Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b. Without Franois' T2202, Michel believes that he owes taxes of $8,000 to the Canada Revenue Agency (CRA - Federal tax authorities). Michel is looking

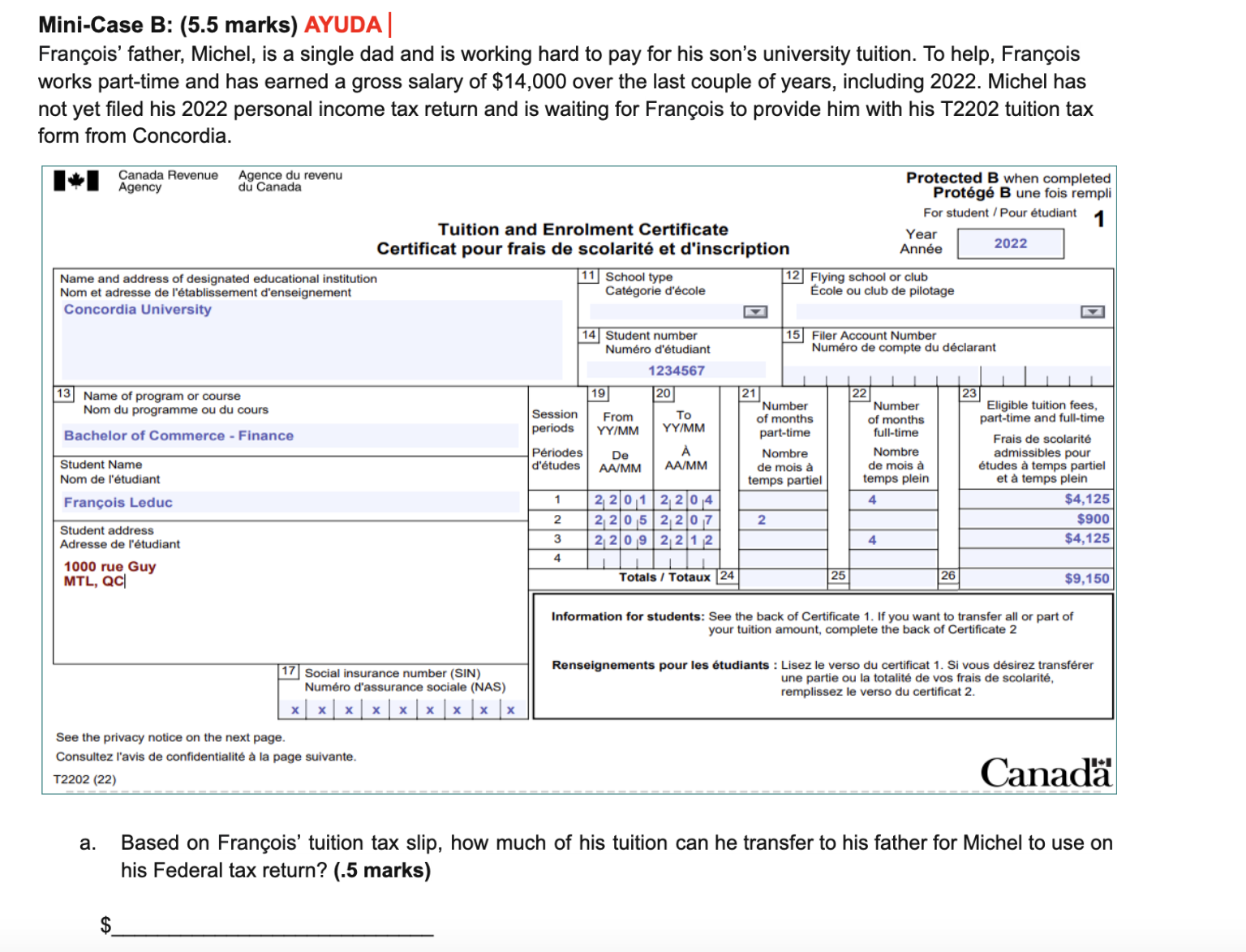

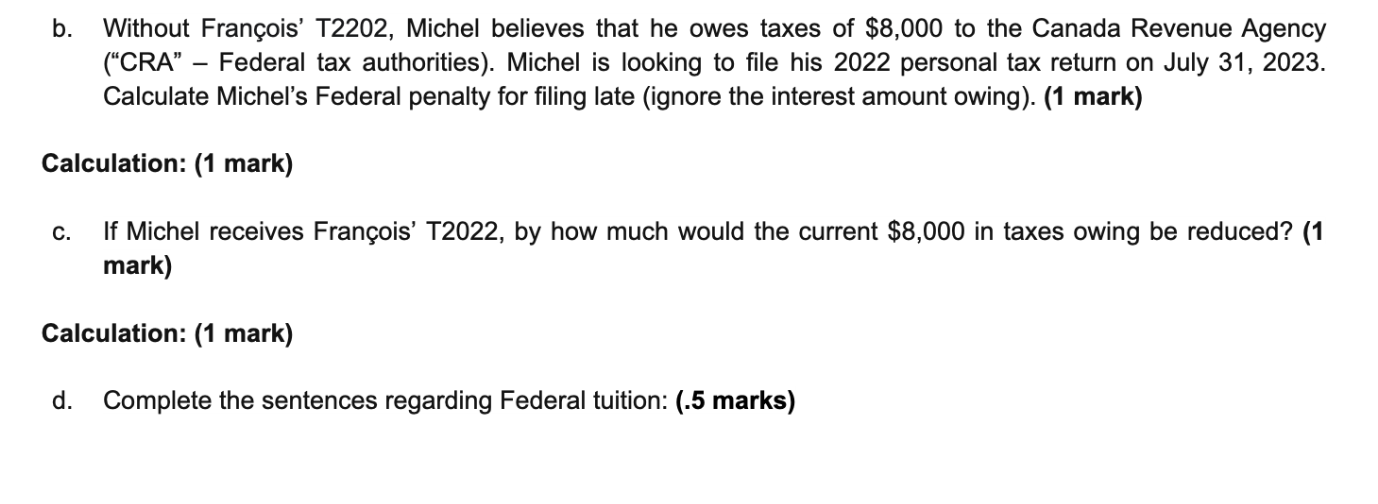

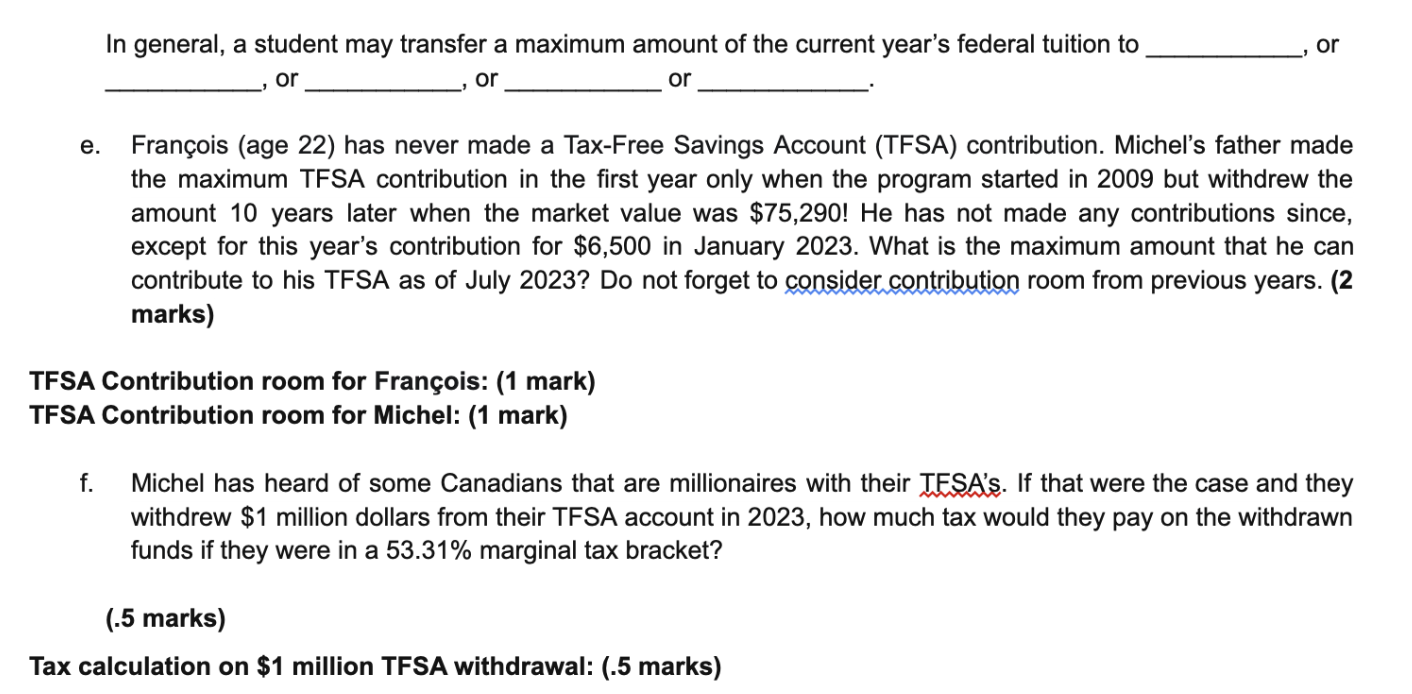

b. Without Franois' T2202, Michel believes that he owes taxes of $8,000 to the Canada Revenue Agency ("CRA" - Federal tax authorities). Michel is looking to file his 2022 personal tax return on July 31, 2023. Calculate Michel's Federal penalty for filing late (ignore the interest amount owing). (1 mark) Calculation: (1 mark) c. If Michel receives Franois' T2022, by how much would the current $8,000 in taxes owing be reduced? (1 mark) Calculation: (1 mark) d. Complete the sentences regarding Federal tuition: (.5 marks) In general, a student may transfer a maximum amount of the current year's federal tuition to , or , or , or or e. Franois (age 22) has never made a Tax-Free Savings Account (TFSA) contribution. Michel's father made the maximum TFSA contribution in the first year only when the program started in 2009 but withdrew the amount 10 years later when the market value was $75,290 ! He has not made any contributions since, except for this year's contribution for $6,500 in January 2023. What is the maximum amount that he can contribute to his TFSA as of July 2023 ? Do not forget to consider contribution room from previous years. (2 marks) FSA Contribution room for Franois: (1 mark) FSA Contribution room for Michel: (1 mark) f. Michel has heard of some Canadians that are millionaires with their TFSA's. If that were the case and they withdrew \$1 million dollars from their TFSA account in 2023, how much tax would they pay on the withdrawn funds if they were in a 53.31% marginal tax bracket? Mini-Case B: (5.5 marks) AYUDA Franois' father, Michel, is a single dad and is working hard to pay for his son's university tuition. To help, Franois works part-time and has earned a gross salary of $14,000 over the last couple of years, including 2022. Michel has not yet filed his 2022 personal income tax return and is waiting for Franois to provide him with his T2202 tuition tax form from Concordia. Consultez l'avis de confidentialite a la a la page suivante. Canad a. Based on Franois' tuition tax slip, how much of his tuition can he transfer to his father for Michel to use on his Federal tax return? (.5 marks) b. Without Franois' T2202, Michel believes that he owes taxes of $8,000 to the Canada Revenue Agency ("CRA" - Federal tax authorities). Michel is looking to file his 2022 personal tax return on July 31, 2023. Calculate Michel's Federal penalty for filing late (ignore the interest amount owing). (1 mark) Calculation: (1 mark) c. If Michel receives Franois' T2022, by how much would the current $8,000 in taxes owing be reduced? (1 mark) Calculation: (1 mark) d. Complete the sentences regarding Federal tuition: (.5 marks) In general, a student may transfer a maximum amount of the current year's federal tuition to , or , or , or or e. Franois (age 22) has never made a Tax-Free Savings Account (TFSA) contribution. Michel's father made the maximum TFSA contribution in the first year only when the program started in 2009 but withdrew the amount 10 years later when the market value was $75,290 ! He has not made any contributions since, except for this year's contribution for $6,500 in January 2023. What is the maximum amount that he can contribute to his TFSA as of July 2023 ? Do not forget to consider contribution room from previous years. (2 marks) FSA Contribution room for Franois: (1 mark) FSA Contribution room for Michel: (1 mark) f. Michel has heard of some Canadians that are millionaires with their TFSA's. If that were the case and they withdrew \$1 million dollars from their TFSA account in 2023, how much tax would they pay on the withdrawn funds if they were in a 53.31% marginal tax bracket? Mini-Case B: (5.5 marks) AYUDA Franois' father, Michel, is a single dad and is working hard to pay for his son's university tuition. To help, Franois works part-time and has earned a gross salary of $14,000 over the last couple of years, including 2022. Michel has not yet filed his 2022 personal income tax return and is waiting for Franois to provide him with his T2202 tuition tax form from Concordia. Consultez l'avis de confidentialite a la a la page suivante. Canad a. Based on Franois' tuition tax slip, how much of his tuition can he transfer to his father for Michel to use on his Federal tax return? (.5 marks)

b. Without Franois' T2202, Michel believes that he owes taxes of $8,000 to the Canada Revenue Agency ("CRA" - Federal tax authorities). Michel is looking to file his 2022 personal tax return on July 31, 2023. Calculate Michel's Federal penalty for filing late (ignore the interest amount owing). (1 mark) Calculation: (1 mark) c. If Michel receives Franois' T2022, by how much would the current $8,000 in taxes owing be reduced? (1 mark) Calculation: (1 mark) d. Complete the sentences regarding Federal tuition: (.5 marks) In general, a student may transfer a maximum amount of the current year's federal tuition to , or , or , or or e. Franois (age 22) has never made a Tax-Free Savings Account (TFSA) contribution. Michel's father made the maximum TFSA contribution in the first year only when the program started in 2009 but withdrew the amount 10 years later when the market value was $75,290 ! He has not made any contributions since, except for this year's contribution for $6,500 in January 2023. What is the maximum amount that he can contribute to his TFSA as of July 2023 ? Do not forget to consider contribution room from previous years. (2 marks) FSA Contribution room for Franois: (1 mark) FSA Contribution room for Michel: (1 mark) f. Michel has heard of some Canadians that are millionaires with their TFSA's. If that were the case and they withdrew \$1 million dollars from their TFSA account in 2023, how much tax would they pay on the withdrawn funds if they were in a 53.31% marginal tax bracket? Mini-Case B: (5.5 marks) AYUDA Franois' father, Michel, is a single dad and is working hard to pay for his son's university tuition. To help, Franois works part-time and has earned a gross salary of $14,000 over the last couple of years, including 2022. Michel has not yet filed his 2022 personal income tax return and is waiting for Franois to provide him with his T2202 tuition tax form from Concordia. Consultez l'avis de confidentialite a la a la page suivante. Canad a. Based on Franois' tuition tax slip, how much of his tuition can he transfer to his father for Michel to use on his Federal tax return? (.5 marks) b. Without Franois' T2202, Michel believes that he owes taxes of $8,000 to the Canada Revenue Agency ("CRA" - Federal tax authorities). Michel is looking to file his 2022 personal tax return on July 31, 2023. Calculate Michel's Federal penalty for filing late (ignore the interest amount owing). (1 mark) Calculation: (1 mark) c. If Michel receives Franois' T2022, by how much would the current $8,000 in taxes owing be reduced? (1 mark) Calculation: (1 mark) d. Complete the sentences regarding Federal tuition: (.5 marks) In general, a student may transfer a maximum amount of the current year's federal tuition to , or , or , or or e. Franois (age 22) has never made a Tax-Free Savings Account (TFSA) contribution. Michel's father made the maximum TFSA contribution in the first year only when the program started in 2009 but withdrew the amount 10 years later when the market value was $75,290 ! He has not made any contributions since, except for this year's contribution for $6,500 in January 2023. What is the maximum amount that he can contribute to his TFSA as of July 2023 ? Do not forget to consider contribution room from previous years. (2 marks) FSA Contribution room for Franois: (1 mark) FSA Contribution room for Michel: (1 mark) f. Michel has heard of some Canadians that are millionaires with their TFSA's. If that were the case and they withdrew \$1 million dollars from their TFSA account in 2023, how much tax would they pay on the withdrawn funds if they were in a 53.31% marginal tax bracket? Mini-Case B: (5.5 marks) AYUDA Franois' father, Michel, is a single dad and is working hard to pay for his son's university tuition. To help, Franois works part-time and has earned a gross salary of $14,000 over the last couple of years, including 2022. Michel has not yet filed his 2022 personal income tax return and is waiting for Franois to provide him with his T2202 tuition tax form from Concordia. Consultez l'avis de confidentialite a la a la page suivante. Canad a. Based on Franois' tuition tax slip, how much of his tuition can he transfer to his father for Michel to use on his Federal tax return? (.5 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started