Answered step by step

Verified Expert Solution

Question

1 Approved Answer

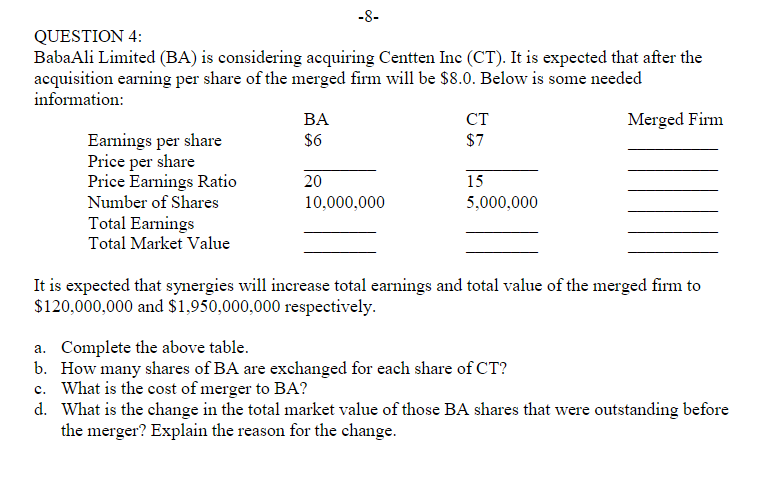

BabaAli Limited ( B A ) is considering acquiring Centten Inc ( CT ) . It is expected that after the acquisition earning per share

BabaAli Limited is considering acquiring Centten Inc CT It is expected that after the

acquisition earning per share of the merged firm will be $ Below is some needed

information:

It is expected that synergies will increase total earnings and total value of the merged firm to

$ and $ respectively.

a Complete the above table.

b How many shares of BA are exchanged for each share of CT

c What is the cost of merger to BA

d What is the change in the total market value of those BA shares that were outstanding before

the merger? Explain the reason for the change.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started