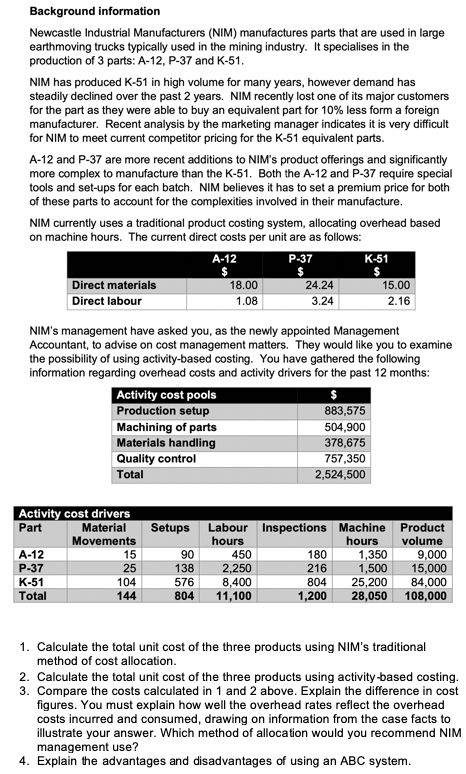

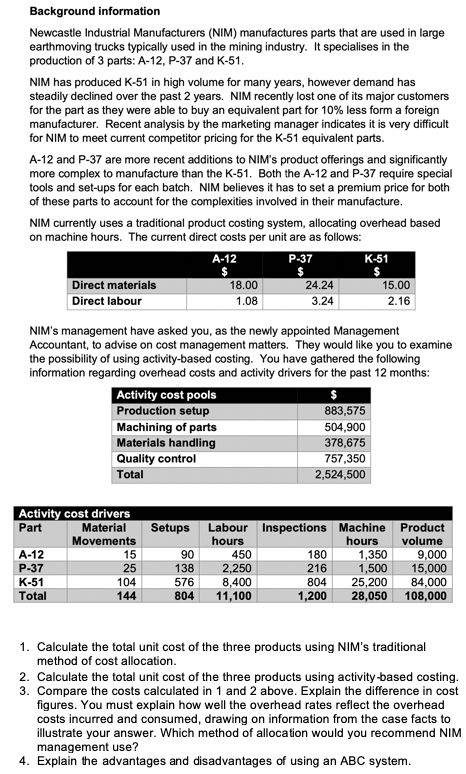

Background information Newcastle Industrial Manufacturers (NIM) manufactures parts that are used in large earthmoving trucks typically used in the mining industry. It specialises in the production of 3 parts: A-12, P-37 and K-51. NIM has produced K-51 in high volume for many years, however demand has steadily declined over the past 2 years. NIM recently lost one of its major customers for the part as they were able to buy an equivalent part for 10% less form a foreign manufacturer. Recent analysis by the marketing manager indicates it is very difficult for NIM to meet current competitor pricing for the K-51 equivalent parts A-12 and P-37 are more recent additions to NIM's product offerings and significantly more complex to manufacture than the K-51. Both the A-12 and P-37 require special tools and set-ups for each batch. NIM believes it has to set a premium price for both of these parts to account for the complexities involved in their manufacture. NIM currently uses a traditional product costing system, allocating overhead based on machine hours. The current direct costs per unit are as follows: A-12 K-51 P-37 Direct materials Direct labour 18.00 1.08 24.24 3.24 15.00 2.16 NIM's management have asked you, as the newly appointed Management Accountant, to advise on cost management matters. They would like you to examine the possibility of using activity-based costing. You have gathered the following information regarding overhead costs and activity drivers for the past 12 months: Activity cost pools Production setup 883,575 Machining of parts 504,900 Materials handling 378,675 Quality control 757,350 Total 2,524,500 Setups Activity cost drivers Part Material Movements A-12 15 P-37 25 K-51 104 Total 144 90 138 576 804 Labour Inspections Machine Product hours hours volume 450 180 1,350 9,000 2.250 216 1,500 15.000 8.400 804 25,200 84,000 11,100 1,200 28,050 108,000 1. Calculate the total unit cost of the three products using NIM's traditional method of cost allocation. 2. Calculate the total unit cost of the three products using activity-based costing. 3. Compare the costs calculated in 1 and 2 above. Explain the difference in cost figures. You must explain how well the overhead rates reflect the overhead costs incurred and consumed, drawing on information from the case facts to illustrate your answer. Which method of allocation would you recommend NIM management use? 4. Explain the advantages and disadvantages of using an ABC system