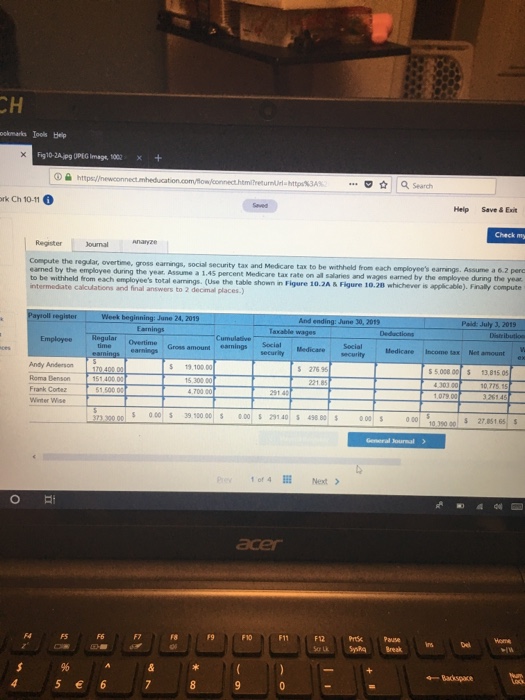

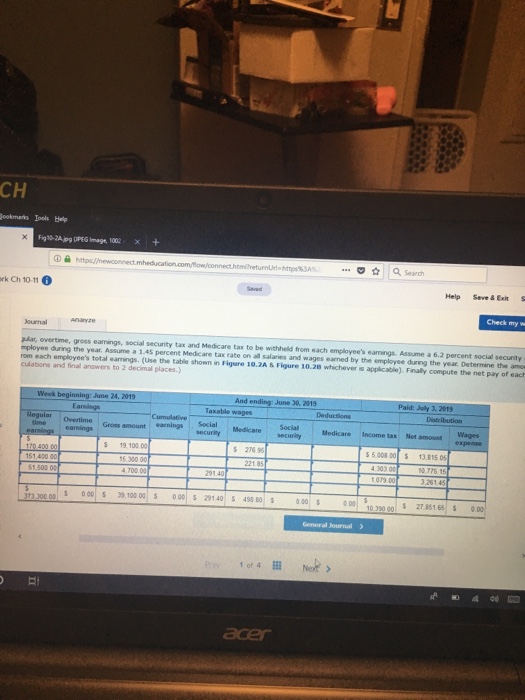

Please fill in winter wise and any other errors noticed

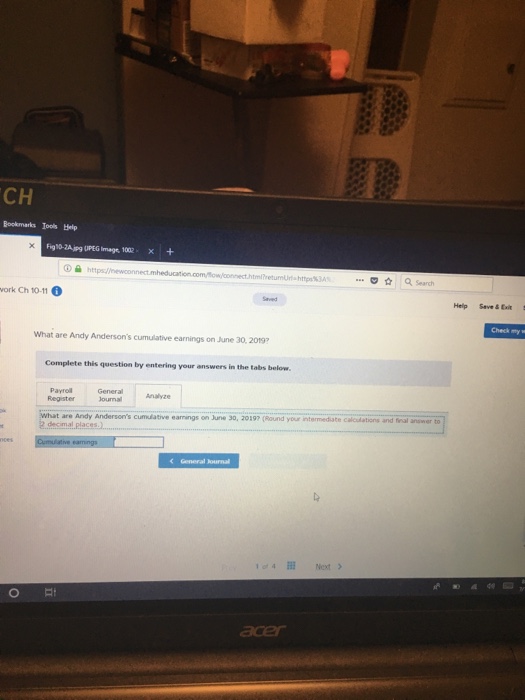

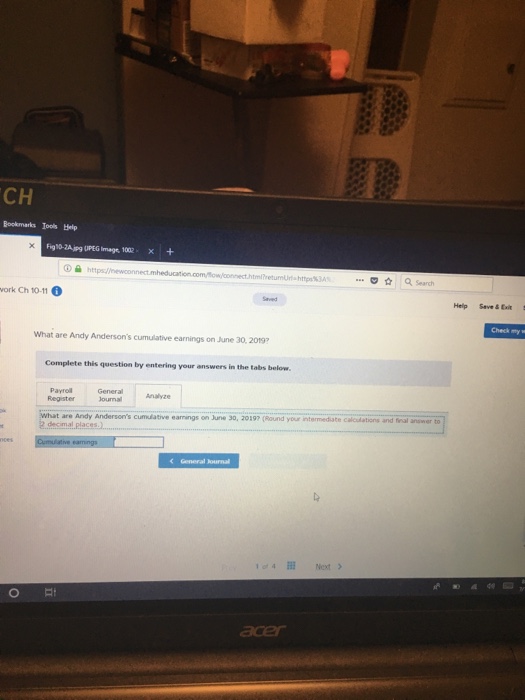

Please answer the analyze question

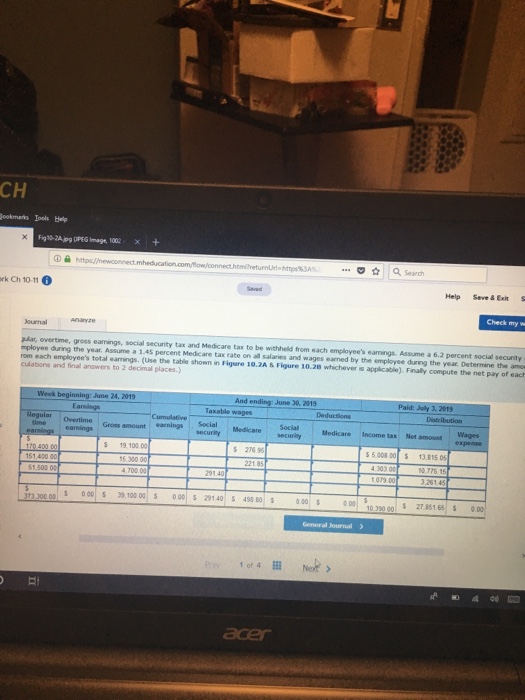

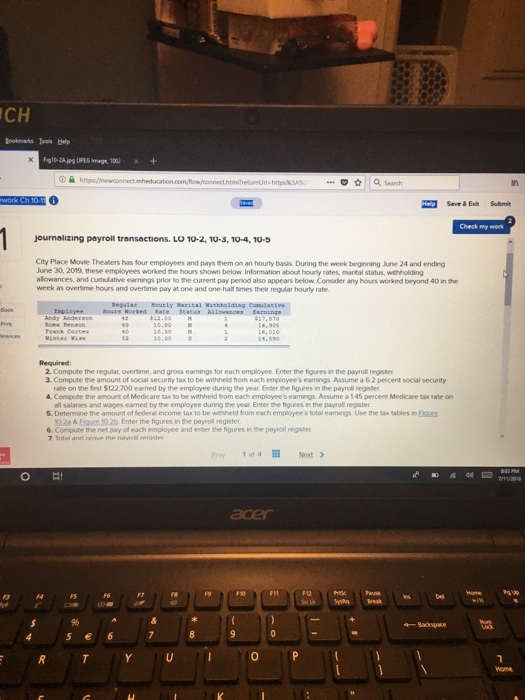

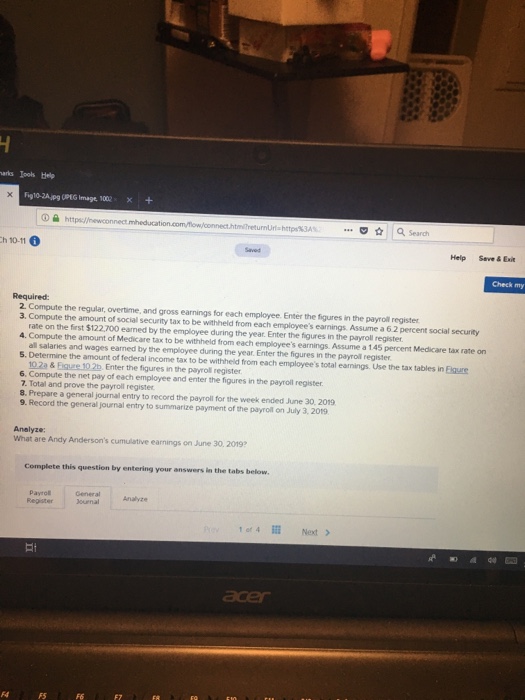

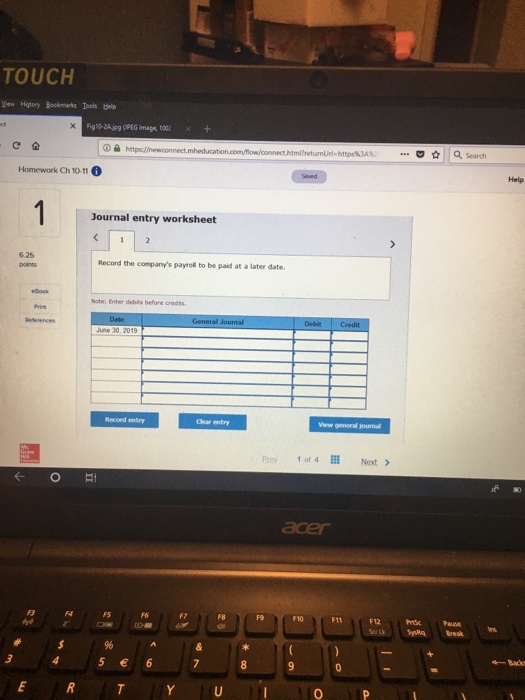

ICH QSeach Hep Save&Exit Submit journalizing payroll transactions. " 10-2, 10-3, 104, 10-5 City Place Movie Theaters has four employees and pays them on an hourly basis. During the week beginning June 24 and ending June 30, 2019, these employees worked the hours shown below Information about hourly rates, manital status, withholding alowances, and cumulative earnings prior to the current pay period also appears below Consider any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one-haif bmes their regular hourly rate 2. Compute the regular, overtime, and gross earnings for each employee Enter the figures in the payroll register 3. Compute the amount of social securny tax to be withheld from each employee's earnings Assume a 6.2 percent social security 4?Corgune the amount of Medicare tax to be withheld mom each employees earnrgs, Assume a 145 pecent MedCaeta.ate on 5. Determine the amount of federal income tax to be withheld om each employee's total earnings Use the tax tables in Eaure 6. Compute the net pay of each employee and enter the figures in the paytoll negister rate on the fest $122700 earned by the employee during the year Enter the figures in the payroll register all salaries and wages earned by the employee during the year Enter the figures in the payroll register 2a&Eure 102b Enter the figures in the payrol register Prey 1 ofa Next F4 96 Bandkspaxe 0 ICH QSeach Hep Save&Exit Submit journalizing payroll transactions. " 10-2, 10-3, 104, 10-5 City Place Movie Theaters has four employees and pays them on an hourly basis. During the week beginning June 24 and ending June 30, 2019, these employees worked the hours shown below Information about hourly rates, manital status, withholding alowances, and cumulative earnings prior to the current pay period also appears below Consider any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one-haif bmes their regular hourly rate 2. Compute the regular, overtime, and gross earnings for each employee Enter the figures in the payroll register 3. Compute the amount of social securny tax to be withheld from each employee's earnings Assume a 6.2 percent social security 4?Corgune the amount of Medicare tax to be withheld mom each employees earnrgs, Assume a 145 pecent MedCaeta.ate on 5. Determine the amount of federal income tax to be withheld om each employee's total earnings Use the tax tables in Eaure 6. Compute the net pay of each employee and enter the figures in the paytoll negister rate on the fest $122700 earned by the employee during the year Enter the figures in the payroll register all salaries and wages earned by the employee during the year Enter the figures in the payroll register 2a&Eure 102b Enter the figures in the payrol register Prey 1 ofa Next F4 96 Bandkspaxe 0

Please fill in winter wise and any other errors noticed

Please fill in winter wise and any other errors noticed

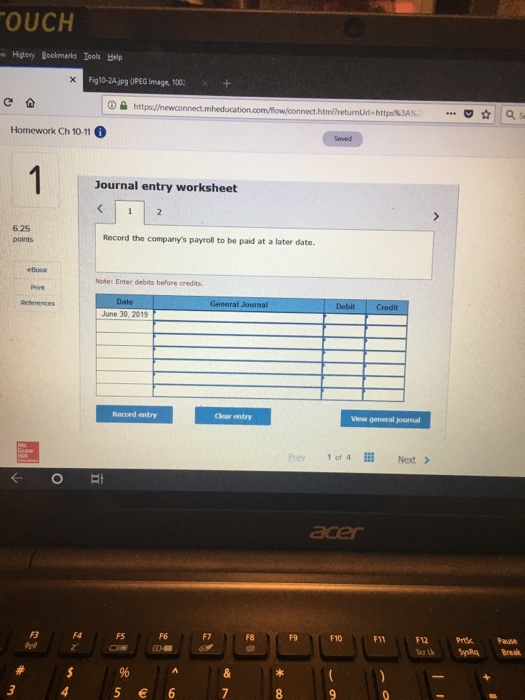

Please answer the analyze question

Please answer the analyze question