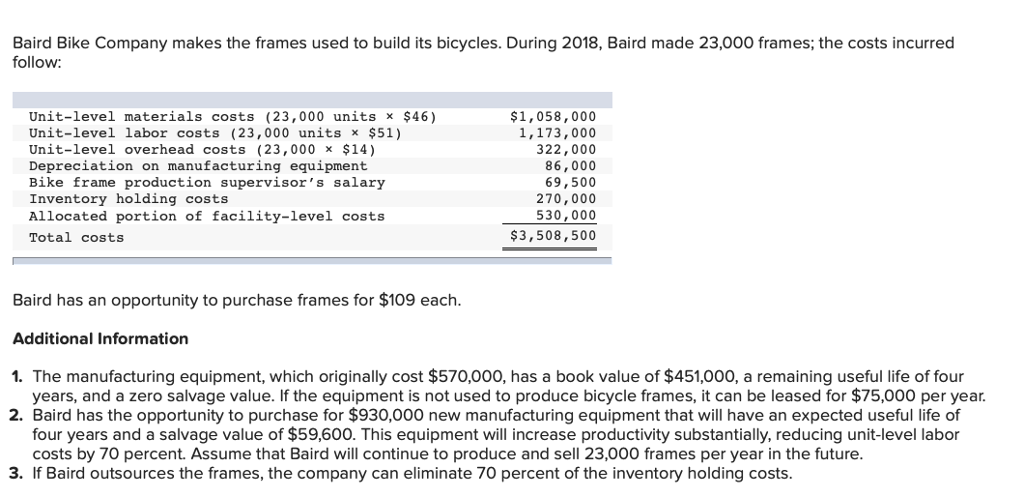

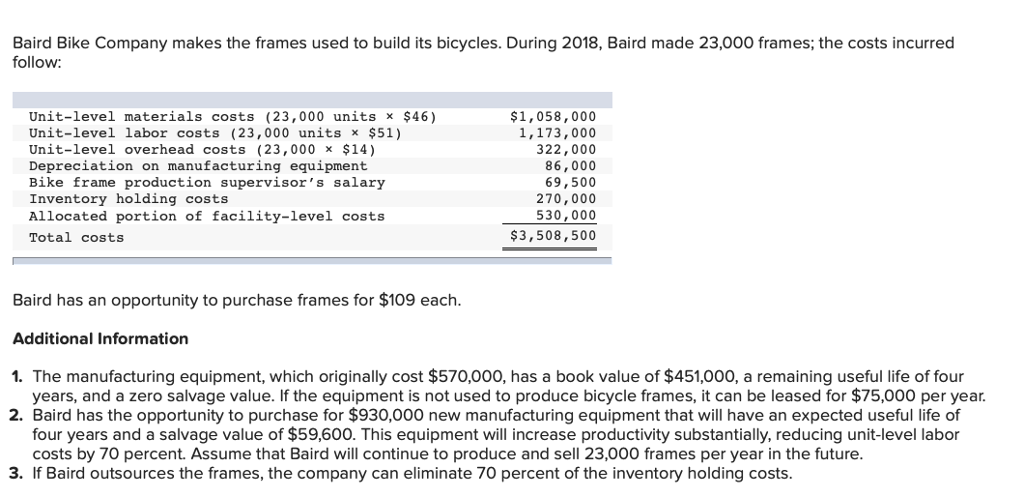

Baird Bike Company makes the frames used to build its bicycles. During 2018, Baird made 23,000 frames; the costs incurred follow: Unit-level materials costs (23,000 units x $46) Unit-level labor costs (23,000 units x $51) Unit-level overhead costs (23,000 x $14 Depreciation on manufacturing equipment Bike frame production supervisor ' s salary Inventory holding costs Allocated portion of facility-level costs Total costs $1,058,000 1,173,000 322,000 86,000 69,500 270,000 530,000 $3,508,500 Baird has an opportunity to purchase frames for $109 each Additional Information 1. The manufacturing equipment, which originally cost $570,000, has a book value of $451,000, a remaining useful life of four years, and a zero salvage value. If the equipment is not used to produce bicycle frames, it can be leased for $75,000 per year. 2. Baird has the opportunity to purchase for $930,000 new manufacturing equipment that will have an expected useful life of four years and a salvage value of $59,600. This equipment will increase productivity substantially, reducing unit-level labor costs by 70 percent. Assume that Baird will continue to produce and sell 23,000 frames per year in the future 3. If Baird outsources the frames, the company can eliminate 70 percent of the inventory holding costs Baird Bike Company makes the frames used to build its bicycles. During 2018, Baird made 23,000 frames; the costs incurred follow: Unit-level materials costs (23,000 units x $46) Unit-level labor costs (23,000 units x $51) Unit-level overhead costs (23,000 x $14 Depreciation on manufacturing equipment Bike frame production supervisor ' s salary Inventory holding costs Allocated portion of facility-level costs Total costs $1,058,000 1,173,000 322,000 86,000 69,500 270,000 530,000 $3,508,500 Baird has an opportunity to purchase frames for $109 each Additional Information 1. The manufacturing equipment, which originally cost $570,000, has a book value of $451,000, a remaining useful life of four years, and a zero salvage value. If the equipment is not used to produce bicycle frames, it can be leased for $75,000 per year. 2. Baird has the opportunity to purchase for $930,000 new manufacturing equipment that will have an expected useful life of four years and a salvage value of $59,600. This equipment will increase productivity substantially, reducing unit-level labor costs by 70 percent. Assume that Baird will continue to produce and sell 23,000 frames per year in the future 3. If Baird outsources the frames, the company can eliminate 70 percent of the inventory holding costs