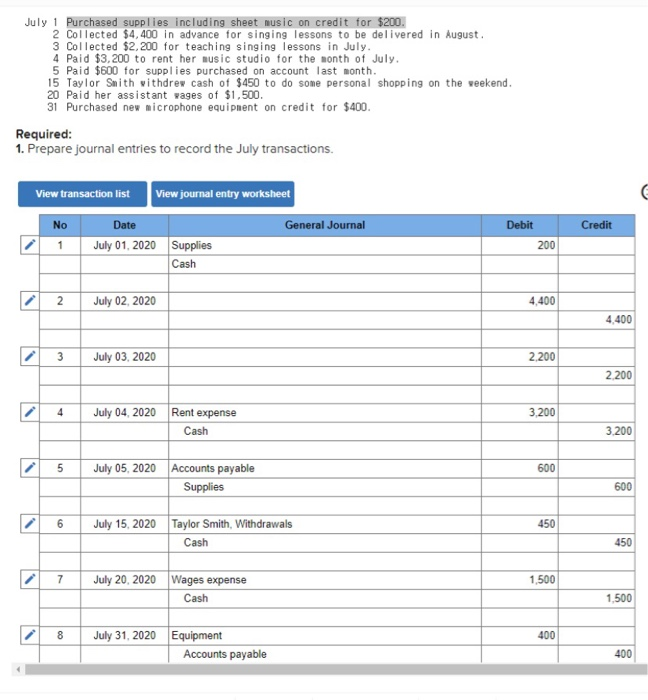

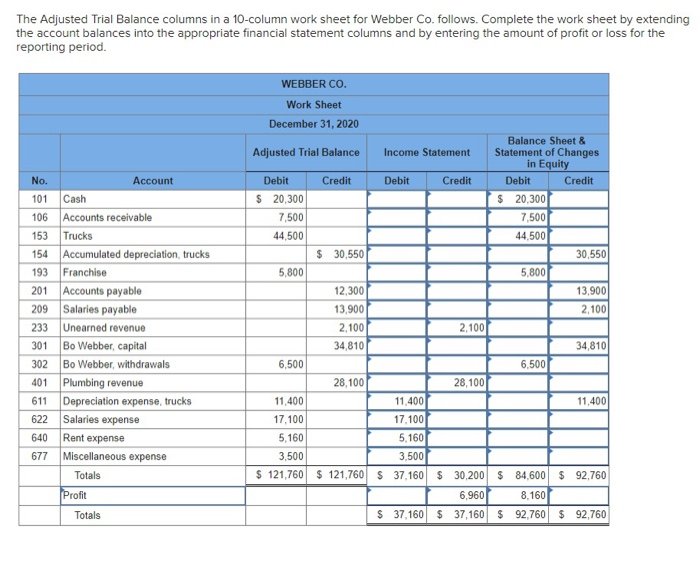

July 1 Purchased supplies including sheet music on credit for $200. 2 Collected $4.400 in advance for singing lessons to be delivered in August 3 Collected $2,200 for teaching singing lessons in July. 4 Paid $3,200 to rent her music studio for the month of July. 5 Paid $600 for supplies purchased on account last month. 15 Taylor Smith withdrew cash of $450 to do some personal shopping on the weekend. 20 Paid her assistant wages of $1.500. 31 Purchased new microphone equipment on credit for $400. Required: 1. Prepare journal entries to record the July transactions. View transaction list View journal entry worksheet E No General Journal Credit Date July 01, 2020 Supplies Cash Debit 200 1 2 July 02, 2020 4,400 4,400 . 3 July 03, 2020 2.200 2.200 . 4 July 04, 2020 3.200 Rent expense Cash 3.200 1 5 600 July 05, 2020 Accounts payable Supplies 600 6 450 July 15, 2020 Taylor Smith, Withdrawals Cash 450 7 1,500 July 20, 2020 Wages expense Cash 1.500 8 400 July 31, 2020 Equipment Accounts payable 400 The Adjusted Trial Balance columns in a 10-column work sheet for Webber Co. follows. Complete the work sheet by extending the account balances into the appropriate financial statement columns and by entering the amount of profit or loss for the reporting period. No. Account 101 Cash 106 Accounts receivable 153 Trucks 154 Accumulated depreciation, trucks 193 Franchise 201 Accounts payablo 209 Salaries payable 233 Unearned revenue 301 Bo Webber, capital 302 Bo Webber, withdrawals 401 Plumbing revenue 611 Depreciation expense, trucks 622 Salaries expense 640 Rent expense 677 Miscellaneous expense Totals WEBBER CO. Work Sheet December 31, 2020 Balance Sheet & Adjusted Trial Balance Income Statement Statement of Changes in Equity Debit Credit Debit Credit Debit Credit $ 20,300 $ 20,300 7,500 7,500 44,500 44,500 $ 30,550 30,550 5,800 5,800 12,300 13.900 13,900 2,100 2.100 2.100 34,810 34,810 6,500 6,500 28,100 28,100 11,400 11,400 11,400 17.100 17.100 5,160 5,160 3,500 3,500 $ 121,760 $ 121,760 S 37,160 $ 30,200 $ 84,600 $ 92,760 6,960 8.160 $ 37,160 $ 37,160 $ 92,760 $ 92,760 Profit Totals