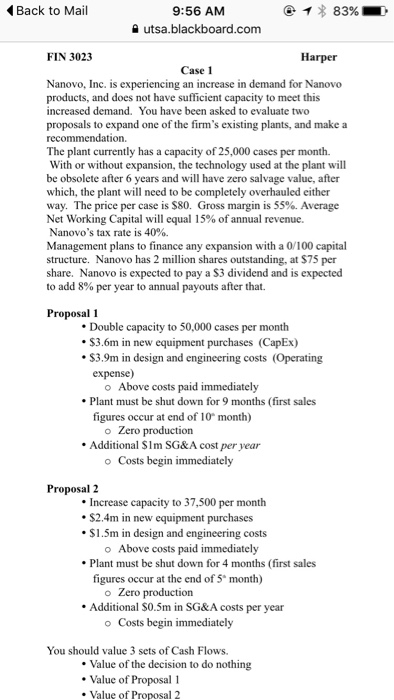

Question: Back to Mail @ 9:56 AM utsa.blackboard.com 83%-. FIN 3023 Harper Case 1 Nanovo, Inc. is experiencing an increase in demand for Nanovo products, and

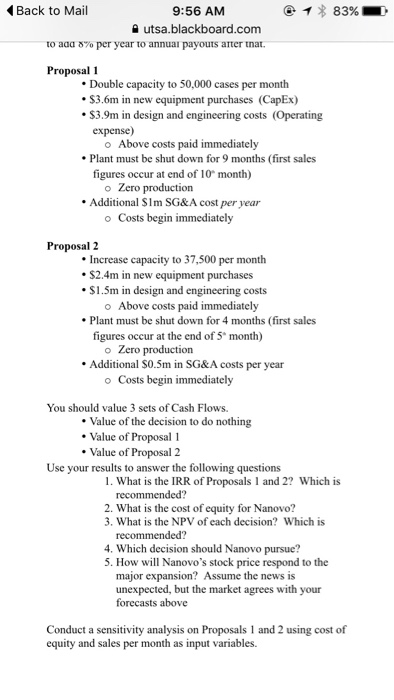

Back to Mail @ 9:56 AM utsa.blackboard.com 83%-. FIN 3023 Harper Case 1 Nanovo, Inc. is experiencing an increase in demand for Nanovo products, and does not have sufficient capacity to meet this increased demand. You have been asked to evaluate two proposals to expand one of the firm's existing plants, and make a The plant currently has a capacity of 25,000 cases per month. With or without expansion, the technology used at the plant will be obsolete after 6 years and will have zero salvage value, after which, the plant will need to be completely overhauled either way. The price per case is $80. Gross margin is 55%. Average Net Working Capital will equal 15% of annual revenue. Nanovo's tax rate is 40%. Management plans to finance any expansion with a 0/100 capital structure. Nanovo has 2 million shares outstanding, at $75 per share. Nanovo is expected to pay a S3 dividend and is expected to add 8% per year to annual payouts after that. Proposal 1 Double capacity to 50,000 cases per month $3.6m in new equipment purchases (CapEx) $3.9m in design and engineering costs (Operating expense) o Above costs paid immediately Plant must be shut down for 9 months (first sales figures occur at end of 10 month) o Zero production Additional SIm SG&A cost per year o Costs begin immediately Proposal 2 Increase capacity to 37,500 per month $2.4mn in new equipment purchases $1.5m in design and engineering costs o Above costs paid immediately Plant must be shut down for 4 months (first sales figures occur at the end of 5 month) o Zero production Additional S0.5m in SG&A costs per year o Costs begin immediately You should value 3 sets of Cash Flows . Value of the decision to do nothing Value of Proposal 1 . Value of Proposal 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts