Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute for the companys Free Cash flow company: Bahrain Islamic Bank Provide the interpretation of the computed free cash flow. (5 marks) Compute for the

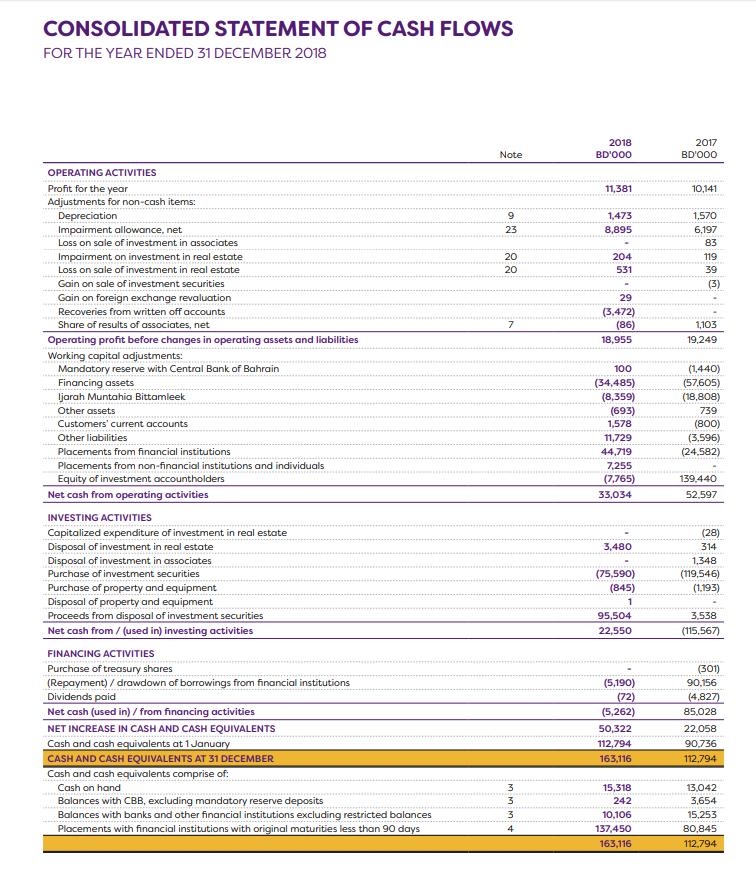

- Compute for the company’s Free Cash flow

company: Bahrain Islamic Bank

company: Bahrain Islamic Bank

- Provide the interpretation of the computed free cash flow. (5 marks)

- Compute for the following Financial Ratio; (for every ratio, 2 marks for correct process 1 mark for the correct answer)

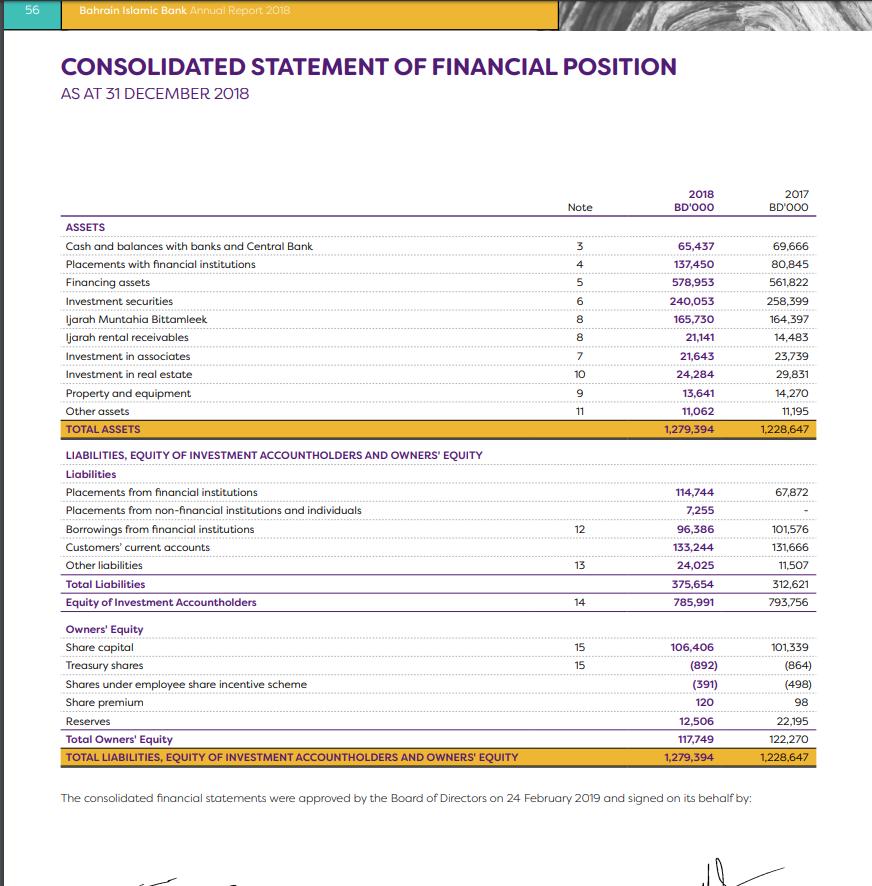

- Current Ratio

- Quick Ratio

- Average Collection Period

- Debt Ratio

- Net Profit Margin

- Earnings per share

- Return on Total Asset

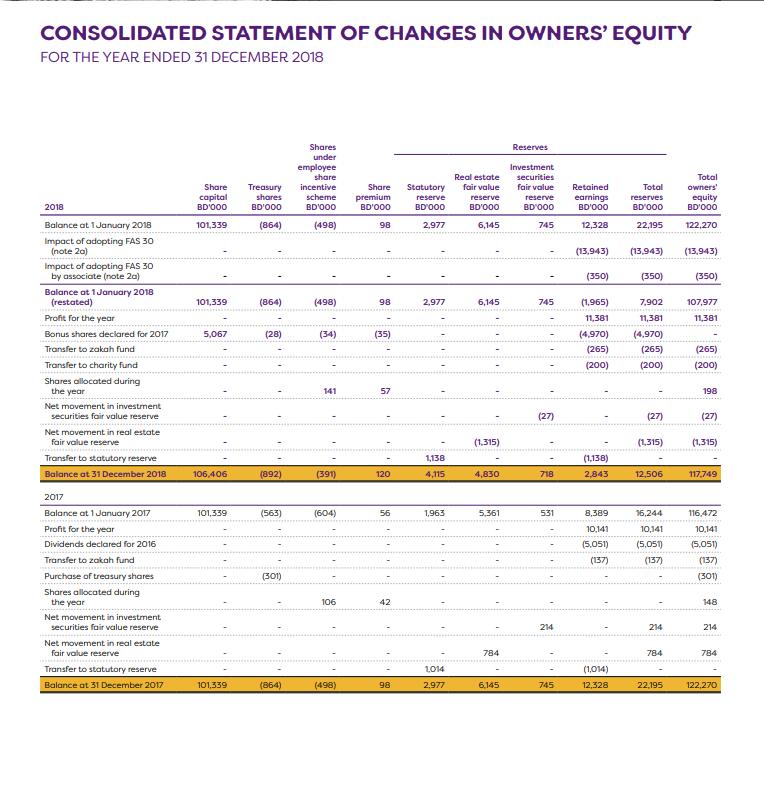

- Return on Equity

- Price Earnings Ratio

- Book Value per share

- Provide the general interpretation of the computed financial Ratios

- Explain how the computed financial ratio may help the financial manager to achieve the goal of financial management.

- Considering your company’s debt ratio, discuss how they should utilize bank and equity financing for the next period.

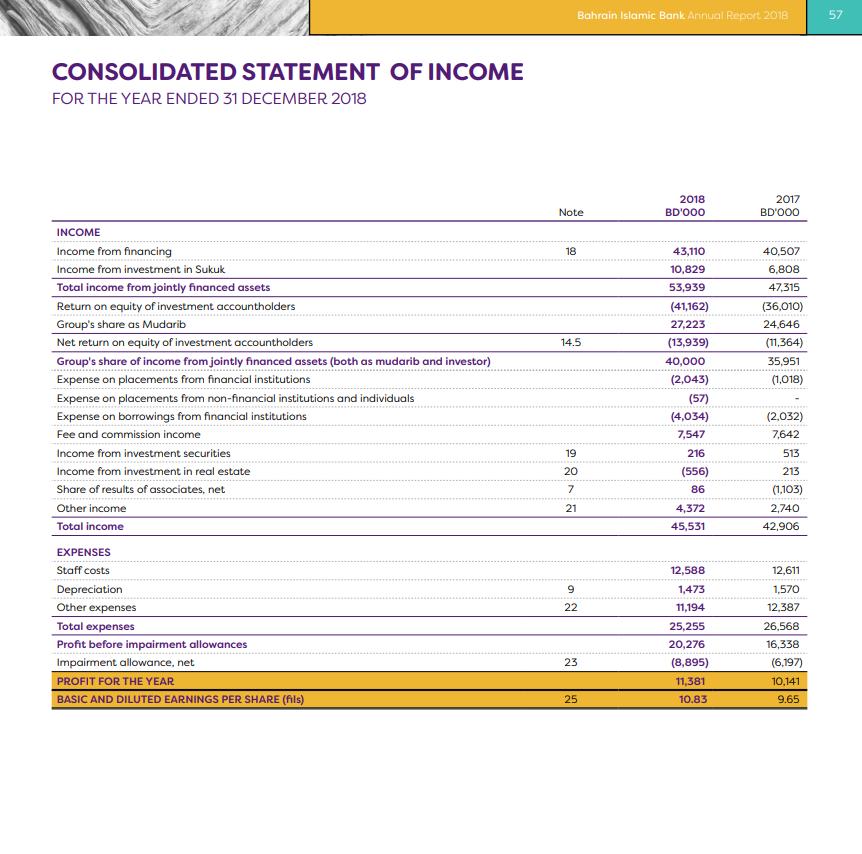

Bahrain Islamic Bank Arinual Report 2018 57 CONSOLIDATED STATEMENT OF INCOME FOR THE YEAR ENDED 31 DECEMBER 2018 2018 2017 Note BD'000 BD'O00 INCOME Income from financing 18 43,110 40,507 Income from investment in Sukuk 10,829 6,808 Total income from jointly financed assets 53,939 47,315 Return on equity of investment accountholders (41,162) (36,010) Group's share as Mudarib 27,223 24,646 Net return on equity of investment accountholders Group's share of income from jointly financed assets (both as mudarib and investor) Expense on placements from financial institutions 14.5 (13,939) (11,364) 40,000 35,951 (2,043) (1,018) Expense on placements from non-financial institutions and individuals (57) Expense on borrowings from financial institutions (4,034) (2.032) Fee and commission income 7,547 7,642 Income from investment securities 19 216 513 Income from investment in real estate 20 (556) 213 Share of results of associates, net Other income Total income 7 86 (1,103) 21 4,372 2,740 45,531 42,906 EXPENSES Staff costs 12,588 12,611 Depreciation 9. 1,473 1,570 Other expenses 22 11,194 12,387 Total expenses 25,255 26,568 Profit before impairment allowances 20,276 16,338 Impairment allowance, net 23 (8,895) (6,197) PROFIT FOR THE YEAR 11,381 10,141 BASIC AND DILUTED EARNINGS PER SHARE (fils) 25 10,83 9.65

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started