Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DEAR SIR/MADAM, CAN YOU HELP ME WITH THIS QUESTION AND SHOW ME HOW DID YOU SOLVE THE QUESTION USING EXCEL SHEET. I WILL UPVOTE, PROMISE

DEAR SIR/MADAM,

CAN YOU HELP ME WITH THIS QUESTION AND SHOW ME HOW DID YOU SOLVE THE QUESTION USING EXCEL SHEET.

I WILL UPVOTE, PROMISE

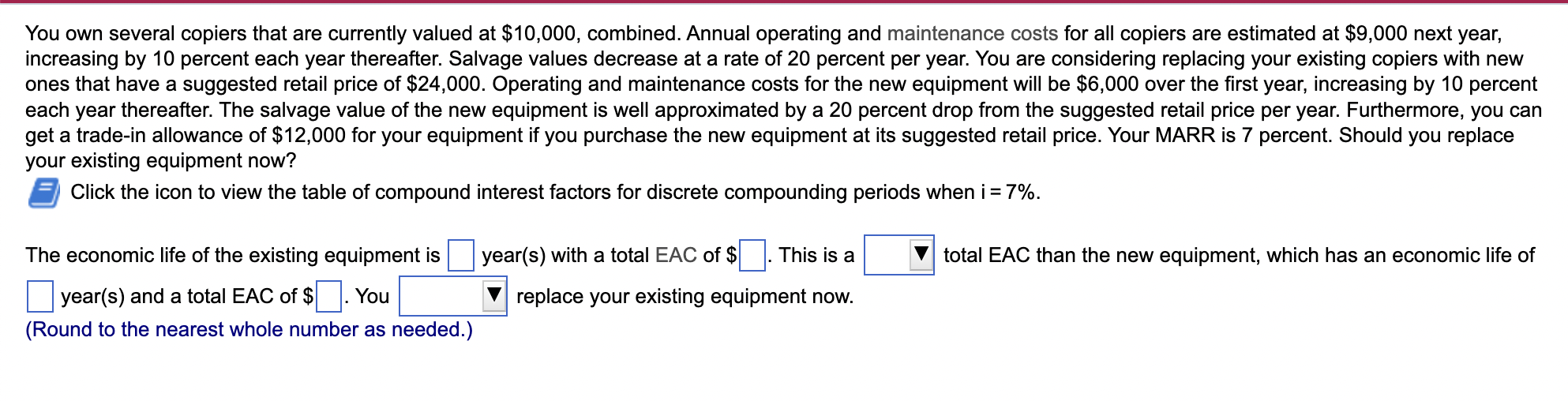

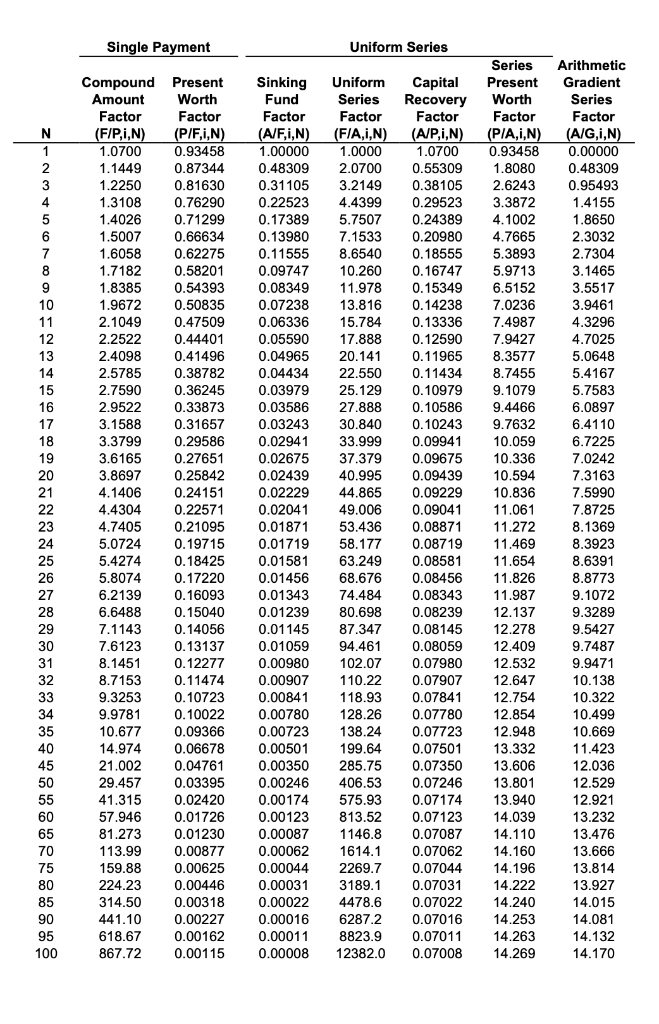

You own several copiers that are currently valued at $10,000, combined. Annual operating and maintenance costs for all copiers are estimated at $9,000 next year, increasing by 10 percent each year thereafter. Salvage values decrease at a rate of 20 percent per year. You are considering replacing your existing copiers with new ones that have a suggested retail price of $24,000. Operating and maintenance costs for the new equipment will be $6,000 over the first year, increasing by 10 percent each year thereafter. The salvage value of the new equipment is well approximated by a 20 percent drop from the suggested retail price per year. Furthermore, you can get a trade-in allowance of $12,000 for your equipment if you purchase the new equipment at its suggested retail price. Your MARR is 7 percent. Should you replace your existing equipment now? Click the icon to view the table of compound interest factors for discrete compounding periods when i = 7%. total EAC than the new equipment, which has an economic life of The economic life of the existing equipment is year(s) with a total EAC of $ This is a year(s) and a total EAC of $. You replace your existing equipment now. (Round to the nearest whole number as needed.) Single Payment Uniform Series N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 40 45 50 55 60 65 70 75 80 85 90 95 100 Compound Present Amount Worth Factor Factor (FIP,1,N) (P/F,i,N) 1.0700 0.93458 1.1449 0.87344 1.2250 0.81630 1.3108 0.76290 1.4026 0.71299 1.5007 0.66634 1.6058 0.62275 1.7182 0.58201 1.8385 0.54393 1.9672 0.50835 2.1049 0.47509 2.2522 0.44401 2.4098 0.41496 2.5785 0.38782 2.7590 0.36245 2.9522 0.33873 3.1588 0.31657 3.3799 0.29586 3.6165 0.27651 3.8697 0.25842 4.1406 0.24151 4.4304 0.22571 4.7405 0.21095 5.0724 0.19715 5.4274 0.18425 5.8074 0.17220 6.2139 0.16093 6.6488 0.15040 7.1143 0.14056 7.6123 0.13137 8.1451 0.12277 8.7153 0.11474 9.3253 0.10723 9.9781 0.10022 10.677 0.09366 14.974 0.06678 21.002 0.04761 29.457 0.03395 41.315 0.02420 57.946 0.01726 81.273 0.01230 113.99 0.00877 159.88 0.00625 224.23 0.00446 314.50 0.00318 441.10 0.00227 618.67 0.00162 867.72 0.00115 Sinking Fund Factor (A/F,i,N) 1.00000 0.48309 0.31105 0.22523 0.17389 0.13980 0.11555 0.09747 0.08349 0.07238 0.06336 0.05590 0.04965 0.04434 0.03979 0.03586 0.03243 0.02941 0.02675 0.02439 0.02229 0.02041 0.01871 0.01719 0.01581 0.01456 0.01343 0.01239 0.01145 0.01059 0.00980 0.00907 0.00841 0.00780 0.00723 0.00501 0.00350 0.00246 0.00174 0.00123 0.00087 0.00062 0.00044 0.00031 0.00022 0.00016 0.00011 0.00008 Uniform Series Factor (FIA,1,N) 1.0000 2.0700 3.2149 4.4399 5.7507 7.1533 8.6540 10.260 11.978 13.816 15.784 17.888 20.141 22.550 25.129 27.888 30.840 33.999 37.379 40.995 44.865 49.006 53.436 58.177 63.249 68.676 74.484 80.698 87.347 94.461 102.07 110.22 118.93 128.26 138.24 199.64 285.75 406.53 575.93 813.52 1146.8 1614.1 2269.7 3189.1 4478.6 6287.2 8823.9 12382.0 Capital Recovery Factor (A/P,1,N) 1.0700 0.55309 0.38105 0.29523 0.24389 0.20980 0.18555 0.16747 0.15349 0.14238 0.13336 0.12590 0.11965 0.11434 0.10979 0.10586 0.10243 0.09941 0.09675 0.09439 0.09229 0.09041 0.08871 0.08719 0.08581 0.08456 0.08343 0.08239 0.08145 0.08059 0.07980 0.07907 0.07841 0.07780 0.07723 0.07501 0.07350 0.07246 0.07174 0.07123 0.07087 0.07062 0.07044 0.07031 0.07022 0.07016 0.07011 0.07008 Series Present Worth Factor (PIA,1,N) 0.93458 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 5.9713 6.5152 7.0236 7.4987 7.9427 8.3577 8.7455 9.1079 9.4466 9.7632 10.059 10.336 10.594 10.836 11.061 11.272 11.469 11.654 11.826 11.987 12.137 12.278 12.409 12.532 12.647 12.754 12.854 12.948 13.332 13.606 13.801 13.940 14.039 14.110 14.160 14.196 14.222 14.240 14.253 14.263 14.269 Arithmetic Gradient Series Factor (A/G,,N) 0.00000 0.48309 0.95493 1.4155 1.8650 2.3032 2.7304 3.1465 3.5517 3.9461 4.3296 4.7025 5.0648 5.4167 5.7583 6.0897 6.4110 6.7225 7.0242 7.3163 7.5990 7.8725 8.1369 8.3923 8.6391 8.8773 9.1072 9.3289 9.5427 9.7487 9.9471 10.138 10.322 10.499 10.669 11.423 12.036 12.529 12.921 13.232 13.476 13.666 13.814 13.927 14.015 14.081 14.132 14.170 You own several copiers that are currently valued at $10,000, combined. Annual operating and maintenance costs for all copiers are estimated at $9,000 next year, increasing by 10 percent each year thereafter. Salvage values decrease at a rate of 20 percent per year. You are considering replacing your existing copiers with new ones that have a suggested retail price of $24,000. Operating and maintenance costs for the new equipment will be $6,000 over the first year, increasing by 10 percent each year thereafter. The salvage value of the new equipment is well approximated by a 20 percent drop from the suggested retail price per year. Furthermore, you can get a trade-in allowance of $12,000 for your equipment if you purchase the new equipment at its suggested retail price. Your MARR is 7 percent. Should you replace your existing equipment now? Click the icon to view the table of compound interest factors for discrete compounding periods when i = 7%. total EAC than the new equipment, which has an economic life of The economic life of the existing equipment is year(s) with a total EAC of $ This is a year(s) and a total EAC of $. You replace your existing equipment now. (Round to the nearest whole number as needed.) Single Payment Uniform Series N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 40 45 50 55 60 65 70 75 80 85 90 95 100 Compound Present Amount Worth Factor Factor (FIP,1,N) (P/F,i,N) 1.0700 0.93458 1.1449 0.87344 1.2250 0.81630 1.3108 0.76290 1.4026 0.71299 1.5007 0.66634 1.6058 0.62275 1.7182 0.58201 1.8385 0.54393 1.9672 0.50835 2.1049 0.47509 2.2522 0.44401 2.4098 0.41496 2.5785 0.38782 2.7590 0.36245 2.9522 0.33873 3.1588 0.31657 3.3799 0.29586 3.6165 0.27651 3.8697 0.25842 4.1406 0.24151 4.4304 0.22571 4.7405 0.21095 5.0724 0.19715 5.4274 0.18425 5.8074 0.17220 6.2139 0.16093 6.6488 0.15040 7.1143 0.14056 7.6123 0.13137 8.1451 0.12277 8.7153 0.11474 9.3253 0.10723 9.9781 0.10022 10.677 0.09366 14.974 0.06678 21.002 0.04761 29.457 0.03395 41.315 0.02420 57.946 0.01726 81.273 0.01230 113.99 0.00877 159.88 0.00625 224.23 0.00446 314.50 0.00318 441.10 0.00227 618.67 0.00162 867.72 0.00115 Sinking Fund Factor (A/F,i,N) 1.00000 0.48309 0.31105 0.22523 0.17389 0.13980 0.11555 0.09747 0.08349 0.07238 0.06336 0.05590 0.04965 0.04434 0.03979 0.03586 0.03243 0.02941 0.02675 0.02439 0.02229 0.02041 0.01871 0.01719 0.01581 0.01456 0.01343 0.01239 0.01145 0.01059 0.00980 0.00907 0.00841 0.00780 0.00723 0.00501 0.00350 0.00246 0.00174 0.00123 0.00087 0.00062 0.00044 0.00031 0.00022 0.00016 0.00011 0.00008 Uniform Series Factor (FIA,1,N) 1.0000 2.0700 3.2149 4.4399 5.7507 7.1533 8.6540 10.260 11.978 13.816 15.784 17.888 20.141 22.550 25.129 27.888 30.840 33.999 37.379 40.995 44.865 49.006 53.436 58.177 63.249 68.676 74.484 80.698 87.347 94.461 102.07 110.22 118.93 128.26 138.24 199.64 285.75 406.53 575.93 813.52 1146.8 1614.1 2269.7 3189.1 4478.6 6287.2 8823.9 12382.0 Capital Recovery Factor (A/P,1,N) 1.0700 0.55309 0.38105 0.29523 0.24389 0.20980 0.18555 0.16747 0.15349 0.14238 0.13336 0.12590 0.11965 0.11434 0.10979 0.10586 0.10243 0.09941 0.09675 0.09439 0.09229 0.09041 0.08871 0.08719 0.08581 0.08456 0.08343 0.08239 0.08145 0.08059 0.07980 0.07907 0.07841 0.07780 0.07723 0.07501 0.07350 0.07246 0.07174 0.07123 0.07087 0.07062 0.07044 0.07031 0.07022 0.07016 0.07011 0.07008 Series Present Worth Factor (PIA,1,N) 0.93458 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 5.9713 6.5152 7.0236 7.4987 7.9427 8.3577 8.7455 9.1079 9.4466 9.7632 10.059 10.336 10.594 10.836 11.061 11.272 11.469 11.654 11.826 11.987 12.137 12.278 12.409 12.532 12.647 12.754 12.854 12.948 13.332 13.606 13.801 13.940 14.039 14.110 14.160 14.196 14.222 14.240 14.253 14.263 14.269 Arithmetic Gradient Series Factor (A/G,,N) 0.00000 0.48309 0.95493 1.4155 1.8650 2.3032 2.7304 3.1465 3.5517 3.9461 4.3296 4.7025 5.0648 5.4167 5.7583 6.0897 6.4110 6.7225 7.0242 7.3163 7.5990 7.8725 8.1369 8.3923 8.6391 8.8773 9.1072 9.3289 9.5427 9.7487 9.9471 10.138 10.322 10.499 10.669 11.423 12.036 12.529 12.921 13.232 13.476 13.666 13.814 13.927 14.015 14.081 14.132 14.170Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started