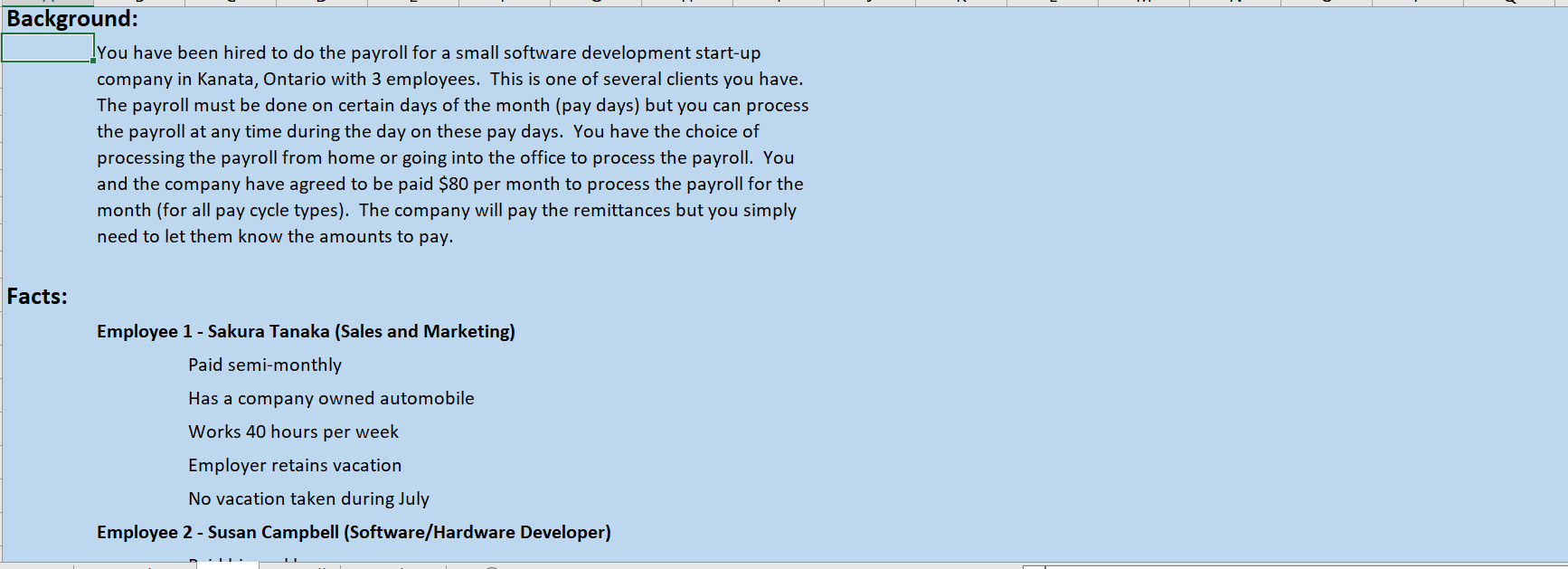

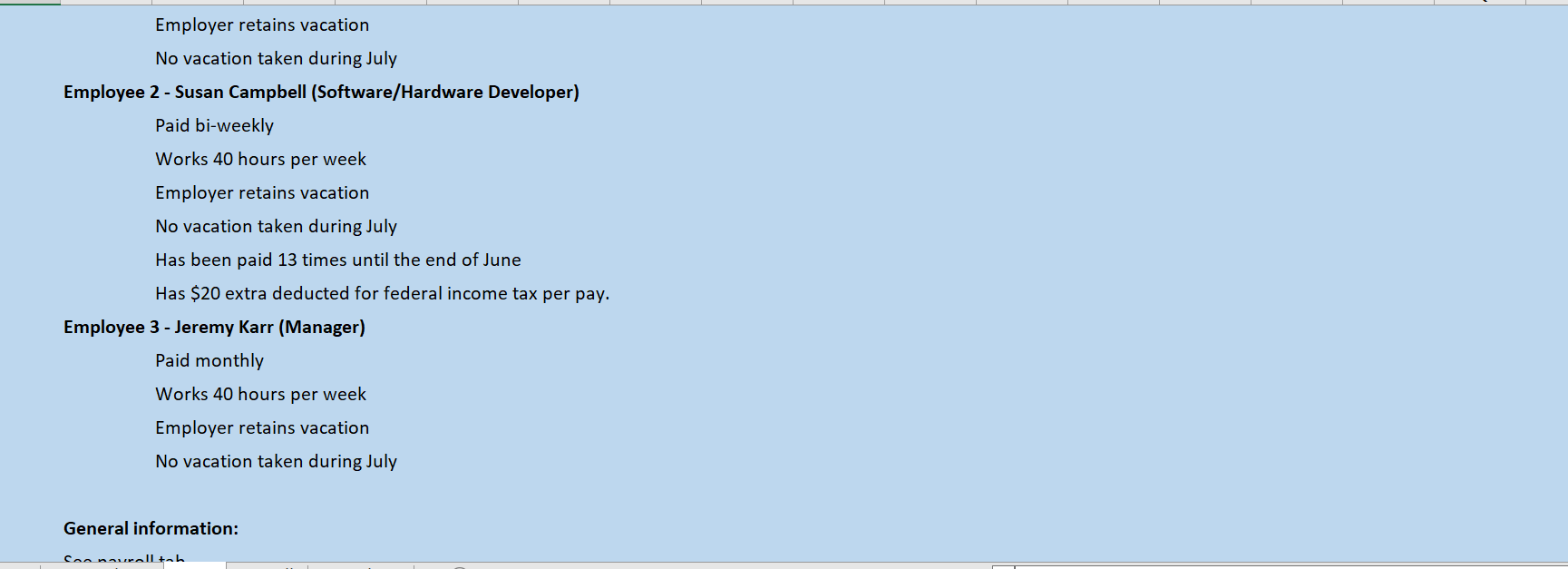

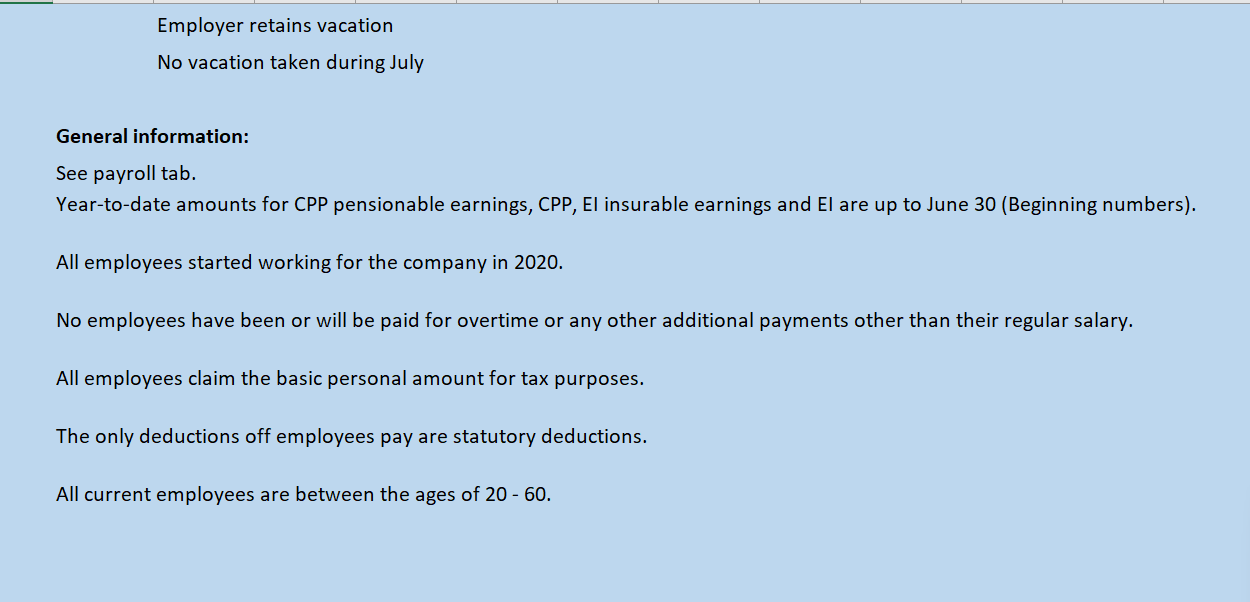

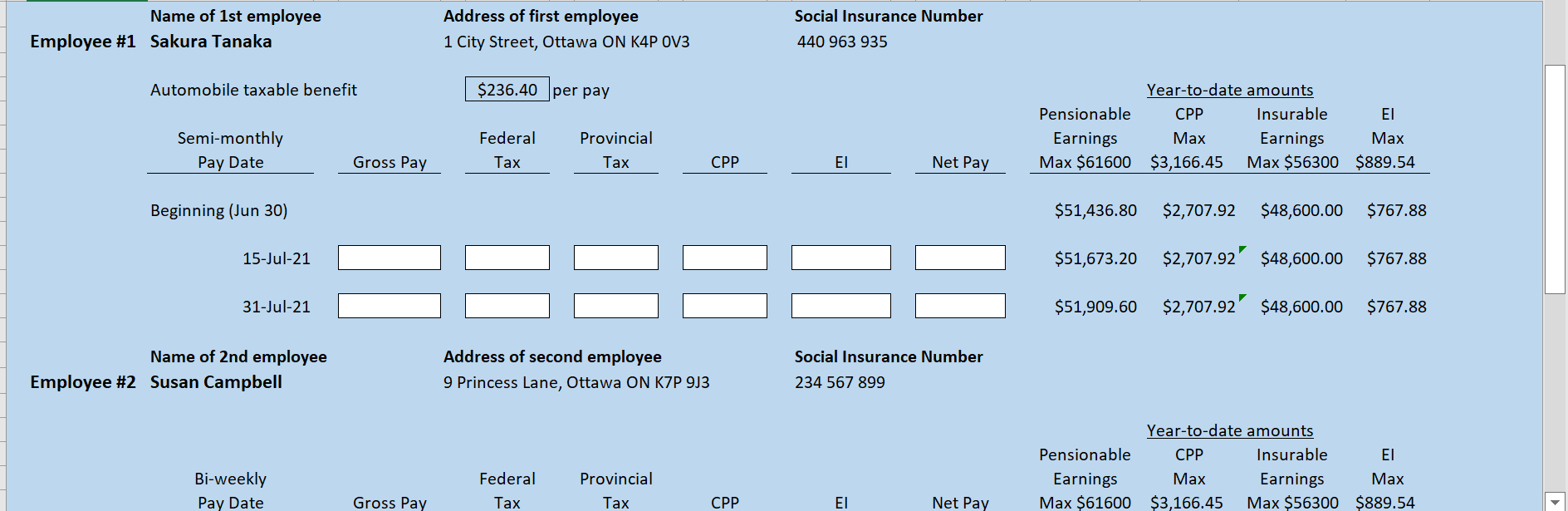

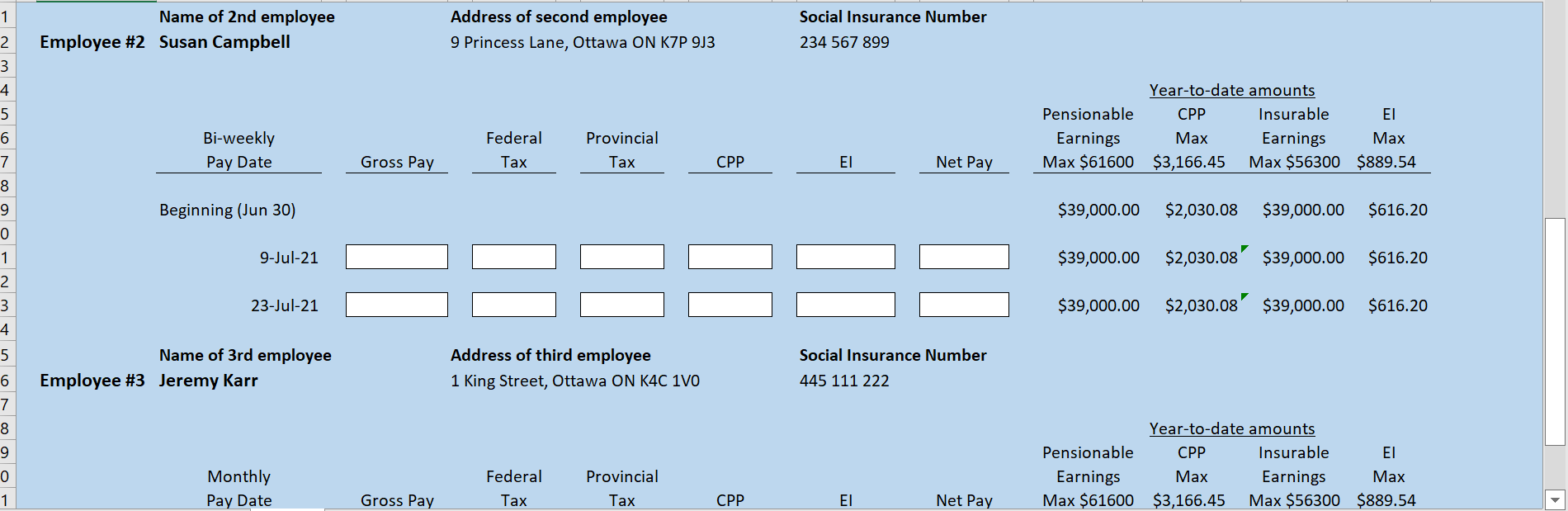

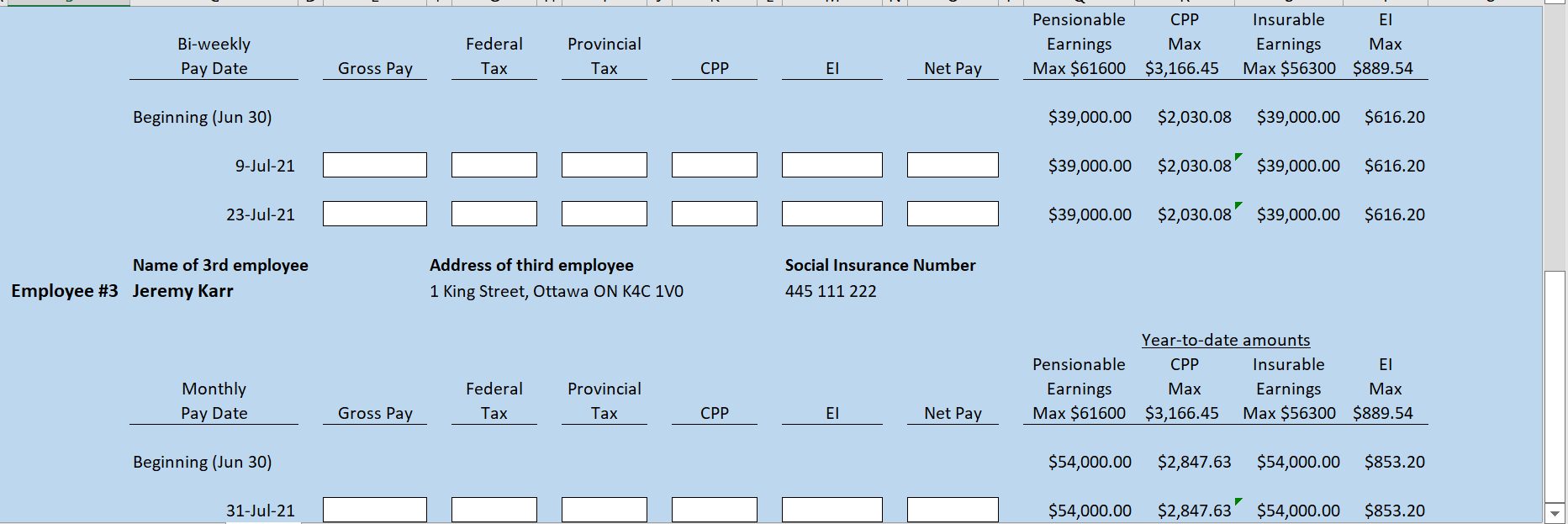

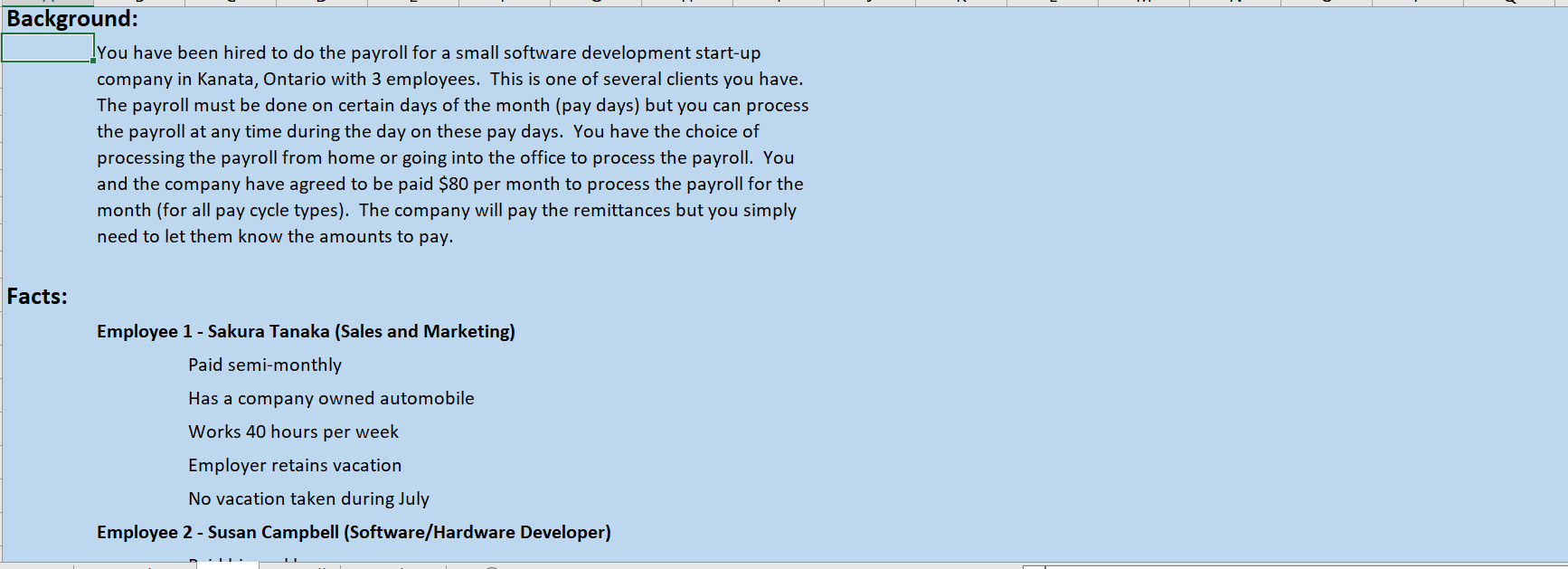

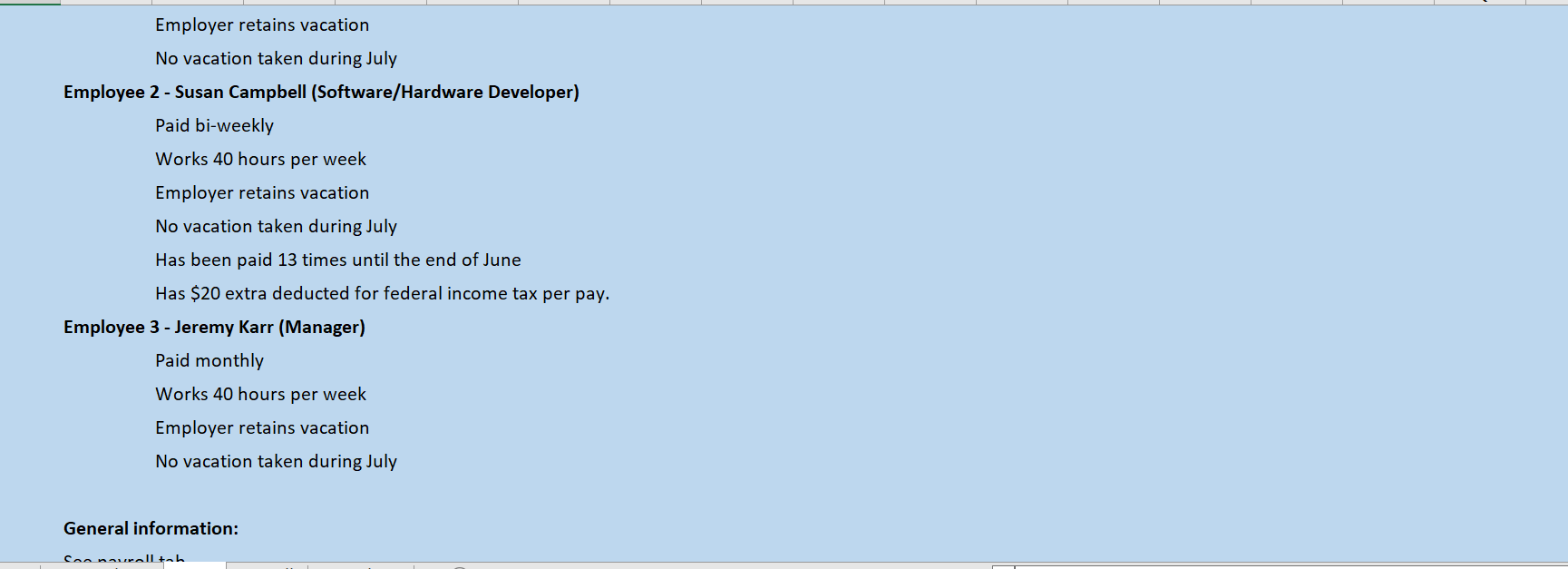

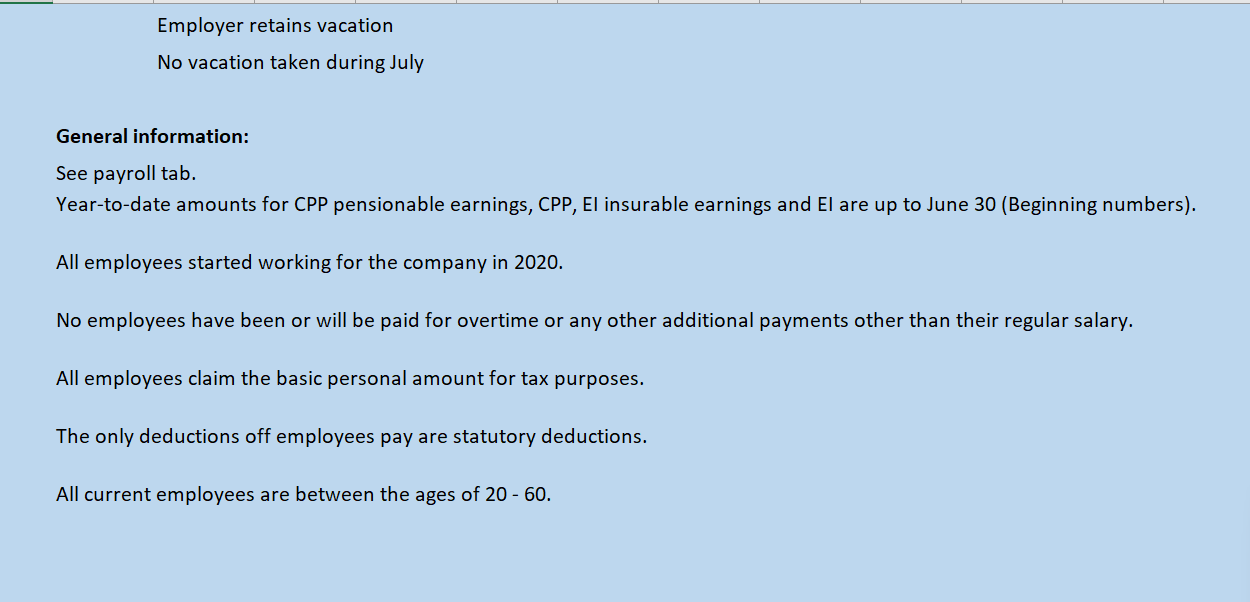

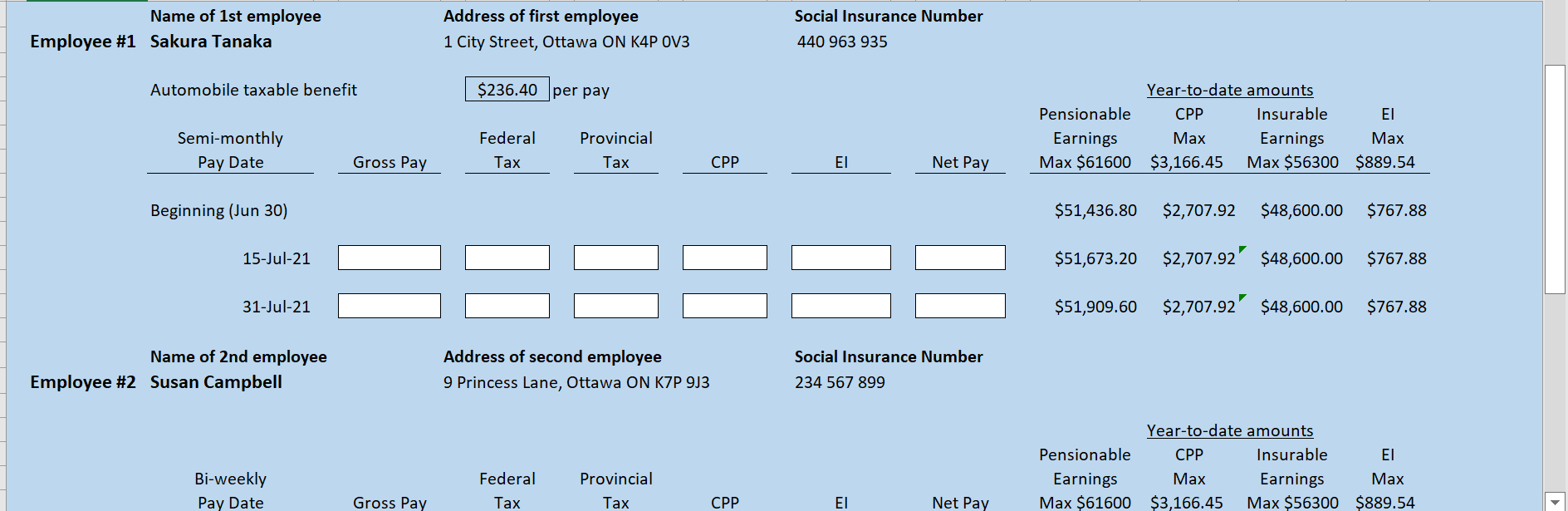

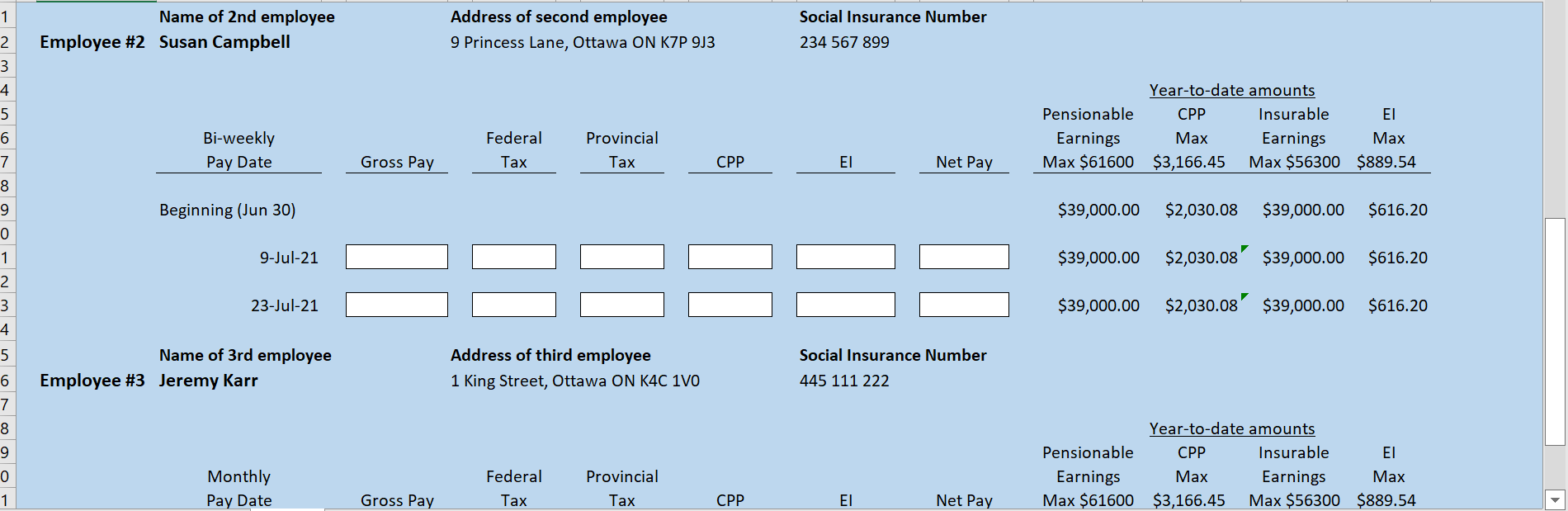

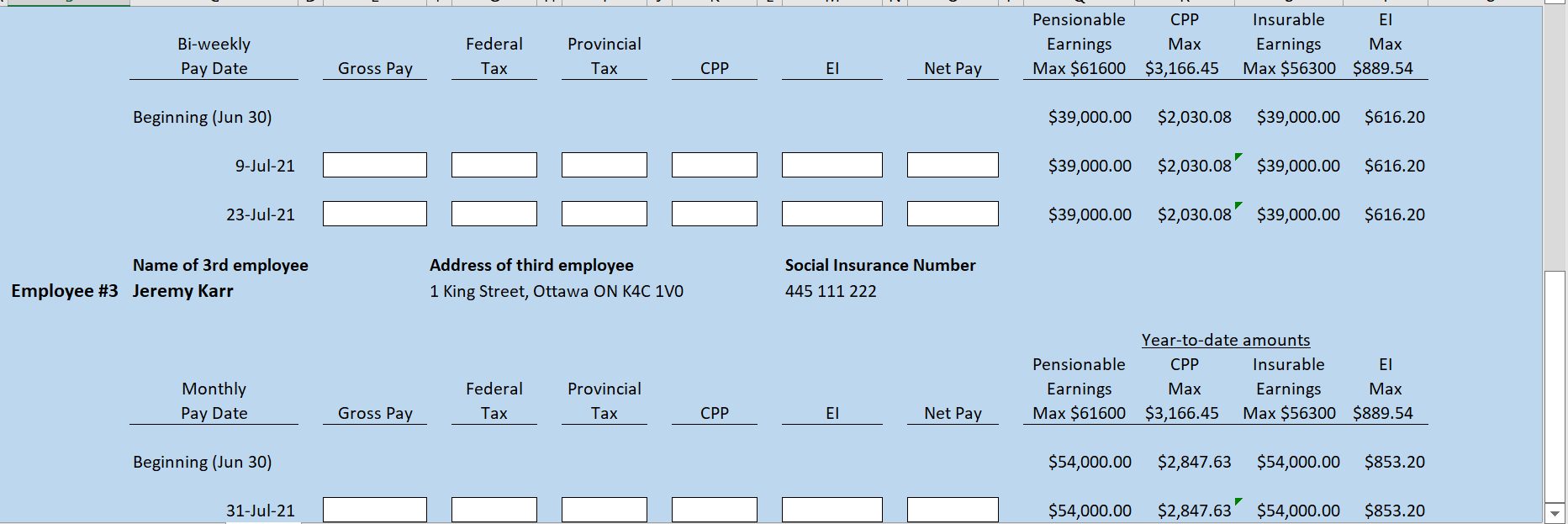

Background: . You have been hired to do the payroll for a small software development start-up company in Kanata, Ontario with 3 employees. This is one of several clients you have. The payroll must be done on certain days of the month (pay days) but you can process the payroll at any time during the day on these pay days. You have the choice of processing the payroll from home or going into the office to process the payroll. You and the company have agreed to be paid $80 per month to process the payroll for the month (for all pay cycle types). The company will pay the remittances but you simply need to let them know the amounts to pay. Facts: Employee 1 - Sakura Tanaka (Sales and Marketing) Paid semi-monthly Has a company owned automobile Works 40 hours per week Employer retains vacation No vacation taken during July Employee 2 - Susan Campbell (Software/Hardware Developer) Employer retains vacation No vacation taken during July Employee 2 - Susan Campbell (Software/Hardware Developer) Paid bi-weekly Works 40 hours per week Employer retains vacation No vacation taken during July Has been paid 13 times until the end of June Has $20 extra deducted for federal income tax per pay. Employee 3 - Jeremy Karr (Manager) Paid monthly Works 40 hours per week Employer retains vacation No vacation taken during July General information: Coonourallah Employer retains vacation No vacation taken during July General information: See payroll tab. Year-to-date amounts for CPP pensionable earnings, CPP, El insurable earnings and El are up to June 30 (Beginning numbers). All employees started working for the company in 2020. No employees have been or will be paid for overtime or any other additional payments other than their regular salary. All employees claim the basic personal amount for tax purposes. The only deductions off employees pay are statutory deductions. All current employees are between the ages of 20 - 60. Name of 1st employee Employee #1 Sakura Tanaka Address of first employee 1 City Street, Ottawa ON K4P OV3 Social Insurance Number 440 963 935 Automobile taxable benefit $236.40 per pay Year-to-date amounts CPP Insurable Max Earnings Max $3,166.45 Max $56300 $889.54 Semi-monthly Pay Date Federal Tax Pensionable Earnings Max $61600 Provincial Tax Gross Pay CPP Net Pay Beginning (Jun 30) $51,436.80 $2,707.92 $48,600.00 $767.88 15-Jul-21 $51,673.20 $2,707.92' $48,600.00 $767.88 31-Jul-21 $51,909.60 $2,707.92' $48,600.00 $767.88 Social Insurance Number Name of 2nd employee Employee #2 Susan Campbell Address of second employee 9 Princess Lane, Ottawa ON K7P 933 234 567 899 Year-to-date amounts CPP Insurable Max Earnings Max $3,166.45 Max $56300 $889.54 Bi-weekly Pay Date Federal Tax Pensionable Earnings Max $61600 Provincial Tax Gross Pay CPP EI Net Pay 1 Name of 2nd employee Employee #2 Susan Campbell Address of second employee 9 Princess Lane, Ottawa ON KZP 9J3 Social Insurance Number 234 567 899 2 3 4 Federal 5 6 7 8 Bi-weekly Pay Date Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 Provincial Tax Gross Pay Tax CPP Net Pay 9 Beginning (Jun 30) $39,000.00 $2,030.08 $39,000.00 $616.20 0 9-Jul-21 $39,000.00 $2,030.08' $39,000.00 $616.20 1 2 3 23-Jul-21 $39,000.00 $2,030.08' $39,000.00 $616.20 4 5 Social Insurance Number Name of 3rd employee Employee #3 Jeremy Karr Address of third employee 1 King Street, Ottawa ON K4C 1VO 6 445 111 222 7 8 9 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 0 Monthly Pay Date Federal Tax Provincial Tax 1 Gross Pay CPP Net Pay Bi-weekly Pay Date Federal Tax Provincial Tax Pensionable CPP Earnings Max Max $61600 $3,166.45 Insurable Earnings Max Max $56300 $889.54 Gross Pay CPP Net Pay Beginning (Jun 30) $39,000.00 $2,030.08 $39,000.00 $616.20 9-Jul-21 $39,000.00 $2,030.08 $39,000.00 $616.20 23-Jul-21 $39,000.00 $2,030.08' $39,000.00 $616.20 Social Insurance Number Name of 3rd employee Employee #3 Jeremy Karr Address of third employee 1 King Street, Ottawa ON K4C 170 445 111 222 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 Monthly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Beginning (Jun 30) $54,000.00 $2,847.63 $54,000.00 $853.20 31-Jul-21 $54,000.00 $2,847.63 $54,000.00 $853.20