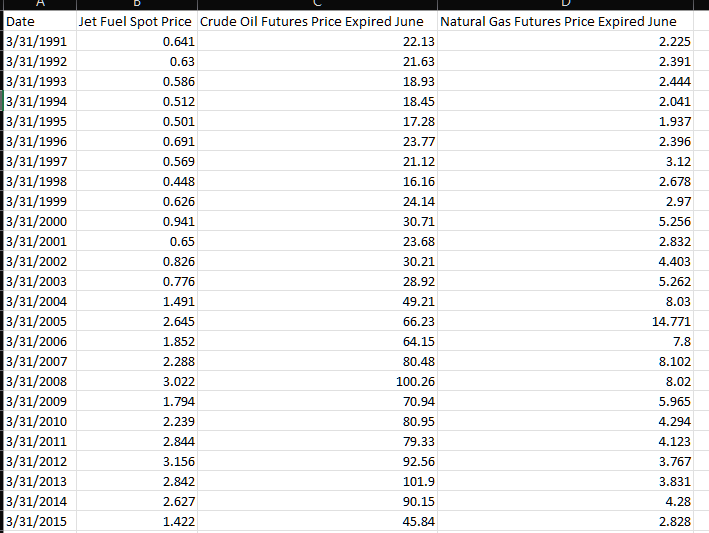

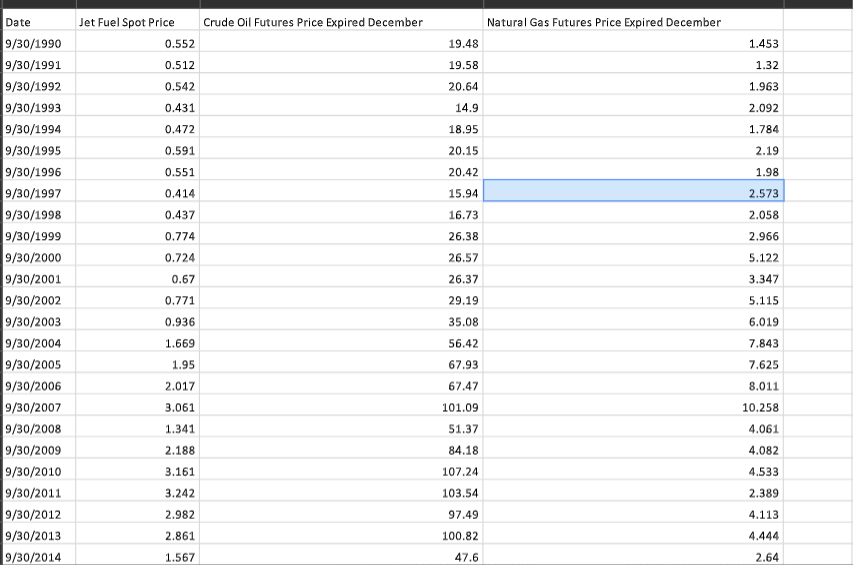

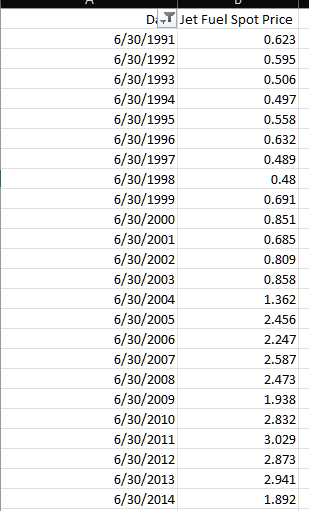

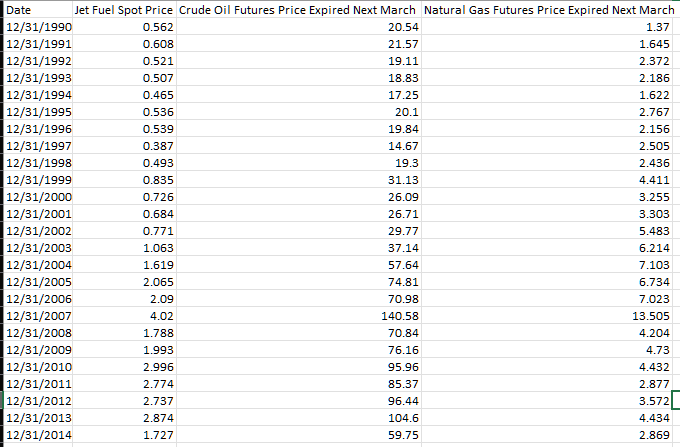

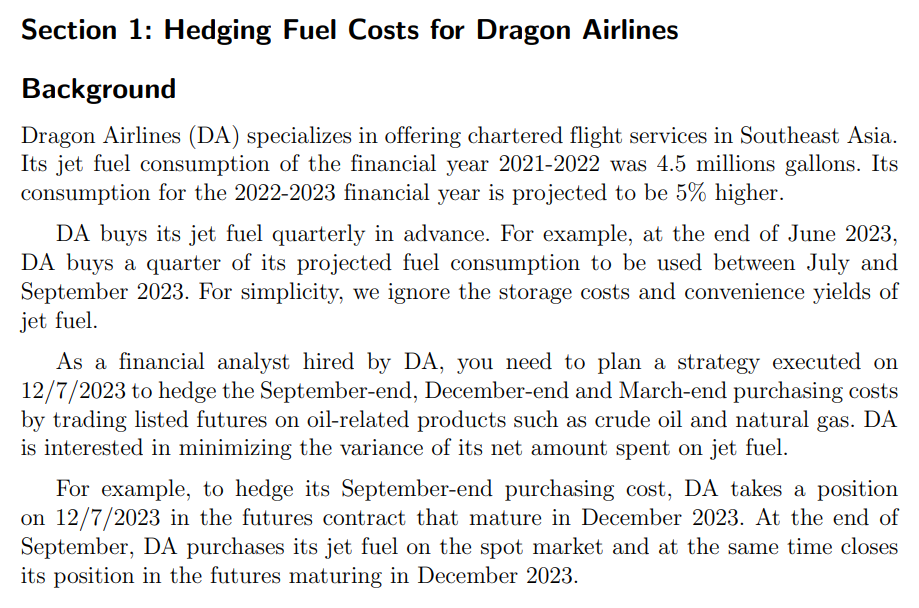

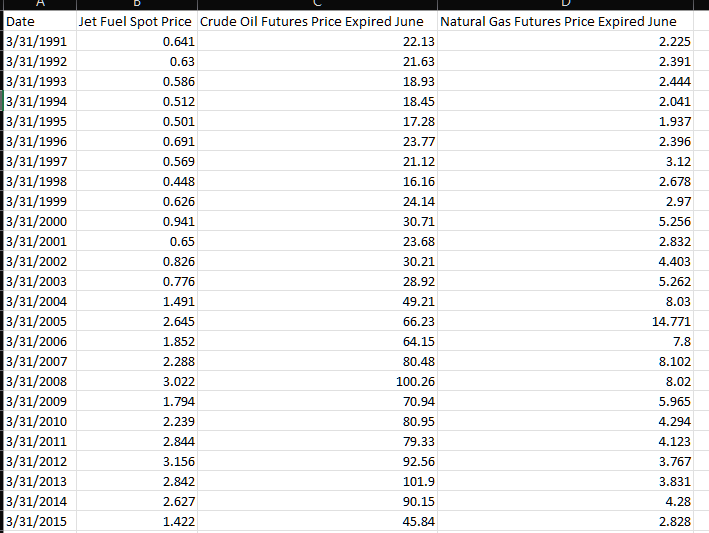

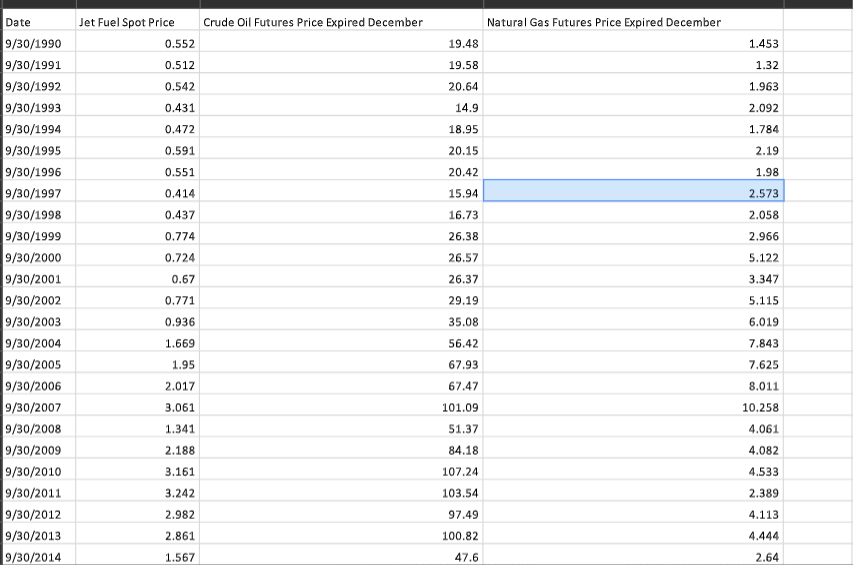

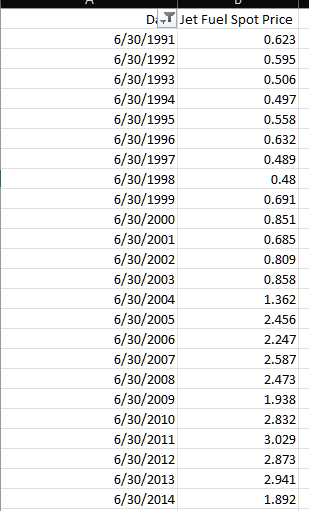

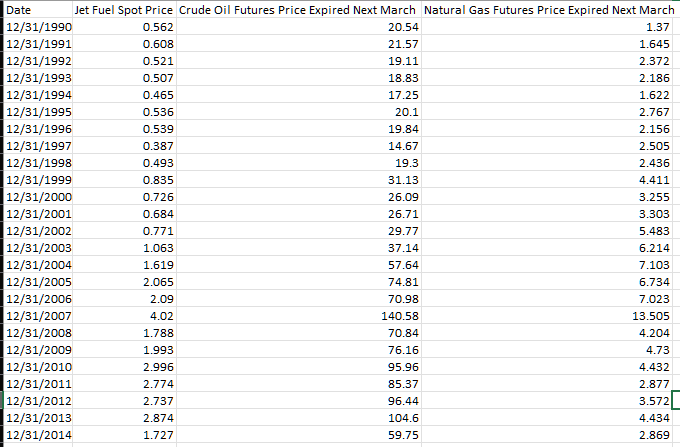

Background Dragon Airlines (DA) specializes in offering chartered flight services in Southeast Asia. Its jet fuel consumption of the financial year 2021-2022 was 4.5 millions gallons. Its consumption for the 2022-2023 financial year is projected to be 5% higher. DA buys its jet fuel quarterly in advance. For example, at the end of June 2023, DA buys a quarter of its projected fuel consumption to be used between July and September 2023. For simplicity, we ignore the storage costs and convenience yields of jet fuel. As a financial analyst hired by DA, you need to plan a strategy executed on 12/7/2023 to hedge the September-end, December-end and March-end purchasing costs by trading listed futures on oil-related products such as crude oil and natural gas. DA is interested in minimizing the variance of its net amount spent on jet fuel. For example, to hedge its September-end purchasing cost, DA takes a position on 12/7/2023 in the futures contract that mature in December 2023. At the end of September, DA purchases its jet fuel on the spot market and at the same time closes its position in the futures maturing in December 2023. 7) Suppose DA also wants to explore trading options on jet fuel as an alternative to trading futures. Suggest at least 3 appropriate trading strategies involving options. Background Dragon Airlines (DA) specializes in offering chartered flight services in Southeast Asia. Its jet fuel consumption of the financial year 2021-2022 was 4.5 millions gallons. Its consumption for the 2022-2023 financial year is projected to be 5% higher. DA buys its jet fuel quarterly in advance. For example, at the end of June 2023, DA buys a quarter of its projected fuel consumption to be used between July and September 2023. For simplicity, we ignore the storage costs and convenience yields of jet fuel. As a financial analyst hired by DA, you need to plan a strategy executed on 12/7/2023 to hedge the September-end, December-end and March-end purchasing costs by trading listed futures on oil-related products such as crude oil and natural gas. DA is interested in minimizing the variance of its net amount spent on jet fuel. For example, to hedge its September-end purchasing cost, DA takes a position on 12/7/2023 in the futures contract that mature in December 2023. At the end of September, DA purchases its jet fuel on the spot market and at the same time closes its position in the futures maturing in December 2023. 7) Suppose DA also wants to explore trading options on jet fuel as an alternative to trading futures. Suggest at least 3 appropriate trading strategies involving options