Answered step by step

Verified Expert Solution

Question

1 Approved Answer

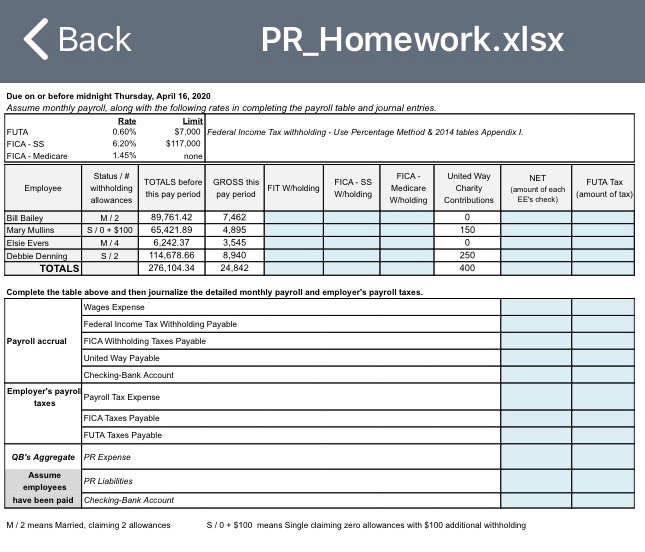

< Back PR_Homework.xlsx Rate 0.60% FICA - Medicare 6.20% 1.45% Due on or before midnight Thursday, April 16, 2020 Assume monthly payroll, along with

< Back PR_Homework.xlsx Rate 0.60% FICA - Medicare 6.20% 1.45% Due on or before midnight Thursday, April 16, 2020 Assume monthly payroll, along with the following rates in completing the payroll table and journal entries. FUTA FICA-SS Limit $7,000 Federal Income Tax withholding - Use Percentage Method & 2014 tables Appendix I. $117,000 none Status/# Employee withholding allowances TOTALS before this pay period GROSS this pay period FIT W/holding FICA-SS W/holding FICA- Medicare W/holding United Way Charity Contributions NET (amount of each EE's check) Bill Bailey Mary Mullins M/2 S/0+ $100 89,761.42 7,462 65,421.89 4,895 150 Elsie Evers M/4 6,242.37 3,545 0 Debbie Denning S/2 114,678.66 8,940 250 TOTALS 276,104.34 24,842 400 Complete the table above and then journalize the detailed monthly payroll and employer's payroll taxes. Wages Expense Federal Income Tax Withholding Payable Payroll accrual FICA Withholding Taxes Payable United Way Payable Checking-Bank Account Employer's payrol Payroll Tax Expense taxes FICA Taxes Payable FUTA Taxes Payable QB's Aggregate PR Expense Assume employees PR Liabilities have been paid Checking-Bank Account M/2 means Married, claiming 2 allowances S/0 + $100 means Single claiming zero allowances with $100 additional withholding FUTA Tax (amount of tax)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started