Answered step by step

Verified Expert Solution

Question

1 Approved Answer

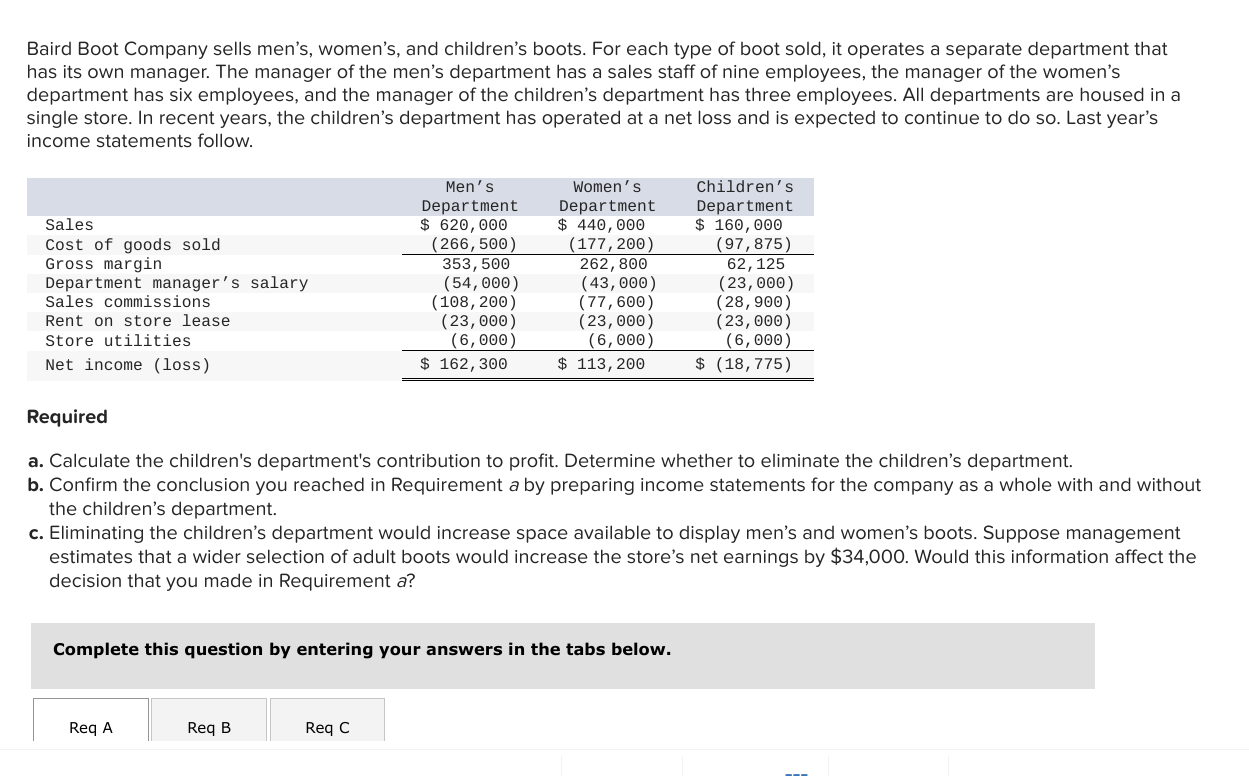

Baird Boot Company sells men's, women's, and children's boots. For each type of boot sold, it operates a separate department that has its own manager.

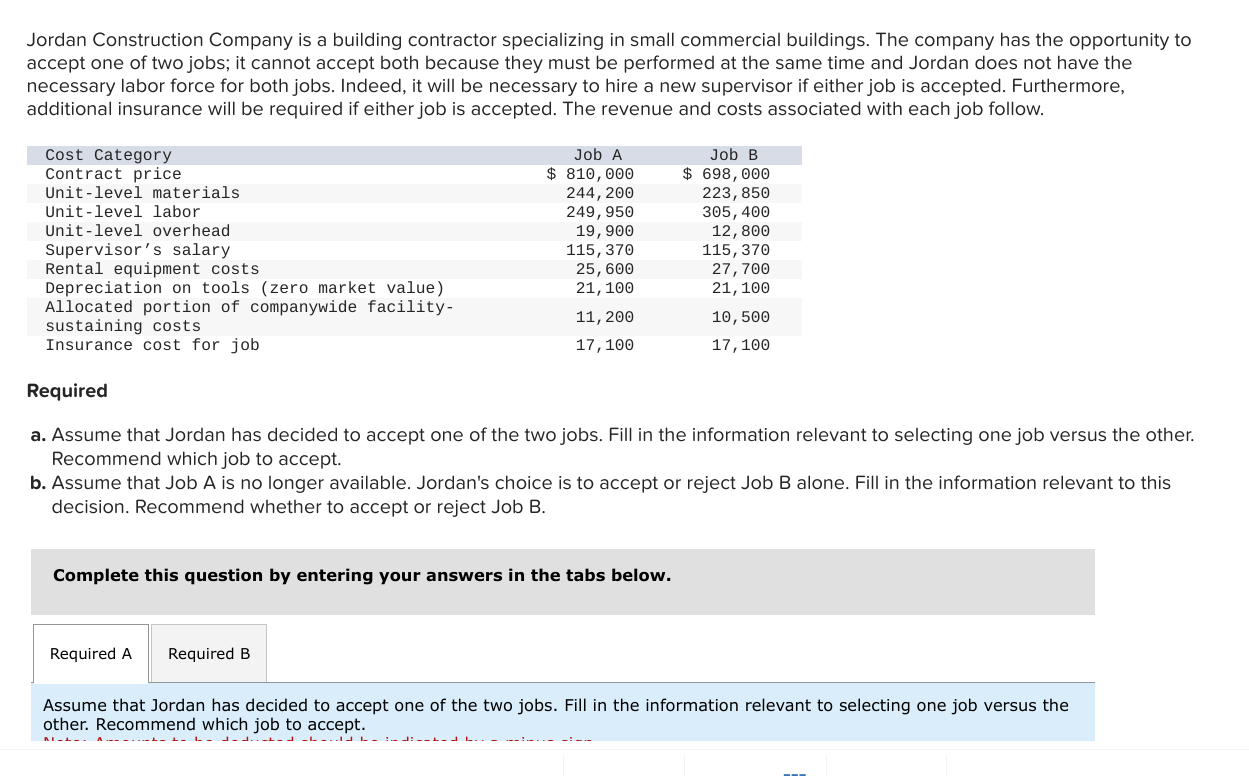

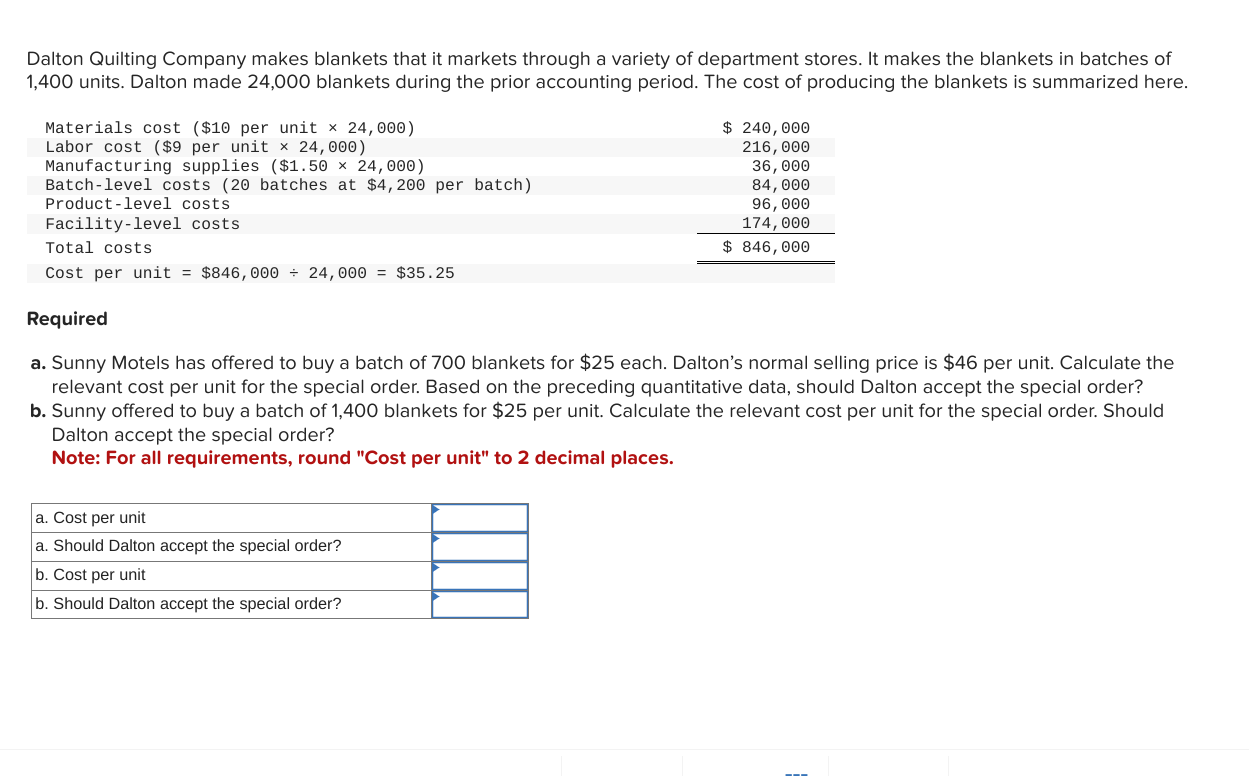

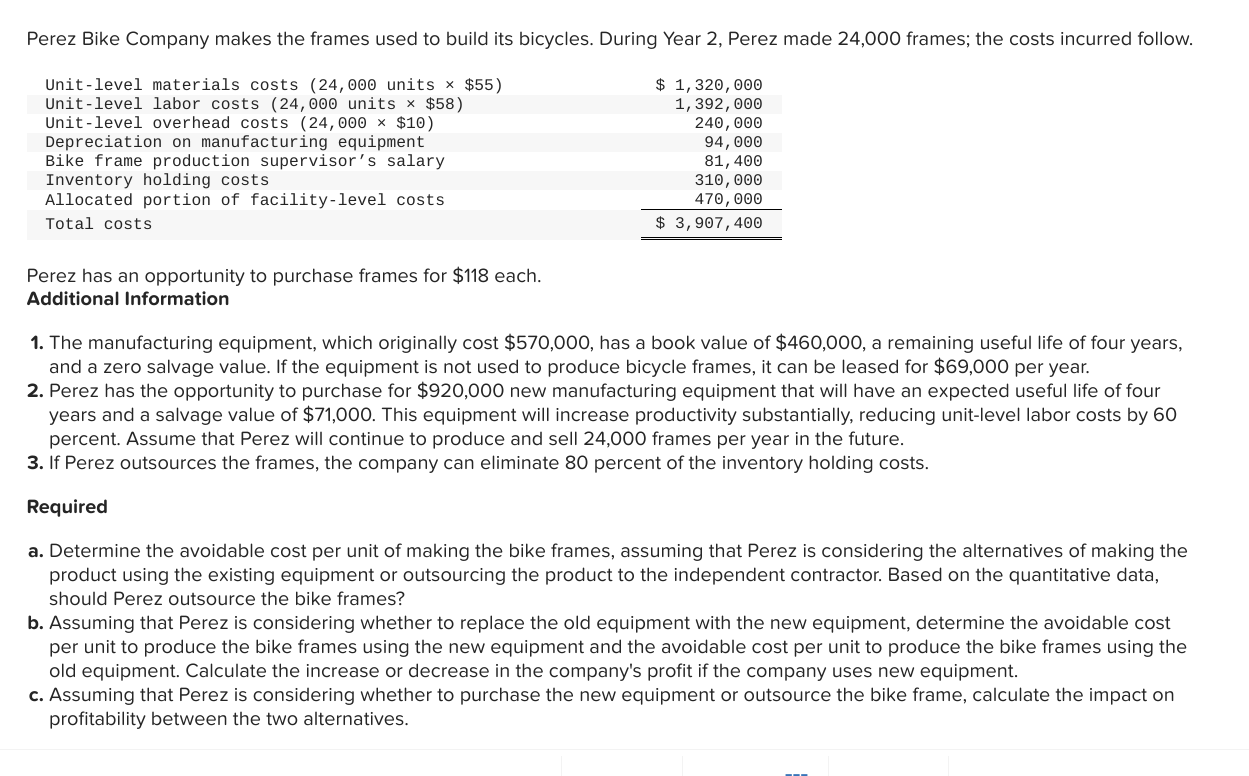

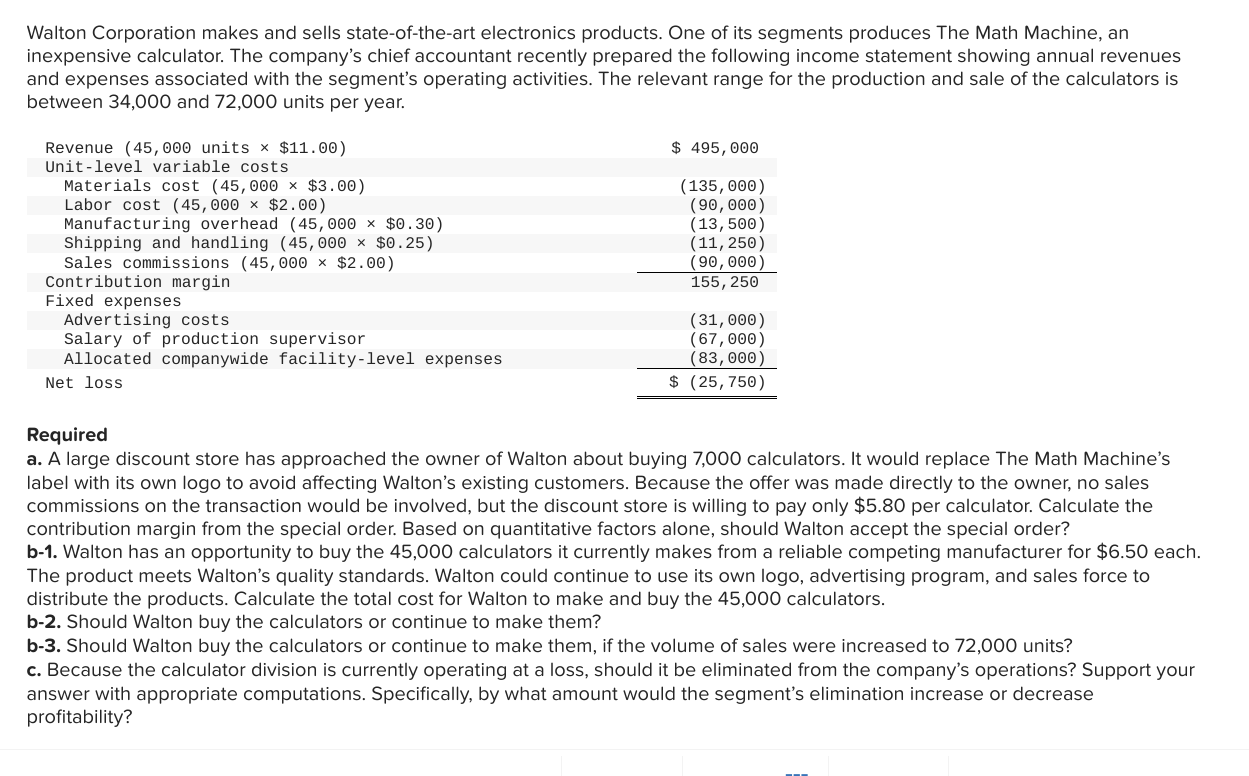

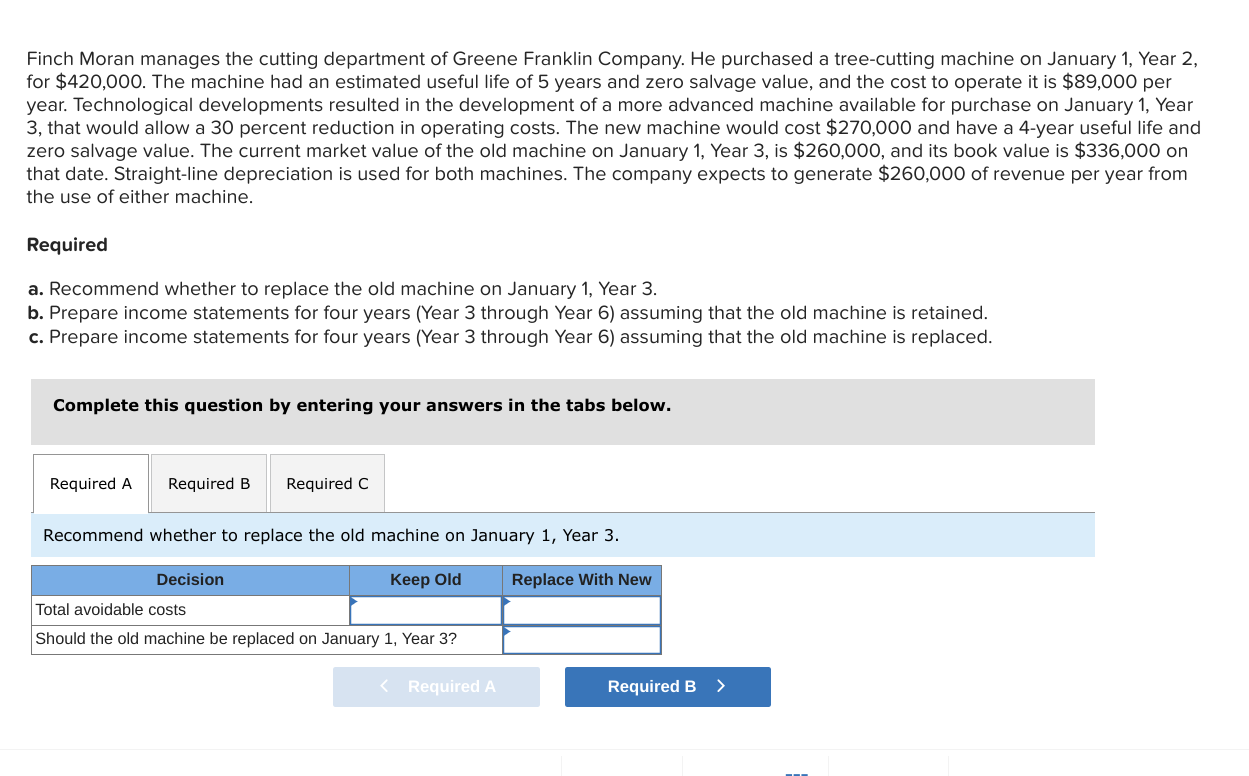

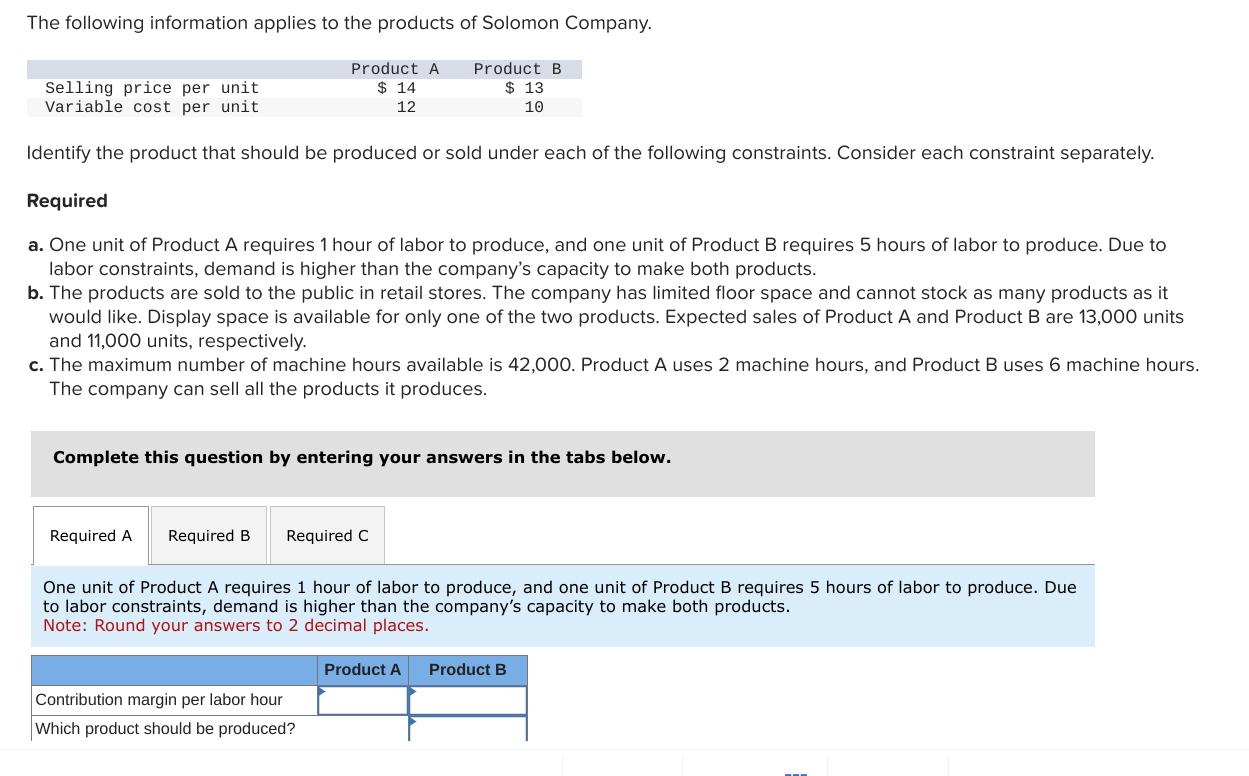

Baird Boot Company sells men's, women's, and children's boots. For each type of boot sold, it operates a separate department that has its own manager. The manager of the men's department has a sales staff of nine employees, the manager of the women's department has six employees, and the manager of the children's department has three employees. All departments are housed in a single store. In recent years, the children's department has operated at a net loss and is expected to continue to do so. Last year's income statements follow. Required a. Calculate the children's department's contribution to profit. Determine whether to eliminate the children's department. b. Confirm the conclusion you reached in Requirement a by preparing income statements for the company as a whole with and without the children's department. c. Eliminating the children's department would increase space available to display men's and women's boots. Suppose management estimates that a wider selection of adult boots would increase the store's net earnings by $34,000. Would this information affect the decision that you made in Requirement a ? Complete this question by entering your answers in the tabs below. Dalton Quilting Company makes blankets that it markets through a variety of department stores. It makes the blankets in batches of 1,400 units. Dalton made 24,000 blankets during the prior accounting period. The cost of producing the blankets is summarized here. Required a. Sunny Motels has offered to buy a batch of 700 blankets for $25 each. Dalton's normal selling price is $46 per unit. Calculate the relevant cost per unit for the special order. Based on the preceding quantitative data, should Dalton accept the special order? b. Sunny offered to buy a batch of 1,400 blankets for $25 per unit. Calculate the relevant cost per unit for the special order. Should Dalton accept the special order? Note: For all requirements, round "Cost per unit" to 2 decimal places. Finch Moran manages the cutting department of Greene Franklin Company. He purchased a tree-cutting machine on January 1, Year 2, for $420,000. The machine had an estimated useful life of 5 years and zero salvage value, and the cost to operate it is $89,000 per year. Technological developments resulted in the development of a more advanced machine available for purchase on January 1, Year 3 , that would allow a 30 percent reduction in operating costs. The new machine would cost $270,000 and have a 4-year useful life and zero salvage value. The current market value of the old machine on January 1, Year 3 , is $260,000, and its book value is $336,000 on that date. Straight-line depreciation is used for both machines. The company expects to generate $260,000 of revenue per year from the use of either machine. Required a. Recommend whether to replace the old machine on January 1, Year 3. b. Prepare income statements for four years (Year 3 through Year 6) assuming that the old machine is retained. c. Prepare income statements for four years (Year 3 through Year 6) assuming that the old machine is replaced. Complete this question by entering your answers in the tabs below. Recommend whether to replace the old machine on January 1, Year 3. The following information applies to the products of Solomon Company. Identify the product that should be produced or sold under each of the following constraints. Consider each constraint separately. Required a. One unit of Product A requires 1 hour of labor to produce, and one unit of Product B requires 5 hours of labor to produce. Due to labor constraints, demand is higher than the company's capacity to make both products. b. The products are sold to the public in retail stores. The company has limited floor space and cannot stock as many products as it would like. Display space is available for only one of the two products. Expected sales of Product A and Product B are 13,000 units and 11,000 units, respectively. c. The maximum number of machine hours available is 42,000 . Product A uses 2 machine hours, and Product B uses 6 machine hours. The company can sell all the products it produces. Complete this question by entering your answers in the tabs below. One unit of Product A requires 1 hour of labor to produce, and one unit of Product B requires 5 hours of labor to produce. Due to labor constraints, demand is higher than the company's capacity to make both products. Note: Round your answers to 2 decimal places. Jordan Construction Company is a building contractor specializing in small commercial buildings. The company has the opportunity to accept one of two jobs; it cannot accept both because they must be performed at the same time and Jordan does not have the necessary labor force for both jobs. Indeed, it will be necessary to hire a new supervisor if either job is accepted. Furthermore, additional insurance will be required if either job is accepted. The revenue and costs associated with each job follow. Required a. Assume that Jordan has decided to accept one of the two jobs. Fill in the information relevant to selecting one job versus the other. Recommend which job to accept. b. Assume that Job A is no longer available. Jordan's choice is to accept or reject Job B alone. Fill in the information relevant to this decision. Recommend whether to accept or reject Job B. Complete this question by entering your answers in the tabs below. Assume that Jordan has decided to accept one of the two jobs. Fill in the information relevant to selecting one job versus the other. Recommend which job to accept. Walton Corporation makes and sells state-of-the-art electronics products. One of its segments produces The Math Machine, an inexpensive calculator. The company's chief accountant recently prepared the following income statement showing annual revenues and expenses associated with the segment's operating activities. The relevant range for the production and sale of the calculators is between 34,000 and 72,000 units per year. Required a. A large discount store has approached the owner of Walton about buying 7,000 calculators. It would replace The Math Machine's label with its own logo to avoid affecting Walton's existing customers. Because the offer was made directly to the owner, no sales commissions on the transaction would be involved, but the discount store is willing to pay only $5.80 per calculator. Calculate the contribution margin from the special order. Based on quantitative factors alone, should Walton accept the special order? b-1. Walton has an opportunity to buy the 45,000 calculators it currently makes from a reliable competing manufacturer for $6.50 each. The product meets Walton's quality standards. Walton could continue to use its own logo, advertising program, and sales force to distribute the products. Calculate the total cost for Walton to make and buy the 45,000 calculators. b-2. Should Walton buy the calculators or continue to make them? b-3. Should Walton buy the calculators or continue to make them, if the volume of sales were increased to 72,000 units? c. Because the calculator division is currently operating at a loss, should it be eliminated from the company's operations? Support your answer with appropriate computations. Specifically, by what amount would the segment's elimination increase or decrease profitability? Perez has an opportunity to purchase frames for $118 each. Additional Information 1. The manufacturing equipment, which originally cost $570,000, has a book value of $460,000, a remaining useful life of four years, and a zero salvage value. If the equipment is not used to produce bicycle frames, it can be leased for $69,000 per year. 2. Perez has the opportunity to purchase for $920,000 new manufacturing equipment that will have an expected useful life of four years and a salvage value of $71,000. This equipment will increase productivity substantially, reducing unit-level labor costs by 60 percent. Assume that Perez will continue to produce and sell 24,000 frames per year in the future. 3. If Perez outsources the frames, the company can eliminate 80 percent of the inventory holding costs. Required a. Determine the avoidable cost per unit of making the bike frames, assuming that Perez is considering the alternatives of making the product using the existing equipment or outsourcing the product to the independent contractor. Based on the quantitative data, should Perez outsource the bike frames? b. Assuming that Perez is considering whether to replace the old equipment with the new equipment, determine the avoidable cost per unit to produce the bike frames using the new equipment and the avoidable cost per unit to produce the bike frames using the old equipment. Calculate the increase or decrease in the company's profit if the company uses new equipment. c. Assuming that Perez is considering whether to purchase the new equipment or outsource the bike frame, calculate the impact on profitability between the two alternatives

Baird Boot Company sells men's, women's, and children's boots. For each type of boot sold, it operates a separate department that has its own manager. The manager of the men's department has a sales staff of nine employees, the manager of the women's department has six employees, and the manager of the children's department has three employees. All departments are housed in a single store. In recent years, the children's department has operated at a net loss and is expected to continue to do so. Last year's income statements follow. Required a. Calculate the children's department's contribution to profit. Determine whether to eliminate the children's department. b. Confirm the conclusion you reached in Requirement a by preparing income statements for the company as a whole with and without the children's department. c. Eliminating the children's department would increase space available to display men's and women's boots. Suppose management estimates that a wider selection of adult boots would increase the store's net earnings by $34,000. Would this information affect the decision that you made in Requirement a ? Complete this question by entering your answers in the tabs below. Dalton Quilting Company makes blankets that it markets through a variety of department stores. It makes the blankets in batches of 1,400 units. Dalton made 24,000 blankets during the prior accounting period. The cost of producing the blankets is summarized here. Required a. Sunny Motels has offered to buy a batch of 700 blankets for $25 each. Dalton's normal selling price is $46 per unit. Calculate the relevant cost per unit for the special order. Based on the preceding quantitative data, should Dalton accept the special order? b. Sunny offered to buy a batch of 1,400 blankets for $25 per unit. Calculate the relevant cost per unit for the special order. Should Dalton accept the special order? Note: For all requirements, round "Cost per unit" to 2 decimal places. Finch Moran manages the cutting department of Greene Franklin Company. He purchased a tree-cutting machine on January 1, Year 2, for $420,000. The machine had an estimated useful life of 5 years and zero salvage value, and the cost to operate it is $89,000 per year. Technological developments resulted in the development of a more advanced machine available for purchase on January 1, Year 3 , that would allow a 30 percent reduction in operating costs. The new machine would cost $270,000 and have a 4-year useful life and zero salvage value. The current market value of the old machine on January 1, Year 3 , is $260,000, and its book value is $336,000 on that date. Straight-line depreciation is used for both machines. The company expects to generate $260,000 of revenue per year from the use of either machine. Required a. Recommend whether to replace the old machine on January 1, Year 3. b. Prepare income statements for four years (Year 3 through Year 6) assuming that the old machine is retained. c. Prepare income statements for four years (Year 3 through Year 6) assuming that the old machine is replaced. Complete this question by entering your answers in the tabs below. Recommend whether to replace the old machine on January 1, Year 3. The following information applies to the products of Solomon Company. Identify the product that should be produced or sold under each of the following constraints. Consider each constraint separately. Required a. One unit of Product A requires 1 hour of labor to produce, and one unit of Product B requires 5 hours of labor to produce. Due to labor constraints, demand is higher than the company's capacity to make both products. b. The products are sold to the public in retail stores. The company has limited floor space and cannot stock as many products as it would like. Display space is available for only one of the two products. Expected sales of Product A and Product B are 13,000 units and 11,000 units, respectively. c. The maximum number of machine hours available is 42,000 . Product A uses 2 machine hours, and Product B uses 6 machine hours. The company can sell all the products it produces. Complete this question by entering your answers in the tabs below. One unit of Product A requires 1 hour of labor to produce, and one unit of Product B requires 5 hours of labor to produce. Due to labor constraints, demand is higher than the company's capacity to make both products. Note: Round your answers to 2 decimal places. Jordan Construction Company is a building contractor specializing in small commercial buildings. The company has the opportunity to accept one of two jobs; it cannot accept both because they must be performed at the same time and Jordan does not have the necessary labor force for both jobs. Indeed, it will be necessary to hire a new supervisor if either job is accepted. Furthermore, additional insurance will be required if either job is accepted. The revenue and costs associated with each job follow. Required a. Assume that Jordan has decided to accept one of the two jobs. Fill in the information relevant to selecting one job versus the other. Recommend which job to accept. b. Assume that Job A is no longer available. Jordan's choice is to accept or reject Job B alone. Fill in the information relevant to this decision. Recommend whether to accept or reject Job B. Complete this question by entering your answers in the tabs below. Assume that Jordan has decided to accept one of the two jobs. Fill in the information relevant to selecting one job versus the other. Recommend which job to accept. Walton Corporation makes and sells state-of-the-art electronics products. One of its segments produces The Math Machine, an inexpensive calculator. The company's chief accountant recently prepared the following income statement showing annual revenues and expenses associated with the segment's operating activities. The relevant range for the production and sale of the calculators is between 34,000 and 72,000 units per year. Required a. A large discount store has approached the owner of Walton about buying 7,000 calculators. It would replace The Math Machine's label with its own logo to avoid affecting Walton's existing customers. Because the offer was made directly to the owner, no sales commissions on the transaction would be involved, but the discount store is willing to pay only $5.80 per calculator. Calculate the contribution margin from the special order. Based on quantitative factors alone, should Walton accept the special order? b-1. Walton has an opportunity to buy the 45,000 calculators it currently makes from a reliable competing manufacturer for $6.50 each. The product meets Walton's quality standards. Walton could continue to use its own logo, advertising program, and sales force to distribute the products. Calculate the total cost for Walton to make and buy the 45,000 calculators. b-2. Should Walton buy the calculators or continue to make them? b-3. Should Walton buy the calculators or continue to make them, if the volume of sales were increased to 72,000 units? c. Because the calculator division is currently operating at a loss, should it be eliminated from the company's operations? Support your answer with appropriate computations. Specifically, by what amount would the segment's elimination increase or decrease profitability? Perez has an opportunity to purchase frames for $118 each. Additional Information 1. The manufacturing equipment, which originally cost $570,000, has a book value of $460,000, a remaining useful life of four years, and a zero salvage value. If the equipment is not used to produce bicycle frames, it can be leased for $69,000 per year. 2. Perez has the opportunity to purchase for $920,000 new manufacturing equipment that will have an expected useful life of four years and a salvage value of $71,000. This equipment will increase productivity substantially, reducing unit-level labor costs by 60 percent. Assume that Perez will continue to produce and sell 24,000 frames per year in the future. 3. If Perez outsources the frames, the company can eliminate 80 percent of the inventory holding costs. Required a. Determine the avoidable cost per unit of making the bike frames, assuming that Perez is considering the alternatives of making the product using the existing equipment or outsourcing the product to the independent contractor. Based on the quantitative data, should Perez outsource the bike frames? b. Assuming that Perez is considering whether to replace the old equipment with the new equipment, determine the avoidable cost per unit to produce the bike frames using the new equipment and the avoidable cost per unit to produce the bike frames using the old equipment. Calculate the increase or decrease in the company's profit if the company uses new equipment. c. Assuming that Perez is considering whether to purchase the new equipment or outsource the bike frame, calculate the impact on profitability between the two alternatives Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started