Answered step by step

Verified Expert Solution

Question

1 Approved Answer

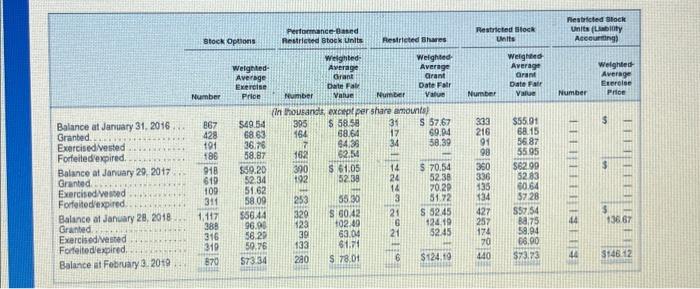

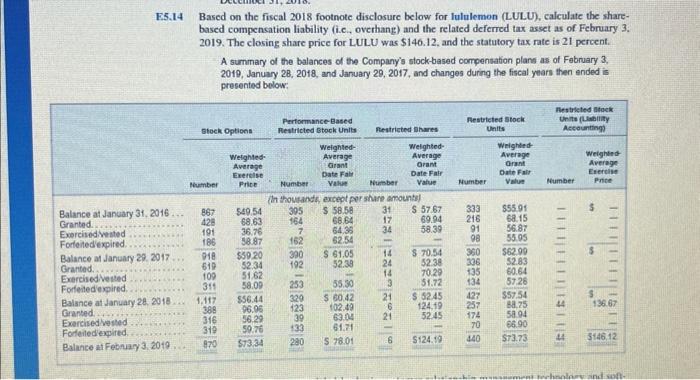

Balance at January 31, 2016 Granted. Exercised vested Forfeited expired. Balance at January 29, 2017 Granted... Exercised/vested Forfeited expired. Balance at January 28, 2018 Granted.

Balance at January 31, 2016 Granted. Exercised vested Forfeited expired. Balance at January 29, 2017 Granted... Exercised/vested Forfeited expired. Balance at January 28, 2018 Granted. Exercised vested Forfeited expired. Balance at February 3, 2019 F Stock Options Number 867 109 388 Weighted- Average Exercise $49.54 68.63 36.76 58.87 $59.20 52.34 58.09 $56.44 96.98 56.29 59.76 $73.34 Performance-Based Restricted Stock Units 7 162 329 123 133 CROPP Weighted- Average 230 Date Fair Number (In thousands, except per share amounts) $ 58.58 $ $1.05 52.39 Restricted Bhares 55.90 S 60.42 102.49 63.04 $1.71 $ 78.01 Number 14 3 21 6 21 Weighted- Average Grant Date Fair Value 6 S 57.67 58.39 52.38 70.29 51.72 S 52.45 52.45 $124.19 Restricted Stock Number 333 216 98 360 336 427 257 Weighted- Average Date Fair Value $55.91 68.15 56.87 55.95 $62.99 52.83 60.64 57.28 $57.54 66.90 $73.73 Restricted Stock Units (Liability Accounting) Number ||||||||||||| Weighted- Average Exercise Price $ $ 136.67 $146.12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started