include Sh. 160 milion. loan stock in another company payable after 10 years. The remaining investments were treasury bills redeemable in 3 months time. Interest on finance leases of Sh. 6 million was included in the interest payable charged to the 2 having 3. 4. income statement. Required: Cash flow statement for Wananchi Ltd. for the year ended 30 September 2006 in accordance with IAS 7 (Cash Flow Statements) (16 marks) (Total: 20 anarko) (b) Wananchi Ltd. prepared the following draft financial statements for the year endea 90 September 2006. Income statement for the year ended 30 September 2006 Sh."million Sh."million' Sales Interest income 710 6 Expenses: Operating expenses Interest expense 470 14 Profit before tax (484) 232 Income tax expense Profit after tax Dividends (paid and proposed) (64) 168 (40) 128 Balance sheets as at 30 September 2006 2005 Sh.million Sh.million Sh.million Sh.million 544 Non-current assets: Property, plant and equipment Intangible assets 550 310 Current assets: 220 280 Inventories 4 264 Trade receivables 2 Interest receivable 576 42 744 190 Investments 976 1294 Cash in hand 180 Ordinary share capital (Sh.2 per value) 10% preference share capital (Sh.2 Per value) Share premium Revaluation reserve Retained profits 200 40 40 70 88 14 162 290 452 632 Non-current liabilities 6% loan stock 40 164 84 140 100 Obligations under finance lease Current liabilities: Bank overdraft 16 40 Trade payables Interest payable Obligations under finance lease Current tax 424 254 10 6 58 40 Dividends proposed 522 360 16 1,294 976 Additional information: 1. During the year ended 30 September 2006, Wananchi Ltd. issued 10 million (Sh. 2 per value) ordinary shares at a price which was 100 % above their par value, incurring issue costs sf Sh. 2 million. During the year ended 30 September 2006, some itens of property, plant and equipment were bought under a finance lease amounting to Sh. 56 million. Disposals of assets net book value of Sh. 38 million realized Sh. 42 million. Depreciation charge was Sh. 74 million. Investments purchased during the year ended 30 September 2006 include Sh. 160 milion. loan stock in another company payable after 10 years. The remaining investments were treasury bills redeemable in 3 months time. Interest on finance leases of Sh. 6 million was included in the interest payable charged to the 2 having 3. 4. income statement. Required: Cash flow statement for Wananchi Ltd. for the year ended 30 September 2006 in accordance with IAS 7 (Cash Flow Statements) (16 marks) (Total: 20 anarko)