Answered step by step

Verified Expert Solution

Question

1 Approved Answer

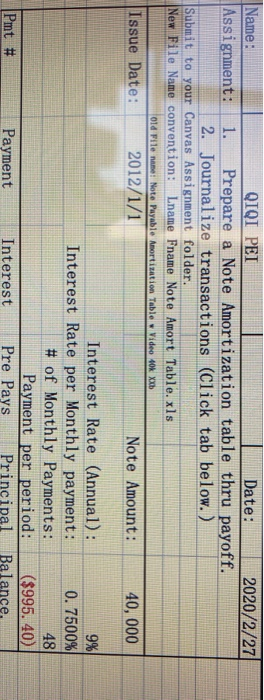

bagin from the second picture Name: QIQI PEI Date: 2020/2/27 Assignment: 1. Prepare a Note Amortization table thru payoff. 2. Journalize transactions (Click tab below.)

bagin from the second picture

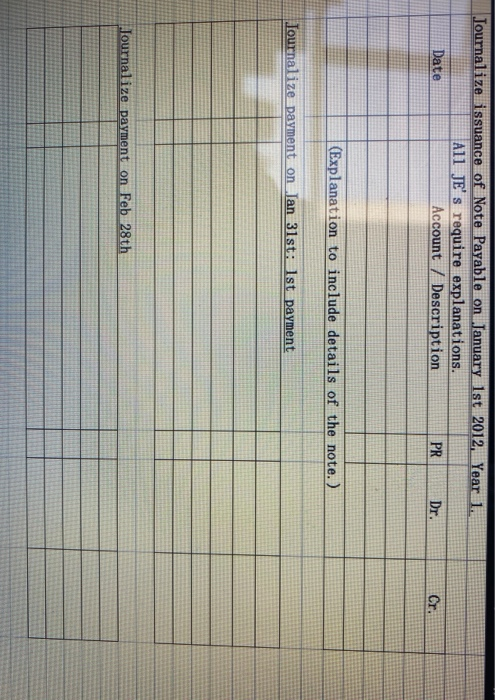

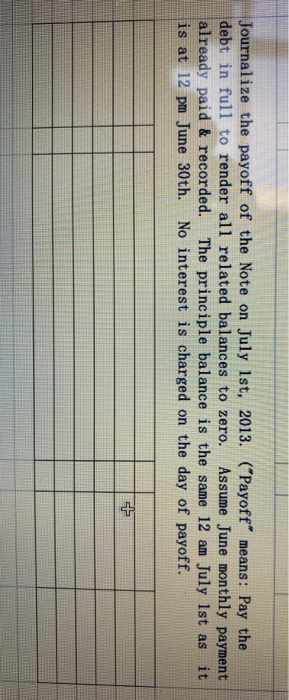

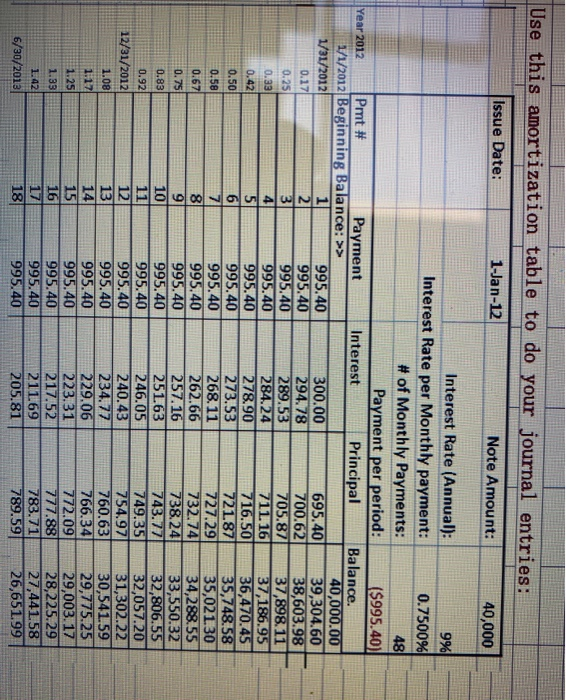

Name: QIQI PEI Date: 2020/2/27 Assignment: 1. Prepare a Note Amortization table thru payoff. 2. Journalize transactions (Click tab below.) Submit to your Canvas Assignment folder. New File Name convention: Lname Fname Note Amort Table.xls 010 File name: Note Payable Amortization Table Video 10kXxb Issue Date: 2012/1/1 Note Amount: 40,000 Interest Rate (Annual): Interest Rate per Monthly payment: 0.7500% # of Monthly Payments: 48 Payment per period: ($995. 40) Interest Pre Pays Principal Balance Pmt # Payment Journalize issuance of Note Payable on January 1st 2012, Year 1. A11 JE's require explanations. Date Account / Description |(Explanation to include details of the note.) Journalize payment on Jan 31st: Ist payment Journalize payment on Feb 28th Journalize the payoff of the Note on July 1st, 2013. ("Payoff" means: Pay the debt in full to render all related balances to zero. Assume June monthly payment already paid & recorded. The principle balance is the same 12 am July 1st as it is at 12 pm June 30th. No interest is charged on the day of payoff. Use this amortization table to do your journal entries: Issue Date: 1-Jan-12 Note Amount: 40,000 Interest Rate (Annual): 9% Interest Rate per Monthly payment: 0.7500% # of Monthly Payments: Payment per period: ($995.40) Year 2012 Pmt # Payment Interest Principal Balance. 1/1/2012 Beginning Balance: >> 40,000.00 1/31/2012 995.40 300.00 695.40 39,304.60 0.17 995.40 294.78 700.62 38,603.98 0.25 995.40 289.53 705.87 37,898.11 995.40 284.24 711.16 37,186.95 995.40 278.90 716.50 36,470.45 995.40 273.53 721.87 35,748.58 995.40 268.11 727.29 35,021.30 995.40 262.66 732.74 34,288.55 995.40 257.16 738.24 33,550.32 995.40 251.63 1743.77 32,806.55 0.92 995.40 246.05 749.35 32,057.20 12/31/2012 995.40 240.43 754.97 31,302.22 995.40 234.77 760.63 30,541.59 995.40 229.06 766.34| 29,775.25 995.40 223.31 772.09| 29,003.17 995.40 217.52 777.88 28,225.29 995.40 211.69 1783.71 27,44158 6/30/2013 995.40 205.81 789.5926,651.99 50 EESUREGULUN 1.08 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started