Answered step by step

Verified Expert Solution

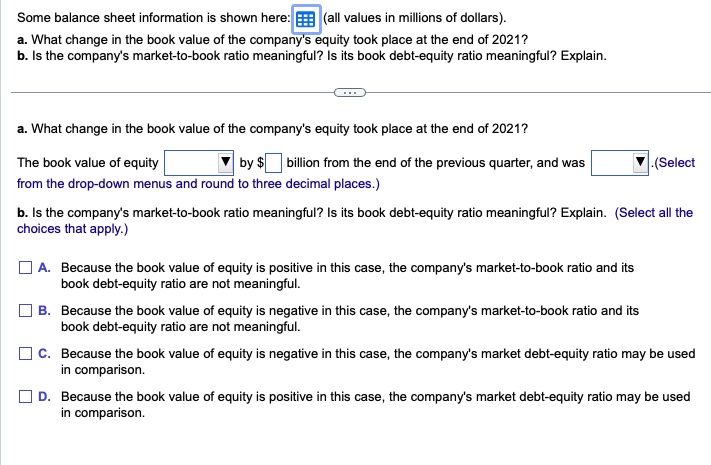

Question

1 Approved Answer

Balance Sheet 31-Mar-2022 31-Dec-2021 30-Sep-2021 30-Jun-2021 Assets Current Assets Cash and cash equivalents 293 300 255 232 Net receivables 401 362 385 460 Inventory 374

| Balance Sheet | 31-Mar-2022 | 31-Dec-2021 | 30-Sep-2021 | 30-Jun-2021 |

| Assets | ||||

| Current Assets | ||||

| Cash and cash equivalents | 293 | 300 | 255 | 232 |

| Net receivables | 401 | 362 | 385 | 460 |

| Inventory | 374 | 342 | 437 | 306 |

| Other current assets | 60 | 43 | 53 | 45 |

| Total Current Assets | 1128 | 1047 | 1130 | 1043 |

| Long-term investments | 128 | 97 | - | 200 |

| Property, plant, and equipment | 979 | 991 | 995 | 1052 |

| Goodwill | 744 | 748 | 736 | 742 |

| Other assets | 777 | 824 | 916 | 797 |

| Total Assets | 3756 | 3707 | 3777 | 3834 |

| Liabilities | ||||

| Current Liabilities | ||||

| Accounts payable | 876 | 1467 | 922 | 980 |

| Short/current long-term debt | 410 | 2 | 173 | 288 |

| Other current liabilities | - | - | - | - |

| Total Current Liabilities | 1286 | 1469 | 1095 | 1268 |

| Long-term debt | 2381 | 2124 | 474 | 475 |

| Other liabilities | 435 | 574 | 559 | 551 |

| Total Liabilities | 4102 | 4167 | 2128 | 2294 |

| Total Shareholder's Equity | -346 | -460 | 1649 | 1540 |

| Total Liabilities and Shareholder's Equity | 3756 | 3707 | 3777 | 3834 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started