Answered step by step

Verified Expert Solution

Question

1 Approved Answer

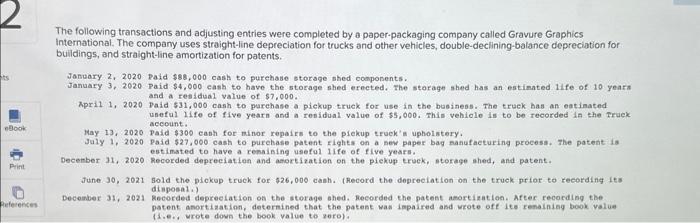

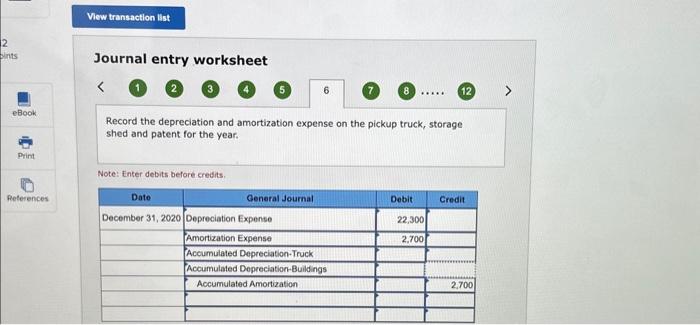

I just need help with these last two please ! (will thumbs up) Journal entry worksheet (1) 2 (3) 4 5 7 8 12 Record

I just need help with these last two please !

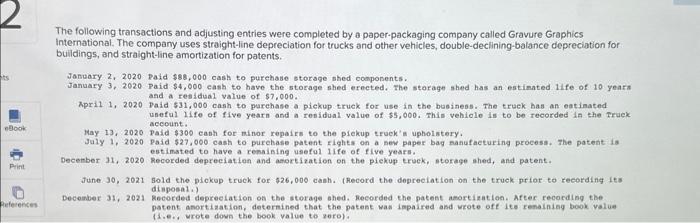

Journal entry worksheet (1) 2 (3) 4 5 7 8 12 Record the depreciation and amortization expense on the pickup truck, storage shed and patent for the year. Note: Enter debits before credits. The following transactions and adjusting entries were completed by a paper-packaging company called Gravure Graphics International. The company uses straight-line depreciation for trucks and other vehicles, double-declining-balance depreciation for bulildings, and straight-line amortization for patents. Jonuary 2,2020 paid $88,000 cash to purehase storsge shed conponents. January 3, 2020 Paid $4,000 cash to have the storage shed erected. The storage shed has an estimated 11 fe of 10 years and a restidul vatue of $7,000. Apri1 1, 2020 Daid $31,000 cash to parehase a pickup truek for use in the business. The truek bas an eatinated uneful iffe of five yearn and a renidual. value of $5,000. This vehicie is to be recorded ia the Fruek account. May 13, 2020 paid $300 eash for minor repairs to the piekup truek's upholntery. Jaly 1, 2020 paid $27,000 cash to purchase patent 5 ights on a pev paper bag nanufacturing procesa. The patent is estimsted to have a remaising usefol life of five yesrs. December 31, 2020 Recorded depreciation and anortization on the piekup truck, storage ahed, and patent. June 90,2021 sold the plekup truek for $26,000 canh. thecord the dopreciation on the truek prifor to recording its disposin) Decenber 31, 2021 Recorded depreciation on the storage ahed. Recorded the patent anortiration. After recording the patent anortization, deternined that the patent was impaired asd wrote oft ite renainiag book value (1.e.., wrote down the book value to zero) (will thumbs up)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started