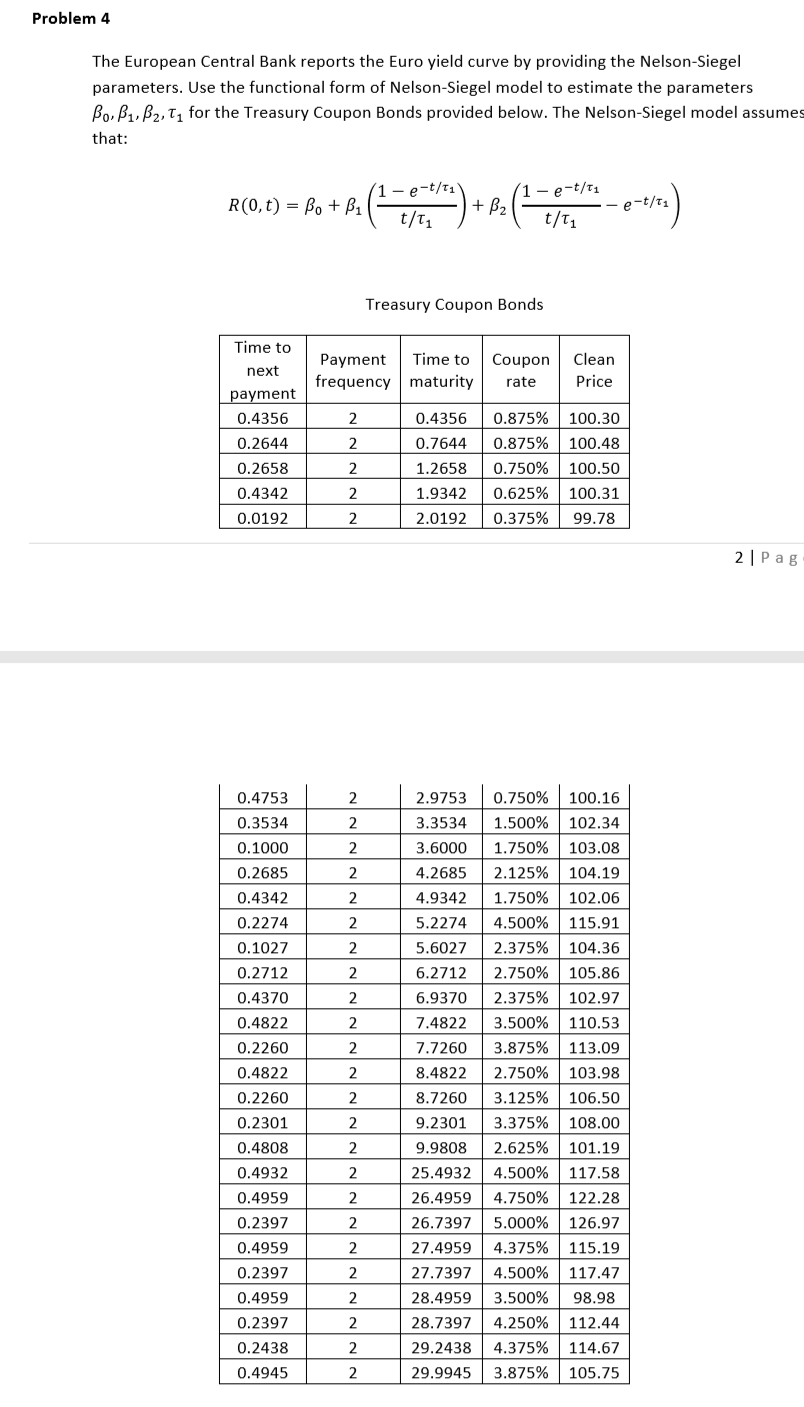

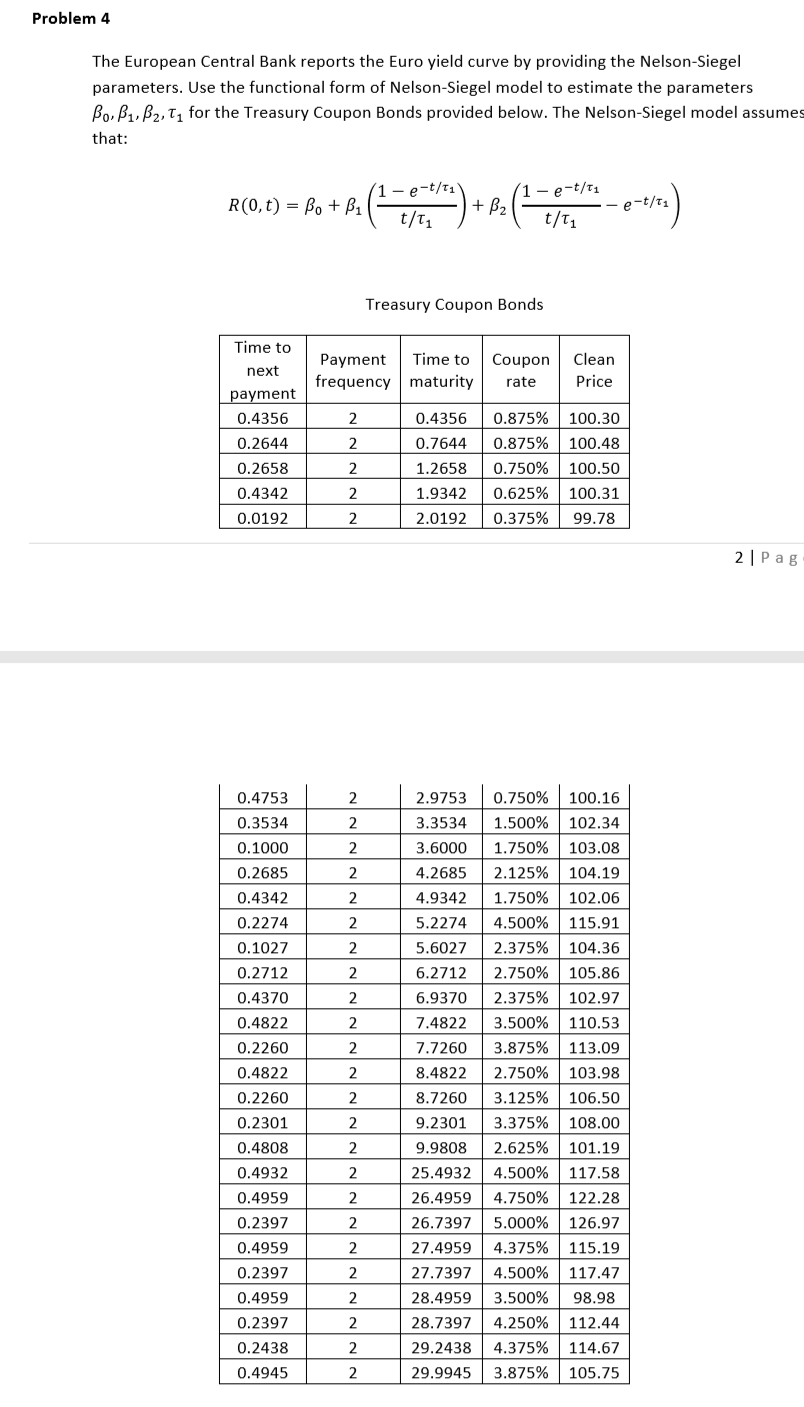

Problem 4 The European Central Bank reports the Euro yield curve by providing the Nelson-Siegel parameters. Use the functional form of Nelson-Siegel model to estimate the parameters Bo, B1, B2, ty for the Treasury Coupon Bonds provided below. The Nelson-Siegel model assumes that: 11- e-t/t1 R(0,t) = Bo + Bil t/ti - (1 - e-t/t1 - + B2 -e-t/ti t/T1 Treasury Coupon Bonds Payment Time to frequency maturity Coupon rate Clean Price 2 Time to next payment 0.4356 0.2644 0.2658 0.4342 0.0192 2 0 0.4356 .7644 1.2658 1.9342 .0192 0.875% 0.875% 0.750% 0.625% 0.375% 100.30 100.48 100.50 100.31 99.78 2 2 2 2 | Pag 2 0.4753 0.3534 0.1000 0.2685 0.4342 0.2274 0.1027 0.2712 0.4370 0.4822 0.2260 - 2 0.4822 0.2260 0.2301 0.4808 2.9753 0.750% 100.16 3.3534 1.500% 102.34 3.6000 1.750% 103.08 4.2685 | 2.125% 104.19 4.9342 1.750% 102.06 5.2274 4.500% 115.91 5.6027 2.375% 104.36 6.2712 2.750% 105.86 6.9370 2.375% 102.97 7.4822 3.500% 110.53 7.7260 3.875% 113.09 8.4822 2.750% 103.98 8.7260 3.125% 106.50 9.2301 3.375% 108.00 9.9808 2.625% 101.19 25.4932 4.500% 117.58 26.4959 4.750% 122.28 26.7397 5.000% | 126.97 27.4959 4.375% 115.19 27.73974.500% 117.47 28.4959 3.500% 98.98 28.7397 4.250% 112.44 29.2438 4.375% | 114.67 29.9945 3.875% 105.75 2 0.4932 0.4959 0.2397 0.4959 0.2397 0.4959 0.2397 0.2438 0.4945 2 2 Problem 4 The European Central Bank reports the Euro yield curve by providing the Nelson-Siegel parameters. Use the functional form of Nelson-Siegel model to estimate the parameters Bo, B1, B2, ty for the Treasury Coupon Bonds provided below. The Nelson-Siegel model assumes that: 11- e-t/t1 R(0,t) = Bo + Bil t/ti - (1 - e-t/t1 - + B2 -e-t/ti t/T1 Treasury Coupon Bonds Payment Time to frequency maturity Coupon rate Clean Price 2 Time to next payment 0.4356 0.2644 0.2658 0.4342 0.0192 2 0 0.4356 .7644 1.2658 1.9342 .0192 0.875% 0.875% 0.750% 0.625% 0.375% 100.30 100.48 100.50 100.31 99.78 2 2 2 2 | Pag 2 0.4753 0.3534 0.1000 0.2685 0.4342 0.2274 0.1027 0.2712 0.4370 0.4822 0.2260 - 2 0.4822 0.2260 0.2301 0.4808 2.9753 0.750% 100.16 3.3534 1.500% 102.34 3.6000 1.750% 103.08 4.2685 | 2.125% 104.19 4.9342 1.750% 102.06 5.2274 4.500% 115.91 5.6027 2.375% 104.36 6.2712 2.750% 105.86 6.9370 2.375% 102.97 7.4822 3.500% 110.53 7.7260 3.875% 113.09 8.4822 2.750% 103.98 8.7260 3.125% 106.50 9.2301 3.375% 108.00 9.9808 2.625% 101.19 25.4932 4.500% 117.58 26.4959 4.750% 122.28 26.7397 5.000% | 126.97 27.4959 4.375% 115.19 27.73974.500% 117.47 28.4959 3.500% 98.98 28.7397 4.250% 112.44 29.2438 4.375% | 114.67 29.9945 3.875% 105.75 2 0.4932 0.4959 0.2397 0.4959 0.2397 0.4959 0.2397 0.2438 0.4945 2 2