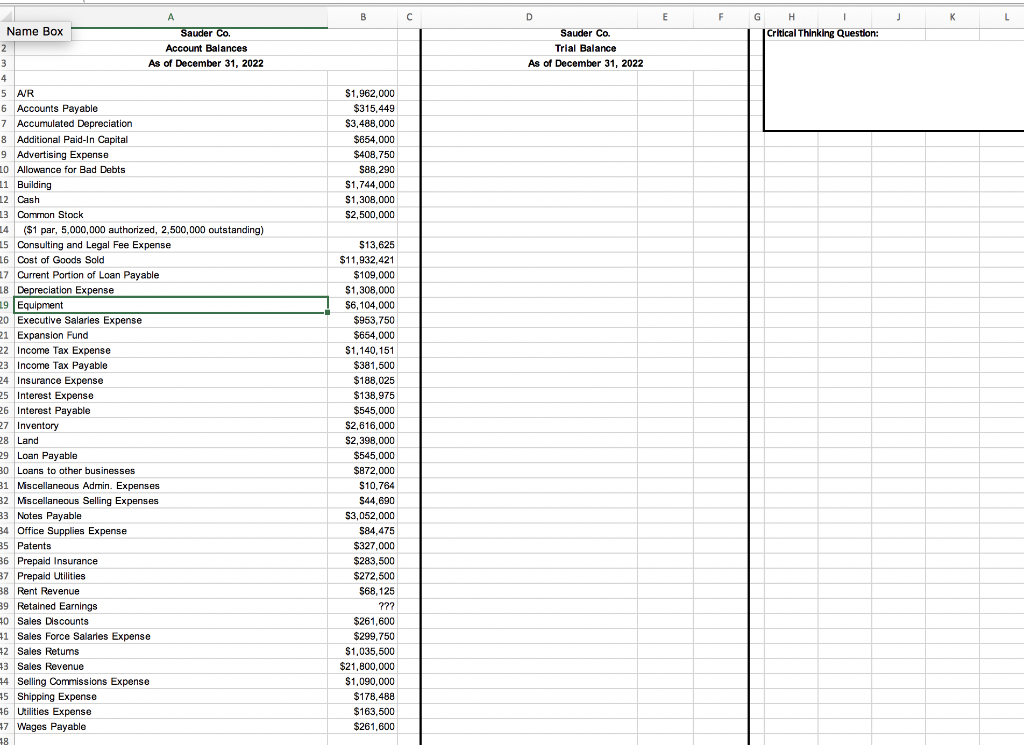

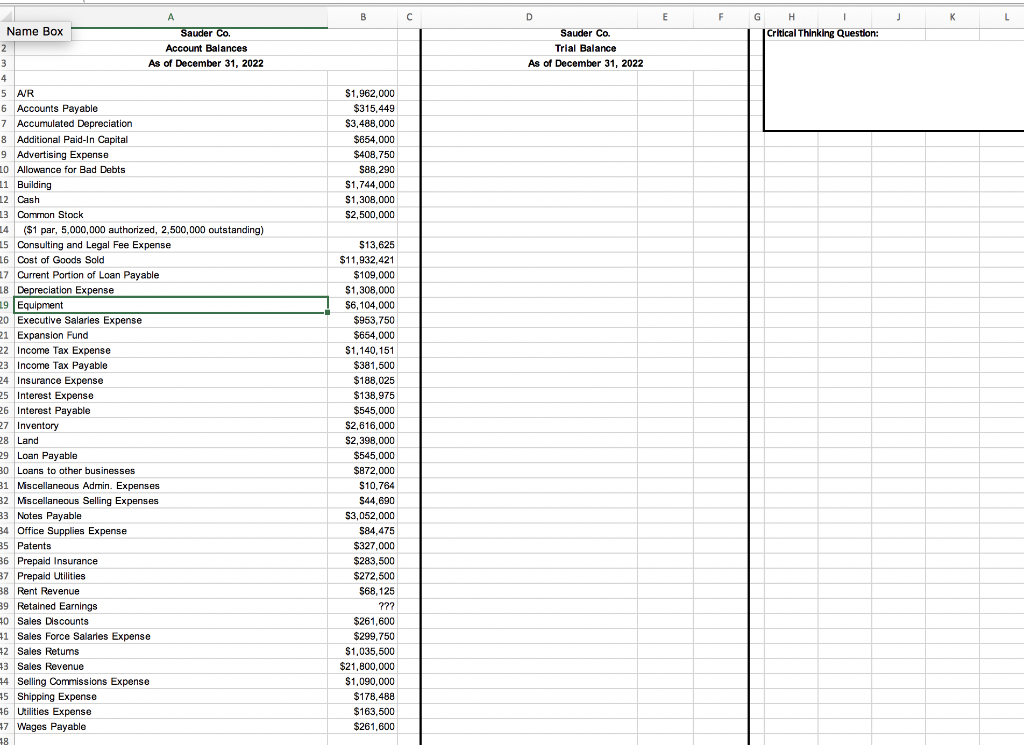

Background Information Sauder Co. sells backpacks, laptop bags, briefcases, and other bags. The bags are purchased already made, then the Sauder branding and finish is added. Because of several exclusive contracts and high quality products, the company has a strong following in its home state of Georgia and the surrounding area. In addition to its own brand, the company also has contracts with many colleges, firms, and local organizations to sell bags with these other groups' logos. This practice has greatly increased Sauder's sales, especially since the company is usually able to use lower quality inventory to fill these orders (this leads to lower costs for the other groups without damaging Sauder's reputation). Because of its success during the past two (2) years, Sauder was able to go public in January of last year. This has given the company additional capital to grow, as well as allowing the original owners to diversify some of their risk. Management's goal now is to begin marketing in the Northeast and Central regions of the country. If they are successful, they will continue on to the West Coast within a few years. Since much of their advertising is done through personal contacts and word of mouth, their growth will be slow. While that worries some of their new investors, recent economic trouble has left many investors pleased with the management team's more cautious growth. In their rush to go public, Sauder's management has forgotten one small detail. They have not created a very strong accounting department. While their auditors have been willing to help them clean up their books in the past, the managers are starting to realize that their lack of in-house accounting expertise is a problem. During the past year they engaged in several transactions and decisions that might have important repercussions on their financial statements, and they didn't know it. In an effort to start cleaning up their accounting system, they have finally hired you. Your first job will be to go through Sauder's decisions for the year and clean up any mistakes that have been made, and to record any transactions that have been missed. In the future, you will be expected to give management good advice about the accounting consequences of their actions before decisions are made. Based on recommendations from their auditor and SEC regulations, Sauder uses an accrual accounting system based on U.S. GAAP. The company's fiscal year end is December 31st. Since Sauder is a relatively small public company with an easy audit, the auditors don't usually arrive until about January 15 th. However, you are expected to have the financial statements ready to go by January 1st so that upper management can issue an earnings announcement to the stockholders. Although an earnings announcement is known to be unaudited, investors are traditionally very harsh with companies that have a final earnings number below the initial earnings announcement. You will need to be as accurate as possible in order to avoid this type of market consequence. Sauder has already completed most of the necessary transactions for the current year (see below). However, they have neglected to include several key pieces of information. Throughout the semester, you will be adding and incorporating this additional information to complete the company's financial report. Sauder's tax rate is 30%. Information: You will find an Excel file with a list of Sauder's accounts on our course website. The list is from the company's accounting system and includes the ending balance for all of the company's accounts. However, a glitch in the program has provided you with only an alphabetical list and put all of the balance information into one column (no debits or credits are shown). The good news is that Sauder has a relatively simple accounting system at this point, and all of its accounts have their traditional balances. In other words, all of the assets have debit balances, the liabilities have credit balances, etc. The one account that doesn't yet have an ending balance is Retained Earnings. However, the balance in that account at the beginning of 2021 was $3,985,500. Assignment: Calculations 1. Sort the accounts into their proper order for a Trial Balance: Assets, Liabilities, Equity, Revenues, Expenses, Gains and Losses. 2. Create Sauder's Trial Balance for 2021. Critical Thinking 3. What value did you use for retained earnings in your trial balance? Explain how you determined that value and why it is correct under U.S. GAAP