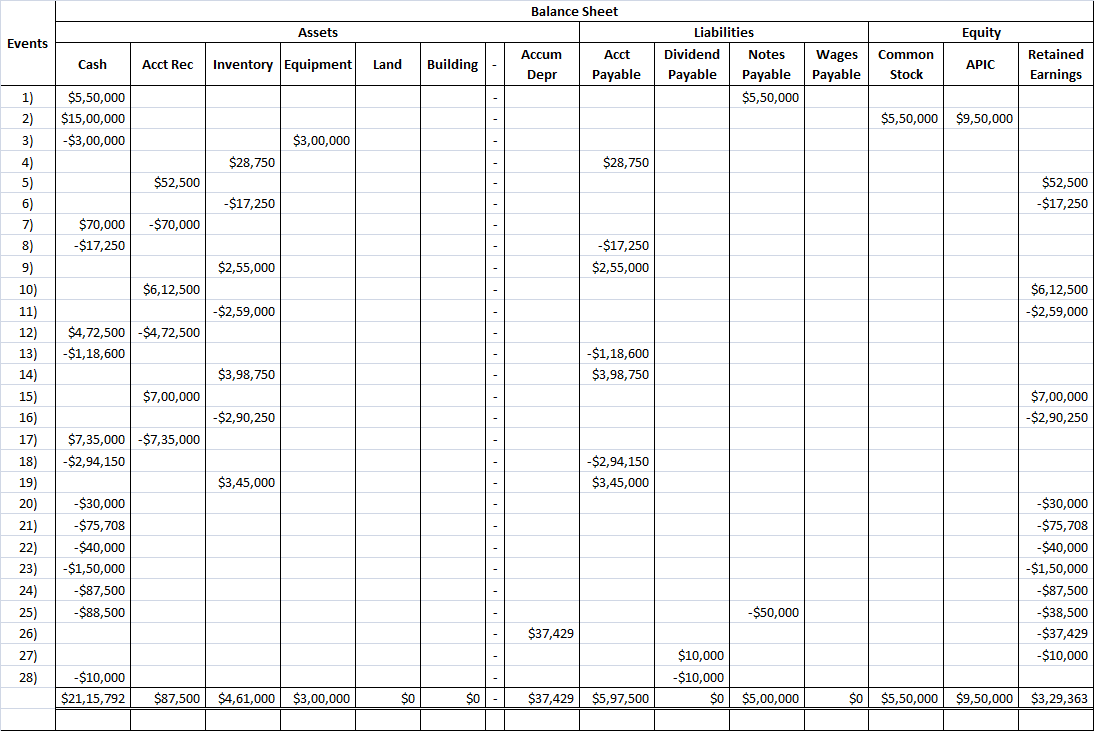

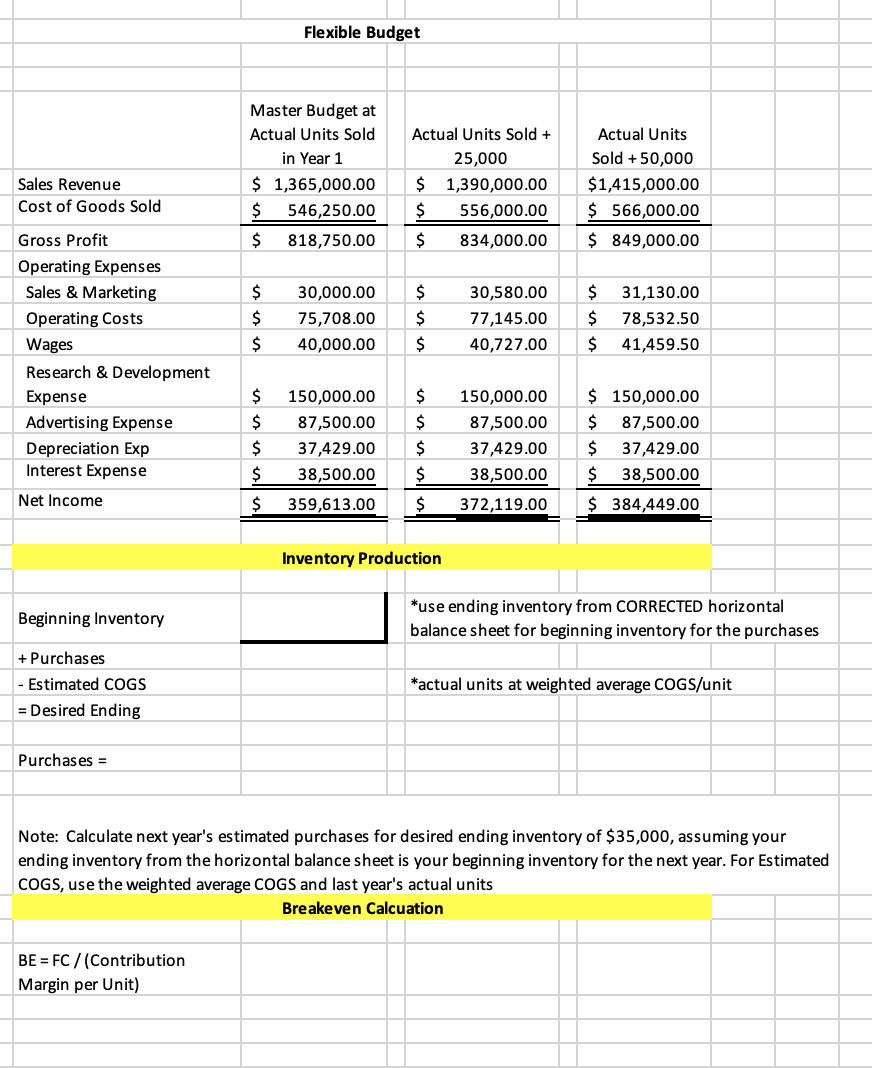

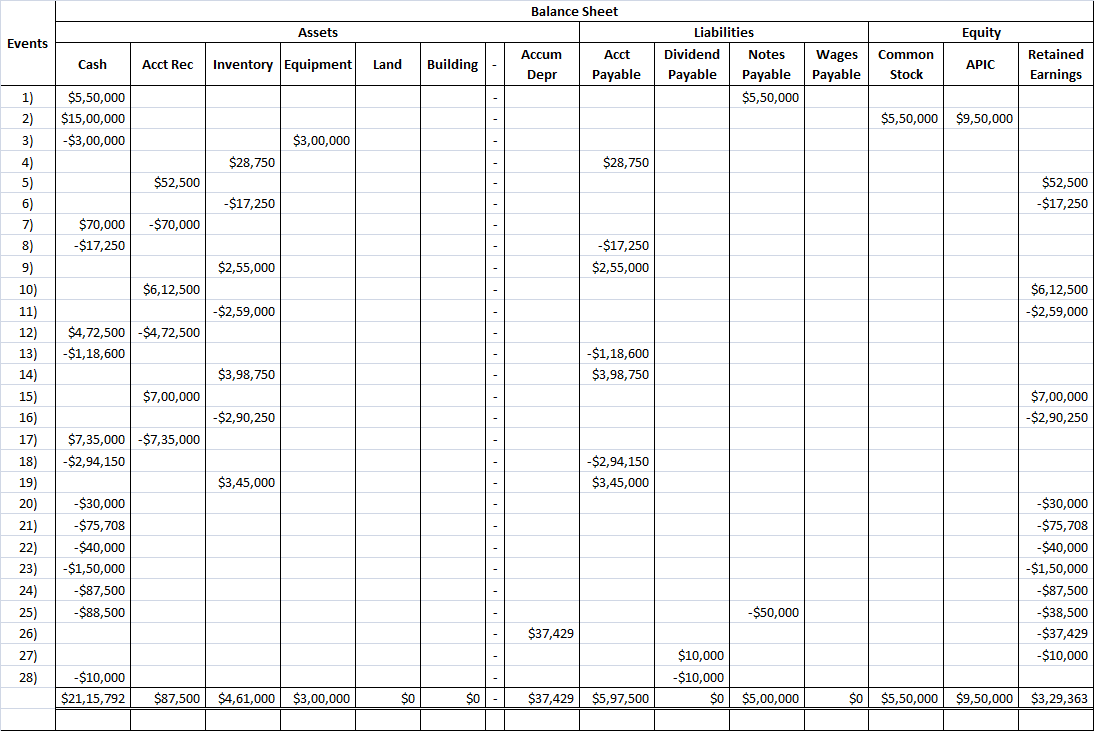

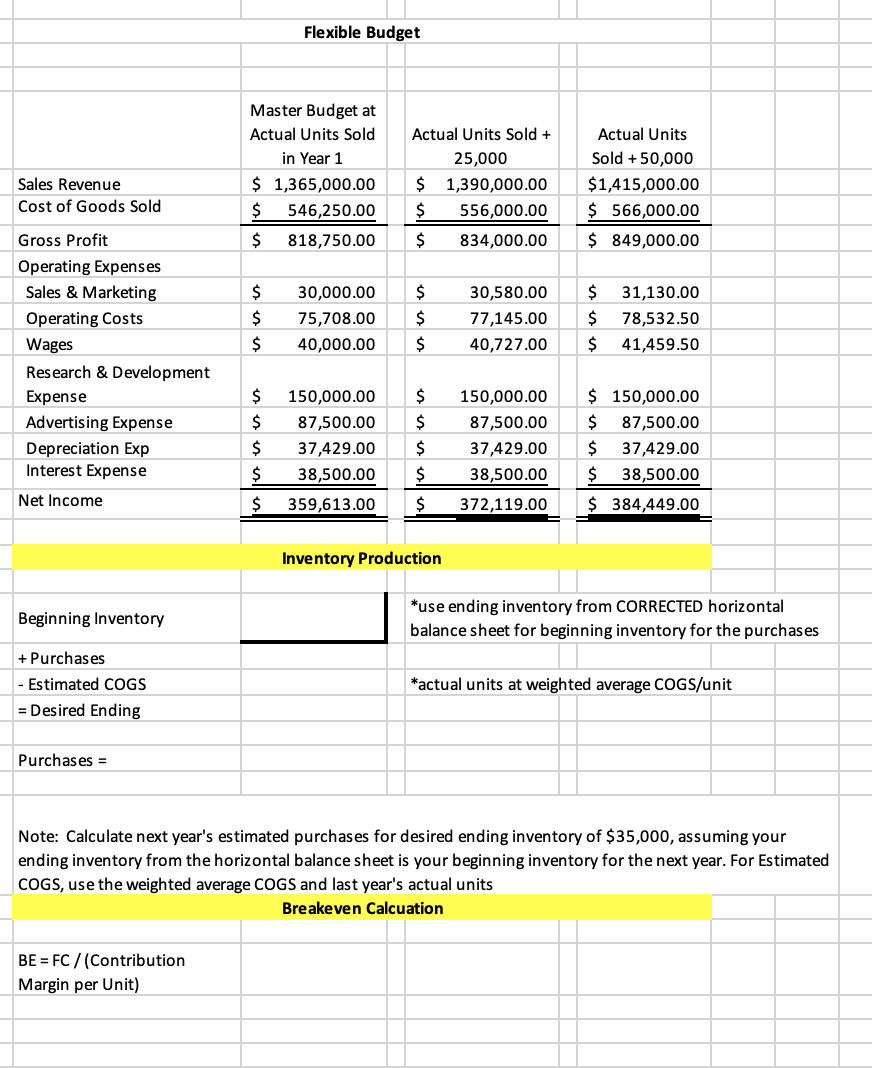

Balance Sheet Assets Equity Events Accum Cash Acct Rec Inventory Equipment Land Building Acct Payable Liabilities Dividend Notes Wages Payable Payable Payable $5,50,000 Common Stock APIC Retained Earnings Depr $5,50,000 $15,00,000 -$3,00,000 $5,50,000 $9,50,000 $3,00,000 $28,750 $28,750 $52,500 $52,500 -$17,250 -$17,250 -$70,000 $70,000 -$17,250 -$17,250 $2,55,000 $2,55,000 $6,12,500 $6,12,500 -$2,59,000 -$2,59,000 $4,72,500 $4,72,500 -$1,18,600 -$1,18,600 $3,98,750 $3,98,750 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) 14) 15) 16) 17) 18) 19) 20) 21) 22) 23) 24) 25) 26) 27) 28) $7,00,000 $7,00,000 -$2,90,250 -$2,90,250 $7,35,000-$7,35,000 -$2,94,150 -$2,94,150 $3,45,000 $3,45,000 -$30,000 -$75,708 -$40,000 $1,50,000 -$87,500 -$88,500 -$30,000 $75,708 -$40,000 -$1,50,000 -$87,500 $38,500 -$37,429 -$10,000 -$50,000 $37,429 $10,000 $21,15,792 $10,000 $10,000 $0 $5,00,000 $87,500 $4,61,000 $3,00,000 $0 SO $37,429 $5,97,500 $0 $5,50,000 $9,50,000 $3,29,363 Flexible Budget Sales Revenue Cost of Goods Sold Master Budget at Actual Units Sold in Year 1 $ 1,365,000.00 $ 546,250.00 $ 818,750.00 Actual Units Sold + 25,000 $ 1,390,000.00 $ 556,000.00 $ 834,000.00 Actual Units Sold +50,000 $1,415,000.00 $ 566,000.00 $ 849,000.00 $ $ $ 30,000.00 75,708.00 40,000.00 $ $ $ 30,580.00 77,145.00 40,727.00 $ 31,130.00 $ 78,532.50 $ 41,459.50 Gross Profit Operating Expenses Sales & Marketing Operating Costs Wages Research & Development Expense Advertising Expense Depreciation Exp Interest Expense $ $ $ $ $ $ 150,000.00 87,500.00 37,429.00 38,500.00 $ $ $ 150,000.00 87,500.00 37,429.00 38,500.00 $ 150,000.00 $ 87,500.00 $ 37,429.00 $ 38,500.00 $ 384,449.00 Net Income 359,613.00 $ 372,119.00 Inventory Production Beginning Inventory *use ending inventory from CORRECTED horizontal balance sheet for beginning inventory for the purchases + Purchases - Estimated COGS = Desired Ending *actual units at weighted average COGS/unit Purchases = Note: Calculate next year's estimated purchases for desired ending inventory of $35,000, assuming your ending inventory from the horizontal balance sheet is your beginning inventory for the next year. For Estimated COGS, use the weighted average COGS and last year's actual units Breakeven Calcuation BE = FC/(Contribution Margin per Unit)