Question

PLEASE HELP ME CALCULATE MONTHLY PRO FORMA CASH FLOWS FOR YEAR 2007 USING THE FOLLOWING CASE. INTRODUCTION Laura Lewis, Patricia Robbins, and Mary Farley were

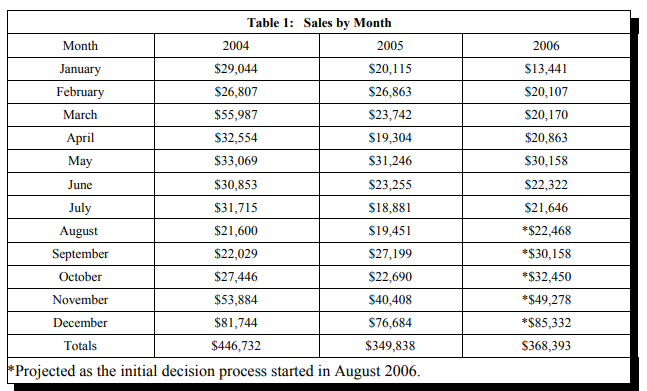

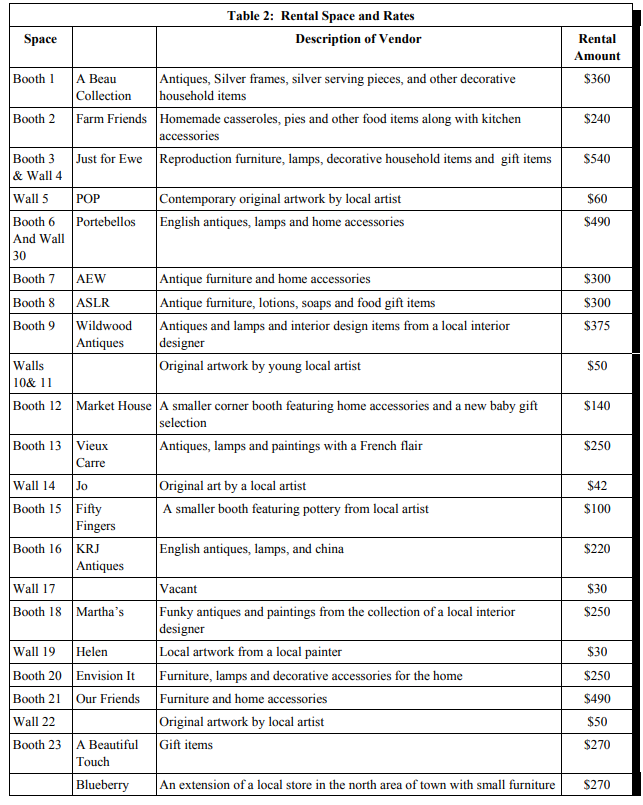

PLEASE HELP ME CALCULATE MONTHLY PRO FORMA CASH FLOWS FOR YEAR 2007 USING THE FOLLOWING CASE. INTRODUCTION Laura Lewis, Patricia Robbins, and Mary Farley were eating lunch at a local delicatessen. The ladies were excited about a recent business opportunity that was presented to them by Lucy Taylor, the owner of The Shoppes at Riverside. Lucy wanted to sell her business to someone that would take over her vision for an art and antique store in the uptown Columbus, Georgia area. PURCHASE PRICE Their initial purchase price would be minimal ($1). STORE INCOME The store has several sources of income. There are direct store sales primarily from inventory of books (cook books and art related books) owned by the store itself. There is additional income from vendors in the form of rent and commissions. Each vendor pays three types of fees. A fee for the booth rental (the rental rates for the available booth and wall spaces are shown in Table 2); a percentage rent or 10% of each sale as a commission; and a fee twice a year for advertising. The fee for advertising is $100 for a booth renters and $50 for wall renters and is due on March 1 and October 1 each year. Vendors are required to sign a six-month lease and pay the first and last months rent payment upon signing the lease. They are to give thirty days written notice to terminate the lease after the initial six-month period. Rent Expense The building the store occupies is currently being managed by a local real estate company on behalf of the foundation. With new ownership, the monthly rental will be $4,322 and a three year lease will be required. The rental payment includes the utilities for water and repairs for major maintenance costs. Utilities Monthly electricity cost runs from $800-$1000 per month. It is typically higher in the summer months. The building is all electric and there are no other utility costs. Employees The store hours are from 10:00am to 5:30pm on Monday thru Friday and from 10:00am to 4:00 pm on Saturdays. The store is closed on Sundays. Two employees are needed during these hours and they usually arrive 15 minutes before the store is opened and leave 15 minutes after the closing time. They do not take a lunch hour but are allowed to take a break and eat lunch in the back kitchen area. During the holidays, additional employees may be needed. One employee acts as a manager and works four days (Monday Thursday) a week and is paid $10 an hour. The manager has worked at the store for five years and would like to continue with the new ownership if possible. A second employee works two days during the week and is paid $8 an hour. Two additional employees work one day a week and are paid $7 an hour. The rest of the hours are completed by part-time employees paid $6.50 per hour. Employees are paid bi-weekly for the week ending the previous Saturday. The first payroll in the year 2007 is January 11th. The employees receive no benefits other than the payroll taxes required by law. Insurance Insurance has been averaging $2200 a year and includes general liability and workmens compensation. Janitorial Service The store provides janitorial service for the common area, kitchen area and bathrooms. The cleaning crew comes once a week and the charge has been running $75 per week. Advertising Lucy Taylor, the current owner has an advertising contract with the local newspaper. This contract is $240 a month and includes three advertisements per week in a local newspaper. An annual contract has to be signed to obtain this rate. Some advertising is also done in two local magazines. Both magazines are bi-monthly and average $350 for a page ad space. Lucy stated that the most effective advertising seemed to be direct mail. She currently has a list of approximately 1,200 customers. The cost to print and mail a basic two-color postcard averages around $600. She usually sends out a postcard twice a year. While some of the cost of the advertising is supplemented by the required fee, the cost of advertising in the past has been over and above that paid by the vendors. Telephone The cost of telephone service averages around $350 a month and includes a two-line business phone and a separate line for a fax machine. To add Internet to the present computers, it would add $60 a month and to add an Internet advertisement on Yellowpages.com, it would add approximately $95 a month. Other operating expenses Other operating expenses include store supplies (cleaning supplies, printer paper, bathroom supplies, etc) and average up to $200 a month. Wrapping products (gift bags, tissue, and ribbon) are frequently used as the store offers free gift wrapping as a customer service. The wrapping products along with the bags used in each sale average 2% of sales. Taxes As stated previously, the store pays employment taxes on employees consisting of FICA at 7.65%; State Unemployment taxes on the first $8,000 of earnings at 2.7%; and Federal Unemployment taxes on the first $7,000 in earnings at .8%. Other taxes and fees include an annual fee for a business license ($100) and a fee for gross receipts (or .03% of each sale). The store collects and remits the state and local 7% sales taxes on all sales. THE PURCHASE DECISION The three individuals (Laura Lewis, Patricia Robbins and Mary Farley) need to evaluate the information given to them by Lucy and decide if they want to purchase the business. If they decide to purchase the business, they would also be required to sign a three-year lease on the building. An investment of cash would also be required for operating expenses and they would need to set up a credit card or line of credit with a bank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started