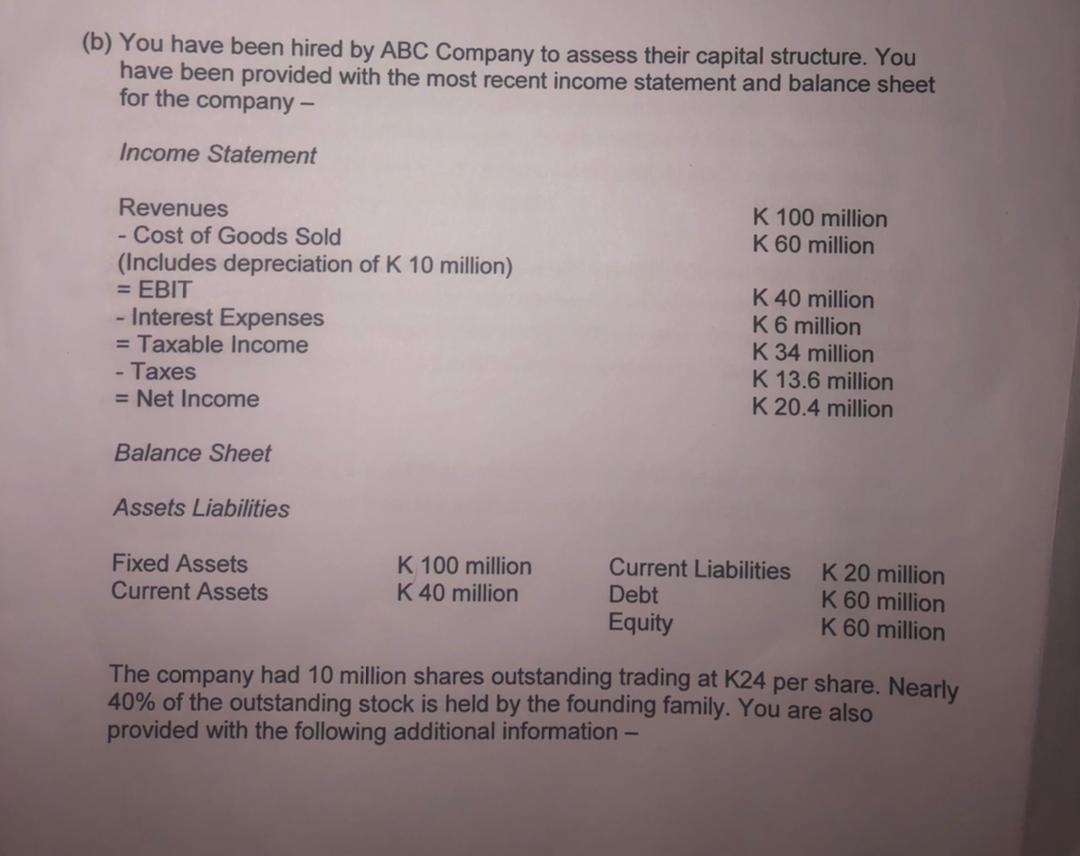

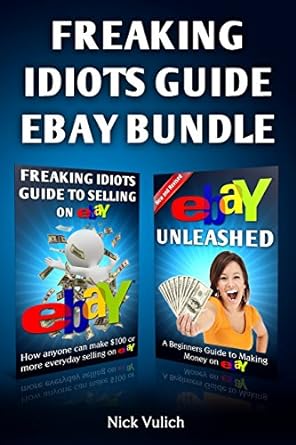

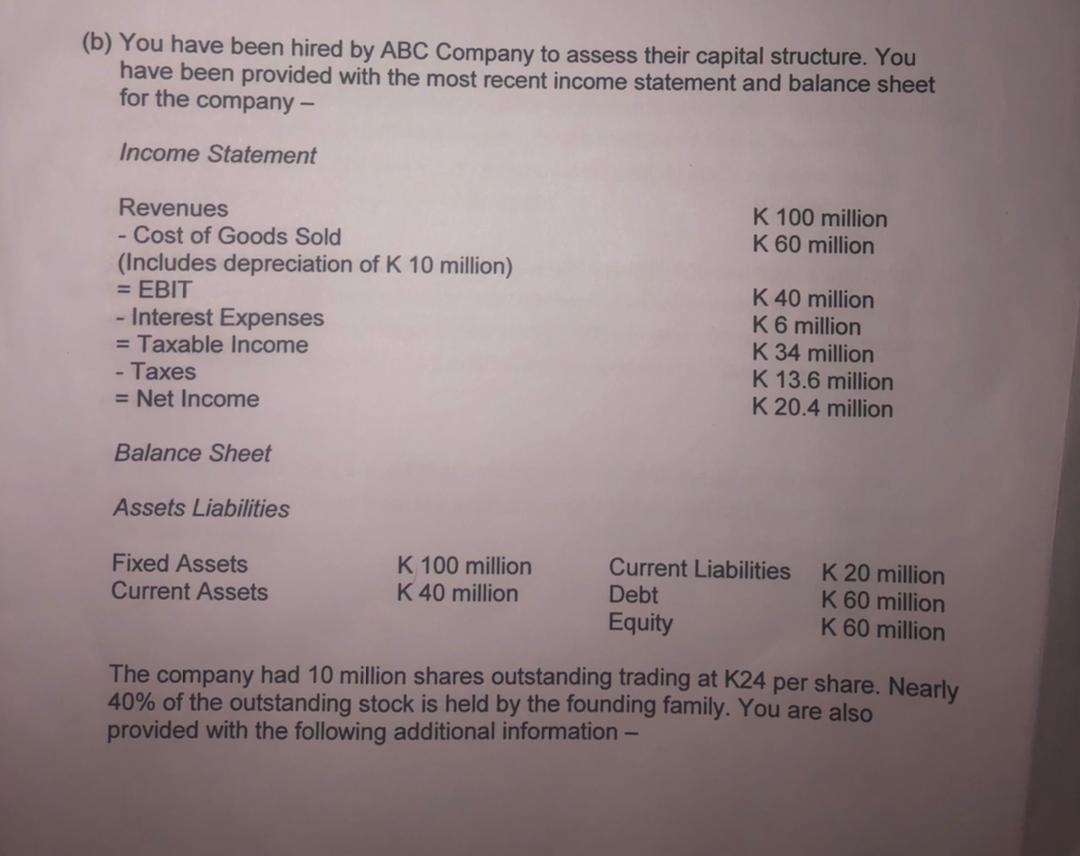

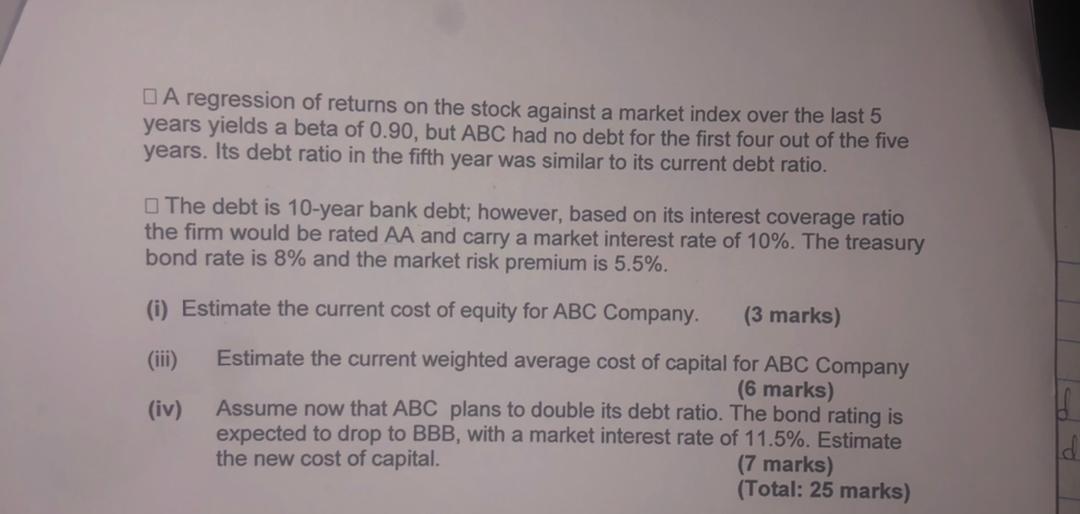

(b) You have been hired by ABC Company to assess their capital structure. You have been provided with the most recent income statement and balance sheet for the company - Income Statement K 100 million K 60 million Revenues - Cost of Goods Sold (Includes depreciation of K 10 million) = EBIT - Interest Expenses = Taxable income - Taxes = Net Income K 40 million K6 million K 34 million K 13.6 million K 20.4 million Balance Sheet Assets Liabilities Fixed Assets Current Assets K 100 million K 40 million Current Liabilities Debt Equity K 20 million K 60 million K 60 million The company had 10 million shares outstanding trading at K24 per share. Nearly 40% of the outstanding stock is held by the founding family. You are also provided with the following additional information - A regression of returns on the stock against a market index over the last 5 years yields a beta of 0.90, but ABC had no debt for the first four out of the five years. Its debt ratio in the fifth year was similar to its current debt ratio. The debt is 10-year bank debt; however, based on its interest coverage ratio the firm would be rated AA and carry a market interest rate of 10%. The treasury bond rate is 8% and the market risk premium is 5.5%. (i) Estimate the current cost of equity for ABC Company. (3 marks) (iii) Estimate the current weighted average cost of capital for ABC Company (6 marks) (iv) Assume now that ABC plans to double its debt ratio. The bond rating is expected to drop to BBB, with a market interest rate of 11.5%. Estimate the new cost of capital. (7 marks) (Total: 25 marks) (b) You have been hired by ABC Company to assess their capital structure. You have been provided with the most recent income statement and balance sheet for the company - Income Statement K 100 million K 60 million Revenues - Cost of Goods Sold (Includes depreciation of K 10 million) = EBIT - Interest Expenses = Taxable income - Taxes = Net Income K 40 million K6 million K 34 million K 13.6 million K 20.4 million Balance Sheet Assets Liabilities Fixed Assets Current Assets K 100 million K 40 million Current Liabilities Debt Equity K 20 million K 60 million K 60 million The company had 10 million shares outstanding trading at K24 per share. Nearly 40% of the outstanding stock is held by the founding family. You are also provided with the following additional information - A regression of returns on the stock against a market index over the last 5 years yields a beta of 0.90, but ABC had no debt for the first four out of the five years. Its debt ratio in the fifth year was similar to its current debt ratio. The debt is 10-year bank debt; however, based on its interest coverage ratio the firm would be rated AA and carry a market interest rate of 10%. The treasury bond rate is 8% and the market risk premium is 5.5%. (i) Estimate the current cost of equity for ABC Company. (3 marks) (iii) Estimate the current weighted average cost of capital for ABC Company (6 marks) (iv) Assume now that ABC plans to double its debt ratio. The bond rating is expected to drop to BBB, with a market interest rate of 11.5%. Estimate the new cost of capital. (7 marks) (Total: 25 marks)