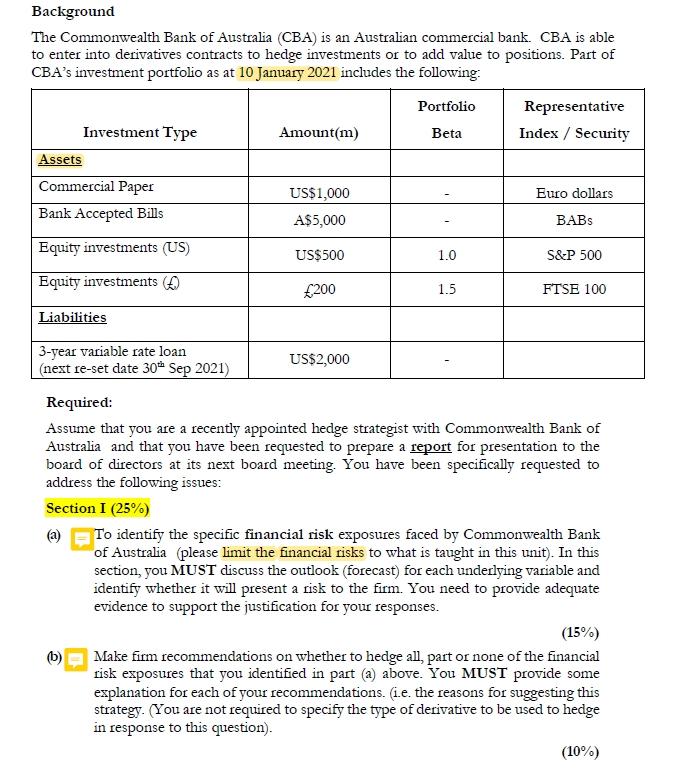

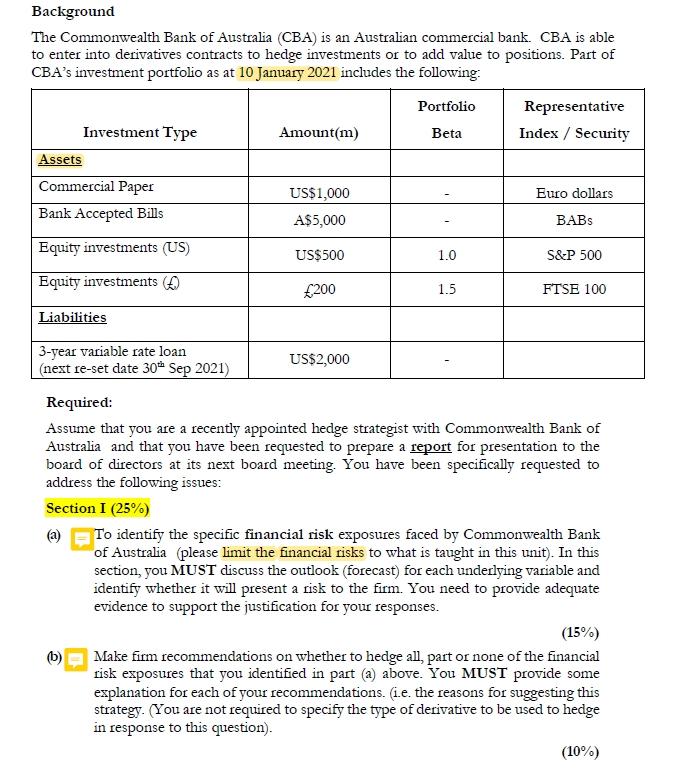

Background The Commonwealth Bank of Australia (CBA) is an Australian commercial bank. CBA is able to enter into derivatives contracts to hedge investments or to add value to positions. Part of CBA's investment portfolio as at 10 January 2021 includes the following: Portfolio Representative Investment Type Amount(m) Beta Index / Security Assets Commercial Paper US$1,000 Euro dollars Bank Accepted Bills A$5,000 BABS Equity investments (US) US$500 1.0 S&P 500 Equity investments 200 1.5 FTSE 100 Liabilities 3-year variable rate loan (next re-set date 30 Sep 2021) US$2,000 Required: Assume that you are a recently appointed hedge strategist with Commonwealth Bank of Australia and that you have been requested to prepare a report for presentation to the board of directors at its next board meeting. You have been specifically requested to address the following issues: Section I (25%) a) To identify the specific financial risk exposures faced by Commonwealth Bank of Australia please limit the financial risks to what is taught in this unit). In this section, you MUST discuss the outlook (forecast) for each underlying variable and identify whether it will present a risk to the firm. You need to provide adequate evidence to support the justification for your responses. (15%) Make firm recommendations on whether to hedge all, part or none of the financial risk exposures that you identified in part (a) above. You MUST provide some explanation for each of your recommendations. (i.e. the reasons for suggesting this strategy. (You are not required to specify the type of decivative to be used to hedge in response to this question). (10%) Background The Commonwealth Bank of Australia (CBA) is an Australian commercial bank. CBA is able to enter into derivatives contracts to hedge investments or to add value to positions. Part of CBA's investment portfolio as at 10 January 2021 includes the following: Portfolio Representative Investment Type Amount(m) Beta Index / Security Assets Commercial Paper US$1,000 Euro dollars Bank Accepted Bills A$5,000 BABS Equity investments (US) US$500 1.0 S&P 500 Equity investments 200 1.5 FTSE 100 Liabilities 3-year variable rate loan (next re-set date 30 Sep 2021) US$2,000 Required: Assume that you are a recently appointed hedge strategist with Commonwealth Bank of Australia and that you have been requested to prepare a report for presentation to the board of directors at its next board meeting. You have been specifically requested to address the following issues: Section I (25%) a) To identify the specific financial risk exposures faced by Commonwealth Bank of Australia please limit the financial risks to what is taught in this unit). In this section, you MUST discuss the outlook (forecast) for each underlying variable and identify whether it will present a risk to the firm. You need to provide adequate evidence to support the justification for your responses. (15%) Make firm recommendations on whether to hedge all, part or none of the financial risk exposures that you identified in part (a) above. You MUST provide some explanation for each of your recommendations. (i.e. the reasons for suggesting this strategy. (You are not required to specify the type of decivative to be used to hedge in response to this question). (10%)