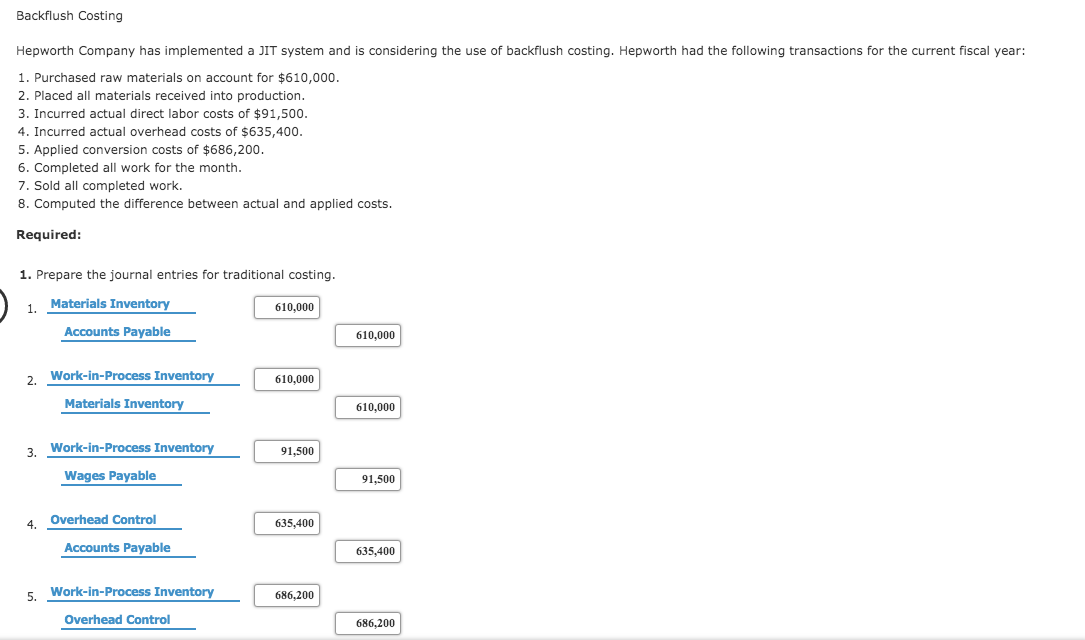

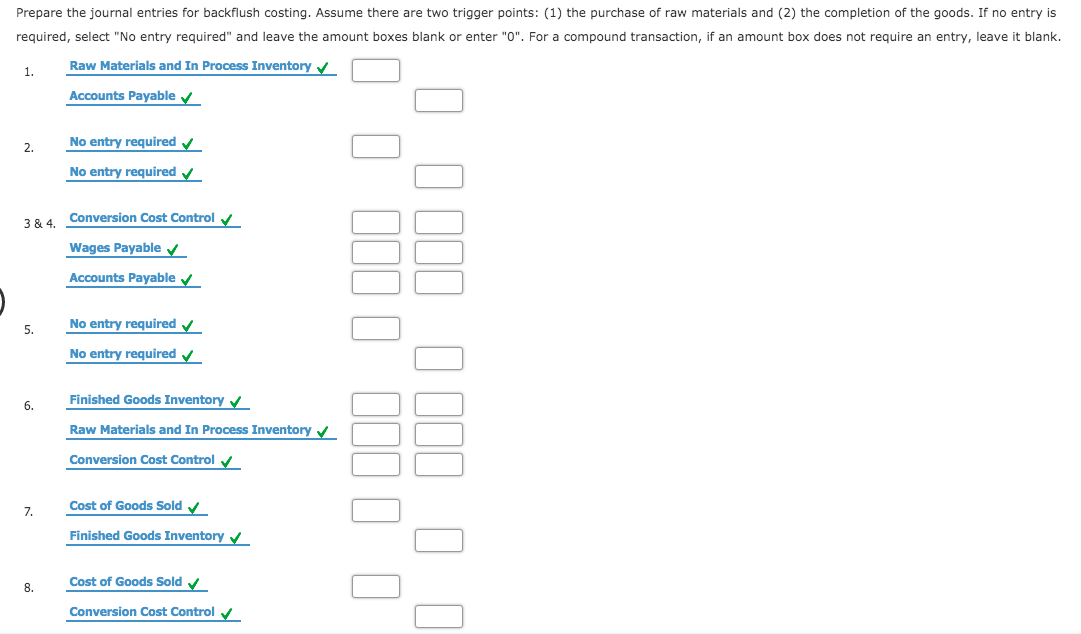

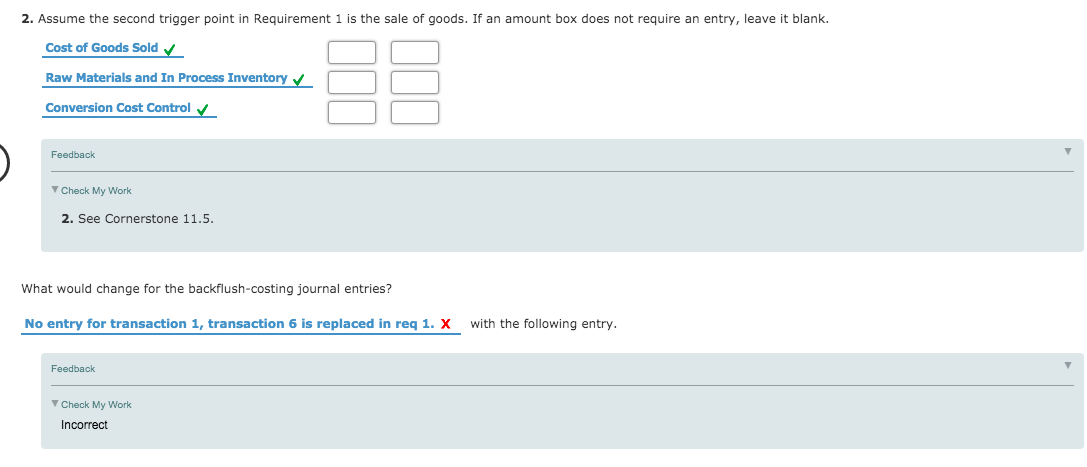

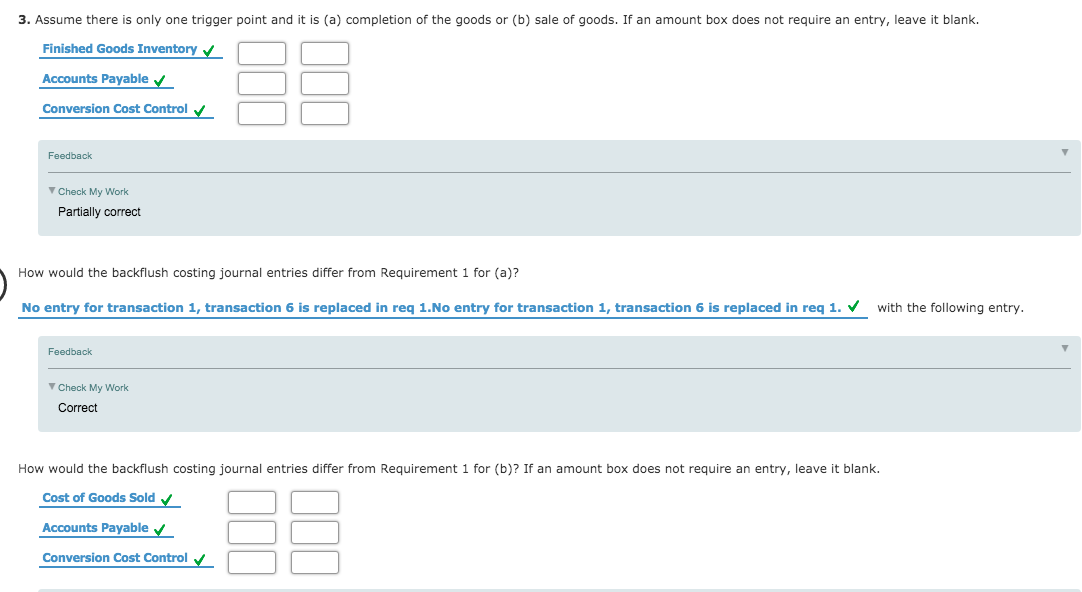

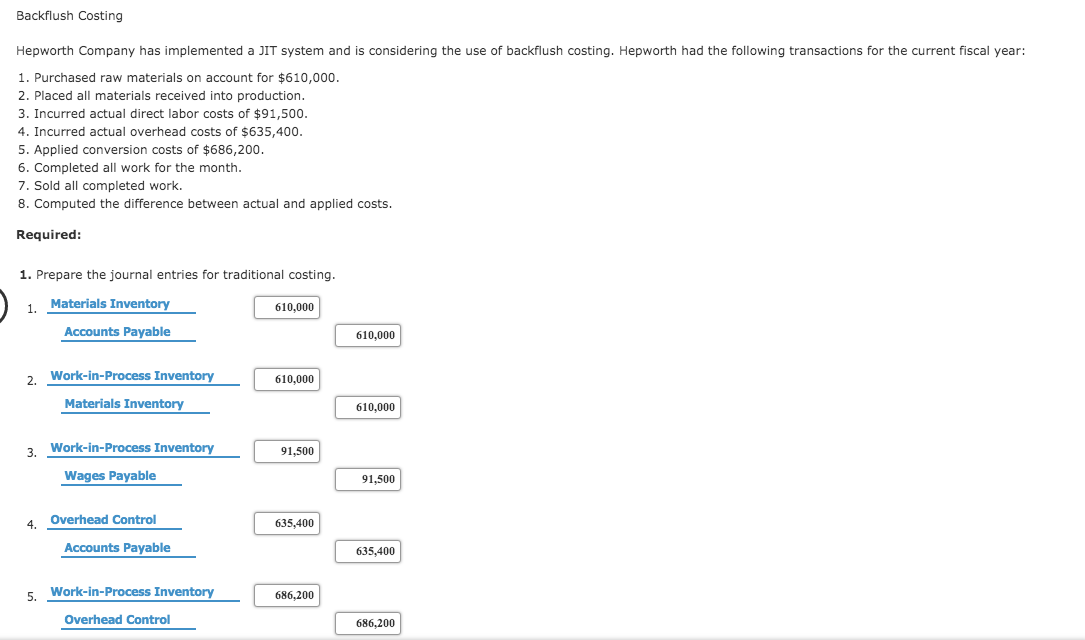

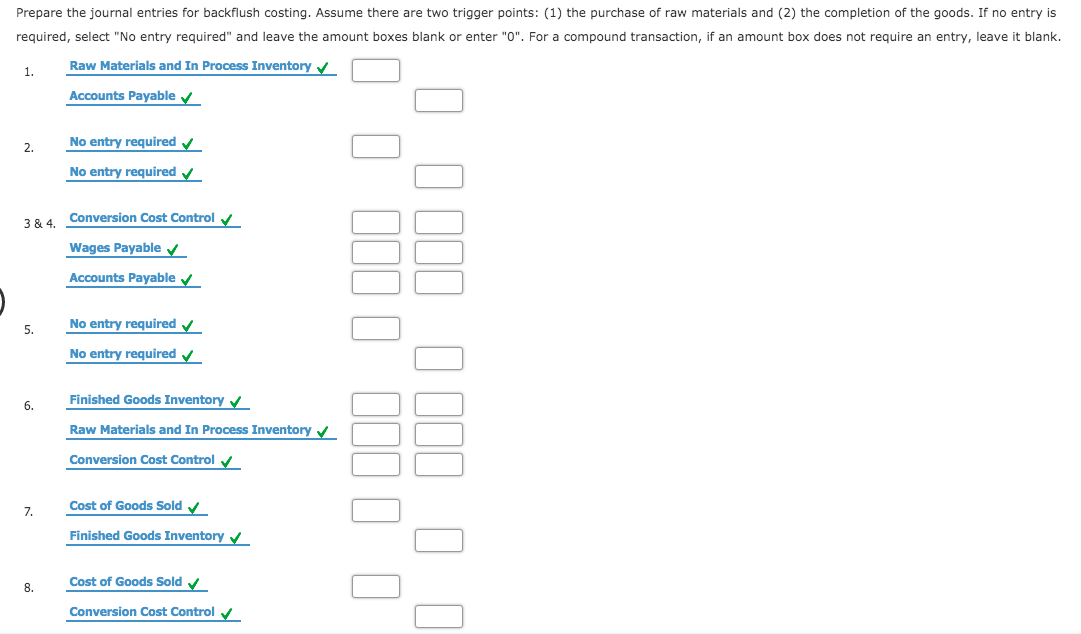

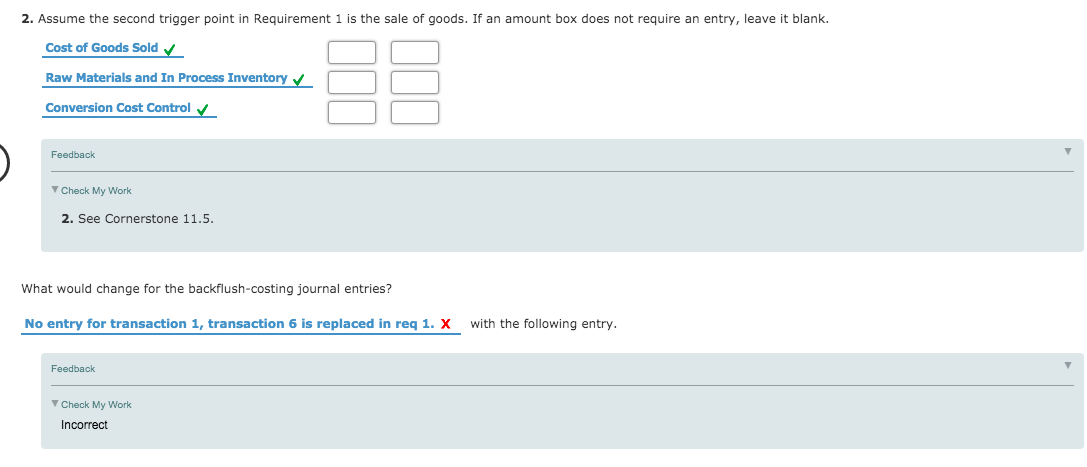

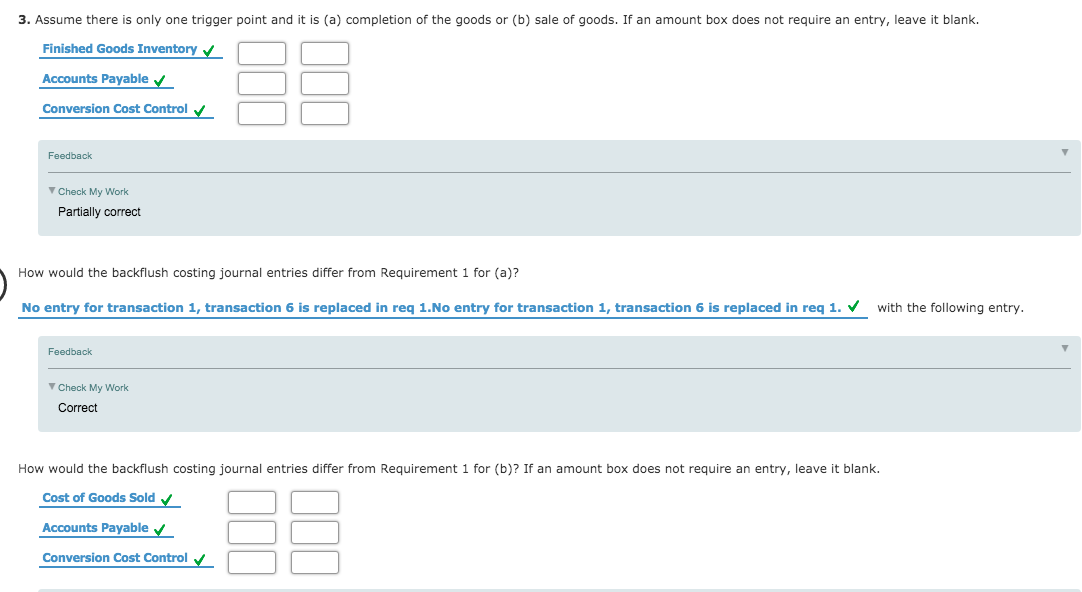

Backflush Costing Hepworth Company has implemented a JIT system and is considering the use of backflush costing. Hepworth had the following transactions for the current fiscal year: 1. Purchased raw materials on account for $610,000. 2. Placed all materials received into production. 3. Incurred actual direct labor costs of $91,500. 4. Incurred actual overhead costs of $635,400. 5. Applied conversion costs of $686,200. 6. Completed all work for the month. 7. Sold all completed work. 8. Computed the difference between actual and applied costs. Required: 1. Prepare the journal entries for traditional costing. Materials Inventory 610,000 Accounts Payable 610,000 Work-in-Process Inventory 610,000 Materials Inventory 610,000 3 Work-in-Process Inventory 91,500 Wages Payable 91,500 4. Overhead Control 635,400 Accounts Payable 635,400 5 Work-in-Process Inventory 686,200 Overhead Control 686,200 6. Finished Goods Inventory Work-in-Process Inventory 7. Cost of Goods Sold Finished Goods Inventory 8. Cost of Goods Sold Overhead Control Prepare the journal entries for backflush costing. Assume there are two trigger points: (1) the purchase of raw materials and (2) the completion of the goods. If no entry is required, select "No entry required" and leave the amount boxes blank or enter "O". For a compound transaction, if an amount box does not require an entry, leave it blank. 1. Raw Materials and In Process Inventory Accounts Payable 2. No entry required No entry required 3 & 4. Conversion Cost Control Wages Payable Accounts Payable 5. No entry required No entry required Finished Goods Inventory 6. Raw Materials and In Process Inventory Conversion Cost Control 7. Cost of Goods Sold Finished Goods Inventory Cost of Goods Sold Conversion Cost Control 2. Assume the second trigger point in Requirement 1 is the sale of goods. If an amount box does not require an entry, leave it blank. Cost of Goods Sold Raw Materials and In Process Inventory Conversion Cost Control Feedback Check My Work 2. See Cornerstone 11.5. What would change for the backflush-costing journal entries? No entry for transaction 1, transaction 6 is replaced in req 1. X with the following entry. Feedback Check My Work Incorrect 3. Assume there is only one trigger point and it is (a) completion of the goods or (b) sale of goods. If an amount box does not require an entry, leave it blank. Finished Goods Inventory Accounts Payable Conversion Cost Control Feedback Check My Work Partially correct How would the backflush costing journal entries differ from Requirement 1 for (a)? No entry for transaction 1, transaction 6 is replaced in req 1. No entry for transaction 1, transaction 6 is replaced in req 1. with the following entry. Feedback Check My Work Correct How would the backflush costing journal entries differ from Requirement 1 for (b)? If an amount box does not require an entry, leave it blank. Cost of Goods Sold Accounts Payable Conversion Cost Control Backflush Costing Hepworth Company has implemented a JIT system and is considering the use of backflush costing. Hepworth had the following transactions for the current fiscal year: 1. Purchased raw materials on account for $610,000. 2. Placed all materials received into production. 3. Incurred actual direct labor costs of $91,500. 4. Incurred actual overhead costs of $635,400. 5. Applied conversion costs of $686,200. 6. Completed all work for the month. 7. Sold all completed work. 8. Computed the difference between actual and applied costs. Required: 1. Prepare the journal entries for traditional costing. Materials Inventory 610,000 Accounts Payable 610,000 Work-in-Process Inventory 610,000 Materials Inventory 610,000 3 Work-in-Process Inventory 91,500 Wages Payable 91,500 4. Overhead Control 635,400 Accounts Payable 635,400 5 Work-in-Process Inventory 686,200 Overhead Control 686,200 6. Finished Goods Inventory Work-in-Process Inventory 7. Cost of Goods Sold Finished Goods Inventory 8. Cost of Goods Sold Overhead Control Prepare the journal entries for backflush costing. Assume there are two trigger points: (1) the purchase of raw materials and (2) the completion of the goods. If no entry is required, select "No entry required" and leave the amount boxes blank or enter "O". For a compound transaction, if an amount box does not require an entry, leave it blank. 1. Raw Materials and In Process Inventory Accounts Payable 2. No entry required No entry required 3 & 4. Conversion Cost Control Wages Payable Accounts Payable 5. No entry required No entry required Finished Goods Inventory 6. Raw Materials and In Process Inventory Conversion Cost Control 7. Cost of Goods Sold Finished Goods Inventory Cost of Goods Sold Conversion Cost Control 2. Assume the second trigger point in Requirement 1 is the sale of goods. If an amount box does not require an entry, leave it blank. Cost of Goods Sold Raw Materials and In Process Inventory Conversion Cost Control Feedback Check My Work 2. See Cornerstone 11.5. What would change for the backflush-costing journal entries? No entry for transaction 1, transaction 6 is replaced in req 1. X with the following entry. Feedback Check My Work Incorrect 3. Assume there is only one trigger point and it is (a) completion of the goods or (b) sale of goods. If an amount box does not require an entry, leave it blank. Finished Goods Inventory Accounts Payable Conversion Cost Control Feedback Check My Work Partially correct How would the backflush costing journal entries differ from Requirement 1 for (a)? No entry for transaction 1, transaction 6 is replaced in req 1. No entry for transaction 1, transaction 6 is replaced in req 1. with the following entry. Feedback Check My Work Correct How would the backflush costing journal entries differ from Requirement 1 for (b)? If an amount box does not require an entry, leave it blank. Cost of Goods Sold Accounts Payable Conversion Cost Control